Summary

Table of Content

Agriculture Specialty Flower Seeds Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Agriculture Specialty Flower Seeds Market Size

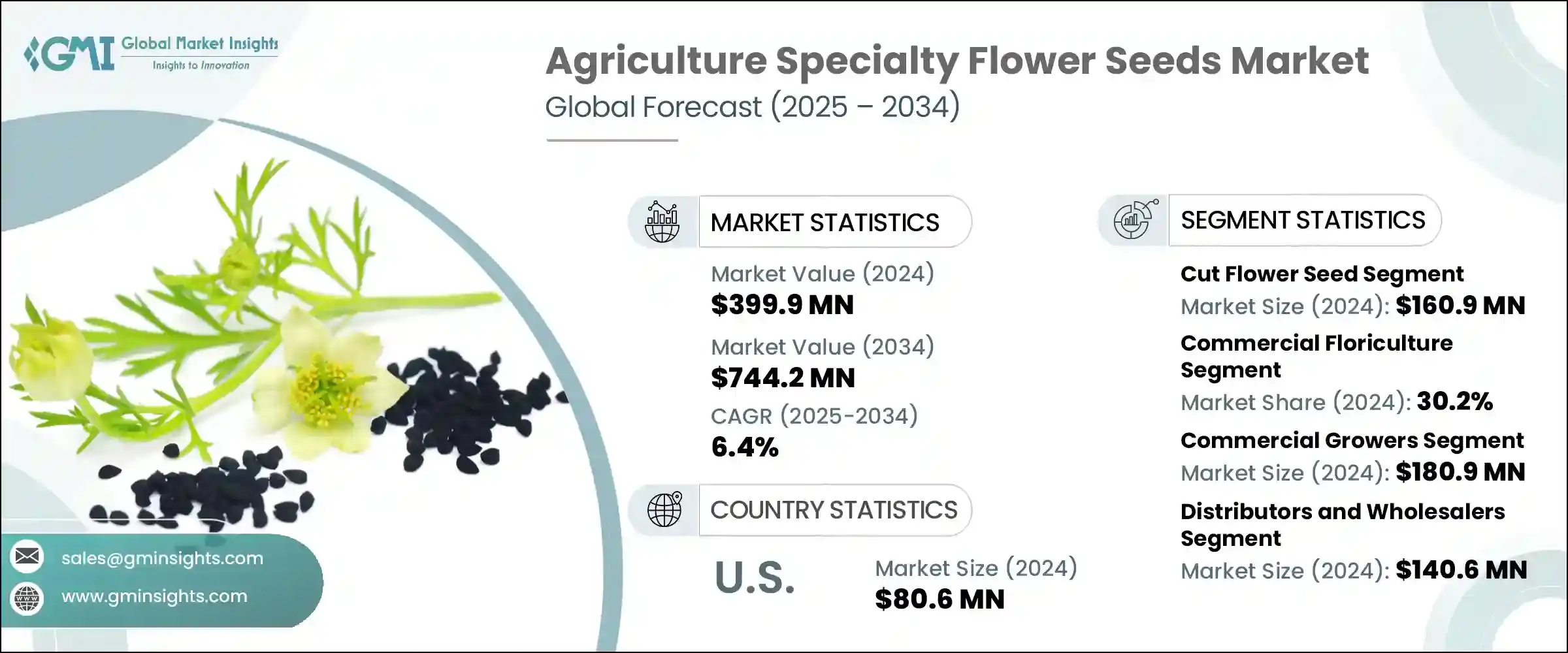

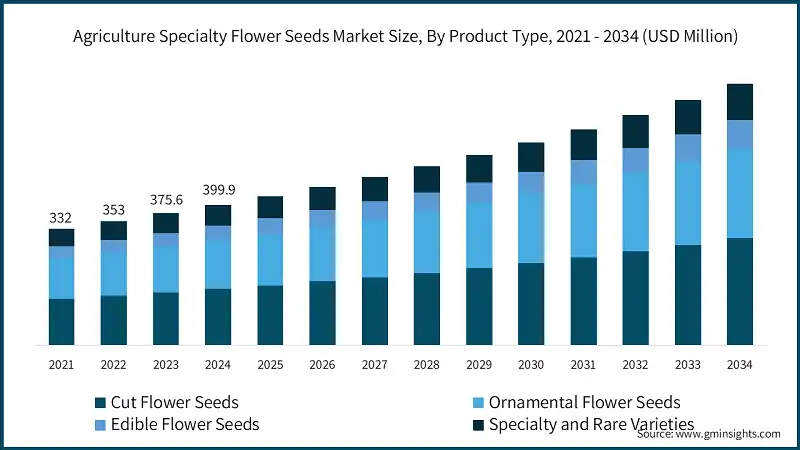

The global agriculture specialty flower seeds market was estimated at USD 399.9 million in 2024. The market is expected to grow from USD 424.2 million in 2025 to USD 744.2 million in 2034, at a CAGR of 6.4%.

