Summary

Table of Content

Clean Label Protein Hydrolysates Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Clean Label Protein Hydrolysates Market Size

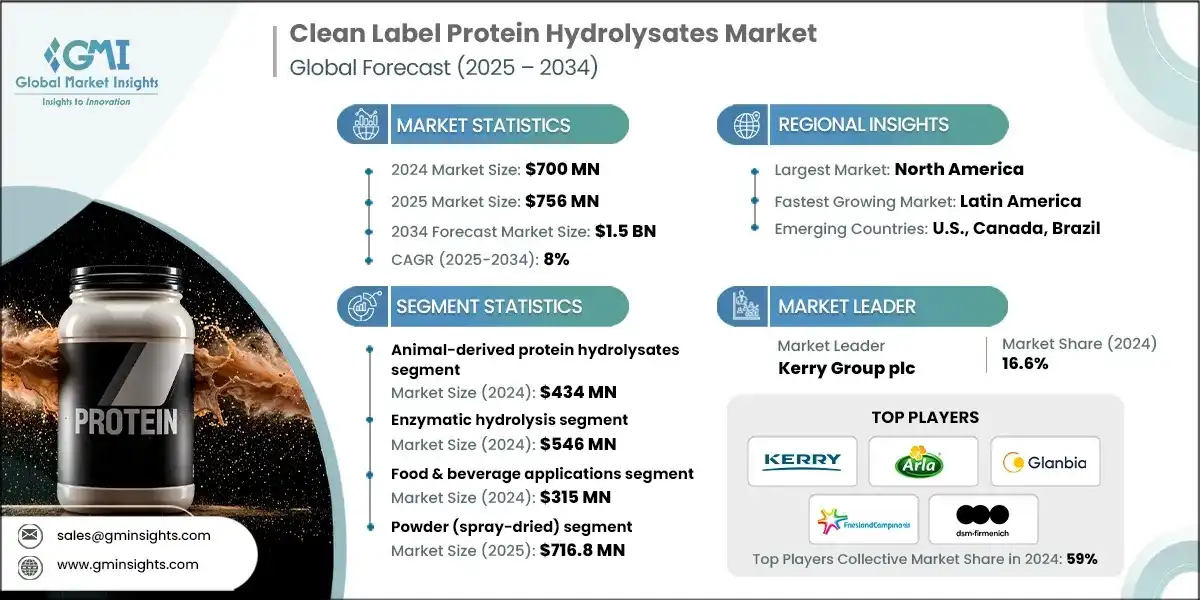

The global clean label protein hydrolysates market size was valued at USD 700 million in 2024. The market is expected to grow from USD 756 million in 2025 to USD 1.5 billion in 2034, at a CAGR of 8% according to latest report published by Global Market Insights Inc.

To get key market trends

- The clean-label protein hydrolysates market is propelling with growing of sports nutrition and performance-oriented formulations. Customers are seeking faster loading faster digestible proteins to aid muscle repair and prolonged energy delivery, moving hydrolysates into the mainstream sports drinks, protein powders, and still functional snacks. Food and beverage brands are re-formulating products with enzyme-processed proteins to provide superior amino-acid accessibility and enhanced tolerance to make them commercially viable in a broader spectrum of athletic and active lifestyle market segments.

- Clean-label demands are changing the ingredient sourcing approach, with consumers seeking shorter and more familiar ingredient labels and less chemical processing. Protein hydrolysates generated using enzymes fit into this move and possess high functionality due to extreme processing apparatus. Tracing of sourcing, reduced additives, and documented purity are some of the benefits being emphasized by brands, and hydrolysates are gaining momentum in early-life nutrition, fortified foods, and wellness beverages.

- Hydrolyzed proteins have been used in clinical and therapeutic nutrition that is an important area of application, due to the high digestibility and bioavailability of these proteins. Hospitals, manufacturers of medical formulas, and nutritionists working with patients are embracing the use of hydrolysates in the treatment of individuals with impaired digestion, metabolic problems or even those with high protein need. They are less allergenic and faster absorbing which contributes to their fitting the enteral feeding, postoperative recovery, and sensitive digestive conditions, which continues to demonstrate good and steady demand by the healthcare sector.

- Processing technologies and formulation science are also improving, which is leading to the market growing. Better enzymatic hydrolysis, flavor systems, and peptide profiling technologies are allowing manufacturers to produce hydrolysates that have superior taste, texture, and solubility and those with a beneficial nutritional effect. This technological advancement is enabling manufacturers to get out of the conventional dairy base and venture into the plant, marine and specialty proteins to reach new commercial areas and diversify the market options.

