Summary

Table of Content

Construction Punch List Software Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Construction Punch List Software Market Size

The global construction punch list software market size was estimated at USD 680.1 million in 2025. The market is expected to grow from USD 691.6 million in 2026 to USD 1.5 billion in 2035, at a CAGR of 9.2% according to latest report published by Global Market Insights Inc.

To get key market trends

Construction teams now rely on punch list software to efficiently identify, track, and resolve project deficiencies during closeout. This market includes web-based platforms and mobile apps, promoting real-time collaboration among general contractors, subcontractors, architects, engineers, and building owners throughout the project's lifecycle.

The U.S. Census Bureau reports sustained construction spending growth, with total U.S. construction put in place exceeding $2 trillion annually, creating substantial total addressable market for digital project management tools including punch list software.

Construction Punch List Software Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 680.1 Million |

| Market Size in 2026 | USD 691.6 Million |

| Forecast Period 2026 - 2035 CAGR | 9.2% |

| Market Size in 2035 | USD 1.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising digital adoption in construction | Facilitates digital workflows, reducing manual errors and improving overall project efficiency. |

| Need for better team collaboration | Enhances communication among teams, ensuring smoother coordination and fewer project delays. |

| Focus on quality and timely completion | Supports adherence to standards and deadlines, minimizing rework and cost overruns. |

| Mobile and cloud-based accessibility | Provides real-time updates and remote access, enabling faster decision-making on-site. |

| Growth in large construction projects | Drives demand for scalable punch list solutions capable of managing complex projects efficiently. |

| Pitfalls & Challenges | Impact |

| High implementation costs | Increases financial burden on construction firms, slowing adoption and ROI realization. |

| Resistance to digital adoption | Delays deployment, reduces user engagement, and limits efficiency gains from the software. |

| Opportunities: | Impact |

| Adoption of AI and automation for defect detection | Enhances accuracy and efficiency in identifying construction defects, reducing manual inspection time and rework costs. |

| Expansion in emerging markets with growing construction activities | Drives market growth by catering to increasing demand for digital construction management solutions in rapidly developing regions. |

| Integration with BIM and project management tools | Facilitates seamless collaboration and real-time data exchange, improving project tracking, coordination, and overall workflow efficiency. |

| Demand for mobile-first and cloud-based solutions | Enables on-site accessibility, real-time updates, and remote monitoring, enhancing field-to-office communication and decision-making. |

| Market Leaders (2025) | |

| Market Leaders |

18% Market Share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil, UAE |

| Future outlook |

|

What are the growth opportunities in this market?

The 2024/25 Global Status Report for Buildings and Construction by GlobalABC highlights that buildings and construction contribute 37% of global energy-related CO2 emissions. This drives the need for digital tools to enhance efficiency, benefiting punch list software vendors promoting lean construction and waste reduction.

In November 2024, Procore Technologies, a frontrunner in the industry, unveiled AI-driven agents within its punch list software. These agents offer automated insights and an intelligent copilot feature, streamlining the processes of defect identification and resolution, and expediting both punch list generation and completion tracking.

In 2023, around 40% of major construction firms harnessed Building Information Modeling (BIM) for energy optimization in design phases, as reported by the Global Alliance for Buildings and Construction (GlobalABC). This trend is paving the way for integrated punch list workflows, especially as punch list software increasingly converges with BIM and other project management platforms, forming cohesive digital construction ecosystems.

The market value is concentrated in developed regions with advanced construction industries and technology. North America leads due to early adoption of construction technology and a strong SaaS ecosystem, while Europe follows, driven by strict quality and safety regulations.

Construction Punch List Software Market Trends

The construction punch list software industry is undergoing significant changes, driven by five key trends transforming quality control, deficiency resolution, and project closeout processes.

Artificial intelligence is transforming construction punch list software into intelligent project assistants. For instance, in November 2024, Procore Technologies' Procore AI, launched, introduces AI-driven agents, insights, and Copilot features to automate tasks, analyze deficiency data, and provide predictive solutions.

In March 2025, Autodesk unveiled the Autodesk Assistant in its Construction Cloud. This innovation harnesses natural language processing, allowing project teams to effortlessly query punch list databases in conversational terms and obtain immediate insights, all without the need to wade through intricate software interfaces.

