Aerogel Insulation Market size to exceed $2.5 bn by 2025

Published Date: August 2019

Aerogel Insulation Market size is estimated to surpass USD 2.5 billion by 2025; according to a new research report by Global Market Insights Inc.

Shifting consumer trends towards the sustainable construction materials owing to the strict government initiatives for energy conservation for reducing the natural resources and electricity loss are among the key factors propelling aerogel insulation market share. Rise in global temperature is likely to elevate the electricity bills and energy consumption which will support the product penetration in the industry. In addition, superior padding properties in maintaining desired temperature and reducing cost for air-conditioning or heating across end use industries such as automotive, aerospace, and marine, and oil & gas will further propel the business expansion.

Shifting trends towards improved management of natural resources and energy conservation will propel the aerogel insulation market growth. Strong applications scope for efficient fuel utilization, enhancement in building energy consumption while offering a comfortable environment will influence the business development. Besides, rising consumer spending on the separate/private residence and several family vehicles owing to the changing lifestyles towards nuclear families will fuel the product demand.

Get more details on this report - Request Free Sample PDF

Growing consumer awareness for the reduction of carbon footprint and greenhouse gas (GHG) emissions coupled with increasing population will strongly drive the industry growth. Favorable government regulations pertaining to the development of residential sectors such as the Government led Energy Company Obligation Scheme (ECO) and Affordable Housing Institute (AHI) will boost the product portfolio. However, increasing crude oil prices and lack of awareness regarding the benefits of the product may hamper the product penetration in the industry.

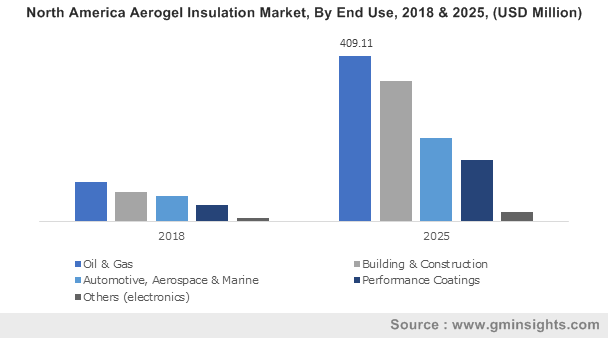

Browse key industry insights spread across 350 pages with 300 market data tables & 13 charts & figures from the report, “Aerogel Insulation Market Size By Type (Silica, Polymer, Carbon), By Form (Blankets, Panels, Particle, Block), By End-Use (Oil & Gas, Building & Construction, Automotive, Aerospace & Marine, Performance Coatings), Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/aerogel-insulation-market

Silica accounted for more than 75% of the industry share in 2018. Key benefits such as low bulk density, optical transparency, effective absorption of infra-red radiations, and lower thermal conductivity will provide strong outlook for the segment growth. Besides, rapid advancements of sol-gel techniques have led to fast progress in synthesis of porous materials which in return will further fuel the segment scope in the industry.

Particle segment will observe significant gains exceeding 15% in the overall aerogel insulation market size over the projected time frame. Key advantages such as easy transport & handling, effective optimization of light transmission for different usage in architectural daylight applications, and superior thermal insulation will propel the segment share. Further, high surface area and light diffusion are among the major properties boosting the business expansion.

Building & construction is anticipated to surpass USD 950 million in the overall market over the forecast period. Rapid urbanization coupled with inclining trend towards nuclear families are among the major factors driving the business growth. Moreover, significant development in the whole house systems design approach for improving the overall energy efficacy for new residential projects will further influence the overall industry landscape.

Europe is anticipated to surpass 30 million square meters in the overall aerogel insulation industry over the projected time period. Rising awareness of green building materials, smart cities, and Internet of Things will propel the business size in Europe. Rapid surge in the automobiles sales and production owing to the increasing consumer disposable income will stimulate the product demand in the region. For instance, as per OICA, Germany accounted the car production for over 5 million in 2018. In addition, favorable government norms and policies in the prevention against harmful GHG emissions and growing carbon emission in the environment will further drive the business share across Europe.

BASF, Aspen Aerogels, Cabot Corporation, Svenska Aerogel, Green Earth Aerogel Technologies, American Aerogel Corporation, and Enersens are among the major manufacturers. Global aerogel insulation market share is competitive due to the presence of large and medium MNC and domestic participants. Manufacturers are involved in production capacity expansions, product innovations, mergers and acquisitions, and new product launches for gaining an edge over others. For instance, on 1st October 2018, Cabot Corporation acquired NSCC Carbon (Jiangsu) Co., Ltd. from Nippon Steel Carbon Co. This acquisition will support the company’s specialty carbons product line within the Performance Chemicals segment and will broaden its presence in China.

Aerogel insulation market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume in Thousand Square Meters & revenue in USD Million from 2013 to 2025, for the following segments:

Aerogel Insulation Market, By Type

- Silica

- Polymer

- Carbon

- Others (fiberglass)

Aerogel Insulation Industry, By Form

- Blankets

- Panel

- Particle

- Block

Aerogel Insulation Industry, By End-Use

- Oil & gas

- Building & construction

- Automotive, aerospace & marine

- Performance coatings

- Others (electronics)

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Netherlands

- Spain

- Belgium

- Sweden

- Asia Pacific

- China

- India

- Japan

- Australia

- Malaysia

- Indonesia

- Thailand

- South Korea

- Vietnam

- Singapore

- Philippines

- Latin America

- Brazil

- Argentina

- Mexico

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Qatar

- Oman