Aerospace Insulation Market worth over $3.5 Bn by 2026

Published Date: July 2020

Aerospace Insulation Market size is set to surpass USD 3.5 billion by 2026, according to a new research report by Global Market Insights Inc.

The airliners are enhancing their fleet to accommodate the increasing air passengers. Improvement in operational efficiency, interior cabin designs, noise reduction capabilities and advanced avionics, driving the aerospace insulation market demand. Rising aircraft demand has positively influenced aerospace manufacturing sector. The OEMs are adopting advanced manufacturing technologies such as electrical systems to overcome supply chain challenges and meet aircraft demand. Additionally, strengthening manufacturing sector will positively enhance the market size.

According to Boeing (CAPA), around 44,000 new commercial aircrafts will be required in the next two decades to cater the proliferating air traffic. Major aircraft manufacturers including Airbus and Boeing are enhancing their manufacturing facilities to meet the previous backlog. In 2019, Airbus recorded a year-on-year growth of 7% in commercial aircraft deliveries. At present, the production backlog is around 50% of the total in-service aircrafts.Insulation materials are highly used in aircraft to aid the aircrafts exteriors and interiors from dust and dirt, rainwater leakage and reduction of noise and vibration Growing aircraft production in conjunction with adoption of advanced structural components will fuel the market growth.

Get more details on this report - Request Free Sample PDF

Foamed plastic is anticipated to witness significant growth in the market during the forecast period owing to its extensive applications and light weight. Some of its features include high tensile strength, rigidity, and durability. Foams used in aerospace industry such as polyurethane, ceramic foam, and polyethylene help in reduction of air leakages and offer superior insulation capabilities over broad temperature range.

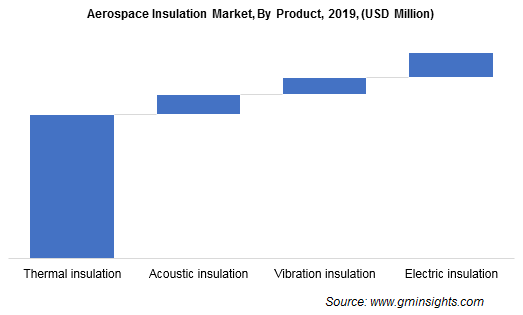

Browse key industry insights spread across 425 pages with 819 market data tables & 16 figures & charts from the report, “Aerospace Insulation Market Size By Product (Thermal Insulation, Acoustic Insulation, Vibration Insulation, Electric Insulation), By Material (Foamed Plastics, Ceramic Material, Fibre Glass, Mineral Wool), By Aircraft (Commercial Aircraft, Military Aircraft, Helicopters, Space), By Applications (Engine, Airframe), By Platform (Fixed Wing, Rotary Wing), Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/aerospace-insulation-market

Rising electrical systems to support electric insulation demand

Electric insulation segment is predicted to expand at over 6.5% CAGR till 2026. Increasing electric systems in aircrafts and helicopters has in turn led to high heat loads. Its attributes include efficient temperature management, overheating prevention, and protection from short circuits and other such threats. This is expected to provide strong growth platform over the forecast period. Moreover, it provides prevention against premature dielectric breakdown, supporting the industry dominance.

Military aircrafts will witness steady gains over the coming years on account of rising defense expenditure in various economies. For instance, the defense budget allocated to China surpassed USD 170 billion in 2019. The U.S. defense budget exceeded USD 700 billion in 2019. High requirement of aircrafts for several mission critical operations that include surveillance, reconnaissance, and target acquisition among other is anticipated to proliferate the military aircraft segment growth. High manufacturing demands will in turn present solid growth prospects for the market.

Commercial aircrafts to enhance Asia Pacific growth

Asia Pacific aerospace insulation market size is slated to register around 7% growth rate from 2020 to 2026 led by rising penetration of commercial aircrafts. Increased demand of these aircrafts in emerging economies including China, Thailand, Indonesia, Malaysia, and India will enhance the product usage. According to Asia Pacific Aviation, India is anticipated to become third largest buyer of commercial aircrafts over the coming years. Several governments across the region are encouraging R&D investments for introducing improvements in the aerospace and defense industry segments.

Manufacturers focusing on partnerships and new product development to enhance their competitive edge

Key aerospace insulation manufacturers are AVS Industries, Elmelin Ltd., 3M, BASF SE, Boyd Corporation, DuPont, Esterline Technologies Corporation, Evonik Industries, Insul.Tecno Group, Johns Manville, Hutchinson, Orcon Aerospace, Duracote Corporation, Polymer Technologies Inc., Promat, Rogers Corporation, etc. These players are emphasizing on partnerships and new product development to bolster their competitive advantage.