Food Emulsifier Market size exceed $4 bn by 2025

Published Date: March 2019

Food Emulsifier Market size is set to surpass USD 4 billion by 2025; according to a new research report by Global Market Insights Inc.

Growing consumer inclination towards packaged food due to rising number of working-class people will stimulate product demand. Food emulsifier are added in small quantity owing to its anti-staling, stable foaming, and emulsifying properties. It helps the dough to rise and makes it look fluffy. Rising utilization of emulsifying agents to manufacture cakes and puddings owing to increasing demand for appealing baked goods will boost emulsifying agents industry growth.

Emulsifying agents are extensively used to produce instant mashed potatoes as when it is added to the product it forms starch complex which secures starch granules hence, providing a smooth texture. Growing demand of instant mashed potatoes owing to rising convenience and high satiety value food consumption will propel food emulsifier market growth.

Get more details on this report - Request Free Sample PDF

Global food emulsifier market size for dairy & frozen desserts application is projected to exceed USD 330 million by 2025. Its emulsion stabilizing and microbial growth reducing properties have applications to manufacture cheese, desserts, and yogurts. Growing inclination towards healthy living will foster dairy products demand owing to their high nutritional value will positively favor industry growth.

Emulsifiers are widely used for making margarine and shortening which functions as a butter substitute due to its spreading effects enhancement and spattering prevention properties. Growing demand for low-calorie butter substitutes owing to rising diet food products intake will positively impact margarine manufacturing industry, thus driving emulsifier market size.

China food emulsifier market size may witness substantial gains up to 5% by 2025. It is added to breads as it helps to produce elastic & less sticky dough and make it soft. Rising bread consumption in the region due to availability of healthier multigrain and low carb breads will fortify regional product demand.

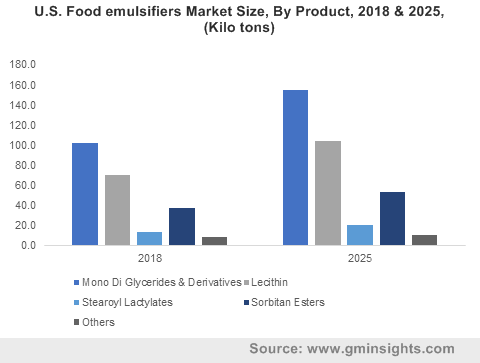

Global lecithin-based food emulsifier market size is projected to exceed USD 1,555 million by 2025. Lecithin is derived from several natural sources including corn, rapeseed, and soy. Rising incidences of allergies and stomach cramps due to synthetic emulsifiers has led to increase in demand for natural products which would drive industry growth.

Clean labels requirement for manufacturing process and raw material procurement may challenge industry growth due to additional compliance cost, thus affecting food emulsifier market price trends.

Global food emulsifier market size from sauces and dressings application is projected to exceed USD 100 million by 2025. The product being a stabilizing and binding agent helps to bind ingredients of several dressings & sauces including mayonnaise, whipped toppings and dips. Growing demand for salads, soups, and snacks due to shifting trends towards daily health management routines will foster mayonnaise and other salad dressings consumption which will favor industry growth.

Browse key industry insights spread across 225 pages with 183 market data tables & 22 figures & charts from the report, “Food emulsifier Market Size, By Product (Mono, Di-Glycerides & Derivatives, Lecithin, Stearoyl Lactylates, Sorbitan Esters), By Application (Bakery & Confectionery, Food & Nutrition, Beverages, Dairy & Frozen Desserts, Sauces & Dressings), Regional Outlook, Price Trend, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/food-emulsifiers-market

Global Mono, Di-Glycerides and derivatives-based food emulsifier market size may witness substantial gains up to 5.5% at the end of 2025. It pursues anti-staling, smoothening & fat dispersion effects and forms interface between ingredients. This makes it suitable for baking cakes. Recent designer cake trends and other baking innovations will fortify product demand.

France food emulsifier market size is projected to exceed USD 195 million by 2025. It helps to avoid deposits and extends preservation time promoting its usage in beverages manufacturing including soft drinks and smoothies. Increasing flavored soft drinks & energy drinks demand owing to changing consumer preferences towards healthy dietary habits will propel emulsifying agents market growth.

India food emulsifying agents market size may witness substantial gains up to 7 % by 2025. Lowering meat prices and increasing animal-based protein nutrition products will propel meat consumption will positively impact product demand.

Global food emulsifier market is highly fragmented with key industry participants including Mitsubishi chemical group, Cargill, Riken vitamin, Lonza Group, and Palsgaard. Manufacturers are making high investments in R&D, product innovation and capacity expansion in order to cater increasing market growth.

Food emulsifier market size research report includes in-depth coverage of the industry, with estimates & forecast in terms of volume in tons and revenue in USD from 2014 to 2025, for the following segments:

Food Emulsifier Market, By Product

- Mono, Di-Glycerides & Derivatives

- Lecithin

- Stearoyl Lactylates

- Sorbitan Esters

- Others

Food Emulsifier Market, By Application

- Bakery & Confectionery

- Food & Nutrition

- Beverages

- Dairy & Frozen Desserts

- Sauces & Dressings

- Others

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Poland

- Asia Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Australia

- Indonesia

- LATAM

- Brazil

- Argentina

- MEA

- South Africa

- UAE

- Saudi Arabia