APAC Mobile Wallets Market Size worth $140bn by 2024

Published Date: May 2019

APAC Mobile Wallets Market size is set to exceed USD 140 billion by 2024; according to a new research report by Global Market Insights Inc.

The increasing penetration of smartphones and the widespread adoption of the internet are the primary factors accelerating the demand for mobile wallets market in the region. China and India are home to more than 50% of the smartphone population across the globe. The number is projected to increase during the forecast period due to the decline in the price of smartphones and the increasing disposable income of the middle class in the Asia Pacific region.

Moreover, the changing customer demand and market dynamics also act as major drivers for the mobile wallets market. As the competition among market players is increasing, customers are becoming more empowered. As a result, financial institutes start to focus more on providing better customer experience and developing more customer-centric products. These companies are leveraging on mobile solutions to reach unbanked & underserved customers in remote areas.

Get more details on this report - Request Free Sample PDF

NFC technology is estimated to grow at a CAGR of over 29% during the forecast period. The growing adoption of non-contact payment solutions along with the integration of NFC chips into smart devices (such as smartphones and wearables) is driving the market growth. Moreover, the increasing interest of the top smartphone manufacturers, such as Apple, Samsung, Xiaomi, in the mobile wallet solutions is presenting a huge opportunity for the NFC technology market.

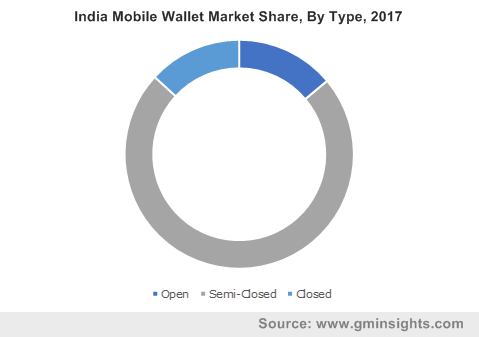

Browse key industry insights spread across 140 pages with 144 market data tables & 28 figures & charts from the report, “Asia Pacific Mobile Wallets Market Size By Type (Open, Semi-closed, Closed), By Ownership (Banks, Telco’s, Device, Tech Companies), By Technology (Near Field Communication (NFC), Optical/QR Code, Digital Only, Text-Based), Industry Analysis Report, Regional Outlook, Growth Potential, Growth Potential Analysis, Competitive Market Share & Forecast, 2018 – 2024” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/asia-pacific-mobile-wallet-market

The India mobile wallets market is estimated to grow at a CAGR of approximately 30% over the forecast period. The growth of the market is driven by supportive government initiatives and policies. In 2015, the government of India launched the Digital India Campaign to deliver government services via digital channels. This promotes banks and other financial institutes to deliver financial services via digital channels. Moreover, in 2016, the government also demonetized its currency, resulting in a swift rise in the mobile wallet transaction in the country.

The key players operating in the APAC mobile wallets market are Alipay, Wechat Pay, Paytm, Union Pay, Google, Samsung, Apple, Xiaomi, Huawei, Rakuten Pay, Paypal, Amazon Pay, and Vodafone pay. These players are leveraging on collaboration activities to gain a competitive edge. For instance, in 2017, Vodafone Group partnered with Ridlr app to offer a seamless BEST Bus ticket booking service. This partnership is aimed at competing with its local competitors such as Jio Money and Paytm.

The APAC mobile wallets market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue from 2013 to 2024, for the following segments:

Mobile Wallets Market in APAC, By Type

- Open

- Semi-closed

- Closed

Mobile Wallets Market in APAC, By Ownership

- Banks

- Telco’s

- Device

- Tech companies

Mobile Wallets Market in APAC, By Technology

- NFC

- Optical/QR code

- Digital only

- Text-based

The above information has been provided for the following countries:

- Australia

- China

- India

- Japan

- South Korea

- Singapore

- Indonesia

- Thailand

- Philippines