Summary

Table of Content

Elevators Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Elevators Market Size

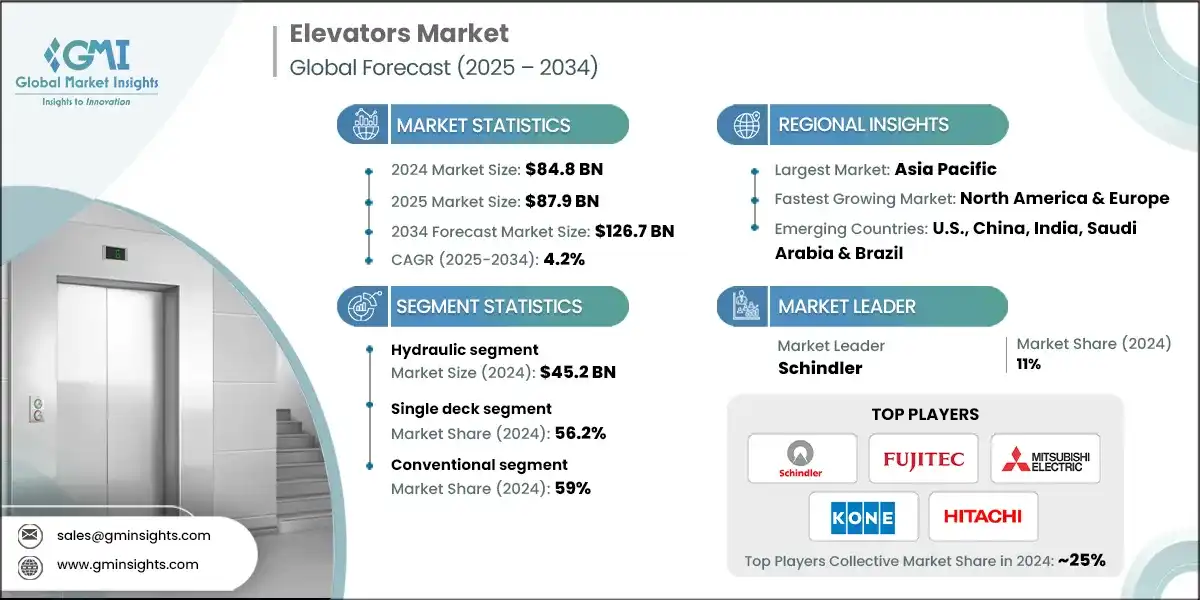

The global elevators market size was estimated at USD 84.8 billion in 2024. The market is expected to grow from USD 87.9 billion in 2025 to USD 126.7 billion in 2034, at a CAGR of 4.2% according to latest report published by Global Market Insights Inc.

To get key market trends

- The elevator market is witnessing growth primarily by the continuous development of smart cities and megaprojects in infrastructure across the world. Government and urban city planners are heavily investing in smart city projects to develop efficient, sustainable, and technologically advanced urban environments. The United Nations estimates that 68% of the world's population will be reside in urban areas by 2050, which required the installation of advanced infrastructure to meet urbanization.

- Such construction projects typically entail the construction of high-rise residential and commercial buildings, transportation stations, and public facilities, all of which need contemporary elevator systems for efficient vertical transportation. For example, India's Smart Cities Mission to develop 100 smart cities has boosted demand for elevators that offer functionality combined with energy efficiency and smart building technology. Similarly, China's urbanization rate, which was reached 65.22% in 2022 as per the National Bureau of Statistics of China, continues to increase the demand for advanced vertical elevators.

- In developed regions like North America and Europe, renovation of old infrastructure is another key driver of growth. Most of buildings constructed in the mid-to-late 20th century are undergoing retrofitting to meet today's needs for safety, accessibility, and the use of energy. The European Lift Association (ELA) estimates that as many as 50% of elevators in Europe are over 20 years old, a reflection of the necessity for immediate modernization. This has created a high volume of retrofit and replacement elevator projects.

- Modernization projects include replacing mechanical components, installing advanced control systems, and upgrading user interfaces to improve performance and reliability. Building owners are spending more on such upgrades to extend the life of their buildings while keeping abreast of new regulations, creating a steady stream of refurbishment business for the elevator market.

- Technological advancement and rising demand for smart elevators are revolutionizing the industry. Smart elevators with IoT sensors, AI-based maintenance, and destination control technology are becoming popular in new building developments as well as retrofits.

