MEA UTV Market Size to surpass $465 Mn by 2025

Published Date: June 2019

MEA Utility Terrain Vehicles (UTV) Market size is estimated to surpass USD 465 million by 2025; according to a new research report by Global Market Insights Inc.

Growing demand of side by side vehicles in applications including agriculture, forestry and goods transportation will boost the MEA utility terrain vehicles (UTV) market penetration. The vehicles offer multiple benefits such as compact size to work in small and remote space and superior towing capacity. The availability of wide range of power and torque capacity along with several distributors in region will support the industry growth. Further, enhanced vehicle capacity and low maintenance of vehicles minimizes overall ownership costs.

Increasing youth involvement in recreational activities such as hunting, and fishing is driving the MEA UTV market size. Consumers are focusing on deployment of side by side vehicles offering high productivity and power output. UTVs provide larger space and facilitates multiple passengers. Moreover, superior safety features including roll-cage-like body structures and bucket seats will support MEA utility terrain vehicles market growth by 2025.

Get more details on this report - Request Free Sample PDF

Rising spending in off-road trailing activities will to drive the MEA UTV market demand. The increasing number of adventure clubs and parks is proliferating the demand for utility vehicles. For instance, Amaury Sport, organizes annual Dakar Rally event for off-road events. Such events are expected to showcase significant growth potential over the coming years.

Regulatory authorities including the Roads & Transport Authority (RTA) of Dubai, Department of Environmental Affairs (DEA) and Department of Transport South Africa (DoT) enact laws regarding vehicle emission and passenger safety. Stringent norms and regulations mandated by government bodies are supporting enhanced protection for environment and consumers. For instance, The Roads & Transport Authority (RTA) of Dubai establishes several amendments and implementations regarding use and licensing of quad vehicles for ensuring passenger and environment safety.

Browse key industry insights spread across 135 pages with 115 market data tables & 9 figures & charts from the report, “MEA Utility Terrain Vehicles Market Size By Displacement (Below 400 CC, 400-800 CC, Above 800 CC), By Application (Utility, Sports, Recreation, Military), Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/mea-utility-terrain-vehicles-market

The 400 to 800 cc segment will witness significant growth in the MEA utility terrain vehicles (UTV) market owing to the rising UTV demand in utility applications including forestry and goods transport. The replacement of bakkies and other good transport vehicles with UTVs are boosting industry penetration. For instance, in July 2015, the replacement of bakkies with 400 cc UTVs enabled two contactors Grinaker and Esor Construction from South Africa to save up to 50% costs. In addition, the presence of several UTV dealers including Polaris, Honda, KYMCO, Kawasaki SA, and Yamaha in South Africa will drive the product demand.

Above 800 cc segment leads the MEA utility terrain vehicles market size owing to its increasing demand in sports and utility activities. Growing off-road racing competitions across the globe is driving the segment growth. The sports event requires higher displacement engines for enhanced power and greater torque to gain competitive advantages. Shifting trend from circuit racing to desert races will significantly influence MEA UTV market share over projected timeframe. Industry players are involved in new product launches to provide new vehicles with superior endurance, high power to weight ratio and increased reliability. For instance, in 2019, Polaris Industries unveiled Ranger Xp 1000 Eps with improved features including anti-lock braking system and comfortable seats.

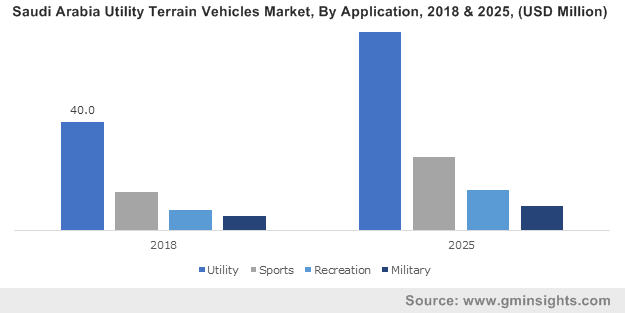

Utility segment will witness steady growth in the MEA utility terrain vehicles market share owing to its multiple applications in forestry, landscaping and agriculture activities. Increasing demand for supplies transport, plowing fields and managing livestock are escalating the product demand. Proven off-road durability, along with comfortable cabin will proliferate the segment penetration. Military segment is at nascent stage and will foresee considerable growth with its use for carrying armaments and troops in rough terrains. Manufacturers offering all terrain traction control for advanced vehicle performance will further stimulate the segment growth.

South Africa will register significant share in the MEA utility terrain vehicles (UTV) market owing to changing preferences to recreational activities including camping, hunting and forest adventures. Rising inclination of farmers and homeowners towards UTV for daily living will influence the market growth. Presence of quad biking facilities including Clarens Xtreme, Induna Adventures, Segwati Quad Trails, Soweto Outdoor Adventures and Kagga Kamma will positively support the industry share. Moreover, regional organizations engaged in arranging outdoor sport events will further enhance the volume demand in the study timeline.

Key industry players of the marketplace include Polaris Industries, Bombardier Recreational Products (BRP), Kawasaki SA, Yamaha Motors, Honda Motors, and Kubota Corporation. Industry participants are expanding the product portfolio to support rescue operations and enhance its regional presence. For instance, in 2018, Polaris Industries launched new equipment line-up for Ranger side by side vehicles for fire & rescue, and law enforcement operations.

MEA utility terrain vehicles (UTV) market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume in units and revenue in USD million from 2013 to 2025, for the following segments:

MEA UTV Market by Displacement

- Below 400 cc

- 400 - 800 cc

- Above 800 cc

MEA UTV Market by Application

- Utility

- Sports

- Recreation

- Military

The above information is provided on a regional and country basis for the following:

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Qatar

- Egypt