APAC Construction Equipment Market size worth over $80bn by 2025

Published Date: February 2019

APAC Construction Equipment Market size is set to exceed USD 80 billion by 2025; according to a new research report by Global Market Insights Inc. The shipments are expected to grow at a CAGR of over 4% from 2019 to 2025.

Technological advancements, such as integration of intelligent machine parts, enhanced ropes, and automated machine functions, are also adding up to the Asia Pacific construction equipment market growth. Due to increasing human labor and aging workers in Asian countries, the end-users are moving toward enhanced machinery with technically-advanced features. Moreover, due to various accidents and labor safety issues in conventional methods, the construction industry is witnessing a shift to modern machinery, further supporting the expansion of the APAC construction equipment market. Countries including China, Japan, and South Korea are experiencing a rapid rise in machinery production & consumption owing to the presence of several key manufacturers that supply products across the globe. The companies are investing in product development and global expansion, supporting the market growth.

A key reason that hinders the APAC construction equipment market rise is the unawareness of several contractors and end-users about the machinery benefits. Buyers in smaller countries primarily focus on the price factor, which is limiting the sales of costly & technically-developed machinery. OEMs in the industry fail to educate the customers about machine’s advantages over human labor working with conventional bulky equipment. With the evolution of high-quality, complex, and multi-purpose machinery in developing countries, there is a need for appropriate customer education aiding the communication of added features. Additionally, increased customer awareness about the reliability & quality benefits is expected to support the APAC construction machinery market expansion.

Get more details on this report - Request Free Sample PDF

Demand for new machines in the Asia Pacific construction equipment market is rapidly rising due to several infrastructure and building enhancement projects undertaken by various governments such as China, India, and Japan. The presence of several major global manufacturers in China and Japan is aiding customers to purchase technically-equipped products at lower prices and less time compared to other countries, increasing the demand for new machinery. Owing to the presence of several manufacturing plants and distribution facilities, the regional customers can easily avail repair & maintenance services provided by manufacturers, further supporting the growing consumption of new products in the APAC construction equipment market.

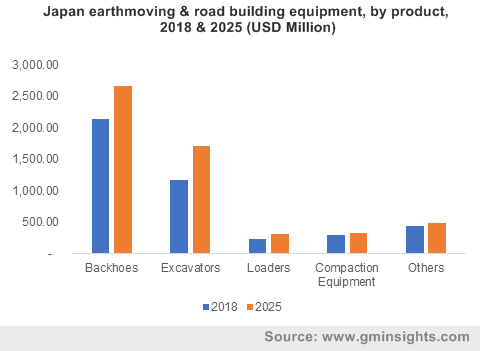

Browse key industry insights spread across 400 pages with 595 market data tables & 29 figures & charts from the report, “Asia Pacific construction equipment market Size By Demand (New Demand, Aftermarket), By Product (Earthmoving & Road Building Equipment [Backhoe, Excavator, Loader, Compaction Equipment], Material Handling & Cranes [Storage & Handling Equipment, Engineered Systems, Industrial Trucks, Bulk Material Handling Equipment], Concrete Equipment [Concrete Pump, Crusher, Transit Mixer, Asphalt Paver, Batching Plant]), By Sales Channel (Independent Dealers/Distributors, Direct Sales To Customers, Rental Companies, Online Channel), Industry Analysis Report, Regional Outlook, Application Potential, Price Trend, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/asia-pacific-construction-equipment-market

Online sales channels in the APAC construction equipment market were valued at over USD 1.3 billion in 2018. These sales channels are gaining high popularity due to increased internet usage and timely & high-quality machine provision through manufacturers’ online websites. Due to the convenience of transportation and digital payments, customers are shifting toward online purchasing options, which provide them timely delivery. Online sales channels are growing steadily in the ASEAN countries due to improved mobile connectivity and digitization trend. Additionally, rental companies also provide construction & material handling machinery at low costs compared to the new machinery, further supporting the APAC construction equipment market growth. Customers with low initial investment capabilities switch to the machinery rental options to save the operational & maintenance costs required in buying new machinery.

In the Asia Pacific construction equipment market, Australia is expected to grow at over 6% CAGR from 2019 to 2025 due to several renovation plans in Australia’s building & infrastructure sector. Due to the rapidly-increasing Australian population, the government is planning several projects, such as airports, railways, housing construction, and renewable energy, which is expected to create a high machinery demand. The rising emergence of online retail facilities and the provision of replacement parts by the companies through online channels across the globe are also creating opportunities for the industry development. Moreover, several Hong Kong government programs and plans, such as Climate Action Plan 2030, Long-Term Housing Strategy (LTHS), Hospital Development Program, and Railway Development Strategy (RDS), are responsible for the consumption of such machinery in the market.

The key companies present in the APAC construction equipment market comprise Hitachi Construction Machinery, Komatsu Ltd., Sany Group, XCMG Group, Caterpillar, Inc., Terex Corporation, Zoomlion, Liebherr Group, and Volvo Construction Equipment. The companies are adopting product innovation plans to develop technically & legally compliant machinery, further strengthening their presence in the construction equipment market. Several players are entering into collaborations & partnerships with local players to serve customers in the regional markets. The companies are making high investments for manufacturing and R&D activities to pose a high competition in the industry. For instance, Volvo invested USD 13.2 million to develop a virtual product development center dedicated for excavators in Changwon complex.

The Asia Pacific construction equipment market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD & shipments in Unit from 2015 to 2025 for the following segments:

Asia Pasific Construction Equipment Market, By Demand

- New demand

- Aftermarket

APAC Construction Equipment Market, By Product

- Earthmoving & road building equipment

- Backhoe

- Excavators

- Loaders

- Compaction equipment

- Others

- Material handling & cranes

- Storage & handling equipment

- Engineered systems

- Industrial trucks

- Bulk material handling equipment

- Concrete equipment

- Concrete pumps

- Crushers

- Transit mixers

- Asphalt pavers

- Batching plants

APAC Construction Equipment Market, By Sales Channel

- Independent dealers/distributors

- Direct sales to customers

- Rental companies

- Online channel

Asia Pacific Construction Equipment Aftermarket, By Product

- Earthmoving & road building equipment

- Backhoe

- Excavators

- Loaders

- Compaction equipment

- Others

- Material handling & cranes

- Storage & handling equipment

- Engineered systems

- Industrial trucks

- Bulk material handling equipment

- Concrete equipment

- Concrete pumps

- Crushers

- Transit mixers

- Asphalt pavers

- Batching plants

APAC Construction Equipment Aftermarket, By Sales Channel

- Independent dealers/distributors

- Direct sales to customers

- Rental companies

- Online channel

The above information is provided for the following regions and countries:

- China

- Hong Kong

- Rest of Asia

- India

- South Korea

- Japan

- ASEAN

- Indonesia

- Malaysia

- Thailand

- Taiwan

- Singapore

- Philippines

- Vietnam

- Myanmar