Clean Label Protein Hydrolysates Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 700 Million |

| Market Size in 2025 | USD 756 Million |

| Forecast Period 2025 – 2034 CAGR | 8% |

| Market Size in 2034 | USD 1.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing Sports Nutrition & Functional Food Consumption | Boosts demand for hydrolysates with rapid absorption and muscle recovery benefits. |

| Rising Consumer Demand for Clean Label Products | Accelerates adoption of minimally processed transparent ingredient solutions. |

| Growth in Clinical & Medical Nutrition Applications | Expands hydrolysate use in specialized diets for patients and elderly care. |

| Pitfalls & Challenges | Impact |

| High Production Costs of Enzymatic Hydrolysis | Limits scalability and price competitiveness in mass-market applications. |

| Complex Regulatory Compliance Requirements | Slows product launches and increases operational burden for manufacturers. |

| Opportunities: | Impact |

| Heat-Stable Hydrolysates for Hot Beverage Applications | Heat-Stable Hydrolysates for Hot Beverage Applications |

| Organic & Non-GMO Certified Hydrolysates | Strengthens appeal among health-conscious and sustainability-driven consumers. |

| Market Leaders (2024) | |

| Market Leaders |

16.6% |

| Top Players |

Collective market share in 2024 is 59% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Latin America |

| Emerging countries | U.S., Canada, Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Clean Label Protein Hydrolysates Market Trends

- A shift towards plant-derived hydrolysates is being observed in the market as producers react to the vegan trend, dairy intolerance, and sustainability demands. The companies are increasing on using pea, rice, fava bean and hemp hydrolysates in place of whey and casein to allow new beverage, snack and performance nutrition formulations. The trend is related to clean-label expectations, whereby plant hydrolysates can use shorter ingredient listings and make allergen-free claims.

- Companies are spending a large amount of money on the next generation systems of enzymes to enhance functional qualities like low level of bitterness, specific size distribution of peptides and enhanced solubility. Such developments allow the use of hydrolysates in broader product lines - RTD beverages, infant formulas, and even medical drinks - without affecting sensorial acceptability. Technology is one of the competitive drivers because the market implication is to develop differentiated and higher-value hydrolysates with reported functional and nutritional performance.

- The market is moving in the direction of sustainability expectations as buyers are increasingly demanding lifecycle transparency, low-impact processing, and responsibly sourced raw materials. This is causing manufacturers to switch to renewable processing energy, reclaimed waste streams, and certified supply chain. Other suppliers are also initiating carbon-cut hydrolysates or engaging in industry reporting systems to show real environmental improvement. The implication here is the change in the competitive direction of the market towards product functionalities or rather a score card of nutrition, transparency and environmental responsibility.

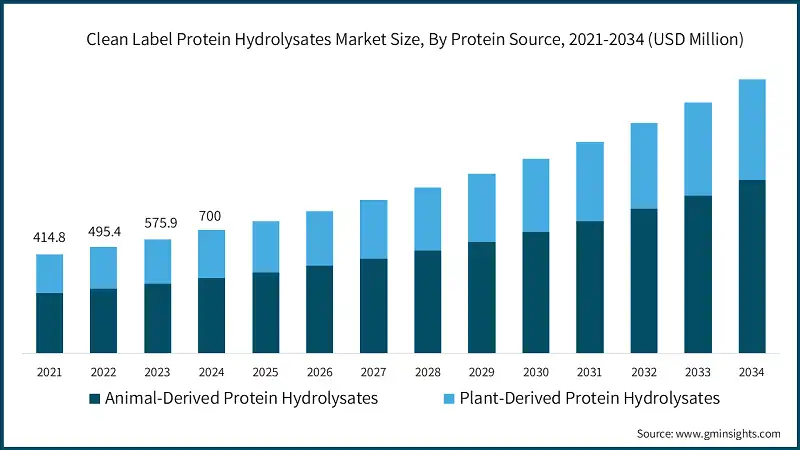

Clean Label Protein Hydrolysates Market Analysis

Learn more about the key segments shaping this market

- The largest proportion of clean-label protein hydrolysates market is also dominated by animal-based hydrolysates, which is mainly propelled by the long-established demand of dairy-based products, including whey, casein, and milk protein hydrolysates, in infant formula and as clinical and sports nutrition ingredients. These ingredients enjoy good scientific validation, good bioavailability and good amino-acid profiles, which are advantages to them when considering high end nutrition usage. Also, manufacturers possess established experience in processing, well-established supply chains, and regulatory frameworks, which reinforce commercial scalability and consistency of products, reinforcing the dominance of the segment.