Computer vision and image recognition enable automated defect detection from photographs. AI systems analyze site walk-through images, identify deficiencies like surface imperfections or misaligned installations, and draft punch list items for human validation.

Leading platforms now prioritize purpose-built mobile apps over responsive web designs. These apps utilize device-specific features like accelerometers, haptic feedback, biometric authentication, and photo gallery integration for enhanced functionality.

Cloud deployment dominates construction punch list software due to its advantages. It eliminates on-premises servers, ensures automatic updates, supports multiple devices, offers scalable storage, and provides integrated backups for seamless data preservation.

Customers increasingly favor unified platforms, leading to a trend were standalone punch list applications merge into broader construction project management systems. This shift aims to reduce software proliferation, eliminate data silos, and simplify integration.

Modern punch list software is shifting from transactional tracking to strategic project intelligence. By aggregating data across projects, subcontractors, and building types, these solutions identify patterns, benchmark performance, and provide predictive insights.

Project teams gain insights into performance metrics through descriptive analytics. These metrics encompass total punch list item counts, resolution rates, aging analyses, comparisons of subcontractor performance, and categorizations of deficiencies based on trade, location, and severity.

Construction Punch List Software Market Analysis

Learn more about the key segments shaping this market

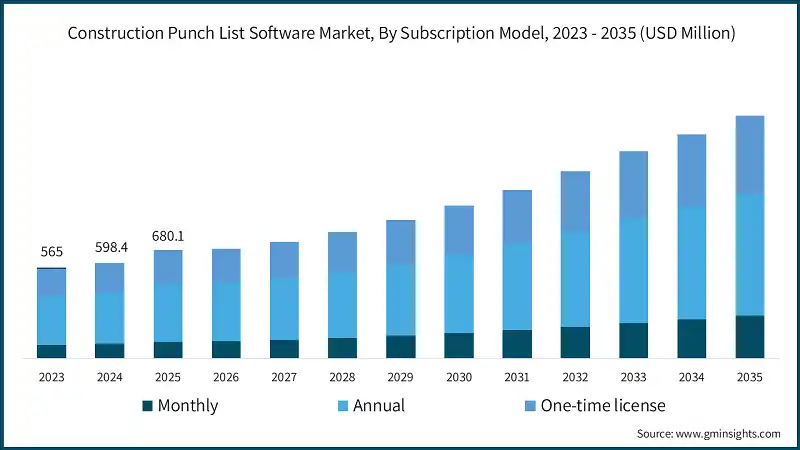

Based on subscription model, construction punch list software market is segmented into monthly, annual, and one-time license. The annual subscription segment dominates the market with 53% share in 2025, and the segment is expected to grow at a CAGR of 8.5% from 2026 to 2035.

- In 2025, annual subscriptions dominate the market, offering predictable vendor revenue and simplified budgeting for customers. Construction firms can expense these subscriptions against projects without requiring capital expenditure approvals.

- Annual subscriptions typically offer cost advantages versus monthly plans while avoiding large upfront licensing fees, making them attractive to mid-sized contractors managing multiple concurrent projects.

- Monthly subscriptions, accounting for 15.2% of the 2025 market, are growing at a 10.6% CAGR, driven by small contractors and specialty subcontractors seeking flexibility.

- Monthly billing reduces adoption barriers for organizations uncertain about long-term needs or testing new software, enabling trial periods without substantial financial commitments.

- The model particularly appeals to contractors with seasonal business patterns or project-based staffing, allowing license count scaling that matches current workload.

- Software-as-a-service (SaaS) industry trends toward monthly recurring revenue models are evident in punch list software vendor strategies, with most platforms offering monthly options alongside annual plans.

- One-time perpetual licenses will account for 31.0% of the 2025 market, growing at a 9.6% CAGR, slower than monthly subscriptions (10.6%) but faster than annual subscriptions (8.5%).

- Large enterprise contractors with established IT infrastructure and multi-year project portfolios often prefer perpetual licenses to minimize long-term costs and maintain software control.

- Yet, the constraints of perpetual licensing hinder vendors from effectively enforcing software updates. This limitation also complicates support for various versions, nudging platform providers to pivot exclusively towards subscription-based offerings.