- Smart elevators offer enhanced safety, reduced energy consumption, and enhanced user experience through touchless interfaces, real-time diagnostics, and adaptive traffic control. Buildings account for nearly 30% of the total energy consumed globally, and energy-efficient solutions like smart elevators are the future of sustainability, states the International Energy Agency (IEA). This technological revolution not only solves current market needs but also establishes the future of vertical transportation.

Elevators Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 84.8 Billion |

| Market Size in 2025 | USD 87.9 Billion |

| Forecast Period 2025 - 2034 CAGR | 4.2% |

| Market Size in 2034 | USD 126.7 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Smart cities & infrastructure development | Drives demand advanced elevator systems to support urban mobility and smart building integration. |

| Modernization of aging infrastructure | Boosts retrofit and replacement market for elevators in older buildings. |

| Development of innovative technologies and rising demand for smart elevators | Accelerates adoption of AI-enabled, energy-efficient, and IoT-integrated elevator solutions. |

| Opportunities: | Impact |

| Smart and connected elevator systems | Opens new revenue streams through predictive maintenance and real-time monitoring services. |

| Urbanization and high-rise construction | Expands market potential with increased need for vertical transportation solutions. |

| Opportunities: | Impact |

| Smart and connected elevator systems | Opens new revenue streams through predictive maintenance and real-time monitoring services. |

| Urbanization and high-rise construction | Expands market potential with increased need for vertical transportation solutions. |

| Market Leaders (2024) | |

| Market Leaders |

Market share of 11% |

| Top Players |

Collective market share of ~25% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | North America & Europe |

| Emerging countries | U.S., China, India, Saudi Arabia & Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Elevators Market Trends

The market is experiencing a shift toward advance technologies with smart elevators being used in new construction and retrofits.

- Smart elevators include sensors, cloud connectivity, and AI to track performance and predict maintenance requirements before the problem arise. Touchless buttons, real-time diagnostics, and destination control systems have become standard, particularly in commercial and high-rise residential buildings. This is fuelled by the demand for safe, more efficient, and more convenient vertical transportation, mainly in high-density city centres.

- One of the trends that are emerging in the market is the increasing prevalence of machine room-less (MRL) elevators. MRL elevators does not requires separate machine room making them a good fit for buildings where space is limited. The streamlined aesthetic, coupled with reduced installation and maintenance expenses, is a draw for developers and architects of contemporary urban developments. MRL elevators are ideal for mid-rise buildings and are increasingly being used as a choice of preference in residential and commercial real estate developments.

- Sustainability is increasingly influencing the design and choice of elevators. With buildings trying to minimize their carbon footprint, elevators must also be energy efficient. Technologies such as regenerative drives, which tap into energy when in use, and energy-saving motors are becoming common. When paired with building management systems, elevators can run more efficiently as part of energy-saving program.

Elevators Market Analysis

Learn more about the key segments shaping this market

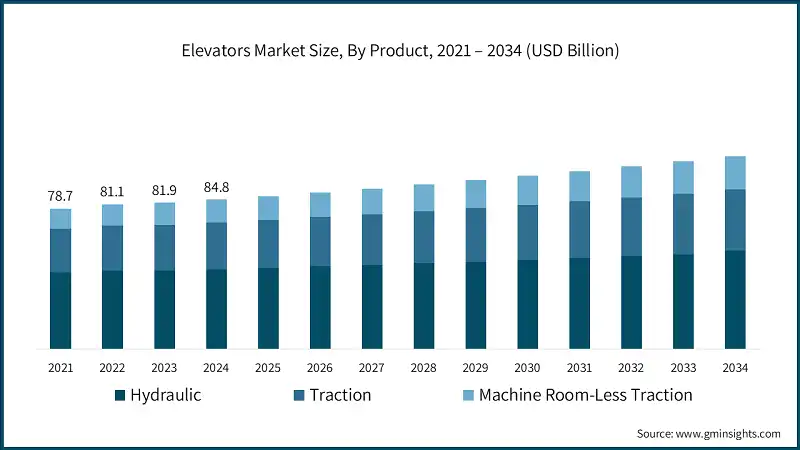

Based on product, the elevators market is categorized into hydraulic, traction and machine room-less traction. The Hydraulic elevators accounted for revenue of around USD 45.2 billion in 2024 and is anticipated to grow at a CAGR of 3.4% from 2025 to 2034.

