Thermal Printing Market worth over $50bn by 2026

Published Date: July 2020

Thermal Printing Market size is set to surpass USD 50 billion by 2026, according to a new research report by Global Market Insights Inc.

The growing demand for thermal printing in the automotive sector for critical compliance labeling mandates is driving the market demand. Automotive Industry Action Group (AIAG) directs the automotive sector to follow labeling standards for improving productivity, efficiency, and accuracy. The implementation of thermal labels provides essential information regarding product use, maintenance, and safety along with the company brand and contact information. These labels are required to be durable under different weather conditions, speed, and pressure. Benefits such as high durability, print quality, and robustness offered by the printing technology will boost its adoption in the automotive sector.

The growing expansion of the e-commerce sector has encouraged brick & mortar stores to implement innovative solutions to compete with online retail giants. The retailers are focusing on providing faster checkouts for enhancing customer satisfaction and increasing profitability. The adoption of thermal printing technology ensures fast & legible printing of receipts without the hassle of changing ink cartridges, eliminating long customer queues in a store.

Thermal printing to gain traction with the growing demand for high quality, durable, and smudge-free prints in the market

Printers offering segment accounted for significant thermal printing market share in 2019. The printers ensure error-free printing of rugged tags and labels that can withstand harsh conditions in industrial environments. The equipment is widely used for shipping labels, logistics tracking, item identification, and inventory management in manufacturing facilities. Sharp, long lasting, and smudge-free images created by these printers are ideal for use in rugged industrial environments. The availability of printers that can connect to devices, such as Programmable Logic Controller (PLC), is further increasing their adoption in manufacturing industries.

POS printers to witness high demand due to increasing usage of POS systems to ensure fast transactions across several end-use verticals

Get more details on this report - Request Free Sample PDF

High adoption of POS terminals across retail, hospitality, and healthcare sectors is being witnessed. The terminals help in facilitating fast payments, reduce errors due to human intervention, and ensure customer satisfaction. POS printers can be connected to tablet or mobile POS terminals for fast receipt printing. The rising hospitality sector will also create growth opportunities for the thermal printing market. According to the U.S. Department of Commerce projection, the U.S. will host 95.5 million international visitors annually by 2023. The expanding hospitality sector will surge the demand for high-performance POS printers to provide enhanced customer service.

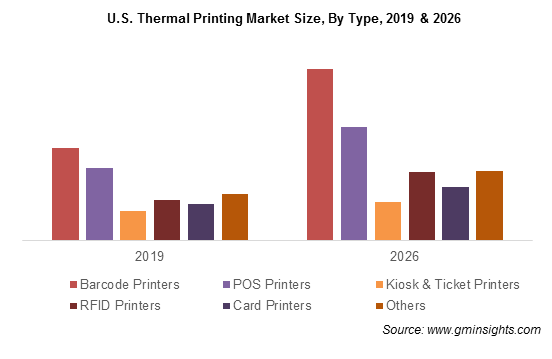

Browse key industry insights spread across 300 pages with 878 market data tables and 28 figures & charts from the report, “Thermal Printing Market Size, By Offering (Printer, Supplies & Consumables), By Product (Industrial, Desktop, Mobile), By Type (Barcode Printers, POS Printers, Kiosk & Ticket Printers, RFID Printers, Card Printers), By Technology (Direct Thermal (DT), Thermal Transfer (TT), Dye Diffusion Thermal Transfer (D2T2)), By Application (Manufacturing, Retail, Government, Transportation & Logistics, Entertainment & Hospitality, Healthcare), Industry Analysis Report, Regional Outlook, Price Trend Analysis, Growth Potential, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/thermal-printing-market

Demand for desktop printers owing to their compact design and ease of use will boost the thermal printing market revenue

Desktop label printers are compact and easy to use for high-quality printing in places with space constraints. They can be used in hospitals and public places, such as parks or theatres, for wristband printing. These printers are increasingly preferred in low to mid volume receipt, label or wristband printing applications. Companies in the market are focusing on product innovations to capitalize the growth opportunities. For instance, in October 2019, Brother Mobile Solutions, Inc. launched TD-4 desktop thermal transfer printer series for manufacturing applications.

Direct thermal printing to gain traction in the market on account of its simplicity, ease of operation, and sharp print quality

Direct thermal printers are easy to operate than other printing technologies due to the absence of ink, toner or ribbon to refill or monitor. The elimination of additional printer supplies reduces the overall replacement & maintenance costs. These printers are mainly popular among SMEs and office due to their smaller size, faster & quiet printing than laser or dot matrix printers. Direct thermal printing technology helps veterinarians, schools, doctors’ offices, and churches to save cost in printing labels daily.

Strong retail & manufacturing sector in North America will provide growth opportunities for the market

The robust industrial, manufacturing, and retail sectors in North America will offer ample opportunities to the thermal printing market expansion. Industries in the U.S. implement advanced technologies to sustain in the competitive market. Government organizations emphasizing on the adoption of latest technologies will positively impact the industry growth. Moreover, digitalization of processes to automate industrial, retail & manufacturing processes will support the adoption of printing solutions across industries.

Increasing use of automation by government authorities to enhance operational efficiencies will fuel the thermal printing market growth

With the advent of digitalization, several government organizations globally are adopting advanced technologies for data identification, collection & storage. Government agencies are using barcode & RFID printers and scanners to manage attendance records along with document tracking. Authorities are implementing the technology for developing access control and law enforcement. Barcode printers, and scanners enable government authorities to precisely track crucial document movement and inventory.

Players undergoing strategic alliances to strengthen offerings and expand the market reach

Prominent companies operating in the thermal printing market are Honeywell International, Inc., Brother Industries Ltd., Bixolon, Fujitsu Ltd., TSC Auto ID Technology Co. Ltd., Toshiba Corporation, Wasp Barcode Technologies Seiko Epson Corporation, Star Micronics Co. Ltd., Avery Dennison Inc., Zebra Technologies Corp., Sato Holdings Corporation, and NCR Corporation. Industry players are undergoing strategic partnerships to enhance their thermal printing offerings and strengthen their market presence globally.

Preeti Wadhwani, Saloni Gankar