Summary

Table of Content

Ethoxylates Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Ethoxylates Market Size

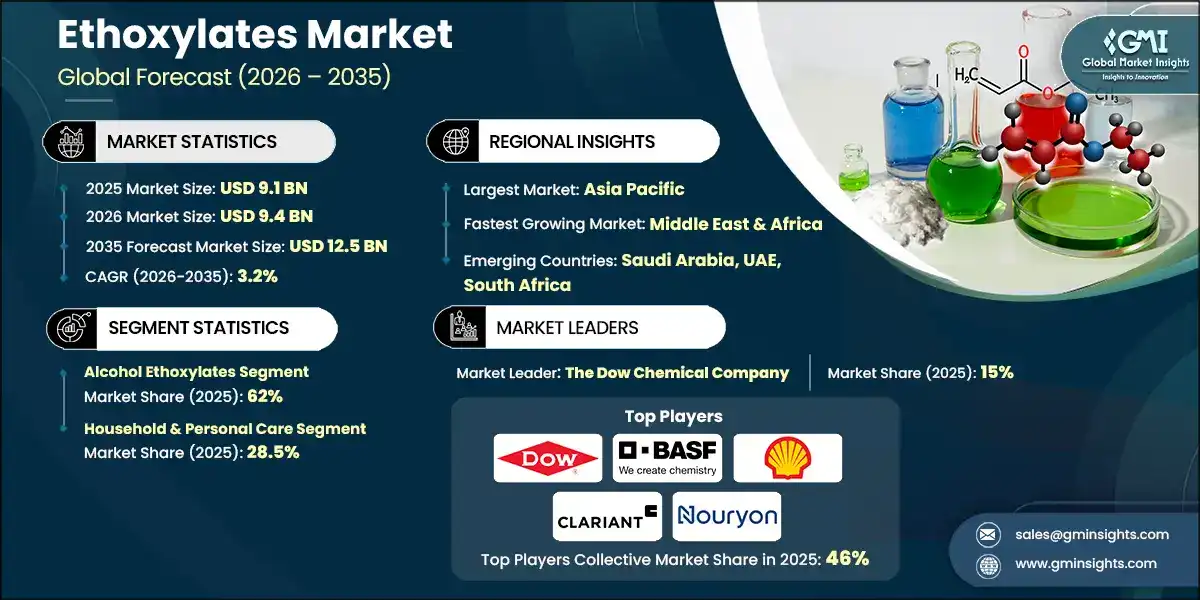

The global ethoxylates market was valued at USD 9.1 billion in 2025. The market is expected to grow from USD 9.4 billion in 2026 to USD 12.5 billion in 2035, at a CAGR of 3.2%, according to latest report published by Global Market Insights Inc.

Ethoxylates Market Key Takeaways

Market Size & Growth

- 2025 Market Size: USD 9.1 Billion

- 2026 Market Size: USD 9.4 Billion

- 2035 Forecast Market Size: USD 12.5 Billion

- CAGR (2026–2035): 3.2%

Regional Dominance

- Largest Market: Asia Pacific

- Fastest Growing Region: Middle East & Africa

Key Market Drivers

- Rising demand for eco-friendly surfactants.

- Consumer preference shift.

- Brand sustainability commitments.

Challenges

- Environmental concerns regarding APEs/NPEs.

- Aquatic toxicity.

Opportunity

- Bio-based ethoxylates market expansion.

- Specialty ethoxylates development.

Key Players

- Market Leader: The Dow Chemical Company led with over 15% market share in 2025.

- Leading Players: Top 5 players in this market include The Dow Chemical Company, BASF SE, Royal Dutch Shell PLC, Clariant AG, Nouryon, which collectively held a market share of 46% in 2025.

Get Market Insights & Growth Opportunities

- The ethoxylate global market is crucial for so many industrial and consumer applications. The market sizing is an extensive evaluation of production trends, pricing structures, regional consumption, and demand for many products and application segments. The growth expectations are in tandem with the growth of the personal care, agrochemicals, and industrial manufacturing sectors, supported by developments in the chemicals industry at large.

