Metal Injection Molding Parts Market size worth $5.2bn by 2026

Published Date: November 2019

Metal Injection Molding (MIM) Parts Market size is set to exceed USD 5.2 billion by 2026; according to a new research report by Global Market Insights Inc.

Strengthening electronics industry across the globe is the major reason uplifting MIM parts demand, especially in Asian countries such as China, Taiwan, and South Korea. These parts are used in many complex electronics parts production with enhanced performance. For instance, these are utilized in the production of Apple’s lightening connector. Some other parts produced by using metal injection molding technique are fiber optic parts, heatsinks and cold plates, cell phone parts etc.

High penetration of electronic component in automotive industry for infotainment, navigation and safety is also expected to fuel growth in the coming years. Emerging technologies such as IOT is another reason driving the growth of electronics industry as a result of gaining high importance in home automation and other applications. The increasing demand for electronic products is expected to positively influence the metal injection molding parts market demand in the sector.Rising demand from consumer goods sector

MM has made strong strides in registering itself as an economic manufacturing technique for watch designs and various other consumer goods. Metal injection molding parts are used to manufacture a range of watches such as general steel watches, diamond clad watches etc. Swatch watches are also a major application for stainless steel MIM parts in producing watch cases. Apart from watches, the product is also used in manufacturing eyewear components. Spectacle frames is one of the major segments for metal injection molding parts as it offers better designing in a cost-effective way.

Get more details on this report - Request Free Sample PDF

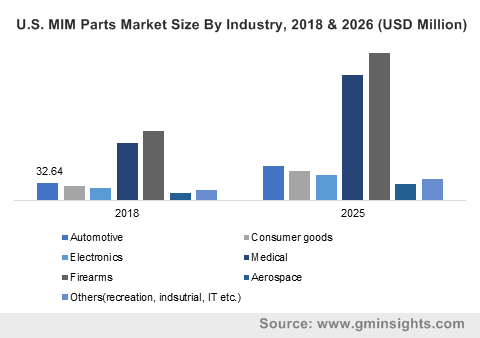

Browse key industry insights spread across 224 pages with 329 market data tables & 29 figures & charts from the report, “(Metal Injection Molding) MIM Parts Market Size By Material (Stainless Steel, Low Alloy Steel, Soft Magnetic Materials), By Industry (Automotive, Consumer Goods, Electronics, Medical, Firearms, Aerospace), Industry Analysis Report, Regional Outlook, Application Development Potential, Price Trends, Competitive Market Share & Forecast, 2019 – 2026” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/mim-parts-market

Low alloy steel to metal injection molding

Low allow steel grabs a share of around 20% in the overall market attributed to its properties such as enhanced strength and resistance against tear and wear. This category of steel produce high wear resistant MIM parts when treated with heat. As a result of having a high strength, the material is generally used in automotive, aerospace and firearms industry, where robust parts are required. Low allow steel are especially designed for strength and toughness at lower temperatures which makes them ideal to be used in manufacturing heavy equipment manufacturing.

Rising healthcare industry will augment metal injection molding parts market demand

With rising labor costs in manufacturing medical equipment, cost reduction in manufacturing become quite necessary in order to control the overall cost. Metal injection molding technique is highly being adopted by medical industry to make the manufacturing process economical. MIM parts are used to manufacture a range of equipment. Implants and surgical instruments are two categories of medical devices in which MIM technology is mostly used. Global medical industry is anticipated to grow at a rate of over 4% in the near future. Key reason behind rising healthcare sector worldwide is increasing aging population, market expansion, technological advancements in the medical sector and rising labor costs. Supported by increasing product penetration in the industry, MIM parts demand is also expected to grow in projected time frame.

Europe’s MIM industry at rise

Europe is among the high growing markets for metal injection molding industry growing at a CAGR of about 12% annually. The growth is mostly supported by Italy, Germany, France and Spain as a result of growing demand from end user industries. Product demand is majorly concentrated on automotive sector followed by consumer goods. Germany leads the automotive market in the region in terms of both production and sales. The country is also responsible for boosting the concentration of OEM plants in the region. Germany automotive manufactures roughly produced 16 million vehicles in 2017, ranking 16 among world’s top 100 automobile suppliers. A rising production in the region demands the need for metal injection molding parts in producing these vehicles.

Strategic mergers & acquisitions by key companies to expand their market share

As a result of increasing competition in the market, key players are focused towards strategic mergers & acquisitions, technology innovation, and product differentiation techniques to gain a competitive edge over other market players. Companies are adopting various strategies to strengthen their portfolio. For instance, Form Technologies acquired Dynacast International Inc. in 2018 to become a larger and more established brand in the industry.