Controlled Release Fertilizer Market Size worth $3.9bn by 2024

Published Date: September 2019

Controlled Release Fertilizer Market size is set to reach USD 3.9 billion by 2024; according to a new research report by Global Market Insights Inc.

One of the major driving factors for the global controlled release fertilizer market growth will be the ever-increasing global population. Population across the world is increasing with growth rate of more than 1% every year, and on an average the increase in population per year is estimated around 80 million. Incessant expansion of residential area to meet the growing housing demand is significantly decreasing the share of agricultural land per capita. Efficient utilization of the available land for agricultural purposes will play an important role in combating the demographic changes. Land fertility requires to be preserved and improved for longer timespans. In countries such as the U.S., the share of arable land has reduced from 18.0% to 16.6% from 2005 to 2016. This will promote the market demand in the region and around the world.

Changing climatic conditions around the world along with increasing threat of droughts because of low and irregular rainfall is boosting the demand for sustainable methods of agriculture. Inadequate monsoon and improper rainfall pattern will negatively impact the productivity of various cash crops. This will result in a dramatic surge in average crop price. By 2030 the rice and wheat growth rates will likely decrease by 23% and 13%, whereas their prices will likely increase by 89% and 75% respectively. Sustainable farming methods to enhance soil productivity and crop yield even in harsh climates will positively influence the global controlled release fertilizer market.

Get more details on this report - Request Free Sample PDF

Gardening industry is flourishing in Europe due to presence favorable environment and extensive usage of modern gardening methods. Countries such as the Netherlands are the major producers of flowers and gardening plants, accounting for 40% of the total EU production, followed by Germany, Italy and France. This clearly indicates that the use of controlled release fertilizers in gardening industry is evident in the region, catapulting the overall demand.

High prices associated with the specialized grades of fertilizers with respect to standard urea or NPK grade products may hinder the controlled release fertilizer market growth in coming years. This limits the product usage among economically established farmers only. Moreover, majority of the farmers in world, especially in the developing countries, are unaware of such product developments, which may further curb the market growth during the forecast span.

Browse key industry insights spread across 134 pages with 146 market data tables & 16 figures & charts from the report, “Controlled Release Fertilizer Market Size By Product (Polymer Sulfur Coated Urea/Sulfur Coated Urea, Polymer Coated Urea, Polymer Coated NPK), By Crop (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables), Industry Analysis Report, Regional Outlook, Application Growth Potential, Price Trends, Competitive Market Share & Forecast, 2016 – 2024” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/controlled-release-fertilizers-market

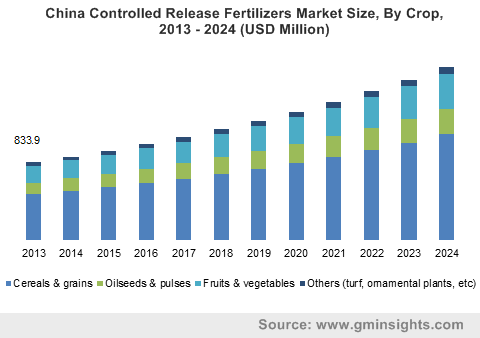

Polymer sulfur coated urea or sulfur coated urea is a noteworthy product segment with over 40% share of the global market and will witness more than 6% growth. Cereals & grains crop segment will likely record a revenue over USD 1.7 billion in 2024. Significant demand for cereals & grains as staple food products is likely to boost market over the duration of the forecast period.

Asia Pacific controlled release fertilizer market will generate over USD 2 billion in product revenues and the region is likely to garner a significant chunk of the overall market share in coming years on the account of rising demand from the vast agriculture sector in India and China.

Some key players in the market include Haifa, Yara, Kingenta, Agrium, Israel Chemicals, and Scotts Miracle-Gro. The industry is characterized by active product developments by the manufacturers and connecting with the farmers to maintain a strong relationship.

The controlled release fertilizer market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume in tons & revenue in USD million from 2013 to 2024, for the following segments:

By Product

- Polymer sulfur coated urea/sulfur coated urea

- Polymer coated urea

- Polymer coated NPK

- Others

By Application

- Cereals & grains

- Oilseeds & pulses

- Fruits & vegetables

- Others

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Asia Pacific

- China

- India

- Japan

- Australia

- Indonesia

- Malaysia

- Latin America

- Brazil

- Mexico

- MEA

- South Africa

- GCC

Kiran Pulidindi, Soumalya Chakraborty