Sodium Metasilicate Pentahydrate Market Size worth $875mn by 2025

Published Date: May 2019

Sodium Metasilicate Pentahydrate Market size is set to surpass USD 875 million by 2025; according to a new research report by Global Market Insights Inc.

Significant demand for silica gel desiccant from the pharmaceutical and food & beverage industries to increase shelf life and avoid decay should sodium metasilicate industry growth. Growing silica gel demand as a catalyst in petrochemical sector for the refining & processing of natural gas should enhance product usage as it is used in the manufacture of silica gel. Increasing silica gel requirement as a scrub additive in personal care products on account of its smooth texturing feature, ability to absorb excessive oil and preventing leakage from packaging should further promote growth of sodium metasilicate pentahydrate market.

Global 99% sodium metasilicate pentahydrate market size exceeded USD 320 million in 2018. Rising demand for washing powders & detergents pertaining to increasing consumer disposable incomes and government regulations encouraging hygienic conditions in food & product manufacturing industries should drive product demand. This substance finds widespread usage as an ingredient of dishwasher & laundry detergent pertaining to its capability to remove oil & grease which should stimulate growth of the market on account of rising demand from healthcare, restaurant and textile industries.

U.S. 50% sodium metasilicate pentahydrate market size from cement applications is likely to register over 4.5% gains in the forecasted timeframe. Growing government initiatives to increase infrastructure spending and introduce tax reforms should stimulate the demand for cement, whereby this substance is extensively used to enhance strength. Rise in construction of non-residential buildings along with transportation infrastructure such as bridges and overpasses should further accelerate market growth.

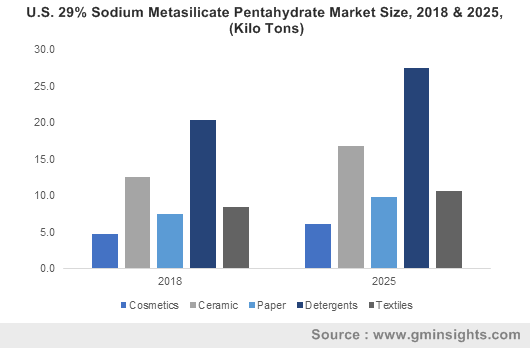

Browse key industry insights spread across 260 pages with 348 market data tables & 20 figures & charts from the report, “Sodium Metasilicate Pentahydrate Market Size By Purity (29% [By Application {Cosmetics, Ceramic, Paper, Detergents, Textiles}], 50% [By Application {Oil Drilling, Cement, Textile, Detergent, Paper, Ceramics, Electroplating}], 99% [By Application {Washing Powder & Detergent, Textile, Cement, Paper, Ceramic, Metal Surface treatment, Chemical Production, Flameproofing, Mineral Floatation}], Industry Analysis Report, Regional Outlook, Application Potential, Price Trends, Competitive Market Share & Forecast, 2019 - 2025” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/sodium-metasilicate-pentahydrate-market

Germany 29% sodium metasilicate pentahydrate industry demand from cosmetic applications is likely to register gains of about 3.5% by 2025. High disposable incomes, increasing product innovations and growing image consciousness among consumers should stimulate the demand for cosmetics, in which this ingredient prevents the corrosion of metallic packaging components. Significant health awareness among young consumers and women along with the easy availability of cost-competitive and high quality products are likely to further promote market growth.

China 99% sodium metasilicate pentahydrate market demand from flameproofing applications surpassed USD 12.5 million in 2018 pertaining to stringent government regulations for fire-proof safety equipment. Booming chemicals, mining, construction and oil & gas sectors have increased the requirement for flameproof fabrics, in which the product is widely used owing to its effective fire retarding property and ability to form an shielding barrier between the flame and the product. Increasing demand for fire protection materials in the walls, joints and floors of manufacturing, warehousing and oil & gas industries should further boost growth of the market.

Global sodium metasilicate pentahydrate market share is consolidated and includes various industry participants such as American Elements, Silmaco, Nippon Chemical, Mistral industrial Chemicals, Qingdao Darun and Jay Dinesh Chemicals. Certain manufacturers have engaged in production capacity expansion to ensure increase in manufacture of end products and achieve competitive advantage.

Sodium metasilicate pentahydrate market research report includes in-depth coverage of the industry, with estimates & forecast in terms of volume in tons and revenue in USD from 2014 to 2025, for the following segments:

By Purity

- 29%

- By application

- Cosmetics

- Ceramic

- Paper

- Detergents

- Textiles

- By application

- 50%

- By application

- Oil drilling

- Cement

- Textile

- Detergents

- Paper

- Ceramics

- Electroplating

- By application

- 99%

- By application

- Washing powder & detergent

- Textile

- Cement

- Paper

- Ceramic

- Metal surface treatment

- Chemical production

- Flameproofing

- Mineral floatation

- By application

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Poland

- Czech Republic

- Asia Pacific

- Japan

- India

- China

- Indonesia

- South Korea

- Latin America (LATAM)

- Brazil

- Argentina

- Middle East & Africa (MEA)

- Iran

- Saudi Arabia

- Egypt

- UAE

- South Africa

- Nigeria

- Ethiopia