Summary

Table of Content

Wi-Fi Module Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Wi-Fi Module Market Size

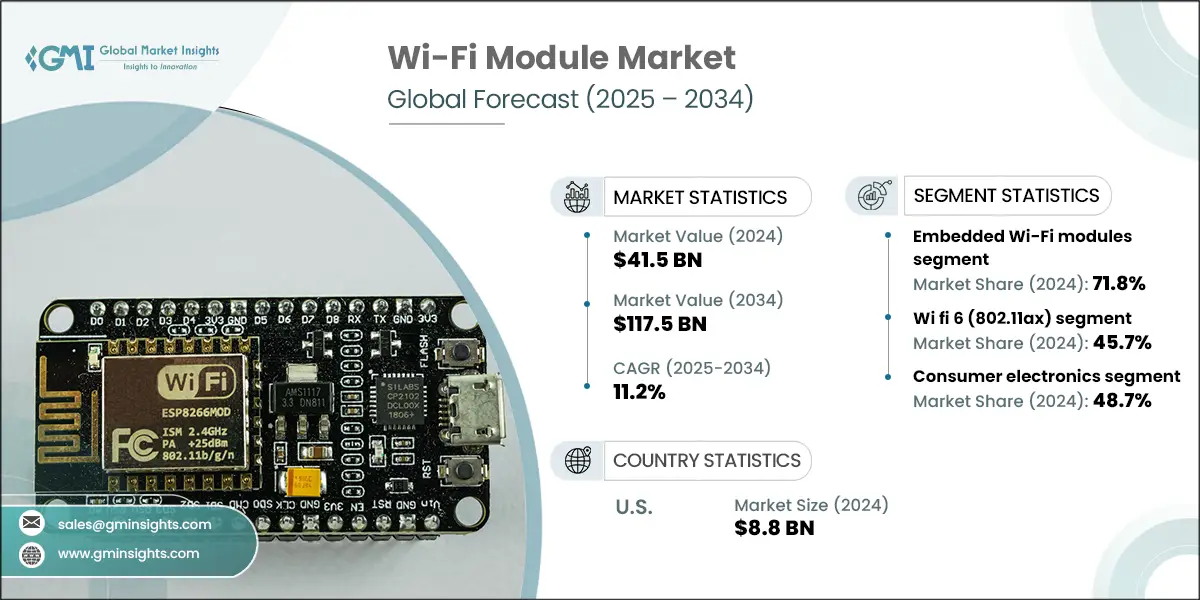

The global Wi-Fi module market was valued at USD 41.5 billion in 2024 with a volume of 785.2 million units. The market is expected to grow from USD 45.2 billion in 2025 to USD 73.4 billion by 2030 and USD 117.5 billion by 2034 with a volume of 2,724.3 million units, growing at a value CAGR of 11.2% and volume CAGR of 13.5% during the forecast period of 2025-2034, according to Global Market Insights Inc.

To get key market trends

- The growth of the Wi-Fi module market is attributed to factors such as increasing demand for IoT devices, increase in adoption of smart home and smart buildings, growth of connected consumer electronics, improvements in Wi-Fi technology, Wi-Fi 6 and 6E and rising focus on industrial automation.

- The increasing demand for IoT devices is a key driver of the market, as these modules are critical for wireless connectivity across smart homes, healthcare, industrial automation, and more. According to a GSMA report, global IoT connections reached 15.1 billion in 2023 and are projected to exceed 29 billion by 2030. This growth highlights the growing demand for dependable, high-speed wireless modules that enable efficient data flow and interoperability among devices.

- The increasing adoption of smart homes and smart buildings is driving the Wi-Fi module industry as these environments require automation, security, energy management, and entertainment systems to function with effortless wireless integration. According to the Consumer Technology Association, more than half of U.S. homes had at least one smart device by early 2024. Moreover, the World Economic Forum estimates that 672 million homes will have smart home technology installed by 2027. This increase in the adoption of smart devices creates the need of sophisticated and scalable Wi-Fi modules to enable real-time data transfer and interaction in both residential and business infrastructures.

