Summary

Table of Content

Europe Blood and Blood Components Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Europe Blood and Blood Components Market Size

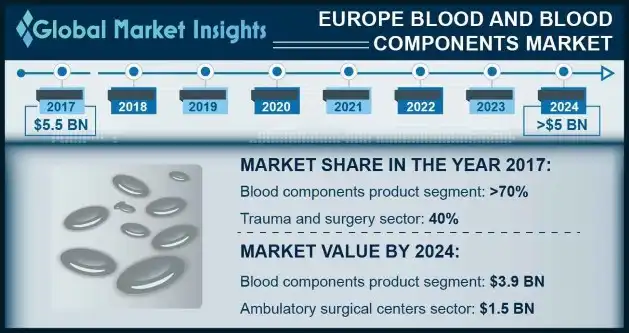

Europe Blood and Blood Components Market size was valued at over USD 5.5 billion in 2017 and is expected to witness -0.7% CAGR from 2018 to 2024.

To get key market trends

To get key market trends

Substantial number of blood transfusions can be attributed to growing number of infectious diseases such as dengue, rising chronic diseases and bleeding disorders. Cancer patients require blood transfusions owing to anemia caused by the internal bleeding or low blood count due to invasion by the cancerous cells. As per the World Health Organization (WHO), with over 3.7 million new cases and nearly 1.9 million deaths every year, cancer represents the second most important factor for morbidity and mortality in the Europe. Thus, with increasing number of cancer cases, requirement of blood transfusions will gradually increase, thereby affecting Europe blood and blood components market size over the forecast timeframe.

Growing proportion of geriatric population, rising awareness and applications of blood derivatives in the upcoming period should sustain the demand for blood components in the region. According to the European Commission, the old-age dependency ratio in Europe is projected to increase by 21.6%, from 29.6% in 2016 to 51.2% by 2070. Thus, increasing number of elderly patients ultimately increases the need for advanced therapies. In addition, application of blood derivatives including platelet rich plasma in anti-aging therapy will further augment demand for blood components in the foreseeable future.

Europe Blood and Blood Components Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2017 |

| Market Size in 2017 | 5 Billion (USD) |

| Forecast Period 2018 - 2024 CAGR | -0.7% |

| Market Size in 2024 | 5 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

However, high risk of infection from transfusion of blood or blood products may pose a challenge for blood and blood components market growth. Additionally, various initiatives were adopted by the European regulatory bodies to avoid wastage of blood and blood products such as, in some countries, programmes for ‘optimal use of blood’ are implemented during the recent period, to reduce unnecessary infections post blood transfusion as well as avoid wastage of blood. Red blood cells (RBCs) are mainly used in obstetrics, surgery, oncology and haematology care and apparently, due to such initiatives adopted in certain countries the use of RBCs has greatly reduced in the last decade, thus decreasing the market value over the forthcoming years.

Europe Blood and Blood Components Market Analysis

Blood components product segment held over 70% market share in 2017. Growing demand for cosmetic procedures coupled with increasing applications of blood components such as platelets and plasma will set substantial demand for blood components. Blood components are frequently used for replacing RBCs or other components of the blood that are absent or at very low levels due to injuries, disorders or blood loss. Increasing number of surgical and cosmetic procedures will drive the demand for blood components. However, limited donations and stringent regulatory norms should hamper segmental growth.

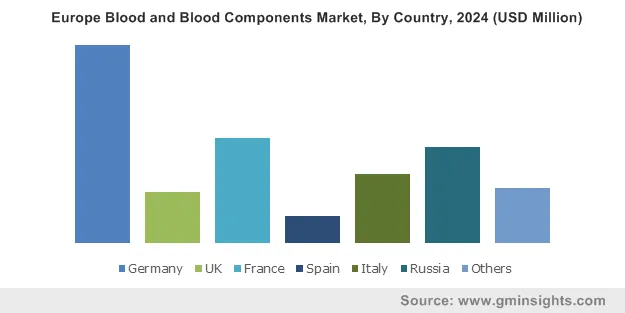

Whole blood product segment is estimated to foresee slow growth owing to declining number of blood donations in majority of the European countries. However, growing number of blood donations in countries such as Germany and Russia will offer growth opportunity. Whole blood is the most common and flexible form of blood donation form and can be transfused in its original form. Whole blood is used in case of patients that have suffered from severe blood loss due to trauma/surgery, that requires transfusion of all the components of blood. Thus, rising number of accidents, chronic diseases and surgeries will offer growth potential to whole blood market in the coming years.

