ABS Market for Automotive Plating on Plastics Application worth $2bn by 2024

Published Date: March 2019

ABS Market for Automotive Plating on Plastics (POP) Application size is set to surpass USD 2 billion by 2024; according to a new research report by Global Market Insights Inc.

ABS market size from automotive plating on plastics (POP) application is anticipated to witness strong gains on account of its usage in manufacturing automotive grills which finds applications in automotive systems including air conditioning, radiator and front grills. Wide acceptance of ABS for POP application to manufacture automotive grills due to high corrosion resistance and durability, which may fuel product demand by 2024.

ABS market size from automotive plating application from fuel covers may cross USD 100 million in forecast timeframe. Fuel covers are components which are used to cover automotive fuel tanks to provide protection from exterior interferences which causes severe fire hazards. Rising implementation of automotive manufacturing quality standards in order to increase passenger safety owing to ABS beneficial attributes including chemical resistance and element rigors withstanding property should propel ABS market size for automotive POP application industry growth.

Get more details on this report - Request Free Sample PDF

ABS market from automotive application from plating for emblem application is anticipated grow over 6% by 2024.Increasing usage in manufacturing automotive emblems. Emblems are components widely used by automotive manufacturers to portray their brand logo and to make products appealing to consumers. Increasing demand for ABS for POP application to manufacture emblems due to ABS owing persuading attributes including easy adherence to metal, glossy finish and light weight should foster product demand growth.

Browse key industry insights spread across 190 pages with 129 market data tables & 44 figures & charts from the report, “ABS Market for Automotive Plating on Plastics (POP) Application Market, Industry Analysis Report, Regional Outlook, Application Potential, Price Trend, Competitive Market Share & Forecast, 2018 – 2024” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/abs-market-for-automotive-plating-on-plastics

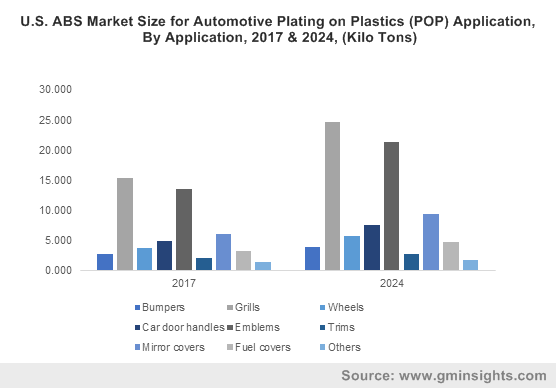

U.S. ABS market size from automotive POP application is anticipated to witness strong gains of over 6% on account of its due to manufacturing hub of world leading car makers including General Motors. Supportive governmental initiatives including Reshoring initiative by U.S. government pertaining to attract more domestic production rather than offshore manufacturing which should boost domestic automotive products which should foster ABS market from automotive plating application industry growth.

Indian ABS market size from automotive plating application may observe gains of 7% by 2024. Supportive FDI policies implemented by Indian government to help foreign automotive players to establish manufacturing units in India which should boost domestic automotive production. Low labor cost and production cost being beneficial factors for automotive manufacturing should boost Indian automotive industry which should propel ABS market size from automotive plating on plastics (POP) application industry growth.

ABS market size from automotive plating application industry share is a moderately consolidated market with prominent players includes SABIC, Retlaw Industries, Preferred Plastics, ELIX Polymers, INEOS Styrolution, OJSC Plastic, Otto Klumpp, Trinseo, Omni Plastics and OTIS TARDA. Manufacturers are involved in JV, mergers & acquisitions, and partnership to implement ground-breaking technologies with increasing production capacities and lowering production cost to cater growing ABS demand for automotive plating application.

ABS market for automotive POP application research report includes in-depth coverage of the industry, with estimates & forecast in terms of volume in tons and revenue in USD from 2013 to 2024, for the following segments:

ABS market for automotive POP application, By Application

- Bumpers

- Grills

- Wheels

- Car door handle

- Emblems

- Trims

- Mirror covers

- Fuel covers

- Others

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Poland

- Russia

- Spain

- Asia Pacific

- China

- Japan

- India

- Thailand

- South Korea

- Malaysia

- Australia

- Indonesia

- LATAM

- Brazil

- Argentina

- MEA

- Morocco

- Egypt

- Iran

- South Africa