- In 2024, North America dominated the global market with a share of 25.2% due to rapid IoT technology adoption, wide availability of smart home technology and advanced building automation, 5G technology investments, and general growth of smart systems. According to 5G Americas, North America’s 5G footprint is forecasted to expand to 772 million connections by 2029, reaching a penetration rate of 197 percent. With high internet penetration, a strong ecosystem of tech innovators, and growing smart city investments, North America is poised for sustained Wi-Fi module demand across consumer and enterprise applications.

Wi-Fi Module Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 41.5 Billion |

| Forecast Period 2025 - 2034 CAGR | 11.2% |

| Market Size in 2034 | USD 117.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing demand for IoT devices | Broaden market growth because more devices will be able to communicate, automate, and control other IoT devices via Wi-Fi as a functionality. |

| Increase in adoption of smart home and smart buildings | Increase demand for reliable high-speed Wi-Fi modules to allow for reliable high-speed internet access to home automation systems. |

| Growth of connected consumer electronics | Broaden the market by embedding Wi-Fi modules in smart devices (smartphones and wearables) and smart appliances that enhance the user experience. |

| Improvements in Wi-Fi technology - Wi-Fi 6 and 6e | Increase upgrades and product development from demand for higher speeds and perceive lower latency by requesting modules. |

| Expanded industrial automation/rise in smart manufacturing | Increase demand for Wi-Fi modules in the industrial area thanks to the rise of real-time monitoring, control and predictive maintenance. |

| Pitfalls & Challenges | Impact |

| Risk of data breaches and device hacking. | Cybersecurity risks from connected devices threaten sensitive user data collection, which undermines trust in connected devices and slows the market adoption rate of Wi-Fi enabled devices. |

| Signal disruption results in unreliable network performance. | Signal interference on Wi-Fi enabled devices, especially in dense crowded networks, and create performance issues which leads to dissatisfied consumer experience and demand for wireless alternatives. |

| Opportunities: | Impact |

| Smart city development | As urban digital infrastructure expands, demand for Wi-Fi modules continues to grow for various applications in traffic management, surveillance and public services. |

| Wi-Fi adopted by various iot devices within healthcare. | The remote patient monitoring and technology within medical devices in healthcare create demand for integration with reliable Wi-Fi modules in health tech ecosystems. |

| Intelligent factory control systems | Industry 4.0 and the evolution of connected technology forces Wi-Fi to be adopted in manufacturing environments where real-time monitoring, robotics and machinery must communicate with one another. |

| Adoption of Wi-Fi 6 and 7 as emerging protocols. | Emerging protocol standards will create demand for existing and upgraded modules that provide improved speeds, range and latency. |

| Market Leaders (2024) | |

| Market Leaders |

Top 2 companies held 25.9 % market share |

| Top Players |

Collective market share in 2024 is 44.7% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | North America |

| Emerging countries | India, Germany and US |

| Future outlook |

|

What are the growth opportunities in this market?

Wi-Fi Module Market Trends

- Rising integration of Wi-Fi modules in connected vehicles to support safety-critical systems is shaping the Wi-Fi module industry. Automakers are embedding Wi-Fi modules to enable features like Advanced Driver Assistance Systems (ADAS), vehicle diagnostics, and over-the-air (OTA) updates. According to the European Automobile Manufacturers Association (ACEA), the automotive industry spends approximately USD 63 billion annually on R&D, with a substantial share going to ADAS technologies, which rely on reliable, high-speed wireless connectivity. This trend began growing around 2019 with the rise of smart mobility initiatives. It is anticipated to remain influential through 2032, as governments and consumers demand for safer, more connected vehicles.

- The trend of adopting Wi-Fi 6/6E modules is reshaping the market for high-bandwidth applications such as AR/VR, 4K video streaming, and gaming devices. According to Wi-Fi Alliance over 5.2 billion Wi-Fi 6 product are expected to be shipped by 2025, 41% of which will be Wi-Fi 6E devices. This trend is currently enhancing speed, latency, and network efficiency in both consumer and enterprise settings. It is expected to dominate through 2031, as support for multi-user performance and congestion reduction becomes standard in future wireless communication architectures.

