Summary

Table of Content

Dental Implants and Abutment Systems Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Dental Implants and Abutment Systems Market Size

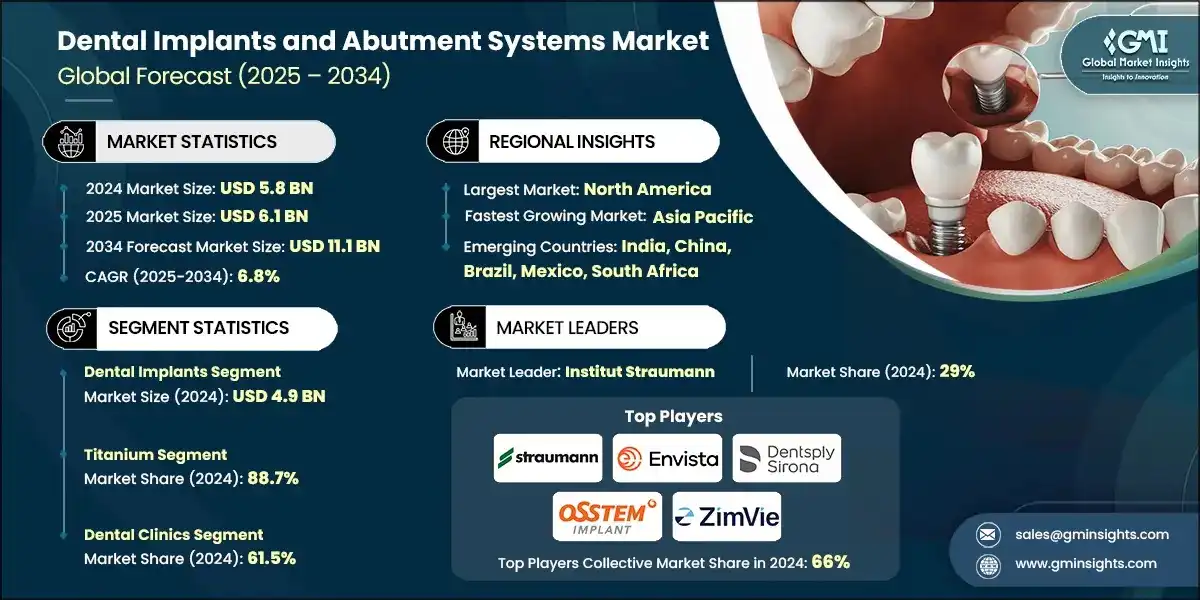

The global dental implants and abutment systems market was valued at USD 5.8 billion in 2024 and is projected to grow from USD 6.1 billion in 2025 to USD 11.1 billion by 2034, expanding at a CAGR of 6.8%, according to the latest report published by Global Market Insights Inc. This steady growth is driven by the expanding elderly population base across the globe, growing prevalence of dental disorders worldwide, rising demand for cosmetic dentistry across the world, and advancements in implant technology in developed countries.

To get key market trends

Major companies in the industry include Institut Straumann, Envista Holdings Corporation, Dentsply Sirona, Osstem Implant, and ZimVie. Key players in the dental implants and abutment systems sector are at the forefront of growth by continually investing in research and development to offer solutions that are precise, durable, and patient-focused. With the addition of digitally integrated patient workflows including advanced imaging and computer-aided design, these companies invest to transform treatment planning and delivery. Companies are performing less invasive surgical techniques and utilizing regenerative biomaterials to enhance clinical outcomes and improve procedures.

