Summary

Table of Content

U.S. Pet Therapeutic Diet Market

Get a free sample of this report

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

U.S. Pet Therapeutic Diet Market Size

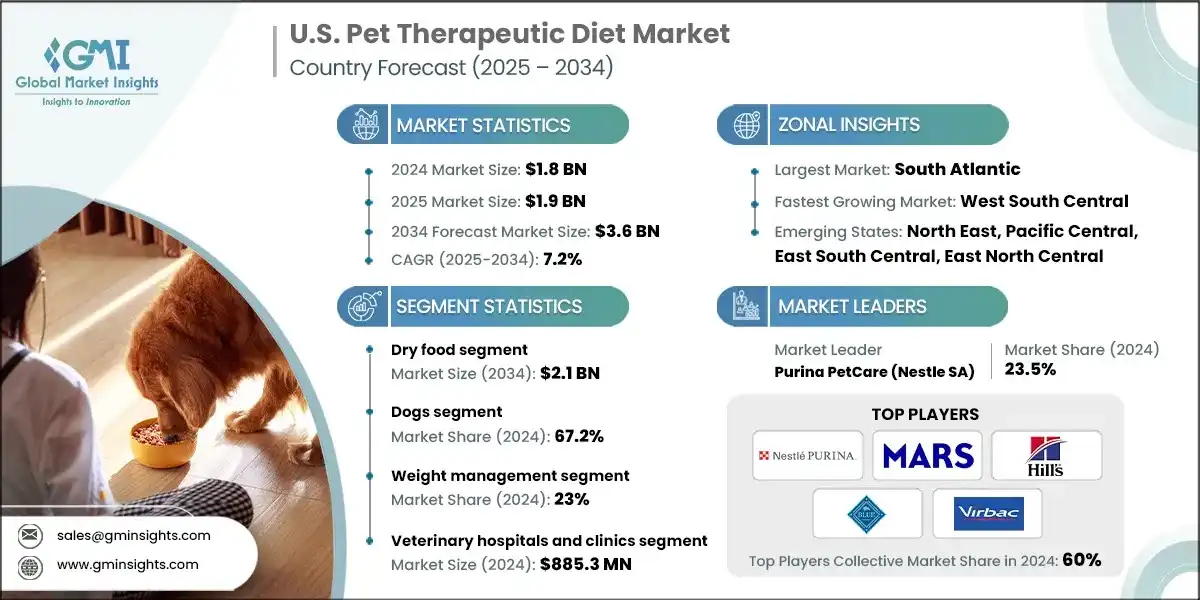

The U.S. pet therapeutic diet market was estimated at USD 1.8 billion in 2024. The market is expected to grow from USD 1.9 billion in 2025 to USD 3.6 billion in 2034, growing at a CAGR of 7.2% during the forecast period, according to the latest report published by Global Market Insights Inc.

To get key market trends

Increased adoption of pet animals such as dogs and cats for companionship and the growing trend of pet humanization has resulted in greater willingness among pet owners to invest in long-term and preventive health solutions. For instance, according to the American Veterinary Medical Association, in 2024, a total of 59.8 million households own a dog, and 42.2 million households own a cat in the U.S. This growing pet population drives the demand for various pet health products, such as therapeutic diets.

Pet therapeutic diet, also known as prescription diet, is specialized pet food designed to be fed to pets with specific health conditions or diseases. They help to treat, prevent, or manage several health conditions such as kidney diseases, diabetes, gastrointestinal issues, skin conditions, and urinary tract issues, among others. Major players such as Mars, Purina PetCare (Nestle SA), Hill’s pet Nutrition (Colgate-Palmolive), and Blue Buffalo (General Mills) collectively hold a dominant share in the U.S. pet therapeutic diet market. These players benefit from strong veterinarian recommendations, brand recognition, and extensive R&D capabilities in order to introduce science-backed therapeutic diets.

The U.S. pet therapeutic diet market witnessed steady growth, growing from USD 1.5 billion in 2021 to USD 1.8 billion in 2023. Between 2021 and 2023, a key trend was increasing adoption of evidence-based nutrition as an adjuvant therapy or sometimes as a first-line therapy. This growing adoption led to advancements in formulation science, such as hydrolyzed and novel proteins, as well as microbiome-supportive fibres, thereby expanding their applicability across various health conditions. Robust regulatory framework further accelerated the growth by ensuring product safety, efficacy and quality, thereby building confidence among the pet owners.

Pet therapeutic diet refers to a feeding regimen that works by meeting specific therapeutic needs, with clinically studied combinations of macronutrients and micronutrients like vitamins, minerals, protein, fats, carbohydrates, antioxidants, fatty acids, and amino acids that positively impact the targeted medical condition.

U.S. Pet Therapeutic Diet Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 1.8 Billion |

| Market Size in 2025 | USD 1.9 Billion |

| Forecast Period 2025 - 2034 CAGR | 7.2% |

| Market Size in 2034 | USD 3.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing pet population and animal healthcare spending | Rising pet ownership and increased spending on animal health are driving demand for therapeutic diets. |

| Rising prevalence of chronic diseases in pets | Conditions like obesity, diabetes, and kidney issues are boosting demand for condition-specific diets, with owners favoring nutrition management over frequent medical treatments. |

| Strong veterinarian endorsement for therapeutic diet | In the U.S., the strong support from veterinarians is accelerating adoption, as their trusted recommendations influence pet owners to choose therapeutic diets for chronic and age-related issues. |

| Growing availability of products through e-commerce and subscription models | Online platforms and subscription models are making therapeutic diets more accessible and convenient, appealing to busy, tech-savvy pet owners. |

| Pitfalls & Challenges | Impact |

| Stringent regulatory requirements | Strict Food and Drug Administration (FDA) and Association of American Feed Control Officials (AAFCO) regulations slow product launches and raise compliance costs, limiting innovation and entry for smaller brands. |

| Increased competition from functional premium pet foods | Functional diets positioned around gut health, skin and coat, urinary care, or mobility often serve as substitutes for mild to moderate conditions, leading many pet owners to opt for these readily available retail or e-commerce products instead of prescribed therapeutic diets. |

| Opportunities: | Impact |

| