Automotive Camera Market worth over $19bn by 2025

Published Date: May 2019

Automotive Camera Market size is set to exceed USD 19 billion by 2025, according to a new research report by Global Market Insights Inc. The changing preferences of automobile manufacturers toward the replacement of side-view mirrors with cameras to offer a wide rear view for drivers will influence the market growth.

The Global National Car Assessment Program (Global NCAP) is providing new motor vehicle safety ratings across the globe to increase the safety of passengers & pedestrians. Vehicles with 5-star ratings ensure maximum vehicle performance in crash incidents while vehicles with 1-star rating have marginal crash protection, increasing the adoption of automotive cameras in vehicles. The latest advancements in camera technology, such as neural network & machine learning coupled with mass production of these units, are anticipated to propel the market demand.

Additionally, these cameras are incorporated in vehicles to support semi-automated and autonomous driving functions, expanding the automotive camera market. These components are used with a vehicle’s electronic controlled braking system to support adaptive cruise control and automatic braking functions. Vehicle manufacturers across the globe are integrating number of cameras with vehicles to support autonomous driving and enhanced safety features.Moreover, the dashboard cameras are used to record external events while a car is parked, increasing the vehicle security. However, the high costs associated with new trifocal cameras are limiting their utilization in economic & low-cost vehicles, hampering the market growth.

Get more details on this report - Request Free Sample PDF

The parking assist applications in the market are gaining popularity as they are installed in vehicles to assist drivers while parking their vehicles. The increasing number of accidents while reversing cars is compelling the demand for rear view cameras in vehicles. Rear view cameras allow drivers to see what is behind, eliminating blind spots and providing adequate time to brake if any object is close to a vehicle. The growing adoption of rear-view systems in vehicles to enhance safety will provide lucrative opportunities to players operating in the market.

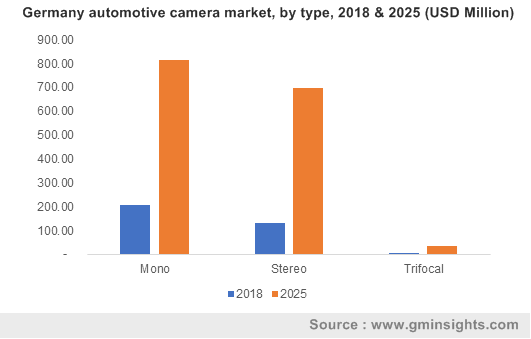

Browse key industry insights spread across 250 pages with 379 market data tables & 22 figures & charts from the report, “Automotive Camera Market Size By Type (Mono, Stereo, Trifocal), By Application (ADAS [Lane Departure Systems, Emergency Braking Systems, Forward Collision Warning, Others], Parking Assist), By Vehicle Type (Passenger Cars, Utility Vehicles, Commercial Vehicles), Industry Analysis Report, Regional Outlook (U.S., Canada, UK, Germany, France, Italy, Russia, China, India, Japan, South Korea, Brazil, Mexico, South Africa), Application Potential, Price Trend, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/automotive-camera-market

The adoption of cameras is projected to increase in the commercial vehicles to provide various safety features such as blind spot monitoring, lane departure warning, and autonomous braking system. The rising trend of truck platooning coupled with the increasing adoption of ADAS in trucks is propelling the market share.

Truck platooning is the linking of two or more trucks using automated driving support and connectivity technologies. These trucks use cameras & sensors to maintain a set distance from each other while travelling. Additionally, these vision components are used in commercial vehicles to keep a track of drivers’ facial expressions and can transmit a warning sound when they are feeling drowsy, boosting the market revenue.

The North America automotive camera market is expected to grow at around 24% CAGR from 2019 to 2025 led by increase in demand for luxury vehicles in the U.S. and Canada. The growing number of vehicle crashes in the U.S. is propelling the integration of ADAS & safety systems in vehicles, driving the industry growth.

The key companies in the market include Continental AG, Veoneer, Magna International Inc., Robert Bosch GmbH, Valeo, Denso Corporation, Aptiv PLC, and Mobileye. These players are striving to develop advanced automotive camera systems to provide reliable & safe performance to drivers. Additionally, camera providers are collaborating with the leading tech companies to develop advanced vehicle networking systems that will be deployed in vehicles in the future.