Reprocessed Medical Devices Market size worth over $3.9 Bn by 2026

Published Date: November 2020

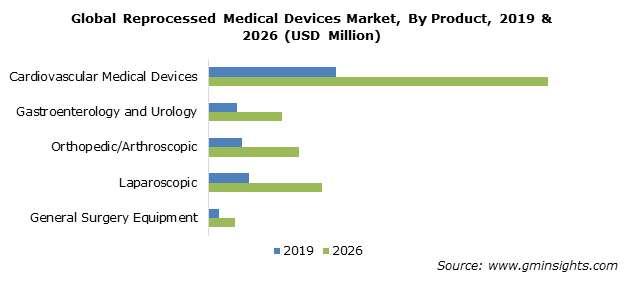

Reprocessed Medical Devices Market size is set to surpass USD 3.9 billion by 2026, according to a new research report by Global Market Insights Inc.

Rising preference of healthcare professionals towards reprocessed devices (SUDs) to ensure the safety of patient by reducing the risk of contracting infections and substantial cost reduction is expected to boost the market growth. Growing number of cardiac surgeries coupled with extensive utilization of products in cardiovascular surgeries and diagnostics will lead to extensive demand for reprocessed medical devices over the coming years.

Growing trend of sustainable waste disposal methods will augment the market expansion

Reprocessed medical devices reduces the medical wastage by hospitals by around 50% and aids in cost saving that will fuel the reprocessed medical devices industry revenue. Due to rising environmental concerns regarding medical waste and its excessive management costs, several favorable regulations for sustainable hospital waste disposal methods are taken in place. Reprocessing assist in reduction and management of regulated medical waste (RMW) also known as red bag waste. RMW waste cost hospitals around 6 to 10 times more in comparison to the disposal of regular solid wastage. The practice of using reprocessed medical devices can save on landfill costs. Also, use of reprocessed medical devices save hospitals’ repurchasing costs.

Increasing use of reprocessed devices in laparoscopic procedures will foster the market value

Get more details on this report - Request Free Sample PDF

The laparoscopic segment is projected to witness around 16% growth rate till 2026 owing to the growing number of laparoscopic procedures and the high amount of waste generation led by the usage of disposable devices during these procedures. These devices include harmonic scalpels, and endoscopic trocars and its components.

Browse key industry insights spread across 218 pages with 346 market data tables & 14 figures & charts from the report, “Reprocessed Medical Devices Market Size By Product (Cardiovascular Medical Devices, [Blood Pressure Cuffs/Tourniquet Cuffs, Electrophysiology Cables, Cardiac Stabilization and Positioning Devices, Diagnostic Electrophysiology Catheters, Deep Vein Compression Sleeves (DVT)], Gastroenterology and Urology, [Gastroenterology Biopsy Devices, Urology Biopsy Devices], Orthopedic/Arthroscopic, Laparoscopic [Harmonic Scalpels, Endoscopic Trocars and Components], General Surgery Equipment [Infusion Pressure Bags, Balloon Inflation Devices]), By End-use (Ambulatory Surgical Centers, Hospitals, Clinics), Industry Analysis Report, Regional Outlook, Application Potential, Price Trends, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/reprocessed-medical-devices-market

Growing preference for reprocessed medical devices in ASCs will lead to significant market demand

The ambulatory surgical centers segment accounted for 26% of the market share in 2019 impelled by rising preference for ambulatory surgical centers due to low costs and faster recovery period offered by the ASC’s. Moreover, physicians owned ASC’s provide treatment for various diseases leading to robust use of reprocessed medical devices that will positively impact the market expansion.

Favorable regulations and rising acceptance of reprocessed medical devices will drive the growth for in European region

Europe reprocessed medical devices market size was over USD 370 million in 2019 on account of the favorable regulations in several European countries pertaining to the use of reprocessed medical devices. Additionally, cost-efficiency and growing awareness amongst clinicians and doctors regarding the availability of improvised reprocessed medical devices will accelerate the industry growth during the forecast period.

Adoption of various strategic initiatives by key market players will offer lucrative growth opportunities

Some of the prominent participants operating in the market include Medline Industries, GE Healthcare, Renu Medical (Arjo), Soma Technology, Teleflex Incorporated, Stryker, Medtronic, Innovative Health, Vanguard AG, Ethicon, and SureTek Medical. These companies have taken several strategic initiatives that have enhanced their business outcome and helped them evolve as major market leaders.