- As the construction software industry embraces SaaS economics and cloud deployment, it's witnessing a notable shift from perpetual licensing to subscription models.

- The subscription model landscape also encompasses freemium strategies, where vendors offer limited free tiers to attract small contractors and drive viral adoption, with upgrade paths to paid subscriptions as usage or team size expands.

- This approach reduces market entry barriers and promotes digital adoption among underserved small contractors. Free tiers provide basic functionality while limiting projects, users, or advanced features.

Learn more about the key segments shaping this market

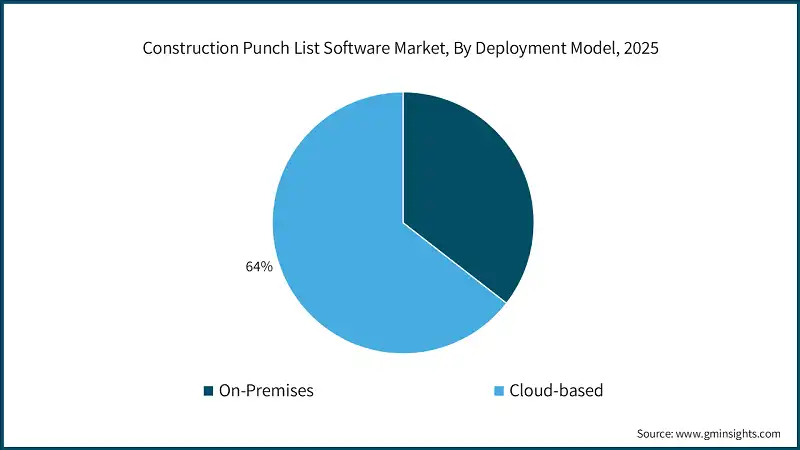

Based on deployment model, construction punch list software market is divided into on-premises and cloud-based. The cloud-based segment dominates with 64% market share in 2025 and is growing at the fastest rate of 9.7% CAGR till 2035.

- Cloud architecture enables seamless software updates, device-agnostic access, and scalable infrastructure without capacity planning.

- It ensures data preservation through integrated disaster recovery and eliminates the need for on-premises hardware and IT personnel.

- The RICS 2024 Digitalization in Construction Report highlights growing cloud adoption in the construction industry, driven by increased confidence in cloud security.

- The COVID-19 pandemic accelerated cloud migration, exposing VPN-dependent on-premises systems' limitations and highlighting cloud platforms' collaboration benefits.

- Cloud punch list platforms use multi-tenancy to serve numerous customers on shared infrastructure while ensuring data security and achieving unmatched economies of scale.

- Leading vendors like Procore, Autodesk, and Trimble are prioritizing cloud-native capabilities with a cloud-first strategy over on-premises version.

- Cloud deployment supports offline mobile functionality through local coaching with automatic sync when connectivity resumes, providing reliability even in network-challenged construction environments.

- On-premises deployment is expected to comprise 36% of the 2025 market, growing at a slower 8.2% CAGR from 2026 to 2035 while losing share to cloud alternatives.

- On-premises solutions appeal to large enterprise contractors with established IT departments, government projects with strict data control requirements, and organizations in regions with unreliable internet connectivity.

- Perpetual licensing and on-premises deployment frequently correlate, as both models prioritize customer control over vendor-managed services.

- On-premises deployment requires extensive IT infrastructure and personnel for setup, maintenance, and troubleshooting.

- Small and mid-sized contractors without IT departments often find cloud solutions more cost-effective. In contrast, large enterprises with established infrastructures can benefit from lower per-user costs through on-premises deployments.

- However, on-premises models sacrifice automatic updates, mobile accessibility, and real-time collaboration advantages that increasingly define competitive construction technology.

Based on type, the construction punch list software market is segmented into wed based and mobile apps. The wed based segment dominates with 66% market share in 2025 leveraging browser-based access that requires no software installation and supports universal device compatibility.

- Web platforms have traditionally been used by project managers, administrators, and office personnel for tasks like bulk data entry, report generation, and workflow configuration.

- Modern responsive web designs adapt to screen sizes from desktop monitors to tablets, providing flexible user experiences across devices.

