Medical Bed Market worth over $30.5 Bn by 2026

Published Date: November 2020

Medical Bed Market size is set to surpass USD 30.5 billion by 2026, according to a new research report by Global Market Insights Inc.

Rising prevalence of chronic diseases has led to an increase in number of patient admissions in hospitals. According to the National Center for Biotechnology Information (NCBI), one in three of all adults suffer from multiple chronic conditions, worldwide. These patients with multiple chronic conditions will require repeated hospital admissions for critical monitoring and care, resulting in growing supply of several types of medical beds in healthcare settings. The three most prevalent chronic disorders having a high impact on hospitalizations are cancer, cardiovascular disorders, and chronic obstructive pulmonary disease (COPD). The cancerous disorders generally require planned hospitalizations while COPD and cardiac disorders lead to unplanned hospitalizations in intensive care units and emergency rooms. Rising rural population suffering from chronic conditions in developing economies has augmented the demand for manual hospital beds.

Increasing funding on healthcare infrastructure in developing economies will uplift the market growth. Developing countries consist of large patient population pool as compared to the developed countries owing to the lack of basic and advanced healthcare facilities as well as poor healthcare infrastructure. The government is engaged in launching several initiatives in developing regions for funding the development of new hospitals that can accommodate large capacity of hospital beds.

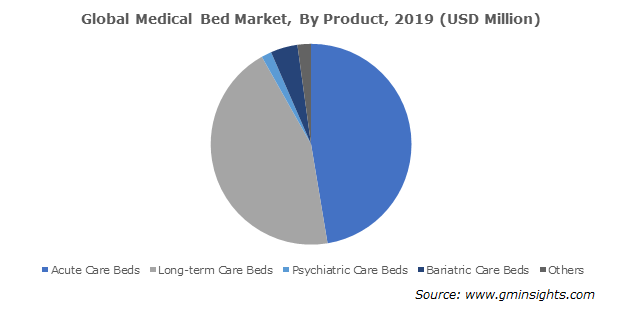

Rise in demand for acute care beds will boost the medical bed market value

Get more details on this report - Request Free Sample PDF

Acute care beds segment valued at more than USD 8.34 billion in 2019 led by the vital role of acute care in prevention of death and disability along with providing critical care to the patients resulting. Acute care facilities in the healthcare settings provide necessary therapeutic services to the patients with urgent and emergency conditions. Increasing incidence of conditions such as acute myocardial infarction, stroke, acute abdominal pain, poisoning, fractures and breathing disorders is leading to growing number of acute care beds in the hospitals.

Browse key industry insights spread across 251 pages with 330 market data tables & 35 figures & charts from the report, “Medical Bed Market Size By Product (Acute Care Beds {MedSurg Beds, ICU Beds, Pediatric Beds, Birthing Beds}, Long-term Care Beds, Psychiatric Care Beds, Bariatric Beds), By Bed Type (Manual Beds, Electric Beds, Semi-electric Beds), By Application (Intensive Care, Non-intensive Care), By Medical Institution/Facility (Private Medical Institutions, Public Medical Institutions), By End-use (Hospitals, Home Care Settings, Elderly Care Facilities), Industry Analysis Report, Regional Outlook, Application Potential, Price Trends, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/medical-bed-market

Growing preference for electric beds will enhance the market revenue

Electric bed segment crossed USD 8.05 billion in 2019 impelled by the increasing number of bariatric patient population that require essential care that can be provided using technologically advanced medical beds. Electric beds are designed to ease the work of healthcare providers and improve the patient comfort. These types of beds consist of a button on the remote-controlled electrical bed that enables patients to adjust themselves as per the desired height or back position and provides easy mobility to the patients.

Increasing demand for non-intensive care beds will spur the market expansion

Non-intensive care beds exceeded USD 16.83 billion in 2019. Non-intensive care units provide a lower level of care such as general hospitalizations, providing pre-and post-delivery care to the pregnant women along with long term care and psychiatric care to the patients. Rising admissions of patients in such units has influenced the demand for non-intensive care beds. Moreover, growing number of patients admitted in post-critical care units, oncology units and surgical units have also impacted the installations of non-intensive care beds. Recently, there has been an increase in number of non-intensive care beds that are required in long-term care wards in order to provide care to patients for extended periods of time.

Rise in number of hospitalizations in public medical institutions/facilities

Public medical institution/facility segment in the medical bed market accounted for around USD 6.65 billion in 2019 led by cost-effective care and several government policies implemented in the public medical institutions. The need for hospital beds is significantly growing due to the ongoing research activities along with several training and rehabilitation programs in hospitals. Medical beds are also required in public medical facilities such as military and general hospitals on a consistent basis in order to address patients with fatal injuries and serious disorders.

Growing preference for home care by the elderly population will propel the industry growth

Home care settings segment revenue was USD 2.31 billion in 2019 driven by increasing government support to decrease the duration of stay in hospitals. Rising geriatric population on a global scale is also leading to an increase in number of beds in home care settings. Growing availability of free beds for patients in geriatric population is boosting the demand for medical beds.

Increasing healthcare reforms in the U.S. region is anticipated to fuel the market growth

U.S. medical bed market size was more than USD 1.53 billion in 2019 on account of the well-established and improved healthcare infrastructure. Rising prevalence of obesity and diabetes also leads to an increased supply of medical beds in hospitals and home care settings to assist severely obese and diabetic patients. Additionally, higher prevalence of cancer disorders in the U.S. is increasing the need for hospital care. According to the National Institutes of Health (NIH), in the U.S., approximately 1.7 million people were diagnosed with cancer in 2019. Growing healthcare expenditure in the country is further augmenting the demand for medical beds in the country.

Companies are focusing on strategies and launch of innovative products to expand customer base

Some of the major players operating in the medical bed industry are Antano Group, Besco Medical, Gendron Inc., Getinge AB, GF Health Products, Inc., HARD Manufacturing Company, Inc., Invacare Corporation and Hill-Rom Holdings among others. These companies are proposing strategic acquisitions, mergers, collaborations with innovative product launches in order to generate significant revenue in the market and increase their geographical presence. For instance, in April 2020, Stryker announced the release of Emergency Relief Bed, a limited-release medical bed with low-cost to support critical needs during the ongoing pandemic. This strategic move will assist the company in expanding its product portfolio and strengthening its industry position.

Sumant Ugalmugle, Rupali Swain