- There is a huge concentration in the distribution, particularly in the Asia-Pacific, North America, and Europe, owing to the chemical manufacturing base, agricultural activity, and consumer goods industry robust in these regions. These emerging regions in the Middle East, Africa, and Latin America are driving the growth as they develop their domestic production capabilities while also responding to the burgeoning consumer demand signaling a gradual diversification of global supply and consumption patterns.

- Alcohol ethoxylates are the leading family of products used predominantly in detergents, personal care, and industrial cleaning formulations. They are chosen primarily because of performance characteristics, cost advantages, and conformity to regulatory requirements. Pricing varies from product type and quality specifications; specialty grades attract premium pricing based on stringent certification requirements and technical standards.

To get key market trends

Ethoxylates Market Trends

- Advanced agrochemical solutions are urgently required due to agricultural intensification, whereby ethoxylates are critical in their functions as adjuvants and emulsifiers, improving the performance of pesticides and herbicides by increasing spreading and penetration while supporting modern farming practices, such as precision agriculture and integrated pest management. Such trends underscore the enhancement of crop protection efficiency along sustainability objectives.

- Ethoxylates associated with drug formulation requirements have been significant opportunities for the growth of the pharmaceutical industry. The compounds act in the form of solubilizers, emulsifiers, and wetting agents which stabilize the emulsions and enhance the bioavailability of active ingredients. They possess versatility and thus form an important part of the formulation of diverse dosage forms such as tablets, capsules, and injectable solutions as access and innovations in healthcare keep on expanding across the globe.

- Industrial and institutional cleaning applications form a major consuming market for them owing to the excellent detergency, low-foaming characteristics, and compatibility with various cleaning agents. Rising awareness of hygiene and sustainability accelerates the pace of adoption of biodegradable formulations particularly in sectors like healthcare, hospitality, and food processing. The outsourcing of cleaning services consolidates the demand for high-performance solutions that incorporate ethoxylate surfactants.

- These changing trends of use in the surfactants industry, driven by sustainability and consumer preferences to eco-friendly products, put forward great momentum for bio-based ethoxylate formulations. Bio-based formulations conform to better biodegradability and compliance with environmental regulations, which move the manufacturer from a petroleum base into renewable feedstock.

Ethoxylates Market Analysis

Learn more about the key segments shaping this market

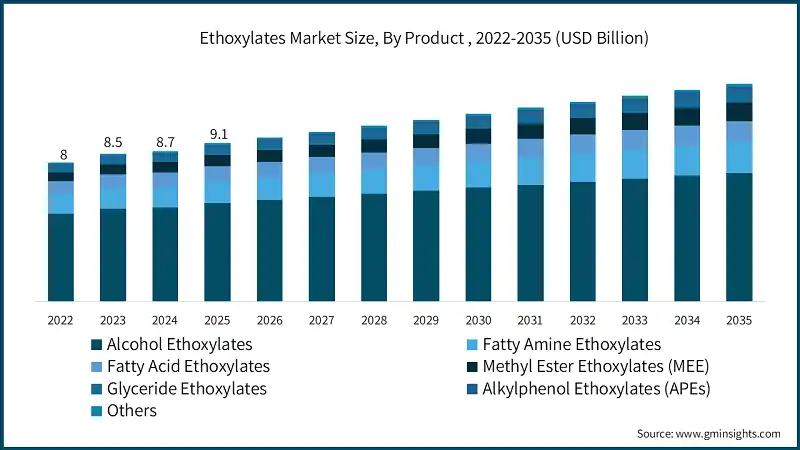

Based on product, the market is segmented into alcohol ethoxylates, fatty amine ethoxylates, fatty acid ethoxylates, methyl ester ethoxylates (MEE), glyceride ethoxylates, alkylphenol ethoxylates (APEs), and others. Alcohol ethoxylates dominated the market with an approximate market share of 62% in 2025 and is expected to grow with a CAGR of 2.7% by 2035.