- Web-based solutions simplify development with a single codebase, automatic updates, and platform independence via standards-compliant browsers. They also reduce storage needs by hosting data on servers.

- These characteristics make web platforms efficient for vendors to develop and support while providing customers with accessible, low-friction interfaces.

- Progressive web app (PWA) technology enables web platforms to function like native apps, offering offline access, push notifications, and hardware integration.

- PWAs provide mobile-like experiences while ensuring web development efficiency. Vendors now use single codebases for mobile users instead of separate iOS and Android apps.

- Mobile applications, projected to capture 34.1% of the 2025 market, are witnessing the industry's swiftest growth at a 10.1% CAGR. This surge underscores a pivotal shift in construction software usage, leaning increasingly towards field-based interactions.

- Native mobile apps for iOS and Android utilize platform-specific features like camera integration, GPS, offline sync, touch-optimized interfaces, and biometric authentication.

- According to the RICS 2024 report, 49% of surveyed construction firms have adopted mobile apps, marking it as one of the highest adoption rates across all construction technology categories.

- Mobile-first design philosophy prioritizes smartphone interfaces as primary user experiences, with tablet and desktop versions serving secondary roles.

- The mobile segment is growing rapidly due to smartphones' widespread use among construction workers and intuitive touchscreen interfaces reducing training needs.

- Segmentation trends show a move towards hybrid architecture, combining web-based admin functions with mobile-first field experiences for different construction roles.

Based on project size, the construction punch list software market is divided into large-scale projects and small and medium-sized projects. The large-scale projects dominate with 72% market share in 2025, and with a CAGR of 8.7% during forecast period.

- Large-scale projects dominate the construction punch list software market due to their complexity, multi-stakeholder coordination, and high punch list item volumes.

- Large projects involve multiple contractors, numerous subcontractors across trades, dedicated project teams, and systematic tracking of thousands of punch list items.

- Infrastructure megaprojects including airports, hospitals, universities, and commercial high-rises exemplify this segment, where manual paper-based punch list management becomes impractical at scale.

- Leading construction firms managing billion-dollar projects adopted punch list software early, recognizing that digital tools were essential rather than optional for complex project coordination.

- According to the RICS 2024 report, 40% of large construction firms are now utilizing BIM platforms, frequently incorporating punch list functionalities.

- Large-scale projects generate higher software revenue due to larger user bases, extended project durations, and demand for premium features like advanced analytics and custom workflows.

- Government infrastructure investments, such as the U.S.'s Infrastructure Investment and Jobs Act, the European Union's recovery programs, and urbanization initiatives in the Asia-Pacific, are bolstering a robust project pipeline.

- In 2024, small and medium-sized projects account for 28% of the market, but they're expanding at the quickest pace, boasting a 10.4% CAGR. This trend underscores a successful market push beyond the conventional enterprise clientele.

- This segment encompasses residential developments, small commercial buildings, tenant improvements, renovations, and specialized industrial projects typically managed by regional or local contractors.

- Vendors targeting small and medium-sized projects offer affordable pricing under USD 100 per user and simplified, easy-to-use interfaces. They focus on quick implementation and mobile-first solutions, catering to contractors with limited office infrastructure.

- The small and medium project segment's growth reflects construction industry democratization of digital tools previously exclusive to large enterprises.

Looking for region specific data?

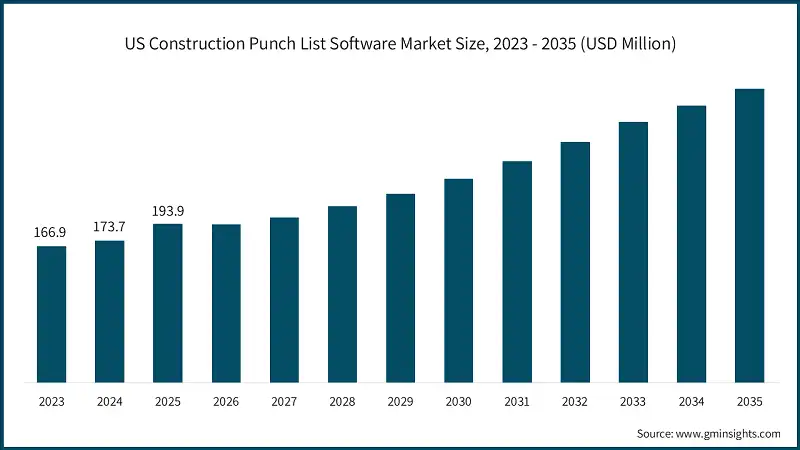

The US construction punch list software market is expected to experience significant and promising growth with a CAGR of 7.1% from 2026 to 2035.