- The Wi-Fi module market is witnessing a rapid transition towards Wi-Fi 7 technologies, driven by advancements in AI and edge computing. There is a growing trend for low-power modules for wearables and heightened network security to manage device-dense environments. According to Intel, over 5000 Wi-Fi device models with support for 6 GHz operation and more than 1200 Wi-Fi 7 devices were announced or made available during 2021-2024. This indicate the pace of Wi-Fi 7 development has surpassed that of Wi-Fi 6E, and only 23% of the Wi-Fi 7 devices identified in 2024 do not support 6 GHz. This trend began around 2019 with Wi-Fi 6, accelerated through 2024 with Wi-Fi 7 launches, and is expected to dominate the market through at least 2030 as these technologies become standard across consumer and enterprise applications.

Wi-Fi Module Market Analysis

Learn more about the key segments shaping this market

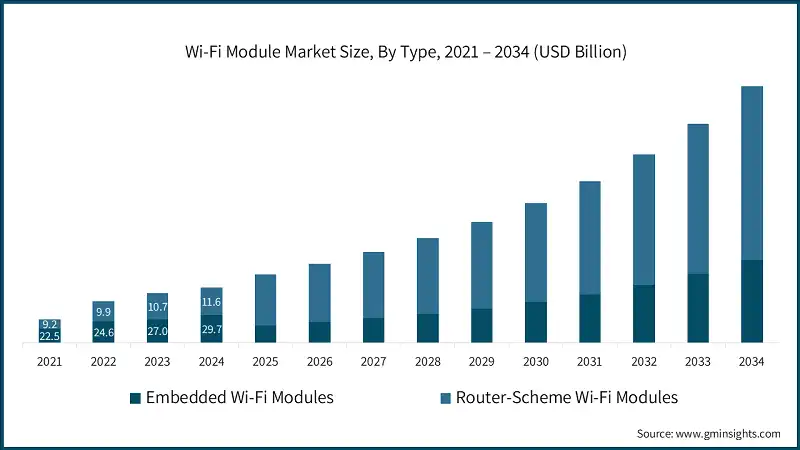

Based on type, the market is segmented into embedded Wi-Fi modules and router-scheme Wi-Fi modules. The embedded Wi-Fi modules segment accounted for market share of 71.8% in 2024.

- The embedded Wi-Fi modules segment was valued at USD 29.7 billion in 2024. The growth of this sector is due to increasing demand for intelligent devices, the expansion of IoT and the continuing evolution of wireless technologies around the globe.

- Manufacturers should invest in developing smaller units, energy efficiency and multi-protocol support for integration in IoT, smart homes, healthcare, and automation.

- The router-scheme Wi-Fi modules segment was valued at USD 11.7 billion in 2024. This segment has continued to grow driven largely by the expansion of broadband penetration, demand for high-speed internet, and the continued expansion of smart devices requiring stable area wide connectivity.

Learn more about the key segments shaping this market

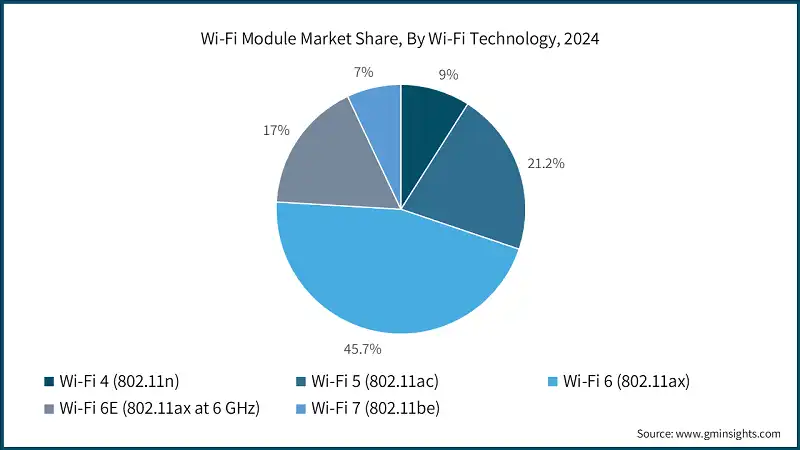

Based on wi-fi technology, the Wi-Fi module market is segmented into wi-fi 4 (802.11n), wi-fi 5 (802.11ac), wi-fi 6 (802.11ax), wi-fi 6e (802.11ax at 6 ghz) and wi-fi 7 (802.11be).

