LATAM Frozen Bakery Market size worth over $5.7bn by 2024

Published Date: October 2018

LATAM Frozen Bakery Market size will surpass USD 5.7 billion by 2024; according to a new research report by Global Market Insights Inc.

Rising economic growth resulting in an expansion of disposable income of the Colombian population has resulted in a vast increase in modern retail space across the country. This would further augment the demand for frozen bakery products in the coming years. The expansion of restaurant chains and fast food outlets are a key component of the sector’s growth. According to the Colombian Chamber of Commerce, there were 32,000 restaurants registered in Bogotá in 2016, the majority of which were fast-food outlets like Subway, Burger King, and McDonald’s. This growth would further increase the demand for frozen dough as the products is widely used in these outlets.

Increased fluctuations in the energy costs could hinder the LATAM frozen bakery market growth during the forecast timeframe. Most of the edible items are perishable and requires preservation for long duration storage. Minimal temperatures reduce biological activity from bacteria and other microorganisms which are responsible for food decaying. Freezing is the only solution for storage of perishable edible products in longer run. As major fuel consumption takes place in freezing, storage, and cryogenic logistical requirements, fluctuations in energy cost would significantly affect the frozen bakery operations.

Get more details on this report - Request Free Sample PDF

Browse key industry insights spread across 92 pages with 83 market data tables & 19 figures & charts from the report, “LATAM Frozen Bakery Market Size By Recipe (Bread, Viennoiserie, Patisserie, Savory Snacks), By Product (Ready-To-Prove, Ready-To-Bake, Fully Baked), By End-User (Convenience Stores, Hypermarkets & Supermarkets, Artisans Bakers, Hotels, Restaurants, And Catering [HORECA], Bakery Chains) Industry Analysis Report, Country Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2018 – 2024” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/LATAM-frozen-bakery-market

In terms of volume, bread segment will be accounted for more than 63% of the overall LATAM frozen bakery market by 2024 owing to the increasing consumption of bread in the region. Significant consumption of bread across in all bakery products will positively influence the LATAM frozen bakery market.

On the basis of product, ready-to-prove products will show the decent growth of more than 3% in forecast timeframe. This is all owing to surge in the usage of ready-to-prove products by artisan bakers in Mexico and Colombia. Rising number of artisanal bakers in the region will increase the consumption of ready to prove products in next seven years down the line.

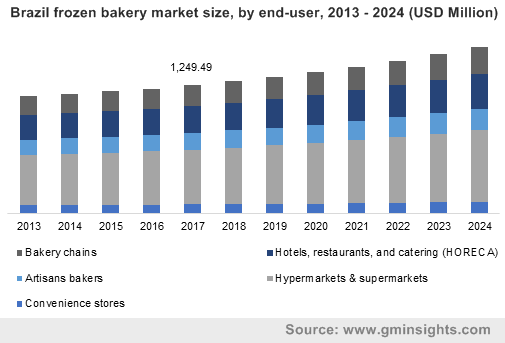

Hotels, restaurants, and catering (HORECA) captured close to 20% volume share of end-user base in 2017. Government initiatives to promote Mexico as a tourist destination has also led to an increase in the number of restaurants and hotels in the country. These restaurants sell a variety of bakery products include cakes, pastries, snacks, etc. Thus, developments in the restaurant industry in the country will drive product demand for use in HORECA during the forecast period.

Based on country, Colombia will show the positive growth with more than 6% CAGR in forecast period. Advancement in different retail channels across the country will be crucial factor behind the frozen bakery market growth in Colombia. The increasing number of restaurants and hotels in the country has also led to sharp increase in the consumption of bakery products such as pastries, cakes, etc. These trends will propel the Colombia frozen bakery market by 2024.

The major LATAM frozen bakery industry players are General Mills, Groupo Bimbo, BredenMaster, and Europastry. The industry ecosystem of LATAM frozen bakery witnesses strong supply chain of frozen dough supply to key end-users. Additionally, strategic mergers & acquisitions and new product development plays a key role across the industry’s value chain.

LATAM frozen bakery market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume in thousand units & revenue in USD million from 2013 to 2024, for the following segments:

LATAM Frozen Bakery Market, by Recipe

- Bread

- Viennoiserie

- Patisserie

- Savory snacks

LATAM Frozen Bakery Market, by Product

- Ready-to-prove

- Ready-to-bake

- Fully baked

LATAM Frozen Bakery Market, by Product

- Convenience stores

- Hypermarkets & supermarkets

- Artisans bakers

- Hotels, restaurants, and catering (HORECA)

- Bakery chains

The above information is provided on country basis for the following:

- Brazil

- Mexico

- Argentina

- Chile

- Colombia