- The United States leads in punch list software adoption, holding a significant share of the global market. High annual spending in the U.S. construction sector drives demand for digital project management solutions.

- Most large and mid-sized contractors in the U.S. have already adopted punch list software, leading to a below-global-average CAGR of 7.1% for the mature U.S. market.

- The U.S. leads the market due to its strong technology ecosystem, including vendors like Procore, Autodesk, Oracle, and Trimble. This gives American contractors early access to innovative solutions.

- The complexity of U.S. construction projects drives demand for advanced software, surpassing simpler international markets. These projects involve multiple contractors, detailed designs, strict code compliance, and high-quality standards.

- Federal and state infrastructure investments, including the Infrastructure Investment and Jobs Act, drive large-scale projects. Regulatory requirements for digital delivery and BIM usage boost demand for integrated punch list solutions.

- Labor shortages in the U.S. construction sector, as reported by AGC, are driving investments in digital tools to boost workforce efficiency.

- The U.S. market shows regional concentration in high-growth areas like the San Francisco Bay Area, Seattle, Austin, Denver, and southeast coastal cities, driven by increased construction activity.

North America dominated the construction punch list software market with a market share of 36% in 2025, which is anticipated to grow at a CAGR of 7.6% during the analysis timeframe.

- North America dominates the market due to advanced technology, early software adoption, and strong building activity.

- North America leads the market due to its mature construction industry, high digital adoption, and focus on quality control and project efficiency.

- The United States leads the regional market due to large-scale construction projects, early adoption of cloud-based software, and strict compliance requirements.

- The Canadian construction industry reflects American practices but stands out with a stronger government role in infrastructure, a concentrated market with dominant contractors, bilingual (English and French) software needs, and climate-specific considerations.

- Major Canadian urban markets including Toronto, Vancouver, Calgary, Montreal, and Edmonton drive construction activity spanning high-rise residential, commercial office, institutional (healthcare, education), and energy infrastructure projects

- Canada's market share is growing steadily, driven by infrastructure investments, urban development, and increased use of digital tools by contractors and builders.

- The Canadian market is growing faster than the U.S. due to lower digital adoption, especially among smaller contractors, offering room for expansion as best practices spread.

- Regulatory frameworks and building codes in the U.S. and Canada drive demand for structured punch list and inspection management solutions.

- North American giants like Procore, Autodesk, Oracle, and Trimble drive regional adoption with their relentless innovation and seamless platform integrations.

The China is fastest growing country in Asia Pacific construction punch list software market growing with a CAGR of 11.6% from 2026 to 2035.

- China's urbanization and focus on construction quality are boosting the use of digital punch list and inspection management software.

- Government initiatives, including Digital China and Smart City programs, are driving the adoption of digital quality management and automated defect tracking.

- China's advanced digital infrastructure enables real-time data sharing and widespread use of punch list software.

- Leading contractors use punch list platforms to streamline inspections and ensure timely project delivery.

- China is one of Asia-Pacific’s fastest-growing markets for construction punch list software, driven by regulatory focus, project complexity, and demand for efficient management solutions.

- Chinese construction technology ecosystem includes domestic vendors developing localized solutions adapted to Chinese practices, languages (Mandarin), standards, and regulatory requirements.

- China's Belt and Road Initiative drive international construction activity by Chinese contractors, creating demand for digital tools facilitating coordination across geographic distances and cultural contexts.

Asia Pacific is the fastest growing construction punch list software market, which is anticipated to grow at a CAGR of 11.5% during the analysis timeframe driven by rapid urbanization, infrastructure megaprojects, manufacturing expansion, and accelerating digital technology adoption.

- Urban population growth in Asia Pacific is driving increased construction activities, boosting demand for digital quality control and punch list management solutions.