- The wi-fi 6 (802.11ax) segment dominated the market with a market share of 45.7% in 2024. This segment is driven mainly by the requirements of higher data throughput, increased capacity of the network, enhanced performance in dense or difficult environments, as well as lower latency. Such improvements are critical for the Internet of Things and targeted for effortless and effective wireless communications.

- Manufacturers should prioritize the development of advanced Wi-Fi 6 modules that offer faster speeds, greater capacity, and enhanced energy efficiency. To meet the increasing global demand for enterprise and consumer connectivity, manufacturers must focus on scalable production through strategic R&D investments and partnerships.

- The wi-fi 5 (802.11ac) segment was valued at USD 8.7 billion in 2024. Wi-Fi 5 delivers the speed and reliability needed by most consumer and industrial IoT applications. It is, therefore, the preferred choice for manufacturers looking to serve the most economical markets, and for those that do not require the advanced features that Wi-Fi 6 or 7 offer.

- Manufacturers should focus on providing greater network efficiency, compatibility and affordability of their wi-fi 5 module for mass-adopted consumer electronics and distributed devices in an enterprise setting.

Based on the end use, the Wi-Fi module market is segmented into consumer electronics, smart home and appliances, industrial, automotive and transportation, healthcare and medical devices, agriculture and environmental monitoring, construction and infrastructure and others.

- The consumer electronics segment dominated the market with 48.7% share in 2024. This segment is benefitting from the adoption of smart devices, growing demand for shared connectivity, and the IoT ecosystem's expansion.

- Manufacturers should focus on developing energy-efficient and compact Wi-Fi modules according to the needs of consumer electronics. The growth of the consumer electronics segment has propelled manufacturers to invest into research and development, building partnerships and putting in place scalable production processes in order meet the demand for smart, connected devices and being able to enhance the customer’s overall experience.

- The automotive and transportation segment was the fastest growing segment and is anticipated to grow with a CAGR of 13.8% during the forecast period. This growth is supported by the increase of demand in connected vehicles, smart transportation programs, and real-time data communication.

- Manufacturers should focus on developing advanced, automotive grade Wi-Fi modules that have the durability, low latency and security required to support the growing need for connected transportation that involves partnerships with vehicle OEMs.

Looking for region specific data?

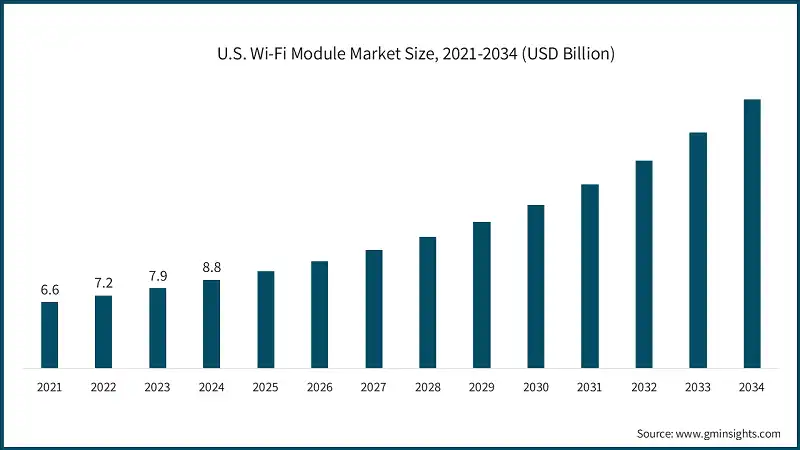

North America Wi-Fi module market held 25.2% market share in 2024 and is growing at a 12.2% CAGR during the forecasted period, driven by demand of smart home and industrial automation, more developed infrastructure, strong government support toward development, and earlier adoption of emerging technology.

- U.S. market was valued at USD 8.8 billion in 2024, driven by expanding remote work trends, early deployments of Wi-Fi 6 and Wi-Fi 7, automotive, consistent innovation and deployment in smart city projects.

- U.S. manufacturers should lead the development of advanced connectivity Wi-Fi 6/7 modules, automotive applications and smart cities while focusing on energy efficiency, security and seamless interoperability.

