Aerospace & Defense Ducting Market Size to hit $7bn by 2025

Published Date: July 2019

Aerospace & Defense Ducting Market size is estimated to surpass USD 7 billion by 2025; according to a new research report by Global Market Insights Inc.

Growing prominence of efficient air management and cabin pressurization in aircrafts is propelling the aerospace & defense ducting market demand. Proliferating aircraft production coupled with requirement of replacing ageing aircrafts are significantly expanding the industry share. Moreover, increasing aircraft order backlogs and production rates are providing a positive outlook for the industry expansion. For instance, in 2017, number of orders for Boeing aircrafts rose to 912 units with an increase of 17.5% as compared with 2016.

Development of advanced air conditioning and propulsion systems are escalating the aerospace & defense ducting market share over the forecast timeframe. Surging aircraft fleet size owing to rise in passenger and commercial air transportation is supporting the industry size. According to International Air Transport Association (IATA), in 2017, air passenger traffic rose to 4.1 billion air passengers with an increase of 7.2% as compared with 2016.

Get more details on this report - Request Free Sample PDF

Rising orders for customized and advanced military aircrafts integrated with innovative anti-icing and cockpit ducts are providing significant growth prospects over the projected timeframe. Growing defense expenditures are supporting the adoption of military jets, further enhancing the market size. Stringent regulations defined by government and non-government regulatory bodies such as Federal Aviation Administration, International Organization for standards for maintaining the airworthiness requirements of heating and ventilation systems are providing positive outlook for the industry size.

Adoption of latest production technologies resulting in shorter lead times and cost-effective solutions is augmenting the aerospace & defense market share over the projected timeframe. Laser sintered and rotational molded ducts providing lightweight, cost effective and durable conveyance of air are gaining higher visibility. Moreover, incorporation of additive manufacturing technologies is promoting the business size.

Browse key industry insights spread across 250 pages with 447 market data tables & 12 figures & charts from the report, “Aerospace & Defense Ducting Market Size By Aircraft (Commercial Aircrafts [Narrow Body, Wide Body], Regional Jets, Business Jets, Military Aircrafts, Helicopter), By Ducting Type (Rigid, Semi-Rigid, Flexible), By Application (Airframe, Engine), By Pressure (High-Pressure, Low-Pressure), By Material (Stainless Steel & Alloys, Titanium & Titanium Alloys, Composites) Industry Analysis Report, Regional Outlook (U.S., Canada, Germany, UK, France, Italy, Spain, Poland, Russia, Netherlands, Sweden, China, India, Japan, South Korea, Singapore, Australia, Brazil, Mexico, Argentina, Saudi Arabia, Qatar, UAE, South Africa) Growth Potential, Price Trends, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/aerospace-defense-ducting-market

Commercial aircrafts will witness significant growth over the forecast period owing to the increasing deployment of mid-size wide body aircrafts. Growing demand for low-cost carriers from emerging economies are supporting the narrow body market share. Deployment of advanced air carriers such as Boeing 787 Dreamline and 777X for longer travel routes will enhance the product demand. Growing requirement for maintaining adequate temperature and pressure in larger cabin areas will further enhance the aerospace & defense ducting market size.

Rigid ducts hold significant share in the market owing to superior strength and optimized flow rates of high-pressure air in environment control system (ECS). Moreover, development of complex shapes and geometries of ducts pressurization and control of oxygen levels will drive the industry growth over the forecast timeline.

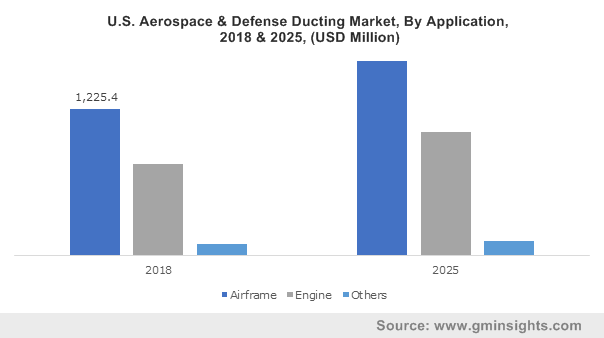

Airframe holds significant share owing to its utilization for supporting the ducting systems for cabin pressurization and conditioning. Integration of telescopic ducts for eliminating ice formation over leading edges of wings is driving the product demand. Engine will foresee strong growth with its use to ensure uniform airflow and maintain internal engine temperature in the turbine section.

High pressure ducts will witness strong growth from 2019 to 2025. This can be credited to the increasing utilization in fuselage and wings. The ducts provide air from engine for cabin air conditioning. Industry participants are developing lightweight materials for high temperature and pressure conditions thereby escalating the aerospace & defense ducting market size.

Titanium ducts providing potential weight savings, corrosion and thermal resistance properties that are prominently augmenting the segment share. Shifting preference of manufacturers to incorporate composite air conditioning and cabin pressurization systems will prominently impact the segment size over the projected timeframe. For instance, as of July 2018, FACC developed new ducting for turbofans of Rolls-Royce Pearl 15 utilizing composite materials.

North America is expected to dominate the market size over the forecast period owing to the presence of major aircraft manufacturers in the region. Proliferating aircraft deliveries coupled with adoption of advanced manufacturing technologies will prominently enhance the industry share. For instance, in 2018, aircraft deliveries of Boeing rose to 806 aircrafts with an increase of over 5% as compared with 2017. Moreover, growing inclination of industry participants to work with aircraft manufacturing companies to develop new products is strengthening the aerospace & defense ducting market size.

Major industry participants in aerospace & defense ducting market include GKN PLC, AIM Aerospace, Senior PLC, Stelia Aerospace, Unison Industries, Eaton Corporation, RSA Engineered Products LLC, Meggitt PLC, Arrowhead products and Encore Aerospace. Industry players are adopting advanced manufacturing technologies and indulging in various strategies for strengthening their foothold in the market.

Aerospace & defense ducting market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD million from 2013 to 2025, for the following segments:

Aerospace & Defense Ducting Market by Aircraft

- Commercial aircraft

- Narrow body aircraft

- Wide body aircraft

- Regional jets

- Business jets

- Military aircrafts

- Helicopter

By Duct Type

- Rigid

- Semi-rigid ducts

- Flexible ducts

By Application

- Airframe

- Engine

- Others

By Pressure

- Low-pressure

- High-pressure

By Material

- Stainless steel & alloys

- Titanium & titanium alloys

- Composites

- Others

The above information is provided on a regional and country basis for the following:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Poland

- Russia

- Netherlands

- Sweden

- Asia Pacific

- China

- India

- Japan

- South Korea

- Singapore

- Australia

- LATAM

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- Qatar

- UAE

- South Africa