To get key market trends

- The specialty flower seed market has been gradually maturing, gaining push from the demand for ornamental and environmentally friendly landscaping. These seeds, exotic and rare, are marketed mainly toward commercial growers who use them as income-generating crops. The flower industry provides employment to over 3 million people globally.

- This is an industry that improves aesthetics and contributes toward biodiversity and sustainability. Specialty flower seeds are also gaining prominence in areas of urban greening, landscape architecture, and floral horticulture providing environmental benefits ranging from air purification to habitat creation. Innovations in seed technology will lift market growth by increasing the chances of success of these crops due to benefits like disease tolerance and faster germination.

- High market growth in recent years has been generated from an increase in demand for specialty flower seeds resulting from organic gardening and eco-consciousness among consumers. Hybrid seed development has become quite innovative and is increasing adaptability to the crop's conditions, leading to great improvement in the success rate of crops. Green space initiatives and sustainability projects by the government also play a role. All these have fast increased the specialty flower seed market over the last few years.

- For instance, the global production of flowers and ornamental plants reaches approximately 150 million tonnes annually, which reflects the growing opportunities in the coming years.

- Europe, with a strong horticultural tradition, has become the leader in the specialty flower seed market along with having consumer demand in ornamental plants, diverse climate, and innovative breeding techniques which enhance the floral varieties as well as quality.

- Asia Pacific is the fastest growing region in specialty flower seed markets owing to increasing urbanization and reviving customer consensus towards ornamental gardening, alongside expanding horticultural ventures and a growing middle class demanding aesthetic value and landscaping improvements.

- For instance, floriculture is now commercially cultivated in several states with Tamil Nadu (21%), Karnataka (16%), Madhya Pradesh (14%) and West Bengal (12%), having gone ahead of other producing states like Mizoram, Gujarat, Andhra Pradesh, Orissa, Jharkhand, Haryana, Assam and Chhattisgarh.

Agriculture Specialty Flower Seeds Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 399.9 Million |

| Forecast Period 2025 – 2034 CAGR | 6.4% |

| Market Size in 2034 | USD 744.2 Million |

| Key Market Trends | |

| Drivers | Impact |

| Expansion of urban and vertical farming practices | New demand for specialty flower seeds that can be cultivated in limited spaces arises, which in turn stimulates innovation and diversification in the seed offerings for urban horticulture. |

| Rising popularity of floral landscaping and decorative gardening | Consumer awareness and interest in the aesthetic appeal of landscaping give rise to the demand for an assortment of high-grade flower seeds, bringing in unlimited market opportunities and motivating product development in view of decorative gardening. |

| Technological advancements in seed production and preservation | These advances enable better seed quality, shelf-life, and germination; thus, making this market competitive by extending distribution and supporting overall industry growth. |

| Pitfalls & Challenges | Impact |

| High costs associated with new technology adoption | These advanced seed technologies may be adopting hindrances for small-scale growers and the markets in their nascent stages, thus impeding market growth and constraining access to innovation in seed variety. |

| Climate change impacting cultivation conditions | Uncertain weather and environmental stresses impact seed viability and successful cultivation causing great concern over supply continuity and, in its wake, market stability |

| Opportunities: | Impact |

| Organic and eco-friendly flower seeds | Growing consumer demand for organic, sustainable and eco-friendly products create a market for non-GMO and environmentally friendly specialty flower seeds. |

| Premium landscaping and urban green spaces | Investment in the urban landscaping of public parks and green roofs creates a demand for unique and resilient flower varieties. |

| Specialty cut flowers for niche markets | An increasing demand for exotic, rare, or heirloom flower varieties set for premium floral arrangements and boutique markets. |

| Medicinal and aromatic flower varieties | Rising interest in natural remedies and aromatherapy with the demand for flowers for medicinal and aromatic purposes. |

| Market Leaders (2024) | |

| Market Leaders |

8.3% Market Share |

| Top Players |

Collective market share in 2024 is Collective Market Share is 33.40% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Europe |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, Japan, South Korea, Italy |

| Future outlook |

|

What are the growth opportunities in this market?