- Canada market is projected to grow significantly with a CAGR of 13.3% during the forecast period. Canada's market is driven by the increase in new connected home devices, expansion of 5G networks and e-learning and tech-savvy consumer base with disposable income, is helping to drive early adoption.

- Manufacturers need to focus on development of connectivity Wi-Fi modules that support high performance, energy-efficient and designed for connected homes, 5G and e-learning applications, while keeping in mind Canada's tech-savvy consumer base while developing high-performance, reliability connectivity solution.

Europe Wi-Fi module market held 16.2% share in 2024. The European market is growing due to expansion of government backed digital transformation strategies, advancements in Industry 4.0 and the large-scale deployment of connected solutions in the energy, automotive and healthcare sectors.

- The Wi-Fi module industry in Germany was valued at USD 2.3 billion in 2024 and is anticipated to grow with a CAGR of 12.1% during the forecast period, driven by the expansion of renewable energy management systems, consumer demand rise for connected healthcare solutions, expanding e-mobility ecosystem and rise in edge computing and data centers.

- Manufacturers should focus on developing connectivity Wi-Fi modules that are high performance, energy efficient, and tailored for renewable energy, connected healthcare, e-mobility, and edge computing applications, delivering reliability in Germany's expanding tech ecosystem.

- The UK market is anticipated to surpass USD 4.3 billion by 2034, market is being impacted by expansion of connected public transport systems, develop green building infrastructure, rising penetration of cloud computing, energy efficient and cybersecurity and compliance focused.

- Manufacturers should prioritize development of secure, energy efficient Wi-Fi modules for connected public transport, green buildings and general cloud computing with an even greater emphasis on cybersecurity, compliance and seamless interoperability necessary for the UK's evolving connectivity ecosystem.

Asia Pacific Wi-Fi module market held 47.3% market share in 2024 and is growing at a 11.2% CAGR. The market is evolving continuously as the e-commerce platforms rapidly expand, the surge of gamers and entertainment streaming apps is increasing, and the cross-border digital trade corridors are being developed, driving the market growth.

- The Wi-Fi module industry in the India was valued at USD 4.9 billion in 2024. The Indian market is evolving continuously from the expansion of telemedicine and in-digital healthcare services, government stimulus to promote rural connectivity and broadband expansion, expansion of smart agriculture technologies, along with the ever-growing use of connected vehicles and smart transportation systems.

- Manufacturers should focus on developing connectivity Wi-Fi modules that are reliable and affordable for telemedicine, rural connectivity, smart agriculture, and connected transportation applications, to help India's growing digital infrastructure and government programs to narrow the digital divide.

- The China market is projected to grow significantly with a CAGR of 10.9% during the forecast period, driven by the increasing penetration of AI-enabled smart home technology, rapid urbanization resulting in growing public wifi hotspots, the growing popularity of wearable technologies, and developing clouds and data centers.

- Manufacturers should prioritize developing advanced, AI enabled Wi-Fi modules with a focus on smart homes, public Wi-Fi hotspots, wearable devices, and cloud infrastructure, while delivering reliability, high performance, scalability, and seamless connectivity in China's expanding database.

- The Japan market is projected to grow significantly with a CAGR of 10.2% during the forecast period, driven by the growth of robotics and AI applications, wearable health device acquiring traction and government incentives encouraging digital transformation in small and medium enterprises.

- Companies must need to focus on high-performance, energy-efficient Wi-Fi modules developed for robotics and AI applications, wearables, and health, along with employing government subsidies to further spur the technological transition of small and medium companies in Japan.

Latin America Wi-Fi module market held 4.1% market share in 2024 and is growing with a CAGR of 8.1%, driven by awareness of cybersecurity solutions, and penetration of mobile broadband (4g/5g).

Middle East & Africa market was valued at USD 3 billion in 2024, driven by continued growth in financial services digitization, growth in logistics and supply chain digitization, increasing urbanization that provides stimulus to demand advanced wi-fi solutions for multi-dwelling units and virtual reality applications with strong demand for low-latency wi-fi modules available.