- China leads the Asia Pacific market, driven by its massive construction industry, including urban development, industrial facilities, and complex projects like high-speed rail and energy infrastructure. This drives strong demand for digital project and punch list management tools.

- Government initiatives like "Made in China 2025" and "Digital China" are driving construction modernization and boosting punch list software adoption.

- China's construction technology market features strong domestic vendors offering localized solutions, while international players address data and regulatory challenges through partnerships.

- Australia has a mature market with strong regulations, advanced construction practices, and high adoption of digital construction tools in commercial, infrastructure, and mining projects.

- India's high-growth market is driven by urbanization, infrastructure projects, and smart city initiatives. Cost-effective punch list solutions and domestic software expertise support localized offerings.

- Japan's construction sector prioritizes precision, quality, and safety, driving interest in punch list management. Labor shortages and an aging workforce push digital adoption, though progress is slowed by conservative business culture.

- South Korea's advanced digital infrastructure and government support drive demand for enterprise-grade project management tools.

- Southeast Asian markets, including Singapore, Malaysia, Thailand, Indonesia, and Vietnam, are growing due to urbanization, infrastructure development, and foreign investment. Singapore leads in digital maturity, driven by regulatory mandates and BIM-focused construction.

UK dominates the Europe construction punch list software market, showcasing strong growth potential, with a CAGR of 8.6% from 2026 to 2035.

- In 2011, the UK government mandated that all centrally procured public projects adopt BIM Level 2 by 2016, a move that significantly sped up digital adoption in the UK's construction sector.

- The Royal Institution of Chartered Surveyors (RICS), based in London, drives construction digitalization through research, education, and professional standards. Its 2024 "digitalization in Construction Report" provides detailed industry analysis.

- UK construction structure combines large international contractors including Balfour Beatty, VINCI, and Skanska with numerous specialized regional and local firms.

- Large contractors handling complex projects use punch list software, valuing digital quality management as a competitive edge demanded by sophisticated clients.

- London's cyclical commercial construction drives software demand due to project complexity, high costs, international involvement, and tenant expectations.

- Regional markets including Manchester, Birmingham, Edinburgh, and other major cities contribute meaningful construction volume, though typically feature fewer complex projects than London.

- Brexit has created labor availability challenges in construction, driving the adoption of productivity tools. Regulatory divergence from the EU has introduced UK-specific compliance requirements, while exchange rate volatility impacts international software pricing.

- UK contractors' familiarity with American construction practices and English facilitates the adoption of U.S.-developed software like Procore, Autodesk, and Oracle in the UK market.

Europe construction punch list software market accounted for USD 180.4 million in 2025 and is anticipated to show growth of 8.5% CAGR over the forecast period.

- The European market is characterized by strict quality and safety regulations, sustainability mandates, and growing BIM adoption driven by regulatory requirements.

- Europe's market strength is driven by strict building regulations, quality assurance, high labor costs, and harmonized EU standards supporting digital construction.

- The UK leads Europe in digital adoption within the construction sector, driven by government BIM mandates, advanced contractors, London's global commercial role, and ease of adopting U.S.-developed software.

- Germany represents Continental Europe's largest construction market, driven by robust manufacturing sector, infrastructure modernization, commercial development, and energy transition investments.

- While German engineering's precision and quality standards resonate with digital punch list management, a conservative contractor culture and a penchant for established technologies could temper the pace of adoption.

- Nordic countries including Sweden, Denmark, Norway, and Finland exhibit advanced digital maturity across industries generally and demonstrate leadership in construction technology adoption specifically.

- France features significant construction activity in Paris and regional cities, with major infrastructure projects, commercial developments, and residential construction generating software demand.

- French market requires language localization and presents cultural preferences for domestic vendors or European alternatives to American platforms, though international vendors have established presence.

- Southern European markets including Spain, Italy, Greece, and Portugal show more variable adoption, with urban centers and large contractors demonstrating digital sophistication while smaller contractors and rural areas lag.

- Central and Eastern European markets including Poland, Czech Republic, Romania, and others represent high-growth opportunities as these economies modernize infrastructure and construction practices converge toward Western European standards.

Brazil leads the Latin American construction punch list software market, exhibiting remarkable growth of 7.6% during the forecast period of 2026 to 2035.