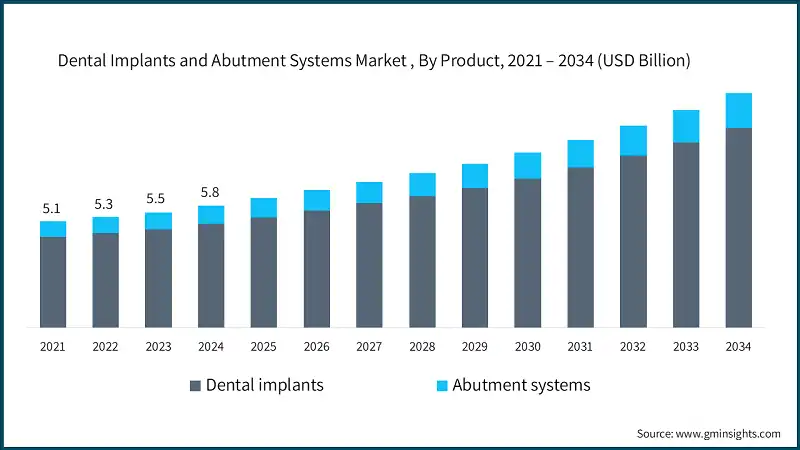

The market increased from USD 5.1 billion in 2021 to USD 5.5 billion in 2023. The rising global demand for cosmetic dentistry is significantly propelling the growth of the dental implants and abutment systems market. Cosmetic procedures such as tooth reshaping, gum contouring, and orthodontics are becoming increasingly popular as individuals seek to enhance their smiles and overall facial aesthetics. This surge in demand is reflected in the growing number of orthodontic patients; in 2024, American Association of Orthodontists (AAO) reported a record 6.66 million patients undergoing active orthodontic treatment across the U.S. and Canada, including 1.91 million adults in the U.S., up from 1.64 million in 2022. As more people pursue cosmetic dental solutions, the need for supportive technologies like implants and abutment systems continues to rise.

The growing prevalence of dental disorders worldwide is a key driver fueling the expansion of the dental implants and abutment systems market. According to World Health Organization, in 2019, oral diseases affected nearly 3.5 billion people globally, they represented the most widespread noncommunicable health conditions. Among these, 2.5 billion individuals suffered from untreated dental caries in permanent teeth, over 1 billion were affected by severe periodontal disease, and 350 million experienced complete tooth loss. These conditions often lead to functional and aesthetic impairments, increasing the demand for restorative solutions such as dental implants and abutments. As the global burden of dental disorders rises, the need for effective, long-lasting, and accessible treatment options continues to grow, positioning implant systems as a vital component of modern dental care.

Additionally, the expanding elderly population base across the globe is playing a crucial role in driving the growth of the dental implants and abutment systems market. As people age, they become more susceptible to oral health issues such as tooth loss, gum disease, and bone resorption, which often necessitate restorative dental solutions. According to the World Health Organization, by 2050, the number of people aged 60 years and older will exceed 2 billion, with the majority residing in low- and middle-income countries. This demographic shift is increasing the demand for durable and functional dental treatments, making implants and abutment systems essential for maintaining oral health and quality of life in aging populations. As the global geriatric population continues to grow, the market for advanced dental restoration technologies is expected to expand steadily.

Dental implants and abutment systems are parts that are used in restorative dentistry to replace missing teeth and restore oral function and aesthetic appearance. A dental implant is an artificial tooth root, usually made from either titanium or zirconia, that is surgically placed in the jawbone to hold a dental prosthesis, such as a crown, bridge, or denture. The abutment is a connector placed on top of the implant that connects the tooth to the implant. Implants and abutment systems provide a long-term, stable, and natural-looking solution to tooth loss that is commonly used in both functional and aesthetic dental treatment.

Dental Implants and Abutment Systems Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 5.8 Billion |

| Market Size in 2025 | USD 6.1 Billion |

| Forecast Period 2025 – 2034 CAGR | 6.8% |

| Market Size in 2034 | USD 11.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Expanding elderly population base across the globe | Fuels demand for dental implants due to age-related tooth loss and increased need for restorative dental care. |

| Growing prevalence of dental disorders worldwide | Drives adoption of implant and abutment systems as a long-term solution for missing or damaged teeth. |

| Rising demand for cosmetic dentistry across the world | Boosts interest in aesthetically pleasing implant solutions and customized abutments. |

| Advancements in implant technology in developed countries | Encourages uptake of innovative implant systems with improved osseointegration and minimally invasive placement techniques. |

