Aircraft Soft Goods Market worth over $690mn by 2026

Published Date: June 2020

Aircraft Soft Goods Market size is set to exceed USD 690 million by 2026, according to a new research report by Global Market Insights Inc.

Aircraft soft goods comprises of seat covers and carpets that are being utilized majorly by airliners. leasing companies and aircraft service providers. Increasing production and deliveries of aircraft across the globe will drive product demand. Additionally, rising MRO activities with frequent cleaning and maintenance activities will contribute in the market revenue.

Stringent government regulations regarding flammability of aircraft interiors and components will limit the aircraft soft goods industry size. Major government bodies including European Aviation Safety Agency (EASA) and Federal Aviation Administration (FAA) have provided guidelines for flammability requirements stating the criteria for soft goods producer and suppliers to ensure aircraft and passenger safety.

Get more details on this report - Request Free Sample PDF

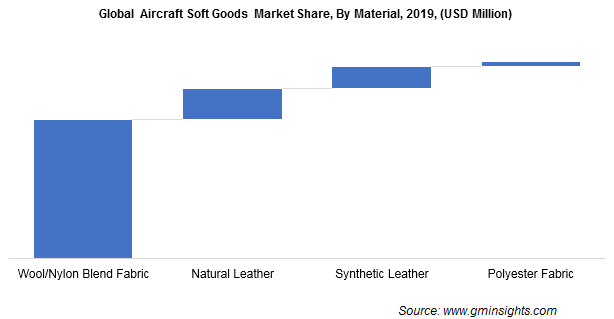

Browse key industry insights spread across 250 pages with 370 market data tables & 11 figures & charts from the report, “Aircraft Soft Goods Market Size By Aircraft (Commercial, Regional, Business, Helicopters), By Product (Carpets, Seat Covers, Curtains), By Material (Wool/Nylon Blend Fabric, Natural Leather, Synthetic Leather, Polyester Fabric), By Distribution Channel (OEM, Aftermarket), Industry Analysis Report, Regional Outlook, Application Growth Potential, Price Trends, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/aircraf-soft-goods-market

Business aircrafts will witness around 4.5% growth through 2026. Growth in number of individuals with high net worth around the globe will enhance penetration of these jets. According to the Wealth Report 2017, the U.S. accounted for highest number of private jets with 12,717 business jets. Business jets manufactures are engaged in improving the aesthetics of aircraft interior, that will enhance the market revenue.

Carpets will account for substantial share in the market owing to large cabin floor space area of aircraft. For instance, commercial aircrafts cabin area can vary anywhere between 250 to 500 square meter depending on the aircraft platform and passenger carrying capacity. Rising usage of composite materials in aircraft soft goods will increase carpet’s share.

In 2019, synthetic leather held over 10% aircraft soft goods market share as material possesses superior characteristics of low cost, easy to clean, durability, high performance under extreme weather conditions, etc. Moreover, luxurious aesthetic and excellent puncture & tear resistance properties will be stimulating growth of synthetic leather in the industry.

The aftermarket segment will foresee a strong growth till 2026 on account of increasing preferences to upgrade the fleet with advanced products. Rising refurbishment and retrofitting activities to provide improved in-flight services for air passengers are boosting the aftermarket demand. The increasing demand for airliners for custom-made designs and ready-to-install products, will further save time during maintenance activities, fueling the aftermarket soft goods segment size.

Asia Pacific market size is anticipated to register gains of more than 3.5% from 2020 to 2026. Increasing number of airliners across emerging countries will positively influence regional penetration. Additionally, regional airliners are introducing cabin refurbishment programs to enhance facilities and provide a comfortable experience.