Agriculture Specialty Flower Seeds Market Trends

Top market trend in specialty flower seed market for agriculture in 2024 has been significantly affected by advancements in biotechnology and changing regulatory frameworks.

The growing acceptance of precision breeding technologies, such as CRISPR, is enabling the quick development of disease-resistant, climate-resilient, and novel varieties of flower seeds. The use of such technologies is fast-tracking the traditional breeding timelines so that development periods that take several years have now been drastically reduced to just over a year and give impetus to product innovation and enhanced market offerings.

This prompts a rapid influx of R&D funding in the industry to incorporate some of the latest tools for gene editing, thus furthering the market. The growing demand for sustainably sourced flowers has also welcomed premium pricing strategies, such initiatives are another driver of market growth.

For instance, Netherlands has served as the centre of activity for the international trade of flowers. The country is a major player in both the export and import markets for floral products around the world. The Growers in the Netherlands breed and nurture between 1,200 and 1,500 different kinds of flowers and plants. The FloraHolland flower auction, which is the largest of its kind in the world, is held in the Netherlands. This Dutch corporation controls around 90 % of the market for cut flowers in the Netherlands, and its yearly revenue amounts to approximately USD 4 billion. This type of data reflect the opportunity of regional growth for the market players.

The regulatory landscape is undergoing changes in pursuit of enhanced quality, safety, and traceability of seeds. Stricter certification and labeling laws in key markets are coming into force, forcing players in the industry to invest highly in compliance and quality assurance. Ultimately, these regulatory changes shall be ensuring increased genetic purity and transparency, all aimed at bolstering consumer confidence in specialty flower seeds.

Increased regulatory surveillance is stimulating innovation and thus the emergence of higher quality certified seed varieties that are crucial for the further expansion of the market.

For example, in 2023, the Bali province partnered with Governor Wayan Koster to produce marigold flower seed packets at the Bali Marigold Experimental Garden. This new seed variety was created with the goal of decreasing imports.

Agriculture Specialty Flower Seeds Market Analysis

Learn more about the key segments shaping this market

Based on product type the market is segmented into cut flower seed, ornamental flower seed, edible flower seed, specialty and rare varieties. Cut flowers are estimated to increase from approx. USD 160.9 million in 2024 corresponding to an increase of 6.6% CAGR.

- The demand for cut flower seeds is rapidly expanding owing to the growing floral industry and a rising trend for fresh floral arrangements in events, for home decor, and retail markets. Growers want high-quality innovative varieties with long vase life, bright-colored, and unique visual appeal.

- For instance, in 2023, Marginpar announced a collaboration with VBW (Royal Association of Florist Retailers) to inspire florists with exclusive cut flowers and support sales through events and competitions.

- Ornamental flower seeds have a steady rise induced by urbanization, landscape project, and increasing aesthetic value of gardens and public areas. Consumers seem to prefer exotic, rare, and heirloom varieties that impart unusual beauty and charm.

- Edible flower seeds are witnessing high growth potential with CAGR of 7.2% due to increasing consumer consciousness about health, gourmet tastes, and organic foods. The use of edible flowers by chefs and restaurateurs, and home gardening is on the increase, creating a niche yet growing market.

- The specialty and rare varieties of flower seeds are gaining wider market acceptance and demand as growers' interests shift toward unique, heirloom, and otherwise hard-to-find plants possessing distinguished aesthetic or commercial values.