- Alcohol ethoxylates is the major ingredient in most cleaning and personal care formulations-great emulsifiers and detergents, while fatty amine ethoxylates serve an unreplaceable role in the very agrochemical pertinent to the enhancement of pesticide spreading and penetration. High in fat that ethoxylates and mild for cosmetic and industrial applications bolster with stabilization or viewing methyl ester ethoxylates as an emerging sustainable pudder as an ecological alternative.

- Glyceride ethoxylates mostly benefit food and personal care applications through moisturizing and emulsification, while alkylphenol ethoxylates used to be the major type in the cleaning industrial application but now face increasing restrictions and thus a need for change to safer alternatives. Specialty ethoxylates are reserved for niche applications such as pharmaceuticals and high-performance coatings because they can provide properties such as solubilization and controlled reactivity. The collective portfolio reflects developing performance-led and environmentally conscious offerings.

Learn more about the key segments shaping this market

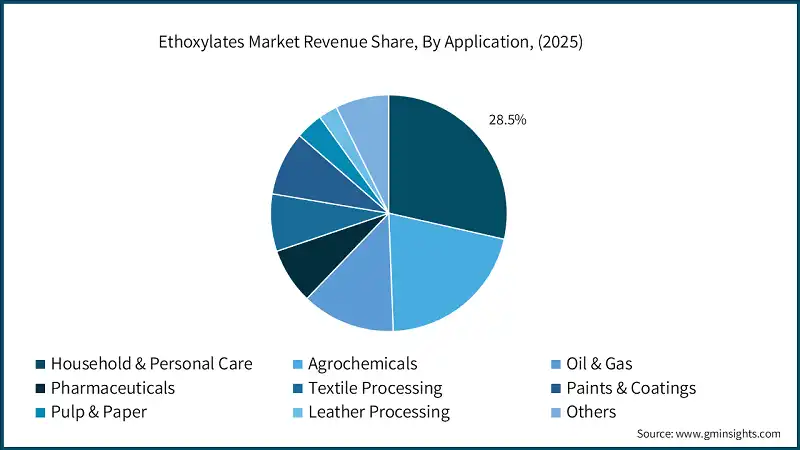

Based on application, the ethoxylates market is segmented into household & personal care, agrochemicals, oil & gas, pharmaceuticals, textile processing, paints & coatings, pulp & paper, leather processing, others. Household & personal care held the largest market share of 28.5% in 2025 and is expected to grow at a CAGR of 2.6% during 2026-2035.

- Ethoxylates are effective in emulsification and cleansing properties, used in formulation stability and mildness for household and personal care products such as shampoos, cleansers, and skincare. The application of ethoxylates in agri-chemicals is as additives, i.e., wetting agents that increase the spreading and penetration of pesticides as part of precision farming and efficient crop protection. Also in upstream oil and gas drilling operations, ethoxylates are used as additives in drilling fluids and demulsifiers, managing abstract extraction environments while enhancing the reliability of the processes involved.

- The pharmaceutical uses of ethoxylates are for solubilization and emulsification in drug formulations, which often either improve bioavailability or stability-in-use of the active ingredients. Scouring and wetting, for example, are the application modes of ethoxylates in textile processing which enable maximum dyeing and finishing uniformity.

Looking for region specific data?