- Brazil, the largest economy and construction market in Latin America, showcases a wide array of projects spanning commercial, residential, infrastructure, industrial, and energy sectors.

- Brazil's construction industry comprises large national contractors, regional firms, and numerous small contractors, particularly in the residential sector.

- Internationally competing contractors, especially those collaborating with multinational clients, are increasingly embracing digital tools, driven by the demand for sophisticated project management.

- Economic challenges, such as inflation and currency fluctuations, may limit technology investments, but cloud-based subscription models ease adoption compared to traditional licensing.

- International platforms like Autodesk, Oracle, and Procore are investing in Brazilian Portuguese interfaces and support, driven by the need for vendor localization to meet Portuguese language requirements.

- Domestic and regional vendors compete by offering localized solutions adapted to Brazilian construction practices, legal requirements, and accounting standards.

- In Brazil, the World Cup and Olympics spurred a wave of construction modernization and a swift embrace of digital tools over the past decade.

UAE to experience substantial growth in the Middle East and Africa construction punch list software market in 2025.

- The UAE, particularly Dubai and Abu Dhabi, is known for its advanced infrastructure and government-driven construction excellence.

- Dubai's rise as a global hub for business, tourism, and logistics has driven iconic construction projects like Burj Khalifa, Palm Islands, and Dubai Expo 2020.

- Abu Dhabi's sovereign wealth and infrastructure investments significantly boost construction volumes. Stringent quality standards and elevated client expectations in both emirates are pushing contractors to embrace advanced management tools.

- UAE construction ecosystem combines international contractors from United States, Europe, Asia, and Middle East with local and regional firms.

- International contractors bring digital practices from home markets, prompting local firms to adopt similar capabilities. Increasing BIM mandates by governments and developers create opportunities for punch list software integration.

- UAE's 10.5% CAGR is fueled by ongoing infrastructure investments, the legacy of Expo 2020 projects, a shift from an oil-dependent economy to one focused on tourism and services, and persistent urban development.

- Projects like Dubai World Central airport expansion, transportation upgrades, and World Expo 2020 site repurpose offer ongoing opportunities. Saudi Arabia's Vision 2030 mega-projects further boost opportunities for UAE-based contractors and consultants.

Construction Punch List Software Market Share

- The top 7 companies in the construction punch list software industry are Procore Technologies, Autodesk, Oracle, Trimble, Buildertrend, Deltek, and Fieldwire contributed around 50% of the market in 2025.

- Procore Technologies, founded in 2002 in Carpinteria, California, leads the construction management market with its integrated platform covering project management, quality and safety, field productivity, financials, and analytics.

- Autodesk leverages its leading design software, including AutoCAD, Revit, and Civil 3D, to promote Autodesk Construction Cloud solutions. This platform integrates modules like BIM Collaborate, Build, Docs, and Takeoff for end-to-end construction workflows.

- Oracle Corporation targets large enterprise construction firms and infrastructure megaprojects through its Aconex collaboration platform and Primavera project controls. These solutions, acquired via Primavera (2008) and Aconex (2018), are integrated into Oracle's Cloud Infrastructure and enterprise applications.

- Trimble offers a diverse construction technology portfolio, integrating hardware, software, and collaboration tools. Its solutions, such as Viewpoint and SketchUp, span from preconstruction to project closeout.

- Buildertrend serves residential and small commercial contractors, addressing gaps left by enterprise-focused competitors. It offers affordable pricing, streamlined workflows, and features like client communication, selections management, and warranty tracking.

- Deltek provides solutions like Vision and ComputerEase for specialty contractors, architects, engineers, and government construction sectors. Its expertise stems from decades in project-based industries like government contracting and aerospace.

- Fieldwire, now a subsidiary of Hilti, integrates its mobile-first task management platform into Hilti's construction ecosystem. This acquisition uniquely connects software with Hilti's tools, equipment, and services.

Construction Punch List Software Market Companies

Major players operating in the construction punch list software industry are:

- Alpha Software

- Autodesk

- Buildertrend

- Deltek

- Fieldwire

- Oracle

- Procore Technologies

- Strata Systems

- Trimble (Viewpoint)

- UDA Technologies

- Procore Technologies, Autodesk, Oracle, Trimble (Viewpoint), Deltek, and Buildertrend lead the construction punch list software market with cloud-based platforms for quality management, inspections, and collaboration. They strengthen their position through product innovation, partnerships, and acquisitions, enhancing workflow efficiency and real-time visibility.