Learn more about the key segments shaping this market

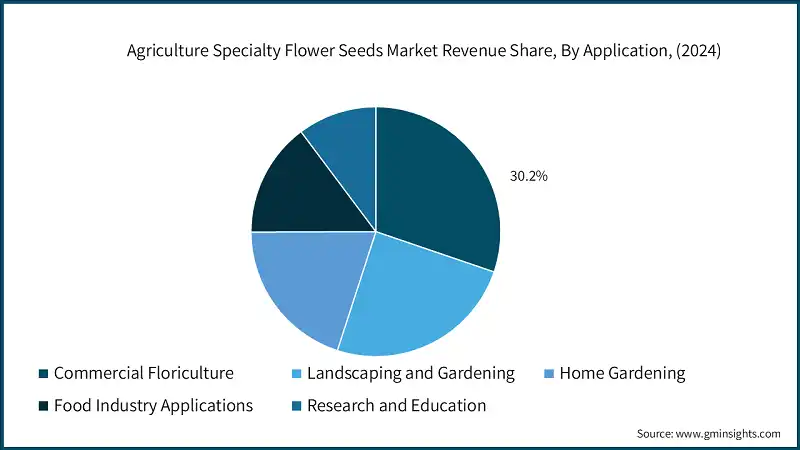

Based on application the agriculture specialty flower seeds market is segmented into commercial floriculture, landscaping and gardening, home gardening, food industry application and research and education. Commercial floriculture commands the major market share, precisely around 30.2% of the total market in 2024 and expected to grow at a CAGR of over 6.7% from 2025 to 2034.

- Growth is impelled by increasing demand for florals within commercial spaces like florists, event organizers, and retail outlets. Innovations regarding seed quality and hybrids of pest resistance will foster growth in this segment.

- The landscaping and gardening segment is experiencing increased demand for ornamental, drought-tolerant, and low-maintenance flower varieties suitable for public parks, commercial spaces, and private gardens. Trends show a growing preference for native and adaptive plants that require less water and chemical inputs, promoting sustainable landscaping practices.

- The global demand for potted plants, including flowers, has increased by 25% since 2020, driven by urban gardening trends and home improvement

- The home gardening segment observed a lot of activity during the COVID-19 pandemic period because people were trying to grow their flowers for decoration and self-satisfaction and this segment is growing with the CAGR of 6.4%. Consumers are more inclined to planning on simple flower species, easy to grow with visible beauty but having less required maintenance.

- The demand for sustainable and eco-friendly flowers has increased by 40% over the last five years.

- In the food industry, edible flowers are increasingly used to garnish and flavor dishes-thus acting on the specialty flower seeds demand. The gourmet and organic tastes in culinary are incorporated into design, whereby the use of ornamental and aromatic flowers becomes quite commonplace among consumers in general.

- Research and education initiatives play an important role in pushing ahead specialty flower seed markets. Most colleges are now focusing their efforts, as is the industry, on developing resilient, disease-resistant, and innovative flower varieties as target research. Such inventions intend to improve sustainability and wider biodiversity; hence, numerous market offerings are influenced by them.

Based on end use the market is segmented into commercial growers, retail nurseries and garden centers, individual consumers and professional services. Commercial growers hold the market size of USD 180.9 million in 2024 and expected to grow at a faster rate of 6.6% CAGR in 2034.

- Commercial growers currently dominate the specialty flower seed market due to their large-scale operations and focus on producing high-quality, unique flowers for wholesale and export markets. They lead in adopting innovative cultivation techniques and meeting rising demand.

- There is growing potential in the retail nurseries and garden centers securing 29.8% of the market share. They also have end consumers, but they are primarily the consumers that the homeowner and small-scale landscaper serve. There is an increasing demand for specialty flower seeds among such nursery and garden centers, and this caters to a growing market of consumers who want unique, ornamental plants for their homes.

- Professional services include landscaping companies, floral designers, and other event decorators. These specialists use specialty flower seeds to make unique high-end floral arrangements and landscape design for their clients. They are growing tremendously in areas where luxury and bespoke projects are emphasized.

Based on the distribution channel, agriculture specialty flower seeds market is segmented into direct sales, distributor and wholesaler, retail channel & online platforms. Distributors and wholesalers is dominating the market accounting for the market size of USD 140.6 million and expected to grow with the CAGR of 6.6.% in 2025-2034.

- Distributors and wholesalers act as intermediaries in purchasing a bulk quantity from the producer to release it to retails, nurseries, and small growers to widen and ensure the efficiency of a supply chain.

- A direct sale occurs when the seed manufacturer sells directly to large commercial growers, professional landscapers, or institutional buyers. Such type of sale allows for customized services to entities that potentially make higher profit margins.

- Retail channels include garden centers, retail nurseries, and chain stores where customers will go for themselves and hobbyist gardeners to where they can buy accessible points and get face-to-face interactivity with the customer.

- In 2022, the global flower and plant retail market was estimated at USD 77 billion.