| Pitfalls & Challenges | Impact |

| Limited reimbursement policies | Restricts access to implant treatments, especially in regions with low insurance coverage for dental procedures. |

| High cost of dental implant treatment | Hampers market growth in price-sensitive regions and among lower-income populations. |

| Opportunities: | Impact |

| Shift towards minimally invasive procedures | Promotes adoption of advanced abutment systems and digital workflows that reduce surgical complexity and recovery time. |

| Expansion of dental tourism in emerging countries | Dental tourism opens new markets for affordable implant systems and boosts demand for high-quality yet cost-effective solutions. |

| Market Leaders (2024) | |

| Market Leaders |

29% market share |

| Top Players |

Collective market share in 2024 is 66% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | India, China, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Dental Implants and Abutment Systems Market Trends

- The market is changing rapidly due to advancements in implant technology in developed countries.

- Recent advancements in implant materials have significantly enhanced biocompatibility, strength, and aesthetics. Manufacturers are increasingly using titanium alloys for their durability and osseointegration properties, and zirconia for its metal-free, natural appearance and compatibility with soft tissues. A notable example is the Straumann PURE Ceramic Implant, made from high-strength zirconia. This implant offers excellent aesthetic outcomes, especially in the anterior region, and is ideal for patients seeking metal-free solutions.

- Enhanced surface technologies have revolutionized implants integration with bone. Techniques such as nano-texturing, plasma spraying, and hydrophilic coatings accelerate osseointegration, reduce healing time and improving implant stability. For instance, Nobel Biocare’s Xeal and TiUltra surfaces feature advanced nano-texturing that provide better soft and hard tissue integration. These surfaces are designed to optimize biological response and long-term success, especially in challenging clinical cases.

- Shifts in implant planning and placement have occurred due to the development of digital technologies. Methods like CAD/CAM systems and intraoral scanners allow for accurate diagnosis, custom design of abutment, and possibly guided surgery. The Dentsply Sirona CEREC System is an example of a chairside CAD/CAM method that allows the clinician to design and fabricate crowns and abutment in one visit. Thus, it streamlines the practice workflow and enhances the patient experience through fewer appointments and turnaround time.

- Overall, these technologies create more predictable outcomes, quicker healing, and tailored treatment, thereby expanding the adoption of dental implants and abutment systems across diverse patient populations and clinical settings.

Dental Implants and Abutment Systems Market Analysis

Learn more about the key segments shaping this market

Based on products, the dental implants and abutment systems market is segmented into dental implants and abutment systems. The dental implants segment led this market in 2024, accounting for the highest market share owing to its biocompatibility and osseointegration. This segment was valued at USD 4.9 billion in 2024.

- Dental implants are artificial teeth, typically made from titanium or zirconia, that are surgically placed into the jawbone to support replacement teeth. They serve as a stable foundation for dental prosthetics and are designed to mimic the function and appearance of natural teeth.

- They have durable, biocompatible qualities that help restore function and aesthetics. The demand is increasing rapidly due to the increasing prevalence of tooth loss, periodontal disease, and demand for cosmetic dental treatments. Technological developments such as surface modifications aimed at improving healing rates and digital dentistry to guide precise implant placement, have made implants convenient and easier to use.

- Envista’s Nobel Biocare TiUltra Implants feature titanium construction with advanced surface chemistry that enhances both soft and hard tissue integration, promoting faster healing and long-term stability. Osstem’s TSIII SA Implant incorporates a sandblasted and acid-etched surface for improved bone contact and high initial stability, making it ideal for immediate loading and placement in soft bone conditions.

- Their ability to deliver long-lasting, natural-looking results while improving patient comfort and clinical efficiency ensures their growth in the market.

Based on the material, the dental implants and abutment systems market is segmented into titanium, zirconium, and other materials. The titanium segment accounted for the highest market share of 88.7% in 2024.

- Titanium has unique combination of strength, biocompatibility, and ability to integrate with bone tissue. In implants and abutment systems, titanium offers a reliable solution that supports long-term functionality and patient comfort.