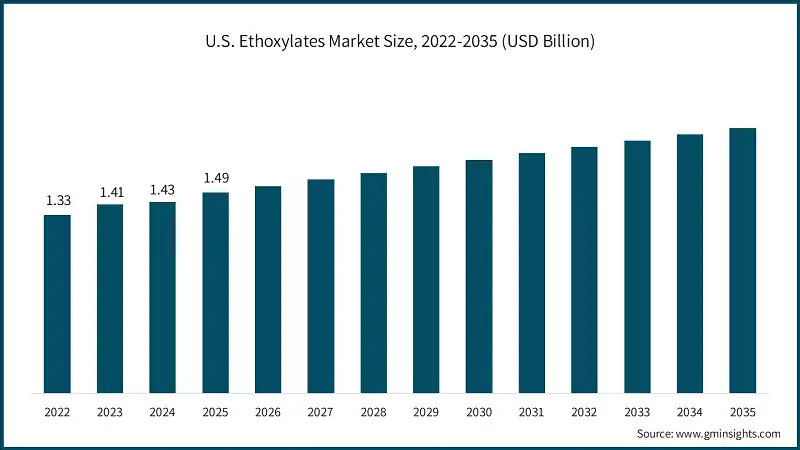

The North America ethoxylates market is growing rapidly on the global level with a market share of 19.7% in 2025.

- North America has emerged as a strategic growth hub due to advanced chemical manufacturing capabilities and strong regulations supporting sustainability and safety. The region's need for environmentally compliant formulations and innovations in specialty chemicals offers considerable opportunity for high-end ethoxylate products to target distinct industrial applications.

U.S. dominates the North America ethoxylates market with revenue of USD 1.49 billion in 2025, showcasing strong growth potential.

- The U.S. has an important role in shaping market trends through various policies that encourage cleaner production practices and modernization of industrial processes. These effectively place the U.S. in a leading position for the transition to bio-based and specialty ethoxylates.

Europe market hold the industry with revenue of USD 2.8 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

- Regulatory frameworks compelling environmental compliance and life-cycle efficiency will rapidly hasten the change toward the next generation of ethoxylates characterized by biodegradability, safety, and functional versatility.

Germany dominates the European ethoxylates market, showcasing strong growth potential.

- Germany is one of the most important growth hubs in Europe, with its backing of a highly developed chemical manufacturing base and innovation-driven approaches toward developing specialty ethoxylates.

The Asia Pacific dominates the ethoxylates industry at a CAGR of 3.7% during the analysis timeframe.

- The Asia Pacific is climbing fast to become growth point for ethoxylates-in concert with its strong industrial base, fast penetration of urbanization, and increasing consumption markets. The emphasis on highly advanced chemical formulations for personal care, agrochemicals, and even industrial cleaning in the region has boosted the adoption of high-performance ethoxylates.

China ethoxylates market is estimated to grow with a significant CAGR in the Asia Pacific region.

- China has emerged as a driver of the region, taking its large-scale production capabilities and the increasing demand for specialty chemicals. Shaping the product development strategies are competitive and eco-friendly formulations, while standards will continuously evolve.

Latin America ethoxylates accounted for 7.2% market share in 2024 and is anticipated to show highest growth over the forecast period.

- Latin America has recently emerged as a promising region for ethoxylates due to the dynamics of industrial growth, modernization of manufacturing infrastructures, and sustainable initiatives. The regulatory and environmental regime provides for the development of sophisticated ethoxylate formulations that meet performance and environmental specifications for a broad range of applications.

Brazil leads the Latin American ethoxylates market, exhibiting remarkable growth during the analysis period.

- Brazil serves as the greatest propellent for the expansion of innovative ethoxylate technologies that are based on a strong industrial base with an expanding chemical sector. Now, the focus on sustainable solutions and introduction of new technologies into agrochemicals, personal care, and industrial cleaning allow Brazil to play a role in changing regional market dynamics.

Middle East & Africa Ethoxylates accounted for 6.3% market share in 2025 and is anticipated to show lucrative growth over the forecast period.

- The ethoxylates market of the Middle East and Africa is picking up traction as diversification into industrial fields and sustainability-oriented policies begin changing the chemical production paradigm. Rising investments in manufacturing infrastructure and environmental compliance initiatives have created a fertile background for progressive ethoxylate formulations meeting international performance standards.