- E-commerce wealth of offering to allow consumers from all ends of the world's buying seeds, accessed through e-commerce websites, marketplaces like Amazon, and specialized gardening portals, has gained phenomenal rise through the years.

- For example, the percentage of floral sales through online platforms increased from 10% in 2018 to 25% in 2022, reflecting rapid growth in e-commerce

Looking for region specific data?

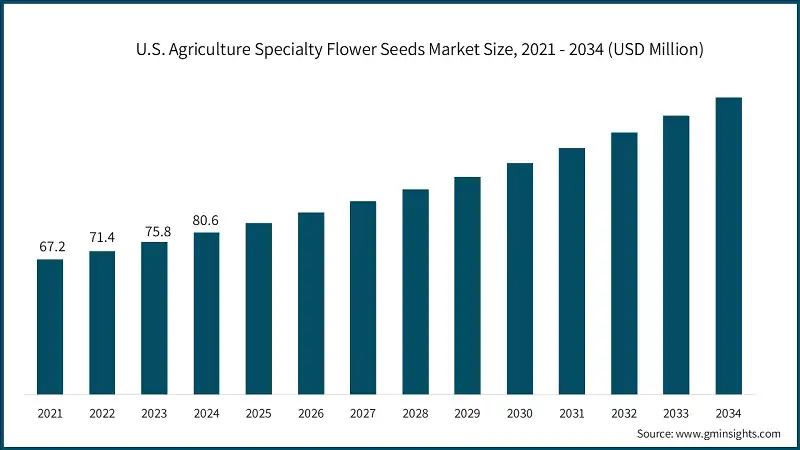

U.S. dominated the agriculture specialty flower seeds market in North America with around 81% share and generated USD 80.6 million in revenue in 2024.

- Growth in the specialty flower seed market in the U.S. is driven by a growing consumer interest in native and ornamental plants for biodiversity and landscaping use. Urban gardening trends and eco-aware consumer tastes create demand for unique flower varieties native or specific to regions, thereby creating additional market opportunities for specialty seed producers.

- For instance, United States is the largest importer of cut flowers, accounting for over 25% of global imports in 2022.

- The Canadian specialty flower seed industry is growing by increasingly promoting sustainable agriculture and green landscaping; there is rising consumer demand for native Canadian wildflowers and drought-tolerant cultivars among growers and landscapers in harmony with environmental conservation strategies and climate adaptation efforts, thus contributing to market growth.

The agriculture specialty flower seeds market in the Germany is expected to experience significant and promising growth from 2025 to 2034.

- Europe accounts for around 30% of the specialty flower seeds for the agriculture market in 2024. Urban gardening, eco-conscious consumers, and increasing interest in biodiversity have triggered a climbing demand for specialty flower seeds in Europe. Farmers and hobbyists are showing their preference toward organic and native flower species, initiating sustainable practices and the possibility of niche markets across the continent.

- For instance, Netherlands is the leading exporter of flowers worldwide, with a market share of about 60%.

- Germany presents an extremely favorable cultivation environment for native and organic flower seeds. There is a growing preference for eco-friendly seeds that are free from pesticides.

- The UK market is increasingly focused on unique flower seeds with high value for exclusive boutique and organic farming operations. Consumers for eco-friendly and locally sourced flowers compel growers to experiment with specialty seeds which aim at sustaining biodiversity, pollinator health, and sustainable landscape development thereby creating new market niches.

The agriculture specialty flower seeds market in China is expected to experience significant and promising growth from 2025 to 2034.

- The strengthening demand for agriculture specialty flower seeds in the Asia-Pacific region is an outcome of accelerated urbanization, the growing interest in gardening, and a change towards sustainable agriculture. Different native and exotic varieties are in demand and advantage the scope for niche markets, organic cultivation, and eco-friendly farming practices across the region.

- The booming specialty flower seed market in China is owing to booming urban gardening, floral tourism, and much emphasis on ecological preservation. There is a strong preference for native and ornamental varieties to support sustainable landscaping and improve ecological benefits to be in line with national environmental policies.

- There is a phenomenal increase in the demand for specialty flower seeds in India due to increased awareness regarding floral aesthetics, cultural traditions, and eco-friending cultivation. About 283 thousand hectares of the area were under Cultivation for floriculture in 2021-22. Most small-scale farmers and urban gardeners are producing organic and indigenous varieties to meet sustainable and commercially viable cultivation practices.

