Payment Processing Solutions Market worth over $180 billion by 2028

Published Date: April 2022

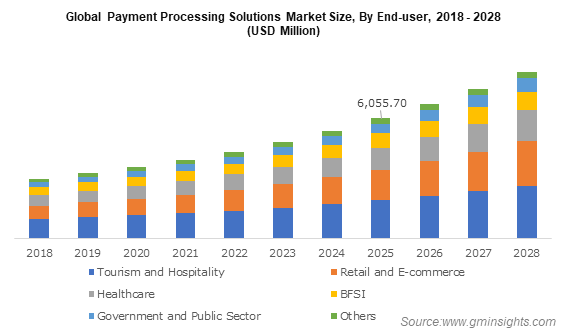

Payment Processing Solutions Market size is set to surpass USD 180 billion by 2028, according to a new research report by Global Market Insights, Inc.

Rising smartphone penetration and surging adoption of digital banking services will drive the market demand. The increasing smartphone penetration allows consumers to settle their bills and payments quickly using payment applications. Retailers are also opting for payment processing solutions to reduce long queues at the billing counters.

Get more details on this report - Request Free Sample PDF

The recent COVID-19 pandemic has completely shifted the consumers’ buying and payment habits. Consumers prefer contactless payment methods, such as NFC and QR code, to avoid the spread of COVID-19 through cash handling. Government authorities in many countries are promoting digital payments to reduce the impact of the COVID-19 outbreak on their economies.

Amid the ongoing Russia-Ukraine war, cash has become a scarcity in Ukraine, and the National Bank of Ukraine (NBU) has encouraged citizens to opt for cashless payments. Russian banks have faced severe restrictions from global payment networks, including SWIFT. These factors have exacerbated the need for payment processing solutions in the regional markets.

Easy of use and swift payment transactions through scannable codes are supporting the adoption of QR code technology

The QR code technology held a market share of 30% in 2021, due to the growing demand for UPI-based payment solutions. Small and medium-sized retailers are using QR-code technology to simplify payment processing methods. QR-code helps consumers to quickly pay bills without the need to enter the banking details of the retailer.

Browse key industry insights spread across 270 pages with 361 market data tables and 34 figures & charts from the report, “Payment Processing Solutions Market Size, By Technology (Near-Field Communication (NFC), QR Code, EMV), By Deployment Model (In-store, Online, Mobile), By Mode of Payment (Credit Cards, Debit Cards, E-wallets), By Organization Size (SMEs, Large Enterprises), By End-user (Tourism and Hospitality, Retail & E-commerce, Healthcare, BFSI, Government and Public Sector)” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/payment-processing-solutions-market

Seismic shift of global consumers towards online shopping is fueling the demand for online deployment model

The online deployment model is expected to grow at a CAGR of over 10% during the forecast period, credited to rising internet penetration, in turn, increasing e-commerce consumers. The major e-commerce businesses generally prefer online transactions for their business operations. Many companies operating in the payment processing solutions industry offer online payment processing solutions with features such as fraud prevention and flexible payment gateway options.

Easy availability of debit cards is propelling the growth of debit card payment mode

Debit card payment mode accounted for 20% payment processing solutions market share in 2021, as its transaction fees and interest charges are low. A large population is availing the facility of debit cards as it can be easily issued to consumers having a bank account. The debit card can be easily issued to a bank account holder without the need to check credit history.

Rising internet penetration to support the adoption of payment processing solutions across SMEs

SMEs are expected to register around 10% growth rate through 2028, due to rising internet penetration. Increasing internet penetration is enabling more retailers to sell their products online. SMEs use payment processing solutions to provide flexibility to their consumers during online payments. Payment processing solutions help these retailers to improve their operations by removing redundancies in online payment methods.

Resurgence of tourism sector supported by stimulus packages is impelling the market expansion

The tourism and hospitality sector dominated around 30% market share in 2021, owing to feasibility of payment for international tourists and travelers. Players operating in the tourism industry use payment processing solutions to simplify payment for their international customers. The ongoing COVID-19 pandemic has further amplified the demand for contactless payments across tourists.

Growing adoption of digital payments in North America

The North America payment processing solutions market is estimated to hold a revenue share of more than 40% by 2028, attributed to the high adoption of digital payments in the region. The growing adoption of e-wallets in the region is another factor supporting market growth. The availability of major e-wallet companies, such as Apple Pay and Amazon Pay, in the U.S. is supporting the adoption of payment processing solutions.

Developing new solutions is the key strategy adopted by major market players

Prominent companies operating in the market include ACI Worldwide, Inc., Adyen N.V., Authorize.Net, Due, Inc., Dwolla, Inc., Fidelity National Information Services, Inc. (FIS), First Data Corporation, Fiserv, Inc., Flagship Merchant Services, Global Payments, Inc., Jack Henry & Associates, Inc., Mastercard Incorporated, PayPal Holdings, Inc., Paysafe Group Limited, PayU, Square, Inc., Stripe, Inc., and Visa, Inc.

Preeti Wadhwani, Smriti Loomba