- Under the animal segment the marine, egg, collagen and meat-based hydrolysate expansion continues to increase product diversity, as well as permit targeted functionality in pharmaceutical and medical feeding as well as specialty food product areas. Further investments in enzymatic processing are assisting in solving sensory properties, allergenicity, and digestibility to keep the animal-derived solutions competitive despite the growing presence of plant-based proteins.

Based on processing method, the clean label protein hydrolysates market is segmented into enzymatic hydrolysis, chemical hydrolysis (acid & alkaline), microbial fermentation. Enzymatic hydrolysis holds a significant share at a valuation of USD 546 million in 2024.

- Enzymatic hydrolysis holds major shares in the market which can generate high purity, cleaner, and controlled hydrolysates which have a high conformity to clean-label and regulatory demands. The process allows specific protein degradation to desired peptide sizes optimizing digestibility, bioavailability, and sensory benefits such as reduced bitterness, the chief benefits of infant nutrition, medical preparations, and performance supplements.

- The increasing demand for natural processing and the elimination of severe chemicals is also increasing the use of enzymatic technologies instead of acid or alkaline hydrolysis. The ongoing development of custom enzyme systems, optimizing bioprocesses, and automation of processes is also helping manufacturers to increase yield, reduce off-flavors, and differentiate functional profiles to be used in special purposes.

Based on application, the clean label protein hydrolysates market is segmented into food & beverage applications, animal feed & nutrition, biopharmaceutical & cell culture, and cosmetics & personal care. Food & beverage applications hold a significant share at a valuation of USD 315 million in 2024.

- The most significant portion of the clean-label protein hydrolysates market are food and beverage applications backed by high demand in sports nutrition, infant formulas, clinical diets, and functional food and beverages innovations. Hydrolysates are very attractive due to high digestibility, rapid absorption and good amino-acid profiles to be used as high-performance nutrition products, to promote medical recovery, and sensitive gastrointestinal needs. The category is also advantaged by product launches that are continuous, the growing trends in protein fortification, and growing trends in favor of clean label, recognizable ingredients in daily food products like dairy, beverages, and fortified snacks.

Learn more about the key segments shaping this market

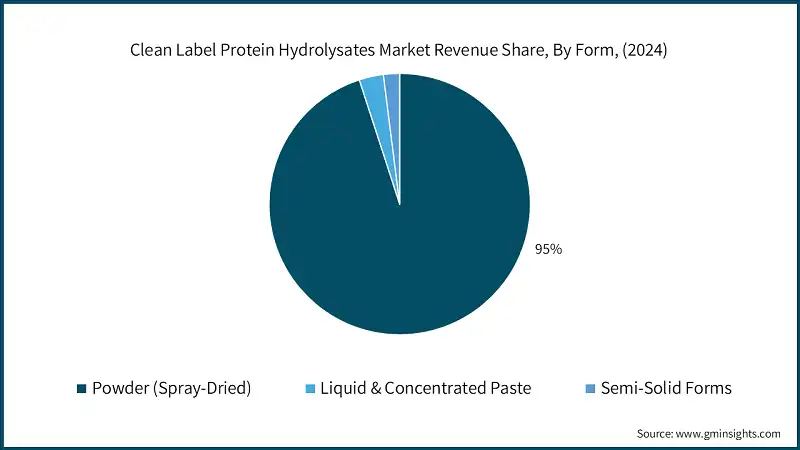

Based on form, the clean label protein hydrolysates market is segmented into powder (spray-dried), liquid & concentrated paste, and semi-solid forms. Powder (spray-dried) is estimated to grasp a value of USD 716.8 million in 2025 and is expected to grow at 7.8% of CAGR during the forecast period.

- Powder (spray-dried) versions represent the biggest portion of the clean-label protein hydrolysates products, largely as they are more stable, have a longer shelf life, and they are easier to transport and store. Spray-dried powders allow great concentration of the products with the least amount of moisture, providing them with high applicability in large-scale production and worldwide distribution. Their suitability to a broad group of food and beverage systems including sports powders, infant formulas, and medical nutrition only enhances their supremacy in commercial applications.