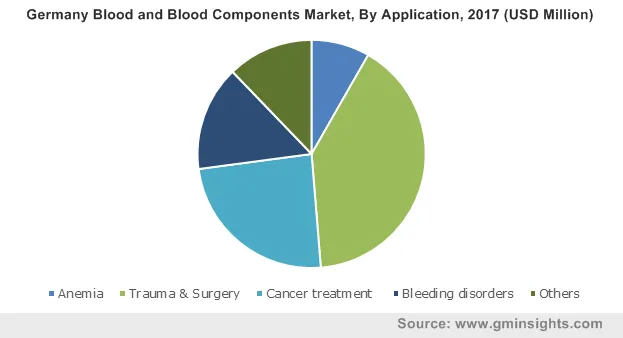

Trauma & surgery segment accounted for major revenue share of about 40% in 2017. Booming number of injuries as well as surgical procedures will stimulate the use of blood and blood components in trauma and surgery cases. Deaths from injury have risen by 23% over the last decade. About 20-40% of deaths from trauma taking place post hospital admission, involve massive haemorrhage. Haemorrhage can be prevented by rapid haemorrhage control and better resuscitation techniques. Massive blood transfusion is necessary in majority of trauma cases for rapid restoration of lost blood. Similarly, blood transfusion during surgical procedures becomes necessary as a part of patient blood management. Thus, rising number of surgeries as well as trauma cases will positively influence adoption of blood and blood component in the coming years.

Cancer treatment segment will foresee relatively rapid growth over other applications owing to increasing cancer incidence in Europe. According to the WHO, Europe accounts for only 12.5% of the total world’s population but has around 25% of global cases of cancer with around 3.7 million new patients annually. Blood transfusion can be required for cancer patients due to factors such as surgeries or side effects of chemotherapy. Hence, patients undergoing chemotherapy treatment possess decreased ability to make new blood cells as they are unable to replace destroyed blood cells. Therefore, transfusion of RBCs and platelets is required to compensate for loss caused by chemotherapy. Thus, cancer treatment will impact demand for blood and blood components over the future years.

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

Hospital segment will witness substantial growth over the coming years owing to rising incidence of chronic diseases. 1 among 10 hospitalized patient undergoing invasive procedure, is transfused. Similarly, about 1,900 hospitals and clinics are provided with labile blood products in the Europe. With increasing number of cardiovascular diseases, cancer, infections, cosmetic procedures coupled with improving healthcare infrastructure in emerging European countries, demand for blood and blood products is estimated to surge in hospital settings. Presence of various norms to control and manage efficient use of blood components will limit segmental size over the forecast years.

Rising patient demand for surgical procedures at ambulatory surgical centers in developed European countries will propel demand for blood and blood transfusion products at these settings. Ambulatory surgical centers perform surgeries within short duration. Although the demand for surgical procedures at ambulatory surgical centers is high, the segment will witness restricted growth across the forecast timeframe. This is attributed to limited supply of blood and blood components due to lack of donors, acting as a restraining factor in the market growth.

Rising number of blood banks and blood donation camps in the region can significantly stimulate market growth in the region. UK has 4 blood transfusion services (BTS) founded in all four countries comprising the United Kingdom. Few countries such as Russia and Germany are witnessing gradual rise in number of blood donations while many countries are undertaking blood donation awareness initiatives. Moreover, rising geriatric population base coupled with increasing prevalence of chronic diseases in the region will further augment market growth in the upcoming years.

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

Europe Blood and Blood Components Market Share

Major associations such as

- International Federation of Red Cross and Red Crescent Societies (IFRC)

- American Association of Blood Banks (AABB)

- Welsh Blood Services

- NHS Blood and Transplant (NHSBT)

the Northern Ireland Blood Transfusion Service are among top European players operating in blood and blood components market. These associations have implemented certain strategic initiatives such as collaborations, mergers and expansion strategies that have enhanced their financial stability and helped them evolve as major industrial associations. For instance, in October 2018, NHS Blood and Transplant announced the opening of a new blood donor centre in Leicester with an appeal for 5,900 donors, thus stimulating geographic presence.

Europe Blood and Blood Components Industry Background

Blood and blood components industry witnessed increase in blood donations till 2010. Eventually, various European regulatory bodies observed tremendous usage and wastage of blood and its components during transfusions. Additionally, numerous blood transfusion-associated infections were identified such as Hepatitis B, Hepatitis C and Human Immunodeficiency Virus (HIV) infections. Such incidents lead to formation of guidelines for optimum utilization of blood. Such restricting trends in the market is leading to decline of blood and blood components industry size and the trend is forecasted to continue over the foreseeable future. However, growing number of surgeries, trauma cases and increasing applications of blood components will influence year-on-year demand for these products.

Frequently Asked Question(FAQ) :

How much will the Europe blood and blood components industry share grow during the forecast timeline?

The industry share of Europe blood and blood components is expected to witness -0.7% CAGR up to 2024.

How much size did the global Europe blood and blood components market register in 2017?

The market size of Europe blood and blood components surpassed USD 5 billion in 2017.

Europe Blood and Blood Components Market Scope

Related Reports