The agriculture specialty flower seeds market in Brazil is expected to experience significant and promising growth from 2025 to 2034.

- Concerns about sustainable gardening and growing green spaces in urban settings and eco-friendly farming practices have contributed to the growing demand for specialty flower seeds in Latin American countries. Consumers and farmers have been increasingly interested in native and exotic flower types that help with biodiversity, ecological balance, and landscapes having some cultural values.

- In Brazil, the market for agriculture specialty flower seeds has seen an impetus, as a flower culture thrives in this land, stimulating eco-tourism and a focus on the native species. More interest is also being given now to organic and sustainable production criteria and the demand for flowering varieties that are native and ornamental, which help conserve the environment and local biodiversity.

- Mexico strongly cultivates native and traditional flower seeds, which underline an appreciation of cultural heritage and manifest respect for ecological wisdom. Urban gardening and sustainable farming provide the driving force behind the demand for specialty seeds across climates that promote biodiversity while supporting the livelihoods of local farmers.

- Argentina is increasingly using specialty flower seeds for ornamental and ecological reasons. This trend leans toward native and high-value flower species and sustainable and organic farming practices since these fit well with the country’s intent of promoting biodiversity and eco-friendly agriculture.

The agriculture specialty flower seeds market in UAE is expected to experience significant and promising growth from 2025 to 2034.

- Middle East & Africa is expected to grow at a CAGR of 6.4% in 2025-2034. The specialty flower seed market within the UAE is rapidly expanding in terms of drought-resilient and heat-tolerant varieties to beautify with respect to urbanization, tourism, and sustainable landscaping projects in line with national sustainability strategies.

- In Saudi Arabia, increasing investments are going into desert-adapted native flowers with emphasis on urban development, the export market, and sustainable growth with water-efficient and climate-resilient varieties in mind.

- The diverse climate of South Africa provides a vibrant market for native, exotic, and drought-tolerant flower seeds and thus boosts the eco-tourism, biodiversity, and sustainable landscaping industries at home and in export markets.

Agriculture Specialty Flower Seeds Market Share

Top 7 companies include BASF SE (Agricultural Solutions), Bayer AG (Crop Science Division), Corteva, Inc., Syngenta AG, Dümmen Orange, Kieft Seed B.V., KWS SAAT SE & Co. These are prominent companies within the global market operating in their respective regions and accounting the market share of 41.4%. These companies hold strong positions globally due to their extensive experience in agriculture specialty flower seeds market. Their diverse product portfolios, backed by robust production capabilities and distribution networks, enable them to meet the rising demand for agriculture specialty flower seeds across various regions.

- BASF SE (Agricultural Solutions) captures emerging markets through innovative crop protection technologies and sustainable practices, focusing on distinguished solutions for specialized flower seed growers.

- Bayer is regarded among leading competitors with well-known advanced seed technologies, pest control, and crop management solutions. Vast research and innovative works enabled the development of high-yield flower seeds, built through climate resiliency, in different environments.

- Corteva is one of the major seed innovators. It goes beyond breeding and traits to include digital agriculture in servicing the flower seed industry. The company prides itself on the sustainable nature of its products and the specific solutions provincialized for climates that have harsher conditions.

- Syngenta has a reputation of being very research-intense and has a broad portfolio in seeds and crop protection. High-performance flower seeds will be developed to match resilient types for arid and semi-arid climates and these were aligned perfectly with the situation on ground in the Middle East and Africa.

- Dümmen Orange is a florist major player focusing on specialized breeding in ornamental flowers and plant species. Its competitive advantage lies with diverse, beautiful flowers for urban physically-built beautification or for commercial landscaping projects.

- Kieft Seed has specialized breeding programs and high-quality flower seeds especially in the ornamental and bedding plants trade. The company focuses on innovation and creating tailor-made solutions for very precise climatic conditions.

- KWS is Europe-leading seed company. KWS focuses on scientific means in developing new resilient, climate-adapted flower varieties for dry countries, it rightly positions itself competitively in this important country region.

Agriculture Specialty Flower Seeds Industry News

- In January 2023, Epic Gardening, a prominent name in the gardening industry, acquired Botanical Interests, a Colorado-based company specializing in vegetable, herb, and flower seed packets. This acquisition broadened Epic Gardening’s presence in the wholesale market and enabled them to offer certified organic and heirloom flower and vegetable seeds.

