Microcrystalline Cellulose Market worth around $1.35 bn by 2026

Published Date: November 2019

Microcrystalline Cellulose (MCC) Market size estimated to cross USD 1.35 billion by 2026; according to a new research report by Global Market Insights Inc.

Changing drug formulation to escalate revenue generation

Excellent compressibility properties of microcrystalline cellulose support its application in the drug formulation for the medical sector. It is preferred for multiple oral dosage products including tablets, capsules, sachets and pellets. The product finds application in baking methods as an anti-caking agent to improve water retention and reduction of food calories. The ingredients in the food sector has changed considerably with changing consumer preferences towards low fat and nutritious diet. MCC is included in multiple nutrition products and widely used in packaged food items along with meat products.

Increasing manufacturing cost along with availability of multiple product alternatives will limit the industry growth over the projected timeframe. Substitutes including pectin and xanthan gum pose a threat to MCC with their increasing usage in food and drug production. Carboxymethylcellulose (CMC) and guar gum are the cost-effective substitutes that will restrict the MCC market size.

Get more details on this report - Request Free Sample PDF

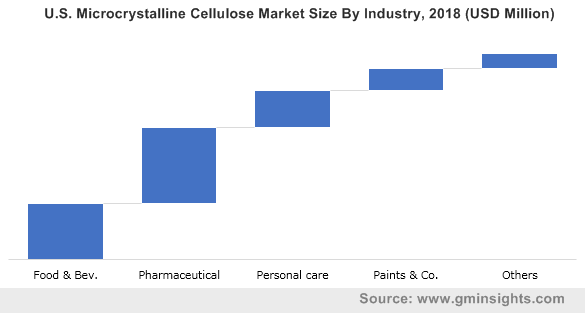

Browse key industry insights spread across 184 pages with 224 market data tables & 15 figures & charts from the report, “Microcrystalline Cellulose (MCC) Market Size By Source (Wood, Non-wood), By End-user (Food & Beverages, Pharmaceutical, Personal Care, Paints & Coatings), Industry Analysis Report, Application Growth Potential, Price Trends, Competitive Market Share & Forecast, 2019 – 2026” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/microcystalline-cellulose-mcc-market

Wood source will account for significant share in the microcrystalline cellulose market share owing to increased application in paper and paints & coatings industry. Manufacturers are involved in strategic investments to cope up with the rising products requirement from pharmaceutical sector. Further, MCC is used as an emulsifier for water-based coatings owing to its thickening and thixotropic properties. Proliferating construction sector in both developed and emerging economies is stimulating the demand for paint & coatings thereby enhancing the industry growth.

Pharmaceutical will witness substantial growth over the projected timeframe owing to the superior chemical inertness and its suitability for manufacturing medical drugs. Industry participants focus on treating MCC with spray drying process to manipulate the final or bulk density and particle size to produce product within specifications. It aids low absorption through gastrointestinal tract that supports reduced toxicity as compared to other excipients used in producing pharmaceutical products.

Latin America to bank upon proliferating cosmetics industry

Latin America microcrystalline cellulose market size is anticipated to foresee steady rise 6.3% CAGR on account of pulsating cosmetic and personal hygiene product demand. Increasing product innovations and rising marketing campaigns from personal care industry participants will drive the regional penetration. New product developments include line extension and diversification of product category with growing preferences for natural ingredients and improved formulations to differentiate with other brands.

Raw material suppliers for cosmetic manufacturers are engaged in supplying specialty ingredients with increasing focus on ‘green chemistry’ principles to meet stringent regulatory requirements. Consumer are inclined towards utilization of natural and safe products to reduce the health hazards caused by synthetic ingredients in the food and beverages, pharmaceutical and personal care products. Moreover, rising environmental concerns towards deforestation is leading to product development by other sources including agricultural waste and cotton linters.

Manufacturers engage in product developments and launches

Major players are involved in expanding their product portfolio to serve larger consumers and strengthen their industry foothold. The prominent players in microcrystalline cellulose market share include Sigachi Industrial Pvt. Ltd, Mingtai Chemical Co. Ltd, Accent Microcell Pvt. Ltd, Asahi Kasei Corporation and DFE Pharma GmbH & Co.