- Fieldwire, Alpha Software, Strata Systems, and UDA Technologies focus on mobile usability and contractor-centric workflows, enabling quick defect identification and efficient project closeouts. By leveraging cloud infrastructure and analytics, they help reduce rework, improve compliance, and accelerate timelines. Their scalable, user-friendly software serves small contractors and enterprises alike.

- Companies are leveraging the demand for faster project completions, better construction quality, and data-driven decisions. By streamlining processes and ensuring regulatory compliance, they are transforming quality management. With rising digital adoption, they are set to expand their platforms and drive innovation in construction punch list software.

Construction Punch List Software Industry News

- In June 2025, Oracle announced its Fiscal 2025 Q4 and full-year results on June 11, 2025. Q4 cloud revenue reached $6.7 billion, driven by strong enterprise cloud adoption.

- In March 2025, Autodesk introduced Automated Drawing Extraction and Autodesk Assistant in its Construction Cloud suite, showcasing advancements in AI integration. Automated Drawing Extraction uses computer vision and machine learning to extract data like room dimensions and equipment specifications from 2D construction drawings, reducing manual effort.

- In January 2025, Autodesk launched the Handover tool within Autodesk Construction Cloud to streamline project closeout and facility handover. It enables efficient transfer of key documents, including punch lists, warranties, manuals, and as-built information, to building owners and facility managers.

- In 20 November 2024, Procore Technologies launched Procore AI, featuring AI-powered Agents, Insights, and Copilot to enhance construction management. These tools automate tasks like punch list categorization, assignment suggestions, and timeline predictions.

The construction punch list software market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Bn) from 2022 to 2035, for the following segments:

Market, By Subscription Model

- Monthly

- Annual

- One-time license

Market, By Deployment Model

- On-premises

- Cloud-based

Market, By Type

- Web-Based

- Mobile apps

Market, By Project Size

- Large-scale projects

- Small and medium-sized projects

Market, By End Use

- General contractor

- Sub-contractor

- Plant engineering contractor

- Architects & engineers

- Building owners

- Others

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Benelux

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Singapore

- Thailand

- Indonesia

- Vietnam

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What was the valuation of the cloud-based deployment segment in 2025?

The cloud-based deployment segment accounted for 64% of the market share in 2025 and is growing at the fastest rate, with a CAGR of 9.7% through 2035.

What is the growth outlook for large-scale projects from 2026 to 2035?

Large-scale projects dominated the market with a 72% share in 2025 and is set to expand at a CAGR of 8.7% during the forecast period.

Which region leads the construction punch list software sector?

The United States leads the market, with significant growth expected at a CAGR of 7.1% from 2026 to 2035. High annual spending in the U.S. construction sector drives demand for digital project management solutions.

Who are the key players in the construction punch list software industry?

Key players include Alpha Software, Autodesk, Buildertrend, Deltek, Fieldwire, Oracle, Procore Technologies, Strata Systems, Trimble (Viewpoint), and UDA Technologies.

What are the upcoming trends in the construction punch list software market?

AI-powered project assistants, NLP-based database queries, computer vision for defect detection, mobile apps, cloud deployment, unified platforms, and data-driven project intelligence.

What is the expected size of the construction punch list software industry in 2026?

The market size is projected to reach USD 691.6 million in 2026.

How much revenue did the annual subscription segment generate in 2025?

The annual subscription segment generated approximately 53% of the market revenue in 2025 and is expected to grow at a CAGR of 8.5% till 2035.

What is the market size of the construction punch list software in 2025?

The market size was estimated at USD 680.1 million in 2025, with a CAGR of 9.2% expected through 2035. Increasing reliance on digital tools for project closeout and deficiency resolution is driving market growth.

What is the projected value of the construction punch list software market by 2035?

The market is poised to reach USD 1.5 billion by 2035, driven by advancements in AI, cloud deployment, and mobile app integration.

Construction Punch List Software Market Scope

Related Reports