Summary

Table of Content

Water Pumps Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Water Pumps Market Size

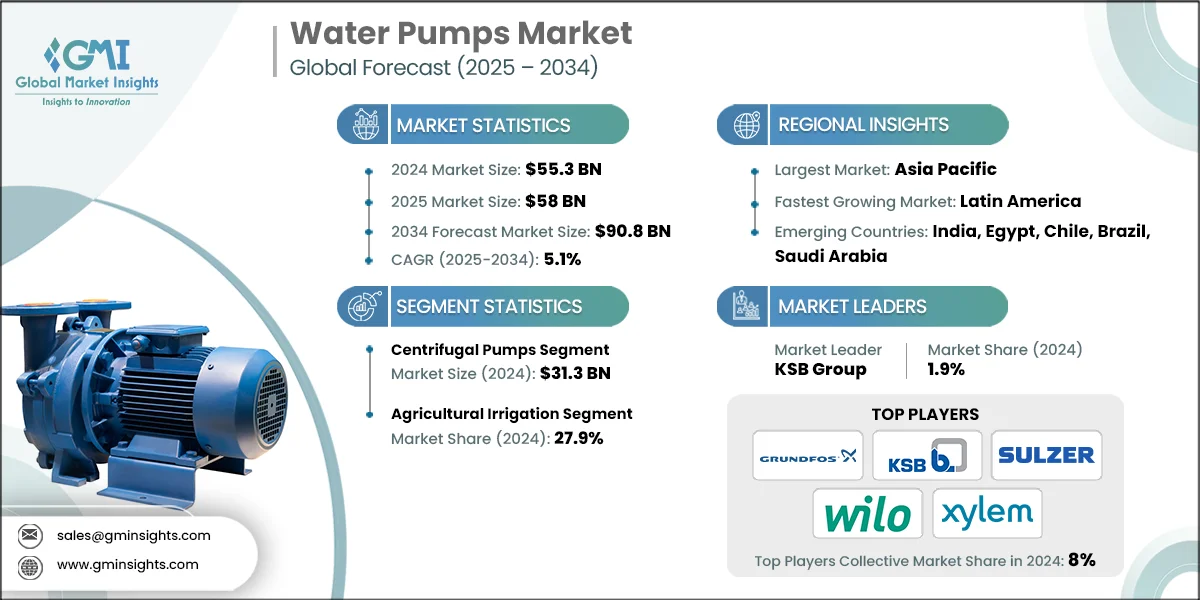

According to a recent study by Global Market Insights Inc., the global water pumps market was estimated at USD 55.3 billion in 2024. The market is expected to grow from USD 58 billion in 2025 to USD 90.8 billion in 2034, at a CAGR of 5.1%.

To get key market trends

- The market has grown 37% since 2019, driven by government-led infrastructure and sustainability initiatives across major economies.

- In India, the government has prioritized agricultural modernization and rural water access through programs like PM-KUSUM, which promotes solar-powered water pumps to reduce diesel dependency and enhance irrigation efficiency.

- Additionally, the expansion of sewage treatment plants and desalination facilities under urban development schemes such as the Smart Cities Mission has increased demand for municipal and industrial water pumps.

- In the U.S., the Bipartisan Infrastructure Law has allocated over USD 50 billion to the Environmental Protection Agency (EPA) for upgrading drinking water, wastewater, and stormwater systems. This includes USD 15 billion specifically for replacing lead service lines and USD 11.7 billion for the Clean Water State Revolving Fund, directly stimulating demand for high-capacity and specialized water pumps.

- Similarly, China’s Ministry of Water Resources reported a 94% rural tap water penetration rate in 2024, supported by scaled water supply projects and modernization of irrigation districts. Brazil’s PROGESTÃO and related programs aim to decentralize and strengthen water governance, incentivizing states to invest in water monitoring, treatment, and irrigation infrastructure, all of which rely heavily on pump systems.

- The United Nations Sustainable Development Goal 6 (SDG 6) emphasizes universal access to safe water and sanitation by 2030. As of 2024, 2.2 billion people still lacked safely managed drinking water, and 3.4 billion lacked sanitation. This global shortfall has catalyzed international and national investments in water infrastructure, particularly in developing regions. Water pumps are central to achieving SDG 6 targets, especially in projects involving water reuse, desalination, and wastewater treatment.

