Aerospace Plastics Market size worth around $55 Mn by 2026

Published Date: July 2020

Aerospace Plastics Market revenue is estimated to surpass USD 55 million by 2026, according to a new research report by Global Market Insights Inc.

Adoption of plastics in next generation aircrafts for reducing the overall aircraft weight and enhance fuel efficiency will drive the aerospace plastics industry growth. Airliners and air transport associations across the globe are collaboratively working with aircraft manufacturers to improve fuel efficiency. Multiple advantages offered by plastics including lower weight compared to metal components and higher degree of freedom will increase the product demand.

Adoption of 3D printing will provide opportunity for market expansion

Aircraft component manufacturers are utilizing several manufacturing technologies, such as 3D printing, that minimize production costs and improve the aesthetics of components. For instance, in April 2015, SABIC developed 3D printed economy class seats from thermoplastic materials that reduce the overall aircraft costs. The development of engineering thermoplastics that can be used in injection molding and thermoforming manufacturing of aerospace components will escalate the market size.

Get more details on this report - Request Free Sample PDF

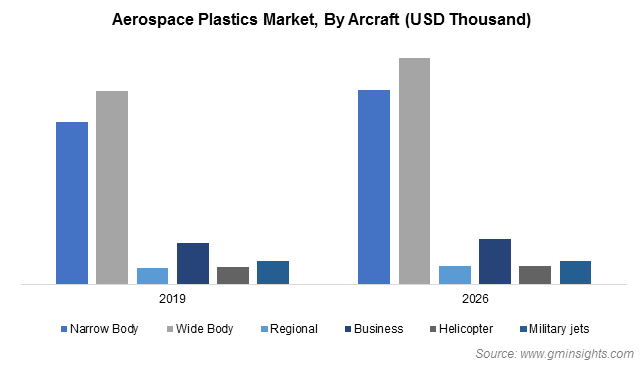

Browse key industry insights spread across 223 pages with 237 market data tables & 29 figures & charts from the report, “Aerospace Plastics Market Size By Aircraft (Commercial Aircraft [Narrow Body, Wide Body], Regi onal Jet, Business Jet, Helicopter, Military Jet), By Application (Cabin Interiors, Window & Windshields, Airframe, Propulsion System), By Fit (Line Fit, Retrofit), Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/aerospace-plastics-market

Aerospace plastics market from wide body aircraft is expected to generate around USD 23 million revenue by 2026. The growth is owing to rising international air traffic in emerging economies. Several airline operators such as IndiGo, SpiceJet, among others are planning to add more overseas routes. Additionally, According to Airbus, India may require around 2,000 new aircrafts by 2038 and around 20% of these are widebody aircrafts. Growing population, rising middle class along with strong economic growth are boosting plastics consumption.

Growing popularity of smart window will drive plastics demand

Windows and windshields application will register growth rate of over 8.5% through 2026. Adoption of advanced window frame for enhancing the flying experience and technological advancements including smart windows are playing a major role in expanding the segment size. Window manufacturers are also introducing plastic products with multiple transparency levels based on end user requirements.

Line fit dominates the market and is expected to generate more than USD 50 million revenue by 2026. Dominance is owing to the deployment of several plastic components in aircraft during the production stage. The development of multiple high engineering plastics including Polyether-ketone-ketone (PEKK) improves the chemical properties of materials. New grade high-strength PEKK materials, such as HT-23, can be alternatives to aluminum components and support industry growth.

Europe aerospace plastics market share is projected to expand at 7.5% CAGR during 2020 to 2026. Ongoing initiatives to develop innovative manufacturing technologies will drive product demand. For instance, in September 2017, the European Commission in collaboration with the Society of Plastics Engineers (SPE) held a seminar to develop plastic components. Further, in April 2018, the EU funded an ECO-COMPASS project, which is aimed at developing natural-fiber-reinforced plastics for aviation.

Some of the key participants involved in aerospace plastics industry include, Curbell Plastics Inc., BASF SE, Ensinger, Drake Plastics Ltd. Co., Evonik Industries AG, EPTAM Precision Plastics, among others.