- The manufacturers also like powder forms because they provide the opportunity to achieve accurate dosing, improved blending properties, and can be easily incorporated into dry-mix formulations without refrigeration and special logistics. The format promotes a standard quality standard, an increased production rate, and a lower risk of contamination, which is crucial in controlled sectors such as infant and clinical nutrition. Increasing use of functional powders in the consumer markets and rising investments in new technologies of spray-drying and agglomeration have further enhanced leadership of powdered hydrolysates in the market.

Looking for region specific data?

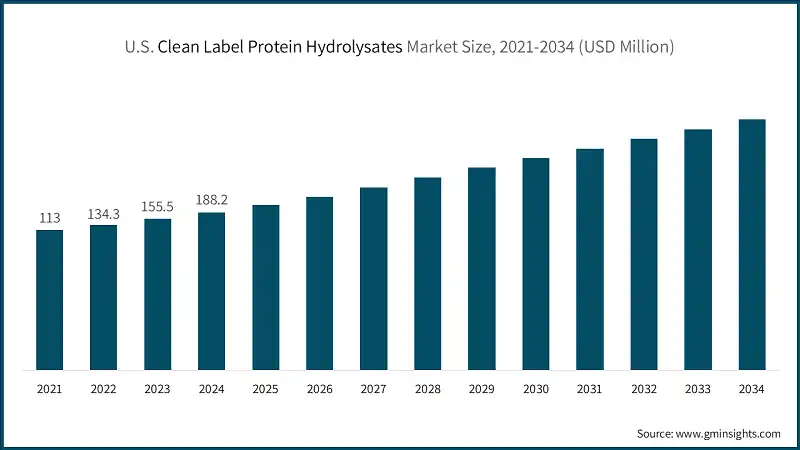

North America clean label protein hydrolysates market accounted for USD 224 million in 2024.

- North America holds 32% market share in 2024 dominated by the United States, which has the lion-share market, due to its vast sports-nutrition industry, sufficient base of clinical-nutrition manufacture, and large infant-formula and dietary-supplement market. High per-capita protein supplement consumption and well-established dairy and biotech infrastructure that allows production on a large scale and subsequent commercialization, such as U.S. players having a disproportionately large share of the world hydrolysate market and sports nutrition taking up a significant portion of domestic demand, contributes to the rapid growth of the region.

Europe clean label protein hydrolysates market accounted for USD 196 million in 2024 and is anticipated to show lucrative growth over the forecast period.

- Europe has approximately 28 % market share in 2024 which is backed by high demand in infant nutrition, medical diets, and performance nutrition markets where high regulatory standards guide the preference of clinically validated and hypoallergenic protein hydrolysates. Germany, France as well as the UK countries rule them because of their highly developed dairy processing technologies and good base to manufacture ingredients and as well as active in enzymatic hydrolyses technologies. Plant-based hydrolysates are also becoming more widely used in the region as clean labels and sustainability demands rise and manufacturers invest more in better taste, supply chain disclosure and functional activity to stay competitive in high-value nutrition uses.

Asia Pacific clean label protein hydrolysates market accounted for USD 175 million in 2024 and is anticipated to show lucrative growth over the forecast period.

- Asia Pacific market held 24.7% of the market share in year 2024 due to the growing intake of infant formula, clinical nutrition and sports supplements in emerging economies like China, India and Southeast Asia. The increasing disposable income and urbanization combined with heightened awareness of the quality of protein products is driving consumers to higher quality, clean-label protein products and regional producers are increasing the size of manufacturing capacity and forming alliances to supply this demand.

- Plant-based hydrolysates are also growing robust in the region due to the rising veganism and government-driven efforts toward further food processing and creation of functional ingredients that reinforce the role of Asia Pacific as one of the most rapidly increasing markets in the world.

Latin America market accounted for 10% market share in 2024 and is anticipated to show steady growth over the forecast period.

- The clean-label protein hydrolysates market in Latin America is experiencing consistent and stable growth, which is attributed to the increased use of sports nutrition, the changing consumer perception towards the use of high-quality functional ingredients, and the increase in the supply of clean-label infant and medical nutrition products.

- Improved penetration of imported and domestically blended formulations is also observed in other markets like Brazil and Mexico where the purchasing power and the large-scale local production capacity are relatively low. With the increase in distribution relationships with global ingredient suppliers and investment in education of the regional market, the level of awareness of hydrolyzed proteins and their nutritional functionality is constantly growing, which further contributes to the further development of demand.

Middle East and Africa clean label protein hydrolysates market accounted for 5% market share in 2024 and is anticipated to show steady growth over the forecast period.