- The South Africa market is projected to grow with a CAGR of 9.8% during the forecast period, driven by the increase of rural broadband programs, rising use of smart agriculture technologies and growth in retail sector digital transformation.

- Companies should try to develop low-cost, resilient Wi-Fi modules suitable for rural broadband expansion, smart agriculture, and digital retail transformation, to address connectivity challenges in South Africa and support new sustainable technology ideas and development underpinned by connectivity solutions.

- The Saudi Arabia Wi-Fi module market is projected to grow with a CAGR of 10.9% during the forecast period, driven by government initiatives to change banking and finance including digital transformation as part of dependent eco-systems, increased IoT uptake in the oil and gas sector and growth in connected industrial automation players across industries beyond oil and gas.

- Manufacturers need to create robust, efficient Wi-Fi modules with security features adapted for use in digital banking, IoT applications in oil and gas, and industrial automation that will help support Saudi Arabia build on the government led digital transformation and connected ecosystems.

- The UAE market was valued at USD 875.6 million in 2024, driven by a further focus on sustainable and energy efficient smart building technologies, development of fintech infrastructure and regulatory measures requiring secure connectivity and use of advanced security systems and smart surveillance involving robust wi-fi.

Wi-Fi Module Market Share

- The top 5 companies are Qualcomm Incorporated, MediaTek Inc., Broadcom Inc., Texas Instruments Inc. and Murata Manufacturing Co., Ltd. collectively held 44.7% of the market share in 2024.

- Qualcomm Incorporated also held 14.4% of the total market share in 2024, due to their knowledge of optical and imaging technologies. Qualcomm’s solutions integration continues to lead the sector as the company combines Wi-Fi and robust mobile technologies.

- Broadcom Inc. held a 11.5% of the total market share in 2024, offering power-efficient, high-performance modules used in smartphones, routers, and IoT devices. Its strong R&D capabilities and diverse product range often set benchmarks for technological advancement in the industry.

- In 2024, MediaTek accounted for 8.8% of the market. MediaTek maintains a robust position worldwide, particularly in burgeoning and developing economies, due to low-priced, high-functionality Wi-Fi modules. They are globally one of the most preferred manufacturers for smart home and IoT devices, owing to Advanced-Fusion AI and low power consumption.

- Texas Instruments Inc. held a 6.5% of the total market share in 2024, showing steady growth in the market through innovation, reliable connectivity solutions, and strong industrial and IoT presence.

- As of 2024, Murata Manufacturing Co., Ltd. held a 3.5% share of the total market. They strengthened their position within the Wi-Fi module market with the introduction of compact, high-performance modules, establishing strategic partnerships, and a burgeoning demand for consumer electronics, healthcare, and industrial IoT systems.

- Qualcomm, Broadcom, MediaTek, Texas Instruments, and Intel are global leaders in the market. They excel through robust R&D, comprehensive product portfolios, and advanced Wi-Fi 6/7 technologies.

- Realtek Semiconductor, AzureWave Technologies, Espressif Systems, Quectel Wireless Solutions, u-blox Holding, Laird Connectivity, and Nordic Semiconductor act as followers in the Wi-Fi module industry. They primarily serve regional markets or specific industry verticals, offering cost-effective products to meet steady demand.

- NXP Semiconductors, Microchip Technology, Marvell Technology, Silicon Laboratories, and Murata Manufacturing are challengers in the market. They possess a solid market presence and advancing technological capabilities by emphasizing innovation, targeting niche applications, and expanding their global client base.

- Telit Cinterion and Redpine Signals are niche players in the market, specializing in innovative and emerging technologies. They focus on delivering specialized and customized solutions crafted for particular industry sectors like the Internet of Things, industrial automation, and specialized linking.

Wi-Fi Module Market Companies

Some of the prominent market participants operating in the Wi-Fi module industry include:

- Qualcomm Incorporated

- Broadcom Inc.

- MediaTek Inc.

- Texas Instruments Inc.

- Murata Manufacturing Co., Ltd.

- Intel Corporation

- NXP Semiconductors N.V.

- u-blox Holding AG

- Quectel Wireless Solutions Co., Ltd.

- Espressif Systems (Shanghai) Co., Ltd.

- Silicon Laboratories Inc.

- Microchip Technology Inc.