- In November 2022, Sakata Seed Corporation introduced a new Begonia variety called the "Viking" series. This vigorous interspecific hybrid demonstrates exceptional garden performance and boasts heat and drought tolerance.

- In August 2021, SBM Company, a global leader in natural and traditional products, acquired SPG (Société de Production Grainières), a France-based firm operating in the vegetable and flower seed segments.

The agriculture specialty flower seeds market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and (Tons) in volume from 2021 – 2034 for the following segments:

Market, By Product Type

- Cut flower seeds

- Rose seeds

- Chrysanthemum seeds

- Carnation seeds

- Gerbera seeds

- Lily seeds

- Tulip seeds

- Sunflower seeds

- Other cut flower seeds

- Ornamental flower seeds

- Annual flower seeds

- Marigold seeds

- Petunia seeds

- Zinnia seeds

- Ageratum seeds

- Other annual seeds

- Perennial flower seeds

- Delphinium seeds

- Lupine seeds

- Hollyhock seeds

- Other perennial seeds

- Bulb flower seeds

- Annual flower seeds

- Edible flower seeds

- Nasturtium seeds

- Viola seeds

- Calendula seeds

- Lavender seeds

- Other edible flower seeds

- Specialty and rare varieties

- Heirloom varieties

- Native species seeds

- Wildflower mixes

- Pollinator-friendly varieties

Market, By Application

- Commercial floriculture

- Cut flower production

- Potted plant production

- Greenhouse operations

- Field production

- Landscaping and gardening

- Commercial landscaping

- Public gardens and parks

- Residential landscaping

- Urban beautification projects

- Home gardening

- Hobby gardening

- Container gardening

- Indoor gardening

- Community gardens

- Food industry applications

- Restaurant and culinary use

- Food processing industry

- Beverage industry

- Nutraceutical applications

- Research and education

- Academic research institutions

- Botanical gardens

- Agricultural extension programs

- Breeding programs

Market, By End Use

- Commercial growers

- Large-scale commercial operations

- Medium-scale growers

- Specialty crop producers

- Greenhouse operators

- Retail nurseries and garden centers

- Independent garden centers

- Chain nurseries

- Home improvement stores

- Online retailers

- Individual consumers

- Home gardeners

- Hobby growers

- Urban farmers

- Educational institutions

- Professional services

- Landscape contractors

- Florists and flower shops

- Event planners

- Agricultural consultants

Market, By Distribution Channel

- Direct sales

- Manufacturer to grower

- Contract sales

- Farm-to-consumer sales

- Distributors and wholesalers

- Regional distributors

- Specialty seed distributors

- Agricultural input dealers

- Retail channels

- Garden centers and nurseries

- Farm supply stores

- Department stores

- Specialty flower shops

- Online platforms

- E-commerce websites

- Online marketplaces

- Direct-to-consumer platforms

- Subscription services

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

Who are the key players in the agriculture specialty flower seeds market?

Key players include Syngenta AG, BASF SE, Bayer AG, Corteva, Inc., Dümmen Orange, Kieft Seed B.V., and KWS SAAT SE & Co. KGaA.

What was the market size of the U.S. agriculture specialty flower seeds market in 2024?

The U.S. market was USD 80.6 million in 2024. Growth is driven by demand for native plants and urban gardening.

What are the upcoming trends in the agriculture specialty flower seeds industry?

Key trends include CRISPR-based seed innovation, eco-friendly seed varieties, online seed retail growth, and demand for exotic and heirloom flowers.

What is the growth outlook for edible flower seeds from 2025 to 2034?

Edible flower seeds are projected to grow at a CAGR of 7.2%, driven by rising demand in organic cuisine and gourmet food applications.

What was the valuation of commercial growers segment in 2024?

Commercial growers accounted for USD 180.9 million in 2024.

What is the market size of the agriculture specialty flower seeds in 2024?

The market size was USD 399.9 million in 2024, with a CAGR of 6.4% expected through 2034 driven by rising demand for ornamental gardening and eco-friendly landscaping.

What is the projected value of the agriculture specialty flower seeds market by 2034?

The market is expected to reach USD 744.2 million by 2034, fueled by urbanization, green space initiatives, and advancements in seed biotechnology.

How much revenue did the cut flower seed segment generate in 2024?

Cut flower seeds generated approximately USD 160.9 million in 2024.

Agriculture Specialty Flower Seeds Market Scope

Related Reports