- Titanium is corrosion-resistant, retains and structure under stress, and is compatible with the human body. These characteristics make titanium ideal in any oral setting, as the requirements of the oral environment can be demanding. The use of digital workflows by dental professionals and manufacturers enables the expansion of the market as they design abutments specific to patient requirements.

- For example, Straumann’s Medentika Ti-base abutments, high-grade titanium, offer customizable chimney and tapered shoulders for retention, and precision. Neoss ProActive implants are also Grade IV commercially pure titanium, which structurally aligns with osseointegrative requirements, along with compatible NeossONE digital platform for universal prosthetics.

- As implant technology evolves with improvements in surface treatments, digital integration, and patient-specific solutions, titanium’s reliability and adaptability will significantly shape market.

Learn more about the key segments shaping this market

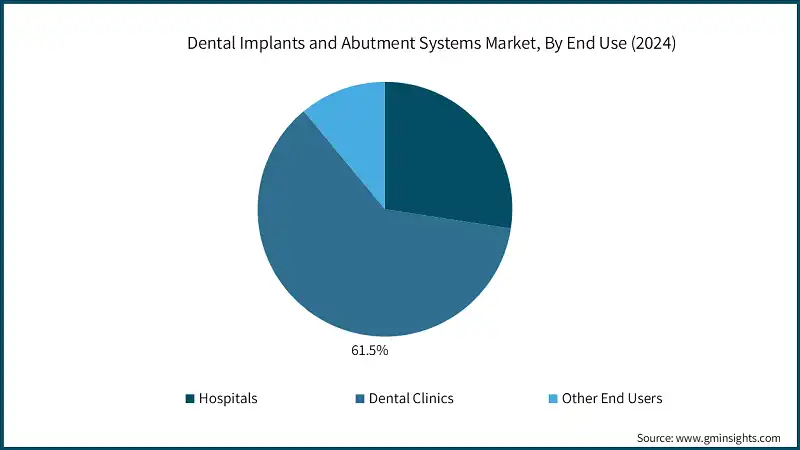

Based on the end use, the dental implants and abutment systems market is segmented into hospitals, dental clinics, and other end users. The dental clinics segment accounted for the highest market share of 61.5% in 2024.

- Dental clinics serve as the primary delivery channel for dental implant and abutment system procedures. Their ability to integrate digital workflows and customize implant solutions makes them critical part of implant treatments.

- The expansion of dental clinics in the implant market is closely linked to increasing patient engagement in oral healthcare. According to the 2023 National Health Interview Survey by CDC, 65.5% of adults underwent a dental exam or cleaning in the past year, while 86.9% of children had a dental visit in 2019. This upward trend in preventive care is accelerating the demand for dental procedures within clinical settings.

- As dental visits continue to rise and patient expectations shift toward personalized, high-quality care, dental clinics will remain pivotal in shaping the future of market.

Looking for region specific data?

North America Dental Implants and Abutment Systems Market

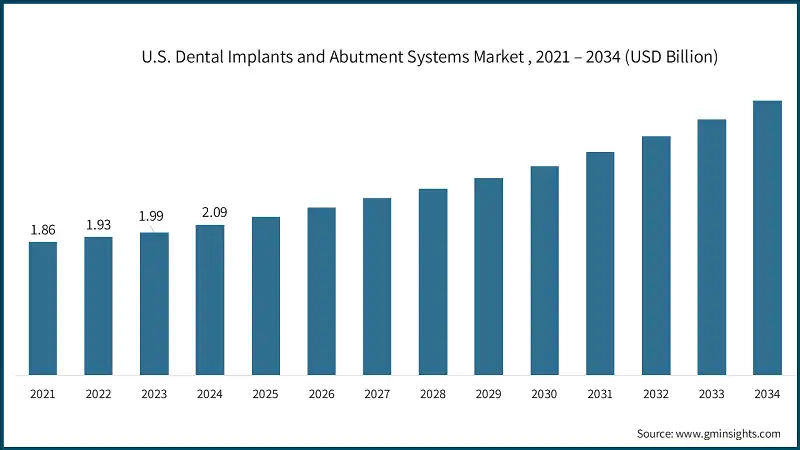

North America dominated the market, valued at USD 2.3 billion in 2024. The market is expected to be valued at USD 4.2 billion by 2034.