- Hydraulic elevators are particularly favored in low- to mid-rise buildings due to their cost-effectiveness, ease of installation, and lower maintenance requirements compared to traction systems. Their ability to operate without a dedicated machine room makes them ideal for buildings with space constraints. Additionally, advancements in energy-efficient hydraulic systems and eco-friendly fluids are enhancing their appeal in markets focused on sustainability. The steady growth in residential and commercial construction, especially in emerging economies, further fuels demand, as developers seek reliable and affordable vertical transportation solutions for smaller structures.

- Furthermore, the traction elevators are expected to grow at a CAGR of 4.3% during the forecast period. The increasing demand for smart and sustainable infrastructure, combined with the development of technologies like regenerative drives and IoT-based maintenance, continues to drive the uptake of traction elevators. Governments are promoting green buildings, and the growth of commercial real estate worldwide are also likely to increase the demand of traction elevator in forecast period.

Learn more about the key segments shaping this market

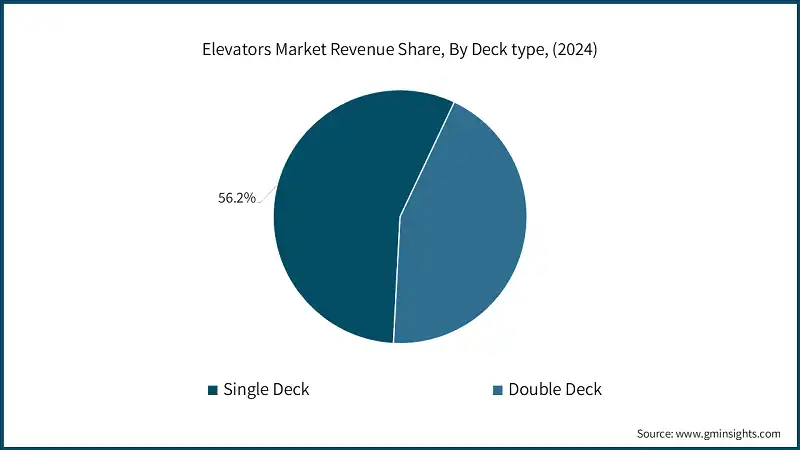

Based on deck type, elevators market consists of single deck and double deck. The single deck industry emerged as leader and held 56.2% of the total market share in 2024 and is anticipated to grow at a CAGR of 3.9% from 2025 to 2034.

- Its growth is due to its wide use in residential, commercial, and low- to mid-rise buildings. Single deck elevators are affordable to install and require less maintenance than double deck systems, which makes them popular and are preferred by building owners.

- These are less complicated design also make it simple to incorporate into existing infrastructure, particularly in retrofit projects. In addition, the relentless growth in demand for vertical transport in cities due to population expansion and development of real estate keeps fueling growth of this segment at a modest CAGR of 2.4% during 2034.

The destination control of elevators market consists of smart and conventional. The conventional segment emerged as leader and held 59% of the total market share in 2024 and is anticipated to grow at a CAGR of 3.8% from 2025 to 2034.

- This growth is mainly fueled by its widespread use in current infrastructure and economy compared to smart systems. Traditional systems are easier to install and maintain, hence, a preferred option for mid-rise buildings, cost-conscious projects, and locations where advanced technologies are not yet fully adopted.

- Some retrofit projects also stick with traditional systems because of compatibility and lower upgrade costs. As urbanization grows and vertical transport becomes a requirement on various types of buildings, the traditional segment of the market is likely to keep a substantial proportion of market share, particularly in the developing economies.

Looking for region specific data?

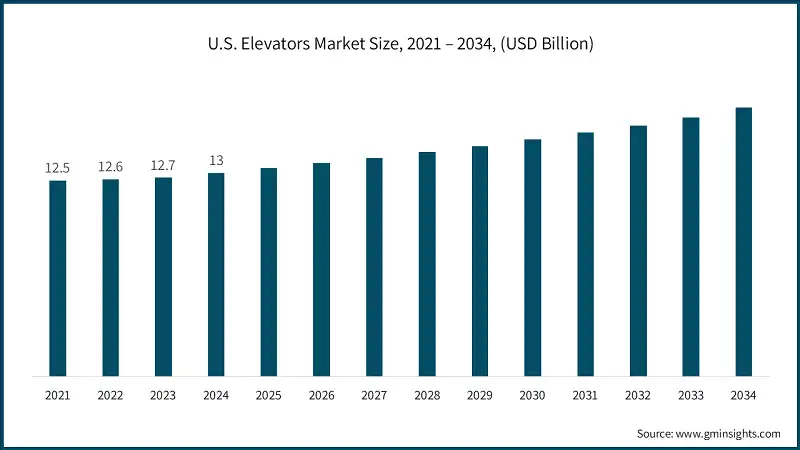

The U.S. dominates an overall North America elevators market and valued at USD 13 billion in 2024 and is estimated to grow at a CAGR of 2.9% from 2025 to 2034.