- Marvell Technology, Inc.

- Realtek Semiconductor Corp.

- Telit Cinterion

- Nordic Semiconductor ASA

- AzureWave Technologies, Inc.

- Redpine Signals, Inc.

- Laird Connectivity

- Advantech Co., Ltd.

Wi-Fi Module Industry News

- In 2023, MediaTek launched its advanced Wi-Fi 7 chipsets, designed to meet the growing demand for faster, more reliable wireless connectivity in premium smartphones and a wide range of IoT devices.

- In 2023, Marvell Technology, Inc. launched Wi-Fi 7 chipsets tailored for enterprises to improve network efficiency as well as interoperate with 5G systems. These chipsets are designed to meet the increasing wireless connectivity needs of advanced enterprises and smart infrastructures, providing unprecedented wireless speeds, capacity, and low latency.

The Wi-Fi module market research report includes in-depth coverage of the industry with estimates and forecasts in terms of revenue (in USD billion) and volume (in Units)from 2021 – 2034 for the following segments:

Market, By Type

- Embedded wi-fi modules

- Router-scheme wi-fi modules

Market, By Wi-Fi Technology

- Wi-Fi 4 (802.11n)

- Wi-Fi 5 (802.11ac)

- Wi-Fi 6 (802.11ax)

- Wi-Fi 6E (802.11ax at 6 GHz)

- Wi-Fi 7 (802.11be)

Market, By End Use

- Consumer electronics

- Smartphones and tablets

- Laptops and personal computers

- Wearables

- Others

- Smart home and appliances

- Smart TVs and streaming devices

- Connected lighting

- Security systems

- Others

- Industrial

- Remote monitoring systems

- Predictive maintenance

- Robotics

- Others

- Automotive and transportation

- In-vehicle infotainment

- EV charging and telematics

- Others

- Healthcare and medical devices

- Remote patient monitoring

- Wireless diagnostic equipment

- Others

- Agriculture and environmental monitoring

- Smart irrigation controllers

- Livestock tracking devices

- Weather and soil monitoring

- Others

- Construction and Infrastructure

- Site surveillance equipment

- Wireless sensor networks

- Connected machinery

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the Wi-Fi module market?

Leading players include Qualcomm Incorporated, Broadcom Inc., MediaTek Inc., Texas Instruments Inc., Murata Manufacturing Co., Ltd., Intel Corporation, Realtek Semiconductor, Silicon Laboratories, Telit Cinterion, Redpine Signals, Laird Connectivity, and Advantech Co., Ltd.

What was the valuation of the U.S. Wi-Fi module industry in 2024?

The U.S. Wi-Fi module market was valued at USD 8.8 billion in 2024. Growth is driven by early adoption of Wi-Fi 6/7, smart city expansion, connected vehicles, and increasing demand for remote work and smart home technologies.

Which end use sector is the fastest growing through 2034?

The automotive and transportation sector is projected to grow at a CAGR of 13.8% through 2034.

Which end use sector dominated the Wi-Fi module market in 2024?

Consumer electronics led with a 48.7% share in 2024, driven by demand for smart devices, wearables, and connected appliances.

Which Wi-Fi technology segment led the market in 2024?

Wi-Fi 6 (802.11ax) dominated with a 45.7% market share in 2024, owing to its higher data throughput, low latency, and efficiency in dense environments.

What is the market size of the Wi-Fi module in 2024?

The Wi-Fi module market was valued at USD 41.5 billion with 785.2 million units in 2024, driven by the surge in IoT devices, smart homes, and connected consumer electronics.

What is the projected value of the Wi-Fi module market by 2034?

The market size for Wi-Fi module is expected to reach USD 117.5 billion with 2,724.3 million units by 2034, growing at a CAGR of 11.2% (value) and 13.5% (volume).

How much revenue did the embedded Wi-Fi module segment generate in 2024?

The embedded Wi-Fi module segment generated USD 29.7 billion in 2024, accounting for 71.8% market share.

What was the valuation of the router-scheme Wi-Fi module segment in 2024?

The router-scheme Wi-Fi module segment was valued at USD 11.7 billion in 2024.

Wi-Fi Module Market Scope

Related Reports