- The North America market is experiencing steady growth, largely driven by the rising prevalence of dental disorders across the region. According to CDC, a significant portion of the aging population faces tooth loss, with 13.2% of adults aged 65 and older in the U.S. experiencing complete tooth loss.

- Between 2020 and 2022, the U.S. recorded an average of 1.94 million emergency department visits annually for tooth-related disorders, with the highest incidence among adults aged 25–34. These figures highlight the unmet need for timely and effective dental care, particularly restorative solutions such as implants.

- As awareness of oral health grows and technology advances, dental professionals and manufacturers are responding with more accessible, efficient, and patient-friendly implant solutions. The integration of digital workflows, minimally invasive techniques, and customized abutments is accelerating the adoption of dental implants and abutment systems in North America

Europe Dental Implants and Abutment Systems Market

Europe market accounted for USD 1.7 billion in 2024 and is anticipated to show lucrative growth over the forecast period.

- The market in Europe is expanding steadily, fueled by the increasing prevalence of oral health disorders across the region. According to the WHO European Region Oral Health Status Report (2023), over 50.1% of adults in Europe had a major oral disease in 2019 marking the highest prevalence globally among all WHO regions. Among these, caries (tooth decay) of permanent teeth affected 33.6% of the population, representing nearly 335 million cases. These figures highlight a significant and growing need for restorative dental solutions.

- Manufacturers and dental clinics across Europe are responding by investing in advanced implant technologies, including surface-enhanced titanium implants, digital workflows, and patient-specific abutments. These innovations are helping improve treatment outcomes, reduce procedure times, and expand access to care across diverse patient segments.

- With the high prevalence of dental disorders and growing patient demand for reliable restorative solutions, Europe’s market is poised for continued growth.

Germany's dental implants and abutment systems market is projected to experience steady growth between 2025 and 2034.

- Germany’s market is witnessing steady growth, fueled by the rising demand for cosmetic dentistry. As patients increasingly seek treatments that enhance both function and aesthetics, dental implants have become a preferred solution for replacing missing or damaged teeth. This shift is particularly evident among adults who prioritize natural-looking restorations and long-term oral health outcomes.

- Manufacturers are also aligning with this trend by developing implant systems that support minimally invasive techniques and personalized prosthetics. These innovations are further driving adoption of dental implants and abutment systems across Germany.

Asia Pacific Dental Implants and Abutment Systems Market

The Asia Pacific region was valued at USD 1.3 billion in 2024 and is projected to show a lucrative growth of about 7.8% during the forecast period.

- Asia Pacific region is witnessing robust growth in the market, fuelled by the rising prevalence of dental disorders and increasing awareness of restorative dental care. According to the WHO Global Oral Health Status Report, South-East Asia alone recorded 135 million cases of untreated caries in deciduous teeth, 526 million cases in permanent teeth, and 307 million cases of severe periodontal disease in 2019. These staggering figures highlight the unmet need for effective dental solutions, particularly among aging populations and underserved communities, where tooth loss and chronic oral conditions are common.

- Technological advancements in implant design and surgical techniques are further accelerating market adoption across the region. Innovations such as CAD/CAM systems, 3D-printed implants, and minimally invasive procedures are making dental implants more accessible and appealing to both patients and practitioners.

Japan dental implants and abutment systems market is poised to witness lucrative growth between 2025 – 2034.

- Japan stands out as a mature and technologically advanced market in the dental implants and abutment systems sector, largely driven by its rapidly aging population. As of October 2023, 29.1% of Japan’s population was aged 65 and older, according to the Statistics Bureau of Japan. This demographic shift has led to a surge in age-related dental conditions such as tooth loss and periodontal disease, significantly increasing the demand for restorative dental solutions like implants and abutments.