- The U.S. leads the North American market because of its strong construction sector, widespread renovation of old infrastructure, and high demand for advance vertical transport systems. The emphasis on smart cities, green building, and high-rise constructions within the country has driven continuous investment in elevator technology.

- The presence of top industry players and the encouraging regulatory environment favoring energy-efficient and safety standards-compliant systems further drive the market's steady growth. With ongoing urbanization and commercial property growth, the U.S. is likely to continue its regional leadership during the forecast period.

In the European elevators market, Germany is expected to experience significant and promising growth from 2025 to 2034.

- Germany's focus on city growth, energy-efficient buildings, and refurbishment of existing properties. The nation's dedication to sustainability and intelligent building technology is driving the use of advanced elevator systems, such as machine room-less and destination control elevators.

- Germany's aging population and growing requirement for accessibility solutions in residential and public buildings also play a role in driving market growth. With favorable government policies and a booming construction industry, Germany is well-equipped to be one of the major drivers of the overall development of the European elevator industry.

The Asia Pacific elevators market, the China held 22.6% market share in 2024 and is anticipated to grow at a CAGR of 5.7% from 2025 to 2034.

- This growth is fueled by strong urbanization, large-scale infrastructure expansion, and the expansion of high-rise residential and commercial buildings across the country. Governments focus on developing smart cities and green buildings are also driving the growth of cutting-edge elevator technologies, such as energy-efficient and intelligent systems.

- China's population and ongoing urbanization of existing buildings are also continuing to drive demand, making the country a leading growth driver in the regional market.

In the Middle East and Africa elevators market, South Africa held 18.4% market share in 2024 promising growth from 2025 to 2034.

- This growth is due to growing urbanization, infrastructure upgrade, and modernization initiatives in commercial and residential areas. The government's emphasis on enhancing public amenities and growing smart city programs is also driving the demand for improved elevator systems.

- Furthermore, growing awareness regarding accessibility and safety standards is promoting the use of advanced vertical transport solutions, making South Africa a leader in the region's market growth.

Elevators Market Share

- In 2024, the prominent manufacturers in elevators industry are Schindler, FUJITEC CO., LTD., Mitsubishi Electric Corporation, KONE and Hitachi, Ltd. collectively held the market share of ~25%.

- Electra Elevators excels in the design, manufacturing, installation, and maintenance of elevator systems. The company has earned a strong reputation for its innovative offerings and unwavering focus on safety and reliability. Electra’s product range includes residential, commercial, and industrial elevators, all customized to address specific client requirements. By prioritizing advanced technology and energy efficiency, Electra Elevators aims to deliver sustainable mobility solutions that improve user experiences and optimize operational performance across various building types.

- CANNY ELEVATOR CO., LTD., a prominent manufacturer of elevators and escalators based in China, has been a symbol of quality and innovation. The company has rapidly emerged as a significant player in the global elevator market, offering a comprehensive range of products, including passenger elevators, freight elevators, and escalators. With a strong commitment to research and development, CANNY consistently integrates state-of-the-art technology to enhance safety, efficiency, and user comfort. Focused on expanding its global footprint, CANNY Elevator provides tailored solutions and exceptional service to clients worldwide, reinforcing its competitive position in the industry.

Elevators Market Companies

Major players operating in the elevators industry include:

- Aritco

- Canny Elevator

- Electra Elevators

- EMAK

- ESCON Elevators

- Fujitec

- Hitachi

- Hyundai Elevator

- KONE

- Mitsubishi Electric

- Schindler

- Schumacher Elevator

- Sigma Elevator

- TK Elevator

- Toshiba

TK Elevator, a global leader in the elevator and escalator industry, is widely recognized for its cutting-edge solutions and steadfast dedication to quality and safety. Formerly a part of Thyssenkrupp AG, TK Elevator became an independent company in 2020 and has since concentrated on advancing urban mobility. The company provides an extensive portfolio of products, including elevators, escalators, and moving walkways, designed to serve both residential and commercial needs. With a strong focus on sustainability, TK Elevator incorporates advanced technologies such as smart building systems and energy-efficient designs, striving to deliver safer, more accessible, and eco-friendly transportation solutions.