- Middle East and Africa market also indicates slow growth, driven by gradual growth in healthcare nutrition, increasing popularity of fortified foods, and acceptance of high-quality dietary products in the markets of the UAE, Saudi Arabia and South Africa. The dependence on imported products ensures stable growth because the region does not have a profound manufacturing base of cutting-edge technologies related to protein processing at that.

- Nevertheless, the increase in modern retail, the rise in economic conditions in major GCC countries and the rise in the understanding of clinically supported and allergen-reduced protein formulations is facilitating the rate at which clean-label hydrolysates are accepted in the medical, wellness and early-life nutrition segments.

Clean Label Protein Hydrolysates Market Share

The leading companies in the market are Kerry Group, Arla Foods Ingredients, Glanbia Nutritionals, FrieslandCampina Ingredients, and DSM-Firmenich collectively comprised 59% market share in the clean-label protein hydrolysates industry in 2024. These companies utilise their extensive knowledge in ingredients manufacturing, their global supply chain networks and large production plants to gain dominance. With their combined strength, they can affect the price, innovate and create industry standards in both dairy and plant-based peptide segments.

To remain competitive, businesses in this sector are generally undertaking several main drivers: investing in enzymatic and bioprocessing technologies to enhance taste and functional performance, in particular, reducing bitterness; expanding capacity to meet the increased demand in sports, clinical, and early-life nutrition; rapidly expanding into plant-based hydrolysates to exploit clean-label and vegan demands; and driving sustainability through traceable sourcing, energy efficiency of manufacturing, and regulatory compliance. They are also making strategic alliances and clinical research to enhance the efficacy and regulatory profile of their peptide ingredients.

Clean Label Protein Hydrolysates Market Companies

Major players operating in clean label protein hydrolysates industry are:

- Arla Foods Ingredients

- Kerry Group plc

- Glanbia Nutritionals

- FrieslandCampina Ingredients

- Archer Daniels Midland Company (ADM)

- Cargill, Incorporated

- DSM-Firmenich

- Norilia AS

- Roquette Frères

- Tate & Lyle PLC

- Lactalis Ingredients

- Peak Protein LLC

- Nuritas

- AB Enzymes GmbH

Kerry Group is a multinational company that provides taste and nutrition solutions in the world with a robust presence in clean-label antiquities and protein hydrolysates formulation technologies. The company targets the use of natural and minimal-processed ingredients and highly enzyme-hydrolyzed solutions. Its success has been in sports nutrition, medical foods and functional beverages. Kerry has been growing out with innovation and focused acquisitions in health-driven ingredients.

Arla Foods Ingredients is a subsidiary company of Arla Foods and it deals with high-quality whey protein and dairy ingredients based on whey. The company has a reputation for clean-label, traceable and minimally processed protein hydrolysates in infant nutrition, medical nutrition as well as performance products. Arla focuses on sustainability and open sourcing to cooperative dairy farms. Its research and development activities promote rapid digestion, enhanced taste, and extremely utilitarian nutritional conditioning.

Glanbia Nutritionals is a large manufacturer of biofunctional and nutritional components, such as whey and plant-based protein hydrolysates. The company is in the business of serving clean-label, high-purity formulations to sports nutrition, clinical nutrition and lifestyle nutrition markets. The broad manufacturing and research capabilities provide Glanbia with an opportunity to enhance digestibility and amino acid content. The acquisitions and partnerships assist it to grow in the high-growth nutritional ingredient categories.

FrieslandCampina Ingredients are developing protein solutions that are obtained in dairy, special hydrolysates that can be used in infant nutrition, clinical nutrition and active nutrition. The company focuses on clean-label, traceable supply chain and controlled processing, which does not alter the natural nutritional value. FrieslandCampina pays a lot of attention to innovation of immune supporting and easily digestible proteins. It has a strong market positioning through sustainability, low-carbon production, and farmer-owned governance.

DSM-Firmenich is one of the largest international manufacturers of nutrition and health ingredients with a collection of dairy and vegetarian protein ingredients (including advanced hydrolysates) in its portfolio. The company focused on scientific research, accuracy in formulation and clean-label material development. It promotes medical, infant, active and fortified food applications. DSM-Firmenich is the product of a merger of biotechnology and massive processing capacity to satisfy the high-end nutritional requirements in the international markets.

Clean Label Protein Hydrolysates Industry News

- In May 2025, Kerry Group announced that its protein hydrolysates which are used in the manufacture of monoclonal-antibody (mAb) are produced through a tightly controlled process to achieve constant composition and minimise batch-to-batch variability in cell culture media.