- Despite strong policy support, the deployment of water pumps in remote or topographically challenging regions remains constrained by high capital and operational costs. In China, the Ministry of Water Resources acknowledged that the final 10% of rural residents without tap water are located in mountainous and alpine zones where water diversion is technically complex and financially burdensome.

Water Pumps Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 55.3 Billion |

| Market Size in 2025 | USD 58 Billion |

| Forecast Period 2025 - 2034 CAGR | 5.1% |

| Market Size in 2034 | USD 90.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Water scarcity and infrastructure modernization | Accelerated investments in resilient water infrastructure are driving global demand for advanced and energy-efficient pumping systems. |

| Agricultural dominance and pump-driven irrigation | Government-backed irrigation programs in agrarian economies are expanding the deployment of high-capacity and solar-powered pumps. |

| Urbanization and municipal water demand | Rapid urban growth is intensifying the need for municipal water distribution and wastewater management, boosting pump installations in cities worldwide. |

| Pitfalls & Challenges | Impact |

| Regulatory complexity and investment hesitation | Inconsistent water governance and prolonged approval cycles are deterring private investment and delaying pump infrastructure deployment globally. |

| Structural water management challenges | Fragmented water systems and outdated distribution networks are limiting the scalability and efficiency of pump-based solutions in both urban and rural regions. |

| Opportunities: | Impact |

| Integration of renewable energy in pumping systems | The adoption of solar-powered water pumps presents a transformative opportunity for the market, particularly in regions with limited grid access and high diesel dependency. According to the World Bank, solar water pumping systems have become financially and environmentally sustainable due to an 80% drop in solar panel costs and their 25-year lifespan with minimal maintenance. |

| Digitalization and smart water management systems | The rise of digital twins and AI-powered water management platforms is reshaping how water systems are monitored and optimized. As highlighted by the World Economic Forum, digital twins can simulate real-time conditions such as flow rates, temperature, and flood risks enabling predictive maintenance and efficient resource allocation. |

| Market Leaders (2024) | |

| Market Leaders |

1.9 % market share |

| Top Players |

The collective market share in 2024 is 8% |

| Competitive Edge |

|

| Regional Insights | |

| Largest market | Asia Pacific |

| Fastest growing market | Latin America |

| Emerging countries | India, Egypt, Chile, Brazil, Saudi Arabia |

| Future outlook |

|

What are the growth opportunities in this market?

Water Pumps Market Trends

- The integration of IoT, AI, and cloud-based analytics into pump systems is transforming water infrastructure management. Manufacturers are embedding sensors and connectivity features to enable predictive maintenance, remote diagnostics, and real-time performance optimization. For example, Grundfos and KSB have launched smart pump platforms that allow utilities to monitor energy consumption and detect anomalies before failures occur. This trend is driven by the need for operational efficiency and data-driven decision-making in urban and industrial water systems.

- Solar-powered and hybrid pumps are gaining traction, especially in off-grid and rural regions. Governments in India, Kenya, and Bangladesh are subsidizing solar pump installations to reduce diesel dependency and improve irrigation access. This shift is not only environmentally sustainable but also economically viable due to declining solar panel costs and extended pump lifespans. Manufacturers are responding by developing modular, low-maintenance systems tailored for decentralized deployment.

- Emerging economies are increasingly adopting decentralized water systems to address regional disparities in access and resilience. This includes community-level water treatment plants, localized irrigation networks, and emergency water supply systems. Such models require flexible and scalable pump solutions, often customized for terrain, climate, and population density. The trend is supported by multilateral funding and national programs like India’s Jal Jeevan Mission and Brazil’s PROGESTÃO.

- Global disruptions have prompted pump manufacturers to localize production and diversify sourcing strategies. Companies are investing in regional manufacturing hubs and supplier networks to mitigate risks associated with geopolitical tensions, shipping delays, and raw material shortages. For instance, Sulzer has expanded its footprint in Asia and the Middle East to serve local markets more efficiently. This trend enhances responsiveness and reduces lead times, especially for large-scale infrastructure projects.

- With increasing water scarcity and regulatory pressure, industries and municipalities are investing in water reuse technologies. Pumps play a critical role in transporting, treating, and recirculating wastewater for secondary applications. Advanced pump systems are being deployed in desalination plants, zero-liquid discharge facilities, and industrial recycling units. This trend is particularly strong in regions facing acute water stress, such as the Middle East, Southern Europe, and parts of Africa.

