Automotive Software Market Size worth $52bn by 2025

Published Date: September 2019

Automotive Software Market size is set to exceed USD 52 billion by 2025; according to a new research report by Global Market Insights Inc.

The market growth is attributed to continuous innovations and technological advancements in the automotive industry and advanced fleet and vehicles. The increasing interest of industry giants including General Motors, Ford, Honda, Bosch Software, Wipro, NVIDIA, and Delphi, is bringing enormous amount of funds as well as investments in the global automotive software market.

The supportive government initiatives for the development of electric vehicle infrastructure across the countries are creating growth opportunities for hybrid electric cars, which would help the automotive software market to grow significantly. Furthermore, subsidies and tax rebates offered by government authorities for promoting the use of hybrid electric vehicles will also fuel market growth. Moreover, the efforts undertaken by government authorities and automotive manufacturers to reduce carbon dioxide emissions have encouraged automotive manufacturers to innovate alternative solutions such as electric vehicles.

The autonomous driving software is expected to show a growth rate of over 17% due to an increase in investments in research & development activities from major software solution providers. The increase in the number of on-road accidents is enabling automotive companies to shift toward autonomous driving technology. The major automotive companies are performing trials for autonomous driving to accelerate the autonomous market growth.

Browse key industry insights spread across 270 pages with 298 market data tables & 31 figures & charts from the report, “Automotive Software Market Size By Software (Autonomous Driving Software, Safety & Security Software, Vehicle Management Software, Infotainment Software), By Application (Engine Management System (EMS), Anti-Lock Braking System (ABS), Airbag Control, Car Navigation System, Music System, Mobility Service), By Vehicle Type (Passenger Vehicle, Commercial Vehicle), By End-Use (Manufacturer Retail Store, Automotive Dealer, Automotive Repair Store, Auto Part Wholesaler & Agent), Industry Analysis Report, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2019 - 2025” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/automotive-software-market

The engine management system is expected to hold the market share over 20% by 2025 due to an increase in awareness regarding carbon emissions from vehicles. The stringent government regulations regarding vehicle emissions and fuel economy are also enabling the rapid adoption of EMS. The prominent automobile manufacturers are adopting electronic EMS to reduce carbon dioxide emissions as compared with the carburetor engine.

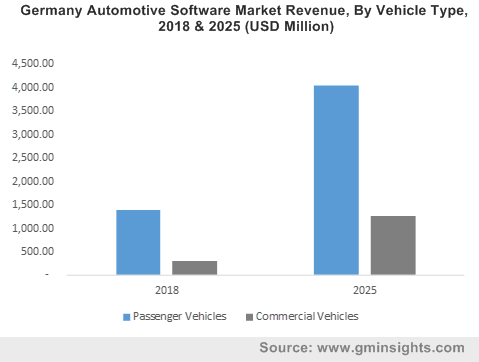

The commercial vehicle segment in the automotive software market is expected to grow at a rate of over 19% due to emerging electrical commercial vehicles and fleet management of autonomous commercial vehicles. The emergence of collision avoidance and vehicle monitoring software to keep a track of driver and vehicle is expected to increase the sales of commercial vehicles. The growing logistics market has also proliferated the growth of commercial vehicles. The emerging trends in mobility technology such as the rise of ride-hailing and carsharing services, have increased the sales of commercial vehicles globally. The growing logistics market has also proliferated the growth of commercial vehicles.

Get more details on this report - Request Free Sample PDF

The manufacturer’s retail store segment is expected to grow at a CAGR of over 19% during the forecast period due to an increase in customer-centric approach due to the increased competition. The shifting preference of consumers from vehicle ownership to mobility services is expected to create new value propositions and follow a service-centric approach. This is expected to increase the growth of the manufacturers’ retail store. The evolving regulatory landscape and increased customer awareness of clean energy vehicles will require the retail network to be well-equipped in terms of key automotive software and skilled workforce. The manufacturer retail stores are required to train their sales and after-sales teams on right competencies including the ability to package mobility services and adopt smart automotive software to give customers transparency on ownership economics.

The Asia Pacific automotive software market is expected to grow at a rate of over 18% during the forecast period due to an increase in internet penetration and the rising adoption of electric vehicles in this region. The prominent automotive manufacturers present in this region are growingly adopting advanced technologies such as AI, AR, and deep learning to upgrade automotive software in features such as infotainment, functional safety, and streamlined key entry. The growing number of technology start-ups with innovative automotive software solutions has been giving stiff competition to key technological companies in this region. This has led technology giants to use significant resources to recruit and acquire these firms. They are also using automobile prototypes and AI to support these projects. The government authorities are also making new regulations for autonomous vehicles.

Major players operating in the market are Cox Automotive, CDK Global, Siemens PLM Software, SAP, NVIDIA, Reynolds and Reynolds Company, Autodesk, Solera Holdings, Dassault Systèmes,, Ansys Inc., Bosch Software, Oracle, Dealertrack, Honda, Genesys, Daimler, Delphi, Ford, Wipro Limited, and General Motors.

The automotive software market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2014 to 2025 for the following segments:

By Software

- Autonomous Driving Software

- Safety and Security Software

- Vehicle Management Software

- Infotainment Software

By Application

- Engine Management System (EMS)

- Anti-Lock Braking System (ABS)

- Airbag Control

- Car Navigation System

- Infotainment System

- Mobility Service

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By End Use

- Manufacturer Retail Store

- Automotive Dealer

- Automotive Repair Store

- Auto Part Wholesaler & Agent

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- APAC

- China

- Japan

- Australia

- South Korea

- India

- Latin America, Middle East and Africa (LAMEA)

- Mexico

- Argentina

- Brazil

- South Africa

- UAE

- Saudi Arabia

- Qatar

- Oman