Schindler Group, a key player in the elevator and escalator industry. Schindler operates in over 100 countries, offering a diverse range of mobility solutions tailored to residential, commercial, and industrial sectors. The company is celebrated for its technological innovation and commitment to improving urban mobility, delivering products that emphasize safety, efficiency, and sustainability. Schindler’s focus on digital transformation is evident in its smart solutions, which utilize IoT and data analytics to enhance maintenance processes and elevate user experiences, positioning the company as a forward-thinking leader in the industry.

Elevators Industry News

- In May 2025, Hyundai Elevator and Samsung C&T formalized an MOU to advance third-generation modular elevator technology, specifically designed for skyscrapers reaching heights of up to 500 meters. This innovative modular system, with over 70% of its components prefabricated, is engineered to significantly reduce construction timelines, enhance safety standards, and drive the adoption of off-site construction practices.

- In November 2024, Hitachi's Taiwan subsidiary achieved a milestone by securing its largest order to date, comprising 147 elevators and escalators. These installations are planned for 13 stations in the second phase of the Taipei MRT Wanda-Zhonghe-Shulin Line, which is projected to be completed by 2031.

- In August 2024, Otis launched its Gen3 connected elevator platform at the 'Platform for Possibility' event in Bangkok. This cutting-edge platform combines the proven technology of Otis' renowned Gen2 elevator with the advanced capabilities of the Otis ONE IoT digital platform. It offers an upgraded passenger experience with features such as Ambiance aesthetics, Pure fixtures, eView infotainment, and air purification technology.

- In January 2024, TK Elevator introduced its innovative home elevator concept, ‘enta villa.’ Designed specifically for multi-floor residences and villas, this product caters to the growing demand for luxury housing and lifestyle solutions in India, the company’s primary market.

The elevators market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Billion) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Product

- Hydraulic

- Traction

- Machine room-less traction

Market, By Deck Type

- Single deck

- Double deck

Market, By Building Height

- Low-rise

- Mid-rise

- High-rise

Market, By Speed

- Less than 1m/s

- Between 1 m/s to 3 m/s

- Between 4 m/s to 6 m/s

- Between 7 m/s to 10 m/s

- Above 10 m/s

Market, By Destination Control

- Smart

- Conventional

Market, By Business

- New equipment

- Maintenance

- Modernization

Market, By Application

- Passenger

- Freight

Market, By End Use

- Residential

- Home lifts

- Others

- Industrial

- Commercial

- Office

- Hotels

- Healthcare

- Others (Shopping malls)

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

Who are the key players in the elevators industry?

Key players include Aritco, Canny Elevator, Electra Elevators, EMAK, ESCON Elevators, Fujitec, Hitachi, Hyundai Elevator, KONE, Mitsubishi Electric, and Schindler.

What are the upcoming trends in the elevator market?

Trends include AI-enabled smart elevators, space-efficient MRL designs, and sustainable tech like regenerative drives and energy-saving motors.

What was the market share of the single deck segment in 2024?

The single deck segment held 56.2% of the total market share in 2024 and is expected to showcase around 3.9% CAGR through 2034.

What was the valuation of the conventional segment in 2024?

The conventional segment accounted for 59% of the total market share in 2024 and is set to expand at a CAGR of 3.8% from 2025 to 2034.

Which region leads the elevators industry?

The U.S. leads the North American market, valued at USD 13 billion in 2024, with a CAGR of 2.9% expected through 2034. Growth is driven by a strong construction sector, infrastructure renovations, and demand for advanced vertical transport systems.

How much revenue did the hydraulic elevators segment generate in 2024?

The hydraulic elevators segment generated approximately USD 45.2 billion in 2024 and is anticipated to witness over 3.4% CAGR till 2034.

What is the market size of the elevators in 2024?

The market size was estimated at USD 84.8 billion in 2024, with a CAGR of 4.2% expected through 2034. Growth is driven by smart city developments and infrastructure megaprojects globally.

What is the projected value of the elevators market by 2034?

The market is poised to reach USD 126.7 billion by 2034, fueled by urbanization, technological advancements, and sustainability initiatives.

What is the expected size of the elevators industry in 2025?

The market size is projected to reach USD 87.9 billion in 2025.

Elevators Market Scope

Related Reports