Water Pumps Market Analysis

Learn more about the key segments shaping this market

Based on pump type, the market is segmented into centrifugal pumps, submersible pumps, vertical turbine pumps, slurry pumps, and others. In 2024, the centrifugal pumps segment dominated the market and generated a revenue of USD 31.3 billion and is expected to grow at CAGR of around 4.7% during 2025 to 2034.

- Centrifugal pumps are suitable for a wide variety of uses from municipal water supply and wastewater treatment to industrial processes and agricultural irrigation, making them the most adaptable pump type across sectors.

- Their relatively simple design, low maintenance requirements, and cost-effective manufacturing make centrifugal pumps economically attractive for both large-scale infrastructure projects and smaller installations.

- These pumps are ideal for applications requiring continuous, high-volume water movement, such as flood control, desalination, and urban water distribution, where flow rate is a critical performance metric.

- Centrifugal pumps can be easily scaled and configured in series or parallel setups, allowing for flexible deployment in systems with varying pressure and flow requirements.

- Leading manufacturers have enhanced centrifugal pumps with smart sensors, variable frequency drives (VFDs), and energy-efficient motors, aligning them with modern infrastructure needs and sustainability goals.

Learn more about the key segments shaping this market

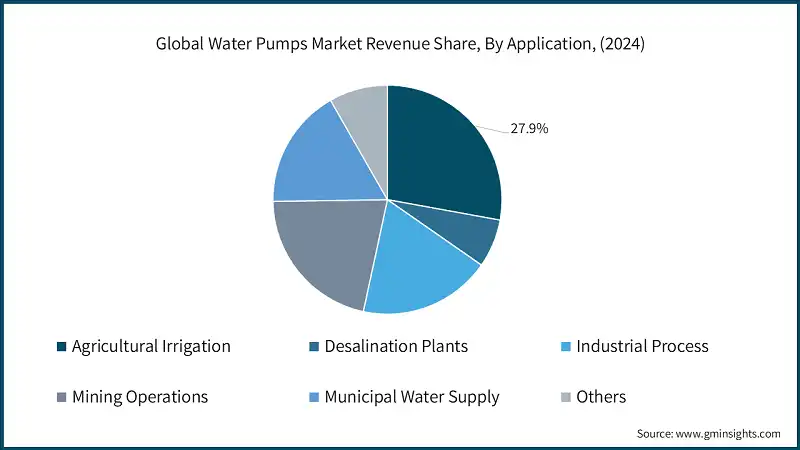

The water pumps market by application is segmented into agricultural irrigation, desalination plants, industrial process, mining operations, municipal water supply, and others. The agricultural irrigation segment was the leading with a revenue of USD 15.4 billion and has a market share of around 27.9% in 2024.

- Countries like India, Kenya, and Bangladesh have heavily subsidized solar and electric water pumps for farmers, making irrigation systems more accessible and affordable across rural regions.

- Agriculture accounts for approximately 70% of global freshwater withdrawals, necessitating continuous and large-volume water movement, an ideal use case for pump-intensive systems.

- The adoption of precision irrigation technologies, such as drip and sprinkler systems, has increased the need for reliable and energy-efficient pumps to maintain consistent pressure and flow.

- Governments and international bodies are investing in pump-based irrigation to mitigate drought risks and ensure food security, especially in climate-vulnerable regions like Sub-Saharan Africa and South Asia.

- Solar-powered pumps are being widely deployed in agricultural settings to reduce diesel dependency and operational costs, aligning with sustainability goals and expanding pump usage in off-grid areas.

Looking for region specific data?

