Automotive NVH Materials Market to exceed $13 Bn by 2026

Published Date: June 2020

Automotive NVH Materials Market size to surpass USD 13 billion by 2026, according to a new research report by Global Market Insights Inc.

Emerging government regulations regarding carbon emissions coupled with shifting consumer focus on quality and cabin acoustics will stimulate automotive NVH materials industry growth. Low cabin noise level is increasingly being considered as the major comfort parameter in vehicle comparison. The automotive OEMs are continually expanding their vehicle portfolio comprising NVH materials. For instance, in May 2020, Hyundai Motor announced launch of its 2020 Creta featuring extensive use of sound absorbing and structural engineering material to ensure superior NVH isolation.

Polyurethane material is poised to observe 6.5% CAGR through 2026 propelled by its resistance to chemical and mechanical influences. High vibration absorption and noise mitigation properties is supporting its application in engine bays due to high sound absorption coefficient, enabling it to absorb high engine frequencies. The material is being used as light weighting component to reduce emissions and increase fuel efficiency to comply with stringent government regulatory norms, especially in North America and Europe.

OEMs initiative for reducing structure borne disruptions to drive dampers demand

Get more details on this report - Request Free Sample PDF

OEMs initiative for reducing structure borne disruptions to drive dampers demand

Dampers are majorly incorporated in vehicle joints and panels to dissipate structure borne excitation of body panels. It works by reducing the aptitude of vibration and transferring vibration energy into heat energy. Further, damper s placed between two different components moving relative to each other to reduce so transfer of cyclic stress on the other component. This escalates the damper usage in vehicle’s engine fins, as engine fins tend to vibrate at different frequencies, it produces unwanted and sometimes loud noises. Absorption material is experiencing high demand as its finds applications in conditions involving excessive radiated noise levels before further transmission. The material is manufactured through die-cut treatments and are installed through pressure sensitive adhesives.

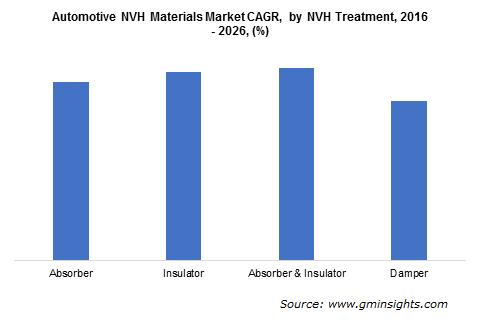

Browse key industry insights spread across 225 pages with 222 market data tables & 23 figures & charts from the report, “Automotive NVH Materials Market Size By Material (Rubber, Polypropylene, Polyurethane, Polyamide, Polyvinyl Chloride), By NVH Treatment (Absorber, Insulator, Absorber & Insulator, Damper), By Vehicle (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicle), Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/automotive-nvh-materials-market

Heavy Commercial vehicle to foster considerable gains

In 2019, heavy commercial vehicle accounted for 5.5% automotive NVH materials market share in terms of consumption and is anticipated to see steady growth during 2020 to 2026. The commercial vehicles are generally operated by diesel powertrain and the operational mechanics of diesel engine are considerably louder than its gasoline operated counterpart. This increasing demand for sound insulation and vibration mitigation from these vehicles will support the segment penetration. Moreover, increasing vehicle demand from manufacturing and logistics industry will drive NVH materials demand.

Industry to witness surge in R&D investments

Automotive NVH materials industry participants are increasing their R&D investment to reduce the production and development cost. The key manufacturers include, 3M, BASF, ErlingKlinger AG, The Dow Chemical Company, NVH Korea, Boyd Corporation, Vibroacoustic AGFostek Corporation, Sumimoto Riko., Covestro AG, Autins., Anand NVH Products, Inc., Paracoat Products Ltd., Roush, and Park Nonwoven Pvt. Ltd.