Global Enterprise Networking Market Size to exceed $90bn by 2024

Published Date: December 2018

Enterprise Networking Market size is set to exceed USD 90 billion by 2024; according to a new research report by Global Market Insights Inc.

The enterprise networking market growth over the forecast timeline is due to rapid adoption of technologies such as network virtualization and the Internet of Things (IoT). The surge in the number of connected devices has accelerated the demand for network monitoring and security solutions, reducing the impact of security risks associated with unsecured devices. Another factor fueling market growth is the increasing network traffic and bandwidth issues to support business-critical applications. To overcome such issues, enterprises are using network management solutions, which provide users with wider network visibility, improving network efficiency and reducing operational costs.

The growing uptake of machine learning and Artificial Intelligence (AI) for network management will also spur enterprise networking market growth. AI-enabled network monitoring solutions help enterprises to discover hidden business threats and make informed decisions based on predictive analytics. The popularity of machine learning in enterprise networking applications, such as network threat monitoring, is enabling users to improve network efficiency and reliability.

Get more details on this report - Request Free Sample PDF

The network enterprise networking market is expected to exhibit a growth rate of over 5% between 2017 and 2024. In this segment, the mobile device security market will witness a growth rate of around 8% over the forecast timeline due to smartphone penetration and the adoption of the BYOD trend. The increasing number of mobile devices used in corporate networks has compelled enterprises to use endpoint protection strategies to ensure security. To provide higher levels of mobile device security, companies operating in the market are developing new mobile endpoint protection solutions to secure endpoints.

The cloud deployment model will exhibit a growth rate of around 10% over the forecast timespan due to the popularity of cloud-based networking solutions. Enterprises are preferring cloud deployment options including public & hybrid cloud due to their cost-effectiveness and the ability to meet workload requirements. The surge in the usage of network virtualization technologies will also spur the cloud-enabled enterprise networking market over the forecast timeline.

Browse key industry insights spread across 270 pages with 456 market data tables & 26 figures & charts from the report, “Enterprise Networking Market Size By Component (Product [Switches, Network Security {Firewall, Intrusion Prevention, Anti-virus/anti-malware, Secure Web Gateway (SWG), Mobile Device Security}, Wireless, Routers, Network Management], Service [Training & Consulting, Integration & Maintenance, Managed Service]), By Deployment Model (On-premise, Cloud), By Application (BFSI, Healthcare, IT & Telecom, Manufacturing, Retail, Government & Public Sector, Energy & Utility), Industry Analysis Report, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2018 - 2024” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/enterprise-network-equipment-market

The healthcare application segment will grow at a CAGR of over 8% over the forecast timeframe due to extensive usage of IoT-enabled devices such as infusion pumps, X-ray machines, and heart monitors, exposing healthcare networks to various vulnerabilities. To ensure privacy and security in healthcare IoT networks, the need for network monitoring and security solutions arises to keep patient data and devices safe. Hospitals and healthcare institutions are embracing network management solutions, which offer unprecedented visibility into network operations to track devices.

The Europe enterprise networking market will observe a growth rate of over 5% from 2017 to 2024, due to the rising smartphone penetration, adoption of cloud computing, and network virtualization technologies to support the changing business needs. Enterprises, particularly in countries including Germany, the UK, and France, are witnessing huge adoption of network virtualization solutions to reduce operational costs and handle the complex network architecture. This will fuel the market growth. The rising number of cyberattacks on networks has also enabled them to implement reliable security solutions to secure business-critical networks. According to National Cyber Security Centre (NCSC), in the UK, over 34 significant cyberattacks and 762 minor cyberattacks were reported in 2017. This is expected to bring a significant increase in the network security spending, driving the market growth.

The enterprise networking market comprises several core networking solution providers, cloud platform providers, and network security companies, which are adopting strategies such as product enhancements and partnerships to lead the market share. In June 2017, Cisco introduced Cisco Catalyst 9000 Series of switches, which are the next generation in the Cisco Catalyst family of campus switches including enterprise LAN and core switches. In February 2018, Fortinet developed the third generation of network security FortiOS 6.0 within its security fabric infrastructure. It is an automated security framework, which provides broader visibility and detects advanced threats to protect dynamic networks. By introducing new product features and capabilities, Fortinet helps its business partners to rely on fabric solutions to defend against the latest threats. In September 2016, Samsung and HPE partnered to provide carriers with integrated NFV and VNF solutions. The combined solution from Samsung’s carrier network and HPE’s IT telecom expertise helped its customers to move its agile cloud-based networks enabled by NFV.

Key players in the market are Checkpoint, Cisco, Dell Technologies, Broadcom, HPE, FireEye, Extreme Networks, F5 Networks, Fortinet, Huawei, Trend Micro, McAfee, Juniper, Riverbed, Netscout, Palo Alto, Symantec, Arista, and VMWare.

The enterprise networking market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2013 to 2024, for the following segments:

By Component

- By Product

- Switches

- Network Security

- Firewall

- Intrusion Prevention

- Anti-virus/Anti-malware

- Secure Web Gateway (SWG)

- Mobile Device Security

- Wireless

- Routers

- Network Management

- By Service

- Training & Consulting

- Integration & Maintenance

- Managed Service

By Deployment Model

- On-premise

- Cloud

By Application

- BFSI

- Healthcare

- IT & Telecom

- Manufacturing

- Retail

- Government & Public Sector

- Energy & Utility

The above information has been provided for the following regions and countries:

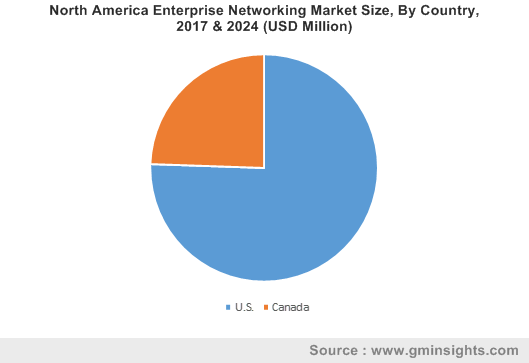

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Netherlands

- APAC

- China

- Japan

- Australia & New Zealand (ANZ)

- South Korea

- India

- Singapore

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- MEA

- South Africa

- UAE

- Saudi Arabia

- Israel