- In response, Japan has embraced cutting-edge dental technologies, including CAD/CAM systems, zirconia implants, and minimally invasive surgical techniques, making implant treatments more precise and patient friendly. The country’s robust healthcare infrastructure, high standards of dental care, and widespread insurance coverage further support market growth.

Latin America Dental Implants and Abutment Systems Market

Brazil in Latin America is experiencing significant growth in the market.

- Brazil represents a significant and evolving market for dental implants and abutment systems, driven by a high burden of oral diseases and increasing demand for restorative dental care. In 2019, according to National Institute of Health, almost 100 million Brazilians equivalent to 45.3% of the population presented with at least one oral disorder. The prevalence of untreated dental caries was especially high, affecting 13.5 million children in primary teeth and over 52 million people in permanent teeth. Additionally, 29.5 million suffered from periodontitis, and nearly 22 million experienced edentulism, underscoring the urgent need for effective dental rehabilitation solutions.

- This widespread oral health burden is fuelling growth in Brazil’s dental implant sector, supported by advancements in implant technology and expanding access to care.

Middle East and Africa Dental Implants and Abutment Systems Market

- Saudi Arabia is experiencing steady growth in the market, driven by rising demand for aesthetic and functional dental restoration. The country’s healthcare sector is undergoing rapid modernization, and dental care is a key focus area within its broader health transformation initiatives.

- Advancements in implant technologies are playing a pivotal role in shaping the market. Saudi dental professionals are increasingly adopting digital dentistry, CAD/CAM systems, zirconia and titanium implants, and minimally invasive surgical techniques to improve precision, reduce recovery time, and enhance patient outcomes. The integration of 3D imaging and guided implant placement has also elevated the standard of care. With strong government support for healthcare innovation and growing investment in dental education and infrastructure, Saudi Arabia is growing in market.

Dental Implants and Abutment Systems Market Share

- The top 5 players, such as Institut Straumann, Envista Holdings Corporation, Dentsply Sirona, Osstem Implant, and ZimVie, collectively held 66% of the total market share.

- These companies are driving market expansion through advanced implant technologies, digital workflows, and strategic acquisitions across key regions including Europe, North America, and Asia-Pacific.

- Leading firms maintain their competitive edge by integrating CAD/CAM systems, AI-assisted diagnostics, robotic placement tools, and biomaterial innovations into their product portfolios. Straumann, for example, offers a diverse range of implant systems like BLX and PURE, tailored for various clinical scenarios.

- Companies like Osstem Implant and ZimVie are gaining traction in emerging markets by offering value-based implant solutions and expanding their presence in dental education and training. Osstem’s strong foothold in Asia and ZimVie’s focus on minimally invasive techniques and smart surgical kits are helping them penetrate underserved regions and outpatient clinics.

- Furthermore, the convergence of implantology with AI-powered treatment planning and remote monitoring platforms is unlocking new opportunities in personalized dental care. As patient expectations evolve and cosmetic dentistry demand rises, these top players will further grow in the market.

Dental Implants and Abutment Systems Market Companies

Few of the prominent players operating in the dental implants and abutment systems industry include:

- Dentsply Sirona

- A.B. Dental Devices

- Adin Dental Implant Systems

- Bicon

- Cortex

- AVINENT Science and Material

- Envista Holdings Corporation

- Henry Schein

- Institut Straumann

- Osstem Implant

- ZimVie

- Biotem

- Dentium USA

- Ziacom

- Dynamic Abutment Solutions

- Keystone Dental Group

- BHI Implants

- Dentalpoint

- Ditron Dental

- Cowellmedi

- TAV Dental

- BioHorizons

- National Dentex Labs

- Glidewell

- BioThread Dental Implant Systems

- Dentsply Sirona

Dentsply Sirona is a global dental technology company known for integrating digital innovation with clinical excellence. In the dental implants and abutment systems market, its USP lies in offering a seamless digital workflow that connects diagnostics, implant planning, surgery, and restoration. A prime example is the Astra Tech Implant System, which features a unique conical connection and surface technology designed to promote long-term stability and bone preservation. By combining this with digital tools like CEREC for chairside restorations, Dentsply Sirona empowers clinicians to deliver efficient and predictable implant treatments.

