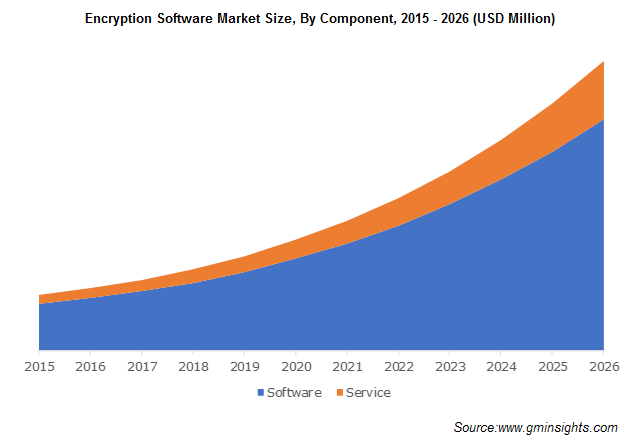

Encryption Software Market demand to hit $20 Bn by 2026

Published Date: January 2020

Encryption Software Market size is set to surpass USD 20 billion by 2026; according to a new research report by Global Market Insights Inc.

The growing trend of Bring Your Own Device (BYOD) policies as enterprises are trying to lower infrastructure costs and increase enterprise agility will fuel the encryption software industry growth. As BYOD devices are not managed by internal IT teams, the risk of losing unencrypted data increases profoundly. Encryption software enables organizations to secure data residing on endpoints, including smartphones and laptops, providing a robust layer of security over passwords and biometric authentication. Additionally, encryption solutions protect the confidentiality of digital information stored in these devices even in severe cases of physical intrusion or device theft/loss.

Rise in adoption of cloud and virtualization technologies augmenting the encryption software market growth

Enterprises are swiftly transitioning towards the uptake of cloud technologies to support business expansion and ensure high profitability. This has led to an increased risk of data theft and unauthorized access to data. Encryption solutions augment the functionalities of the existing cybersecurity measures by enabling enterprises to store confidential data in a scrambled format, significantly reducing the risks of information leak, even if the data is stolen or accessed unlawfully. Small enterprises and start-ups are increasingly using encryption software to encrypt the data before uploading it on cloud platforms, ensuring the safety of encryption keys stored within enterprise networks, and reducing cloud expenditure.

Get more details on this report - Request Free Sample PDF

The adoption of new technologies, including homomorphic encryption and quantum key encryption, will further lead to encryption software market growth. For instance, in June 2019, researchers from the Beijing University of Posts and Telecommunications successfully tested the transmission of quantum encryption keys over a 50 km distance. The new technology distributed public keys 100 times quicker than the existing methods and is a significant step in the commercialization of quantum encryption technologies.

Browse key industry insights spread across 260 pages with 269 market data tables and 26 figures & charts from the report, “Encryption Software Market Size, By Component (Software [Endpoint Encryption, Email Encryption, Cloud Encryption], Service [Training & Consulting, Integration & Maintenance, Managed Service]), By Deployment Model (On-Premise, Cloud), By Application (IT & Telecom, BFSI, Healthcare, Retail, Government & Public Sector, Manufacturing), Industry Analysis Report, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/encryption-software-market

Services market to grow impressively as organizations focus on core business strengths

The adoption of encryption services is projected to grow at more than 20% CAGR through 2026, as enterprises are looking to outsource encryption operations to reduce maintenance costs and focus on core business strengths. As Small and Medium Enterprises (SMEs) are outsourcing cloud storage to managed service providers, there is an increasing trend of procuring encryption services from these service providers to reduce IT expenses and leverage bundled offers.

Service providers have identified encryption software as an important business prospect and are focusing accordingly to strengthen their domain expertise to increase encryption software market share.

Usage of Encryption-as-a-Service (EaaS) propelling the deployment of cloud-based solutions

The cloud deployment segment is set to witness the fastest growth rate with a CAGR of around 25% from 2020 to 2026. As enterprises are increasingly deploying cloud services for accelerated business growth, the EaaS subscription model is becoming more popular for providing encryption solutions, eliminating the need for upfront infrastructure investments. These solutions assist enterprises in encrypting enterprise data without investing in additional resources and also meet regulatory compliance.

Furthermore, the growing trend of Bring Your Own Key (BYOK), which offers cloud customers an option to provide their own encryption keys for cloud data encryption, will accentuate the encryption software market revenue.

Stiff data privacy laws driving the uptake of encryption software in the healthcare sector

The healthcare application is poised to observe rapid growth in the encryption software due to the increasing pressure on healthcare organizations to meet data security regulatory compliance. Government regulations make it mandatory for institutes to encrypt all sensitive Personal Health Information (PHI), such as medical diagnostic history, surgeries and terminally ill patient data. Additionally, the encryption of PHI provides an additional breadth of security to healthcare enterprises in cases of employee negligence or ransomware attacks due to the failure of other cybersecurity protocols. Encryption solution providers and healthcare enterprises are working in conjunction to ensure digital healthcare records are safeguarded against malicious cyberattacks.

Growing usage of blockchain technology augmenting the Italy encryption software market

Italy is anticipated to exhibit lucrative market growth with a CAGR of above 10% till 2026 owing to the surging adoption of blockchain technologies and the rising mainstream use of cryptocurrencies in the digital payments market.

The encryption software market players are laying emphasis on forging strategic alliances and improving their research capabilities to offer new solutions and provide regular software updates, strengthening their market position and gaining a competitive edge. For instance, in November 2019, NordVPN, a global provider of VPN solutions, launched NordLocker, an end-to-end encryption software. This solution acts as a unified data security platform for both personal & commercial uses, pushing the NordVPN brand as a total cybersecurity solutions provider.

The industry growth is attributed to growing investments by major market players in new cryptographic algorithms for improving software performance and promoting the adoption of data encryption.

Some of the key players in the encryption software market share are AO Kaspersky Lab, Bitdefender, Check Point Software Technologies Ltd., Ciphercloud.com, Cisco Systems, Inc., Dell Technologies Inc., ESET, spol s.r.o, IBM Corporation, F-secure, McAfee, LLC (Intel), MicroFocus, Microsoft Corporation, Panda Security, Proofpoint, Sophos Ltd., Symantec Corporation (Broadcom, Inc.), Thales eSecurity, and Trend Micro, Inc.