Saudi Arabia Ethoxylates industry to experience substantial growth in the Middle East and Africa market in 2025.

- Saudi Arabia itself is rapidly evolving into one such growth driver for the region, while hunting innovative chemical technologies under also transformation industrial agenda. Equally sustainable solution and modern material are the main focus of the country's drive to be a leader in specialty ethoxylates for oilfield chemicals, agrochemicals, and high-end industrial applications.

Ethoxylates Market Share

The top 5 companies in Ethoxylates industry include The Dow Chemical Company, BASF SE, Royal Dutch Shell PLC, Clariant AG, Nouryon. These are prominent companies operating in their respective regions covering approximately 46% of the market share in 2025. These companies hold strong positions due to their extensive experience in ethoxylates market. Their diverse product portfolios, backed by robust production capabilities and distribution networks, enable them to meet the rising demand across various regions.

- The Dow Chemical Company is a global company focused on the development of materials science, covering chemicals, advanced materials, and specialty products. The company's portfolio includes surfactants and ethoxylates used in a wide range of applications, such as home care, industrial cleaning, and personal care.

- BASF SE is a diversified chemical manufacturer covering the sectors of chemicals, materials, solutions for industry, and performance products. The ethoxylate portfolio is applied in detergents, coatings, agriculture, and personal care.

- Royal Dutch Shell PLC operates as an integrated energy and petrochemical company with strong footholds in specialty chemicals. Its ethoxylates are well-accepted, marketed under established brands, and sold mainly to the detergent, lubricants, and agrochemical sectors.

- Clariant is a specialty chemical company offering solutions in industrial and consumer markets. Their portfolio of ethoxylates includes those used for emulsification, wetting, and solubilization in applications including crop protection, textiles, and personal care.

- Nouryon is Specialty chemicals producer for cleaning, personal care, and agricultural industries. Ethoxylates are used in formulations requiring non-ionic surfactants and performance additives.

Ethoxylates Market Companies

Major players operating in the ethoxylates industry include:

- BASF SE

- Royal Dutch Shell PLC

- The Dow Chemical Company

- Clariant AG

- Nouryon

- Huntsman International LLC

- Sasol Limited

- Stepan Company

- Evonik Industries AG

- Solvay SA

- INEOS Group Limited

- Croda International PLC

- Arkema SA

- SABIC (Saudi Basic Industries Corporation)

Ethoxylates Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 9.1 Billion |

| Market Size in 2026 | USD 9.4 Billion |

| Forecast Period 2026 - 2035 CAGR | 3.2% |

| Market Size in 2035 | USD 12.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising demand for eco-friendly surfactants | Encourages the adoption of sustainable ethoxylate formulations around product development and compliance |

| Consumer preference shift | Pushes the manufacturers to go towards greener alternatives and transparent sourcing thereby redefining portfolio priorities |

| Brand sustainability commitments | Drives the spend on low-footprint raw materials and innovation pipelines in line with corporate ESG goals |

| Pitfalls & Challenges | Impact |

| Environmental concerns regarding APEs/NPEs | Creates the regulatory pressure or even the possibility of phasing out which requires reformulations and compliance cost |

| Aquatic toxicity | Results in limitations in certain applications with even stricter test and certification requirements |

| Opportunities: | Impact |

| Bio-based ethoxylates market expansion | New avenues for renewable feedstock commercialization and premium positions in the sustainability market |

| Specialty ethoxylates development | Allows differentiation via high-performance solutions designed for unique applications found in pharma, cosmetics and industrial needs |

| Market Leaders (2025) | |

| Market Leaders |

15% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Middle East & Africa |

| Emerging countries | Saudi Arabia, UAE, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Ethoxylates Industry News

- In October 2025, Bhageria Industries Limited, a specialty chemicals manufacturer, announced the launch of a new Plasticizers & Ethoxylates product line in a regulatory disclosure under SEBI’s Regulation 30.