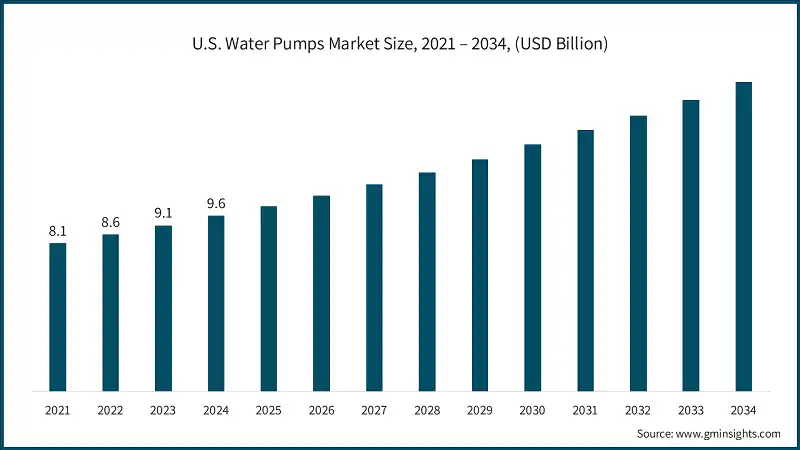

The U.S. water pumps market was valued at around USD 9.6 billion in 2024 and is anticipated to register a CAGR of 5.9% between 2025 and 2034.

- The U.S. is demonstrating robust demand in the market, primarily driven by historic federal investments in water infrastructure.

- Under the Bipartisan Infrastructure Law, the U.S. Environmental Protection Agency (EPA) has been allocated over USD 50 billion the largest federal investment in water infrastructure in American history.

- This funding supports the modernization of drinking water systems, wastewater treatment, and stormwater management across urban and rural communities.

- Notably, USD 15 billion is earmarked for lead service line replacement and USD 11.7 billion for the Clean Water State Revolving Fund, which directly stimulates demand for high-capacity and specialized pump systems.

- Additionally, the U.S. agricultural sector continues to be a major consumer of water pumps, particularly for irrigation. According to the USDA Economic Research Service, irrigation accounted for 42% of the nation’s total freshwater withdrawals, and farms with irrigation contributed to over 54% of the total value of U.S. crop sales, despite irrigated land comprising less than 20% of harvested cropland.

- States like Nebraska and California lead in irrigated acreage, supported by abundant groundwater resources and federal reclamation policies. The shift toward pressurized irrigation systems such as sprinkler and drip technologies has further increased the need for efficient and durable pumps.

Europe witnessed steady demand in the water pumps market with a share of around 16.9% in 2024 and is expected to grow at a robust CAGR of 4.7% during the forecast period.

- Europe is demonstrating steady demand in the water pumps, largely driven by its strategic focus on water resilience and infrastructure modernization.

- The European Commission’s Water Resilience Strategy outlines a comprehensive plan to improve water management across the continent, including restoring water cycles, reducing leakage, and modernizing infrastructure through public and private investment.

- The strategy aims to improve water efficiency by 10% by 2030 and supports the adoption of digital solutions and green infrastructure. Europe’s water industry already generates approximately USD 110 billion annually and supports 1.7 million jobs, with the region holding 40% of global water technology patents.

- Additionally, Europe’s regulatory framework and investment commitments further reinforce market stability. According to the European Commission and OECD, EU member states collectively spend over USD 100 billion annually on water supply and sanitation, with an additional over USD 250 billion in cumulative expenditures required by 2030 to meet compliance with directives such as the Urban Waste Water Treatment Directive (UWWTD) and Drinking Water Directive (DWD).

- The EU is also promoting water reuse as a solution to address drought and water scarcity, with new regulations mandating minimum quality standards for treated wastewater used in agricultural irrigation. These initiatives are creating sustained demand for pumps across municipal, agricultural, and industrial applications, ensuring Europe remains a stable and strategically important market for water pump manufacturers.

Asia Pacific is leading the water pumps market in 2024 with 40.2% market share and is expected to grow at 4.6% during the forecast period.

- Asia Pacific is demonstrating strong demand in the market due to its vast agricultural base and increasing government focus on water-efficient technologies.

- According to the Indian Ministry of Agriculture, over 13 million hectares have been brought under micro-irrigation through the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY), with sprinkler systems playing a key role in field crop irrigation.

- Similarly, China’s Ministry of Water Resources has prioritized modern irrigation infrastructure under its “High-Efficiency Water-Saving Irrigation” initiative, aiming to improve irrigation coverage and reduce water waste in northern provinces. These large-scale programs reflect a regional shift toward sustainable irrigation practices, supported by public funding and policy alignment.

- Asia Pacific is home to some of the fastest-growing urban centers globally. Investments in municipal water supply, wastewater treatment, and smart city infrastructure, especially in Southeast Asia, are driving sustained demand for high-capacity and energy-efficient pumps.