Envista Holdings Corporation brings together a portfolio of trusted dental brands, offering a wide range of implant solutions tailored to different clinical and economic needs. Its USP is the ability to serve both premium and value segments through a unified digital ecosystem that enhances clinical precision and workflow efficiency. For instance, Nobel Biocare’s N1 implant system exemplifies this approach, featuring a biologically driven design and a digitally integrated workflow that simplifies the surgical process while supporting optimal patient outcomes. Envista’s commitment to innovation and education ensures that clinicians are equipped with the tools and knowledge to succeed.

Institut Straumann is a pioneer in implant dentistry, recognized for its commitment to research, innovation, and premium quality. Its USP is the use of advanced materials and surface technologies that enhance implant integration and long-term success. A standout example is the Straumann BLX implant system, which is designed for immediate placement and loading, offering high primary stability even in challenging bone conditions. Straumann’s comprehensive approach, which includes digital dentistry and regenerative solutions, allows clinicians to deliver personalized, esthetic, and durable outcomes for patients across a wide range of clinical scenarios.

Dental Implants and Abutment Systems Industry News:

- In February 2024, ZimVie Inc. launched the TSX Implant in Japan, strengthening its market presence in Asia. This strategic release enabled the company to attract new clientele and enhance its competitive positioning in the region’s advanced dental care segment.

- In May 2023, Henry Schein, Inc. announced an agreement to acquire S.I.N. Implant System, one of Brazil’s leading dental implant manufacturers. This acquisition expanded Henry Schein’s footprint in Latin America and provided access to a broader customer base in one of the world’s most dynamic dental markets

- In May 2022, Osstem Europe, the European division of Osstem Implant, unveiled its next-generation Key Solution (KS) implant. Featuring a unique internal design, the KS system improved implant strength and offered a streamlined platform for both surgical placement and prosthetic loading. The launch contributed to the company’s customer base expansion across Europe.

The dental implants and abutment systems market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 – 2034 for the following segments:

Market, By Product

- Dental implants

- Tapered implants

- Parallel-walled implants

- Abutment systems

- Stock abutments

- Custom abutments

- Abutments fixation screws

Market, By Material

- Titanium

- Zirconium

- Other materials

Market, By End Use

- Hospitals

- Dental Clinics

- Other End Use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

What is the projected value of the dental implants and abutment systems market by 2034?

The market is expected to reach USD 11.1 billion by 2034, fueled by technological innovations, enhanced implant materials, and increasing adoption of advanced surface technologies.

What is the projected size of the dental implants and abutment systems market in 2025?

The market is projected to reach USD 6.1 billion in 2025.

How much revenue did the dental implants segment generate?

The dental implants segment generated USD 4.9 billion in 2024, leading the market due to its biocompatibility and osseointegration properties.

What was the market share of the titanium segment?

The titanium segment accounted for 88.7% of the market share in 2024, driven by its durability and osseointegration benefits.

Who are the key players in the dental implants and abutment systems market?

Key players include Dentsply Sirona, A.B. Dental Devices, Adin Dental Implant Systems, Bicon, Cortex, AVINENT Science and Material, Envista Holdings Corporation, Henry Schein, Institut Straumann, Osstem Implant, ZimVie, and Biotem.

Which region leads the dental implants and abutment systems market?

North America led the market with a valuation of USD 2.3 billion in 2024. The region's dominance is supported by advanced healthcare infrastructure and high adoption of innovative dental technologies.

What are the upcoming trends in the dental implants and abutment systems industry?

Key trends include advancements in implant materials such as titanium alloys and zirconia, adoption of enhanced surface technologies like nano-texturing and hydrophilic coatings, and increasing demand for metal-free and aesthetic solutions.

Which end-use segment dominated the dental implants and abutment systems market?

The dental clinics segment dominated the market in 2024, holding a 61.5% share, attributed to the increasing number of dental procedures performed in clinics.

Dental Implants and Abutment Systems Market Scope

Related Reports