Aerospace Accumulators Market size to exceed $8.8 Mn by 2026

Published Date: August 2020

Aerospace Accumulators Market size is likely to surpass USD 8.8 Million by 2026, according to a new research report by Global Market Insights Inc.

Rising defense spending to enhance aerial supremacy and expand aircraft fleet will drive aerospace accumulator industry growth. In 2020, the Indian Government fast-tracked the purchase of 12 Sukhoi Su-30 MKI aircraft as well as additional 21 MiG 29 fighter jets from Russia, with spiraling tensions at Indo-China border. Growing demand for military aircraft, fighter jets, and helicopters will positively influence product penetration in the aviation sector.

Increasing adoption of high-performance material composites to reduce overall weight and maintenance cost will support the aerospace accumulator market demand. Further, their ability to energize Auxiliary Power Units (APUs), landing gear system, and braking system by meeting temporary energy demand to improve aircraft functioning during lift-off and landing will surge its installation in hydraulic systems. However, stringent government regulations coupled with disruption in the supply chain owing to current COVID-19 pandemic situation will hamper its growth.

Get more details on this report - Request Free Sample PDF

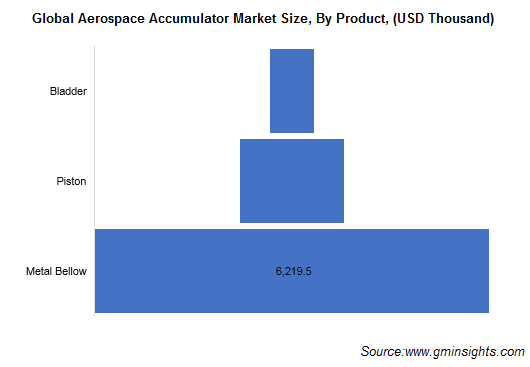

Browse key industry insights spread across 200 pages with 210 market data tables & 19 figures & charts from the report, “Aerospace Accumulator Market Size By Product (Bladder, Piston, Metal Bellow), By Material (Steel, Aluminum ), By Aircraft (Commercial [Narrow Body, Wide Body], Regional, Business, Helicopter, Military Aircrafts), Industry Analysis Report, Regional Outlook, Application Potential, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/aerospace-accumulator-market

Aircraft piston accumulator is a moveable component supported by elastomeric seal configurations to offer high endurance capability to withstand extreme-pressure fluctuations without extrusion failures. The segment is likely to witness around 3.5% CAGR from 2020 to 2026 owing to its growing demand across various aircraft models. Further, its ability to handle higher flow rates with wider temperature extremes will provide opportunities for aerospace accumulators market growth.

High-performance capabilities to support material growth

The materials other than steel in the accumulators include, aluminum, titanium, alloys, composites, and hybrid materials. The segment holds significant growth potential owing to its compatibility with hydraulic fluids as well as coolant fluids and a wide range of processing fluids including highly corrosive liquids. Further, reduced weight, zero-maintenance, and low long-term installation cost will boost the industry growth.

In 2019 regional aircrafts will witness over 3% CAGR owing to rising intra-regional traffic with improving living standards and consumer spending. Technological advancement in aerospace accumulator manufacturing coupled with increasing usage of lightweight composite materials for regional aircrafts is providing a positive outlook for accumulator demand.

Low-cost aircraft carrier production in Europe will surge product demand

Europe aerospace accumulators market growth is driven by the presence of multiple low-cost aircraft carriers’ manufacturers, such as Airbus and Dassault Group. across the region. These offer a wide network of airline routes to multiple cities to server larger number of passengers. A few of the low-cost air service providers in the region are Ryanair, EasyJet, and Air Berlin.

Investment in product differentiation and innovation to enhance competition

Major manufacturers in the aerospace accumulator industry includes, Eaton Corporation, Senior Aerospace, Woodward, Haydac Technologies, Triumph Group, APPH Group, Valcor Engineering, and Parker Hannifin. Product manufacturers are primarily focusing on product differentiation through innovation activities to manage competition in the industry.

Kiran Pulidindi, Akshay Prakash