Neoprene Market worth over $2.28 billion by 2025

Published Date: February 2019

According to a new research report by Global Market Insights Inc. the neoprene market is expected to reach $2.8 billion by 2026, growing at 2.3% CAGR. The burgeoning construction sector dominates the growth of neoprene industry in the coming years.

Global neoprene market is anticipated to be driven by burgeoning construction and automotive industry across the globe. The growing government investments in infrastructural projects in Asia Pacific and the Middle East is expected to attract huge funds from proficient financial players, in turn positively influencing the market growth during the forecast period.

Neoprene is a synthetic rubber that exhibits excellent weather and thermal resistance. It also possesses high tensile strength which makes them ideal for the use in transmission belts, vibrating mounts, shock absorber seals, bridge seals, and anchor components among others. The growing adoption of product in the end user industries is expected to generate substantial revenue during the assessment period. However, neoprene is a petroleum derivative and volatility in crude prices is likely to impede with the smooth growth for neoprene market over the forecast period.

Get more details on this report - Request Free Sample PDF

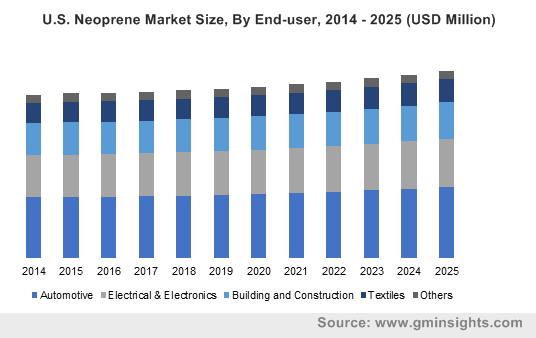

Browse key industry insights spread across 182 pages with 271 market data tables & 24 figures & charts from the report, “Neoprene Market Size By Product (Neoprene Foam/Sponge, Rubber Sheet, Latex), By End-user (Automotive, Electrical & Electronics, Building & Construction, Textiles), Industry Analysis Report, Regional Outlook, Application Growth Potential, Price Trends, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/neoprene-market

Based on product, neoprene market has been segmented into foam/sponge, sheet and latex. Neoprene foam are widely used in aquatic sports gears; diving suits, life jackets, dry suits, and other outdoor applications such as elbow and knee pads, sports gloves, bicycle seats and others. In the building and construction industries neoprene foam is used for sound proofing and thermal insulating applications. Rubber sheets possess excellent weathering and ozone resistance which makes them suitable for wide range of applications in electronics as well as automotive industries. Latex is used in the manufacturing of industrial gloves and also in the production of latex adhesives which has varied applications in the automotive and building and construction industries.

Among the various end use industries, the automotive, electrical and electronics and building and construction segment respectively are the major revenue pockets during the assessment period. The growing adoption rate of neoprene in these industries is estimated to generate substantial revenue review period.

Asia Pacific is anticipated to grow at the highest CAGR during the forecast period. Increasing infrastructural spending along with the propelling automotive sector in India, China and Japan is likely to boost Neoprene market share over the review years. Moreover, the presence of major product manufacturing companies such as Denka Company Limited, TOSOH Corporation and Shanxi Synthetic Rubber Group Co Ltd is anticipated further augment the market growth.

The companies operational in neoprene industry includes giants such as Denka Company Limited, TOSOH Corporation and Shanxi Synthetic Rubber Group Co Ltd, Sundow Polymers Co., Ltd, Covestro AG, Lanxess, Zenith Rubber, BGK GmbH Endlosband, Pidilite Industries, The 3M Company, and TuHuang Chemical Co among others.

The proficient manufactures are adopting various organic and inorganic growth strategies to expand their market presence. For instance, In May 2014, Denka announced the acquisition of Dupont’s business of chloroprene rubber. Denka entered into a joint venture with Mitsui chemicals and formed Denka Performance Elastomer with a capital split of 70% Denka and 30% Mitsui for this acquisition.