Automotive Part Cleaners & Degreasers Market Size to hit $47.5bn by 2024

Published Date: February 2019

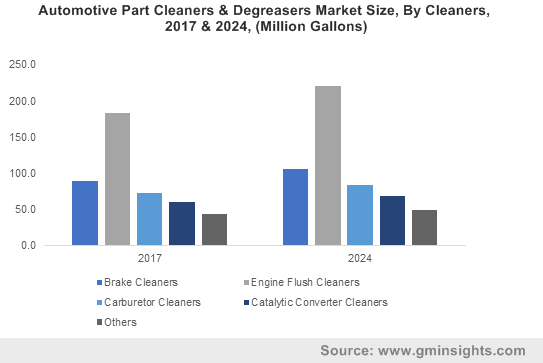

Automotive Part Cleaners & Degreasers Market size is set to surpass USD 47.5 billion by 2024; according to a new research report by Global Market Insights Inc.

High performance & low emission engine demand and rising importance of servicing & maintenance operations should promote automotive part cleaners & degreasers market growth. These products promote removal of engine contaminants prior to oil change which improves fuel efficiency. There is an increasing trend for online sale of automotive part & repair accessories to enhance the performance and efficiency of engines. Rising heavy and commercial vehicle demand owing to booming construction and e-commerce industries are expected to further increase automotive part cleaners and degreasers market demand.

U.S. engine flush cleaner market should witness gains of about 2.5% by 2024. These products impart engine longevity, efficiency and clean lubrication system which enhances vehicle performance. They remove varnish, gum and deposits from various engines in passenger cars, light & heavy-duty vehicles and two wheelers thereby improving vehicle lifespan and fuel performance. Rise of average vehicle age and stringent regulations to reduce VOC emissions should boost growth of automotive part cleaners’ market.

Get more details on this report - Request Free Sample PDF

Catalytic converter cleaner market size was valued at over USD 2.5 billion in 2017. These products exhibit various benefits such as fuel efficiency improvement, safety measure, and reduced VOC emissions. They help prevent clogging of catalytic converters which can worsen performance, produce harmful air emissions and lead to poor mileage. Rising government regulations pertaining to emissions and investments made by automobile manufacturers in R&D activities to reduce emissions are likely to stimulate automotive part cleaners and degreasers market growth.

Browse key industry insights spread across 290 pages with 411 market data tables & 44 figures & charts from the report, “Automotive Part Cleaners & Degreasers Market Size By Product (Cleaners [Brake Cleaners, Engine Flush Cleaners, Carburetor Cleaners, Catalytic Converter Cleaners], Degreasers [Engine Degreasers, Transmission Degreasers, Exhaust Parts Degreasers]), By Type (Water-Based, Solvent-Based), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Two Wheelers), Industry Analysis Report, Regional Outlook, Application Potential, Price Trends, Competitive Market Share & Forecast, 2018 - 2024” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/automotive-part-cleaners-and-degreasers-market

UK automotive part cleaners & degreasers market size regarding light commercial vehicles was valued at USD 28.5 million in 2017. These vehicles offer low operating & maintenance costs, fuel efficiency and are used on a larger scale. These vehicles allow modification as per requirements and are witnessing significant demand on account of road infrastructure growth. The country is witnessing growing investment in R&D activities to increase vehicle lifespan, engine performance and ensure regulatory compliance which should lead to a significant demand for various automotive part cleaners and degreasers.

China transmission degreaser market size is estimated to exceed USD 1 billion by 2024 pertaining to rising purchasing power and standard of living. This product breaks down varnish deposits and cleans internal transmission components to prevent damage and ensure passenger safety. They improve vehicle speed and maintain optimal gearbox condition. Increasing demand for vehicle longevity, performance, leakage elimination and periodic servicing should accelerate automotive part cleaners and degreasers market growth.

Global automotive part cleaners & degreasers market from HCV’s may register growth at over 2.5% by the end of forecast period. Government initiatives to invest in road construction, commercial and & non- commercial projects, and travel & tourism sector have increased the demand of for heavy commercial vehicles for the transportation of raw materials, thereby enhancing product demand.

Global automotive part cleaners market share is consolidated and less competitive with the key manufacturers being BASF, 3M Company, DowDupont, WD-40 and Valvoline Inc. Other manufacturers include Wurth USA, GUNK, Bardahl Manufacturing Corporation, and Engen Petroleum Ltd. Various manufacturers are indulging in strategic acquisitions to foster regional presence and improve product offering. Companies are engaging in strategic collaborations to develop innovative products and expand production range which should accelerate automotive part cleaners market growth.

Automotive part cleaners & degreasers market research report includes in-depth coverage of the industry, with estimates & forecast in terms of volume in Gallons and revenue in USD from 2013 to 2024, for the following segments:

By Product

- Cleaners

- Brake cleaner

- Engine flush cleaner

- Carburetor cleaner

- Catalytic converter cleaner

- Others

- Degreasers

- Engine degreaser

- Transmission degreaser

- Exhaust parts degreasers

- Others

By Type

- Water based

- Solvent based

By Vehicle Type

- Passenger car

- Light commercial vehicle

- Heavy commercial vehicle

- Two-wheeler

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Poland

- Czech Republic

- Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Indonesia

- Malaysia

- Australia

- Latin America (LATAM)

- Brazil

- Middle East & Africa (MEA)

- Iran

- Morocco

- Algeria

- Tunisia

- Egypt

- South Africa