- Regional governments are actively promoting solar-powered and energy-efficient pumps to address water scarcity and reduce carbon emissions.

Water Pumps Market Share

- The top 5 companies in the water pumps industry, such as Grundfos, KSB Group, Sulzer Ltd, WILO SE, and Xylem, hold a market share of 8-10%.

- Grundfos has built its competitive edge through a strong commitment to sustainability, innovation, and digital transformation. Under its Strategy 2025, the company is responding to global megatrends such as climate change and urbanization by investing in energy-efficient and intelligent pump systems. Its diversified product portfolio spans critical applications like desalination, wastewater treatment, and flood control. Grundfos also leverages regional manufacturing hubs and a robust global supply chain to ensure responsiveness to local market needs. The launch of Ignite’27, its new group strategy, further reinforces its ambition to lead in sustainable water solutions and maintain resilience amid rising competition.

- KSB’s Mission TEN30 strategy is a comprehensive roadmap aimed at achieving double-digit profitability by 2030, with a strong focus on operational excellence and digital customer experience. The company has positioned itself as a Fluid-handling know-how Champion, consolidating technical expertise and making it accessible through digital platforms. Its aftermarket division, KSB SupremeServ, plays a pivotal role in customer retention by offering predictive maintenance, spare parts logistics, and lifecycle support. KSB is also expanding into future-oriented sectors such as hydrogen, wind power, and battery manufacturing, while strengthening its presence in the U.S. and China through targeted capacity expansion.

- Sulzer’s strategy centers on cleantech innovation and environmental stewardship, with a strong emphasis on energy transition technologies. The company continuously invests in R&D to develop high-efficiency pumps for complex applications such as carbon capture, desalination, and wastewater recycling. Through Sulzer Ventures, it fosters strategic partnerships and incubates new business models, enabling it to stay ahead of technological shifts. Sulzer’s global R&D footprint and testing capabilities allow for rapid prototyping and customization, which is critical in industries like oil & gas, power generation, and municipal water systems.

Water Pumps Market Companies

Major players operating in the water pumps industry are:

- Baker Hughes Corporation

- Crompton

- Dover Corporation

- Ebara Corporation

- Flowserve

- Grundfos

- ITT Gould Pumps

- JEE Pumps Limited

- KSB Group

- Pentair Corporation

- SPP Pumps

- Sulzer Ltd

- The Weir Group PLC

- WILO SE

- Xylem

Xylem’s strategy is built around solving global water challenges through technology-driven innovation and sustainability. The company offers smart water solutions that integrate IoT, data analytics, and cloud platforms to optimize water usage and infrastructure performance. Xylem collaborates closely with utilities and municipalities to address issues like water scarcity, quality, and affordability. Its multi-year growth strategy includes expanding its digital portfolio, enhancing service capabilities, and entering new markets through strategic acquisitions. This approach positions Xylem as a holistic water technology provider capable of delivering end-to-end solutions.

WILO SE has evolved from a hidden champion to a visible and connected global leader, driven by its focus on digitalization, sustainability, and regional responsiveness 4. The company’s region-for-region strategy ensures localized production and service delivery, enhancing supply chain resilience. WILO is also pioneering the integration of AI into pump systems and infrastructure projects, aligning with its long-term vision of climate-friendly and intelligent water solutions. Its strong presence in emerging markets, combined with strategic partnerships and social impact initiatives, reinforces its brand equity and market adaptability.

Water Pumps Market News

- In June 2025, Panasonic Holdings Corporation announced the development of a new water purification system that integrates a high-performance pump with proprietary filtration technology, aimed at enhancing access to clean water in underserved regions. The system, designed for scalability and energy efficiency, leverages Panasonic’s expertise in fluid control and environmental engineering to support global sustainability goals. This innovation aligns with growing market demand for integrated water solutions and positions Panasonic to contribute meaningfully to infrastructure modernization efforts across emerging economies.

- In April 2025, CG Power and Industrial Solutions launched SmartSENSE, India’s first cordless, float-free automatic water pump controller, marking a significant innovation in domestic water management. Designed for modern Indian households, SmartSENSE eliminates the need for manual wiring and float switches, offering intelligent water level sensing, automatic start-stop functionality, and dry-run protection. With support for multiple tank connectivity and a durable, energy-efficient build, this launch positions CG Power as a frontrunner in smart water control solutions, aligning with the growing demand for sustainable and user-friendly pump technologies across India.