- In September 2023, Dow introduced EcoSense 2470 Surfactant, providing customers with a sustainable solution to meet their formulation goals by harnessing innovative carbon capture technology for the home care market. Developed in collaboration with LanzaTech Global, Inc., the carbon recycling company transforming carbon waste into sustainable raw materials, this surfactant contributes to a circular carbon economy without sacrificing performance.

This ethoxylates market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By Product

- Alcohol ethoxylates

- Natural alcohol ethoxylates

- Synthetic alcohol ethoxylates

- Linear alcohol ethoxylates (LAE)

- Branched alcohol ethoxylates (BAE)

- Fatty amine ethoxylates

- Fatty acid ethoxylates

- Methyl ester ethoxylates (MEE)

- Glyceride ethoxylates

- Alkylphenol ethoxylates (APEs)

- Nonylphenol ethoxylates (NPEs)

- Octylphenol ethoxylates (OPEs)

- Others

- Carbonate ethoxylates (CO2-based)

- Enzymatically produced ethoxylates

- High-Purity pharmaceutical-grade ethoxylates

Market, By Application

- Household & personal care

- Laundry & dishwashing detergent

- Industrial & institutional cleaning

- Personal care

- Agrochemicals

- Herbicides

- Fungicides

- Insecticides

- Fertilizers & micronutrients

- Oil & gas

- Enhanced oil recovery (EOR)

- Foam control & wetting agents

- Lubricants & emulsifiers

- Demulsification

- Pharmaceuticals

- Drug solubilization & delivery

- Biologics & biosimilars

- Excipients & emulsifiers

- Medical device sterilization (EtO-related)

- Textile processing

- Scouring & wetting

- Dyeing & finishing

- Paints & coatings

- Emulsion polymerization

- Wetting & dispersing agents

- Protective coatings

- Architectural coatings

- Industrial coatings

- Pulp & paper

- Deinking agents

- Dispersing agents

- Defoamers

- Leather processing

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Who are the key players in the ethoxylates industry?

Key companies include The Dow Chemical Company, BASF SE, Royal Dutch Shell PLC, Clariant AG, and Nouryon. These leaders maintain strong market presence through robust product portfolios, technical expertise, and global distribution networks.

What was the revenue of the U.S. ethoxylates market in 2025?

The U.S. led the North America market with USD 1.49 billion in revenue in 2025, reflecting strong growth momentum. This expansion is driven by rising demand for sustainable surfactants and advanced specialty chemical formulations.

What are the emerging trends shaping the ethoxylates market?

Major trends include the shift toward bio-based ethoxylates, adoption of eco-friendly and biodegradable surfactants, development of specialty ethoxylates for pharmaceuticals, and increased focus on environmental compliance and sustainable formulations.

What was the valuation of the household & personal care segment in 2025?

The household & personal care segment accounted for 28.5% market share in 2025, supported by rising usage of ethoxylates in shampoos, skincare, detergents, and cleaning formulations.

What is the ethoxylates market size in 2025?

The global market size for ethoxylates was valued at USD 9.1 billion in 2025, driven by strong demand from personal care, agrochemicals, and industrial cleaning applications.

What is the market size of the ethoxylates industry in 2026?

The market size for ethoxylates reached USD 9.4 billion in 2026, reflecting steady expansion supported by rising consumption of non-ionic surfactants across industries.

What is the projected value of the ethoxylates market by 2035?

The market size for ethoxylates is expected to reach USD 12.5 billion by 2035, growing at a CAGR of 3.2% from 2026 to 2035. Growth is supported by sustainable surfactant innovations, bio-based formulations, and increasing demand from pharmaceuticals and agrochemicals.

How much share did alcohol ethoxylates account for in 2025?

Alcohol ethoxylates held approximately 62% market share in 2025, driven by its extensive use in detergents, personal care, and industrial cleaning formulations.

Ethoxylates Market Scope

Related Reports