- in March 2025, FrieslandCampina Ingredients introduced Nutri Whey ProHeat, a heat-stable microparticulated (performance and active-nutrition-friendly) whey protein and is targeted at ready-to-drink beverages.

- In October 2024, FrieslandCampina Ingredients got EU approval on the use of Hyvital Whey HA 300 protein hydrolysate in infant and follow-on formulas according to the new EU regulations.

- In February 2024, Roquette launched NUTRALYS H85, its first pea-protein food-grade hydrolysate, as well as other pea-protein variations on enhancing texture and solubility in bars and beverages.

The clean label protein hydrolysates market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) & volume (Kilo Tons) from 2021 to 2034, for the following segments:

Market, By Protein Source

- Animal-derived protein hydrolysates

- Dairy-based hydrolysates

- Whey protein hydrolysates

- Casein hydrolysates

- Milk protein hydrolysates

- Meat & poultry hydrolysates

- Hydrolyzed poultry protein

- Hydrolyzed beef & pork proteins

- Marine-derived hydrolysates

- Other animal sources

- Collagen & gelatin hydrolysates

- Egg protein hydrolysates

- Blood protein hydrolysates

- Dairy-based hydrolysates

- Plant-Derived Protein Hydrolysates

- Soy protein hydrolysates

- Pea protein hydrolysates

- Rice protein hydrolysates

- Wheat protein hydrolysates

- Corn protein hydrolysates

- Other plant sources (fava bean, hemp, sorghum)

Market, By Processing Method

- Enzymatic hydrolysis

- Chemical hydrolysis (acid & alkaline)

- Microbial fermentation

Market, By Application

- Food & beverage applications

- Sports nutrition & performance products

- Infant nutrition & hypoallergenic formulas

- Clinical & medical nutrition

- Functional foods & beverages

- Bakery & confectionery

- Savory applications & flavor enhancement

- Dairy products

- Animal feed & nutrition

- Aquaculture feed

- Pet food

- Livestock feed

- Biopharmaceutical & cell culture

- Mammalian cell culture media

- Vaccine production

- Monoclonal antibody manufacturing

- Cosmetics & personal care

Market, By Form

- Powder (spray-dried)

- Liquid & concentrated paste

- Semi-solid forms

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- MEA

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Who are the key players in the clean label protein hydrolysates industry?

Key players include Arla Foods Ingredients, Kerry Group plc, Glanbia Nutritionals, Cargill, Incorporated, DSM-Firmenich, Norilia AS, Roquette Frères, Tate & Lyle PLC, Lactalis Ingredients, and Peak Protein LLC.

What are the upcoming trends in the clean label protein hydrolysates market?

Trends include a shift to plant-derived hydrolysates, advanced enzyme systems for improved functionality, and sustainability initiatives like renewable energy processing, reclaimed waste streams, and carbon-cut hydrolysates.

What is the growth outlook for the powder (spray-dried) segment?

The powder (spray-dried) segment is expected to grow at a CAGR of 7.8% during the forecast period, reaching a valuation of USD 716.8 million in 2025.

Which region leads the clean label protein hydrolysates sector?

North America leads the market with a valuation of USD 224 million in 2024, accounting for 32% of the global market share.

How much revenue did the animal-derived protein hydrolysates segment generate in 2024?

The animal-derived protein hydrolysates segment generated approximately USD 434 million in 2024. The market is led by the demand for whey, casein, and milk protein hydrolysates in infant formula and clinical and sports nutrition.

What was the valuation of the enzymatic hydrolysis segment in 2024?

The enzymatic hydrolysis segment was valued at USD 546 million in 2024, owing to its ability to produce high-purity, clean-label hydrolysates with optimized digestibility and sensory benefits.

What is the expected size of the clean label protein hydrolysates industry in 2025?

The market size is projected to reach USD 756 million in 2025.

What is the market size of the clean label protein hydrolysates in 2024?

The market size was valued at USD 700 million in 2024, with a CAGR of 8% expected through 2034. The growth is driven by increasing demand for sports nutrition, performance-oriented formulations, and enzyme-processed proteins.

What is the projected value of the clean label protein hydrolysates market by 2034?

The market is poised to reach USD 1.5 billion by 2034, fueled by advancements in enzyme systems, sustainability initiatives, and the rising popularity of plant-based hydrolysates.

Clean Label Protein Hydrolysates Market Scope

Related Reports