- In June 2025, ITT Goulds Pumps introduced a new line of large double-suction pumps designed for high-efficiency performance in demanding industrial and municipal applications. Engineered to deliver superior hydraulic performance and reduced energy consumption, the new product line supports critical operations such as water distribution, power generation, and wastewater treatment. This launch reflects ITT’s strategic focus on expanding its portfolio of robust, large-scale pumping solutions to meet growing global infrastructure and utility demands.

- In September 2024, KSB Group unveiled a new range of intelligent submersible motor pumps designed specifically for wastewater applications, integrating advanced sensor technology and automated control systems. These pumps offer real-time performance monitoring, energy optimization, and enhanced fault detection, making them ideal for municipal and industrial wastewater treatment facilities. The launch reflects KSB’s strategic focus on digitalization and sustainability, reinforcing its competitive position in the smart water infrastructure segment.

The water pumps market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Pump Type

- Centrifugal Pumps

- Single-stage Centrifugal Pumps

- Multi-stage Centrifugal Pumps

- Submersible Pumps

- Deep Well Submersible Pumps

- Borehole Submersible Pumps

- Sewage & Wastewater Submersible Pumps

- Vertical Turbine Pumps

- Slurry Pumps

- Rubber-Lined Slurry Pumps

- Metal-Lined Slurry Pumps

- Others

Market, By Material

- Cast Iron Pumps

- Stainless Steel Pumps

- Bronze & Brass Pumps

- Composite & Plastic Pumps

- Others

Market, By Water Capacity Range

- Low Capacity Pumps (Up to 100 m³/h)

- Medium Capacity Pumps (100-1,000 m³/h)

- High Capacity Pumps (1,000-5,000 m³/h)

Market, By Power Source

- Electric-Powered Pumps

- Diesel Engine-Driven Pumps

- Solar-Powered Pumps

- Wind-Powered Pumps

- Hydraulic-Powered Pumps

- Others

Market, By Application

- Agricultural Irrigation

- Desalination Plants

- Industrial Process

- Mining Operations

- Municipal Water Supply

- Others

Market, By Distribution Channel

- Direct sales

- Indirect sales

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Question(FAQ) :

Who are the key players in the water pumps market?

Major key players are Baker Hughes Corporation, Crompton, Dover Corporation, Ebara Corporation, Flowserve, Grundfos, ITT Gould Pumps, JEE Pumps Limited, KSB Group, Pentair Corporation, SPP Pumps, Sulzer Ltd, The Weir Group PLC, WILO SE, Xylem.

What are the upcoming trends in the water pumps market?

Key trends include integration of IoT, AI, and cloud-based analytics for predictive maintenance, adoption of solar-powered pumps, decentralized water systems, and supply chain localization strategies.

Which region leads the water pumps market?

Asia Pacific held 40.2% market share in 2024 and is expected to grow at 4.6% during 2025 to 2034, fueled by vast agricultural base and government focus on water-efficient technologies.

What is the growth outlook for the U.S. water pumps market from 2025 to 2034?

The U.S. market is anticipated to register a 5.9% CAGR between 2025 and 2034, supported by historic federal investments in water infrastructure.

What was the valuation of the agricultural irrigation application segment in 2024?

Agricultural irrigation held 27.9% market share and generated USD 15.4 billion in 2024, fueled by government subsidies for solar and electric pumps and precision irrigation technologies.

What is the current water pumps market size in 2025?

The market size is projected to reach USD 58 billion in 2025.

How much revenue did the centrifugal pumps segment generate in 2024?

Centrifugal pumps generated USD 31.3 billion in 2024, dominating the market and expected to grow at around 4.7% CAGR during the forecast period due to their versatility across sectors.

What is the projected value of the water pumps market by 2034?

The water pumps market is expected to reach USD 90.8 billion by 2034, propelled by water scarcity challenges, infrastructure modernization, and integration of renewable energy in pumping systems.

What is the market size of the global water pumps in 2024?

The market size was USD 55.3 billion in 2024, with a CAGR of 5.1% expected through 2034 driven by government-led infrastructure initiatives, agricultural modernization, and urbanization across major economies.

Water Pumps Market Scope

Related Reports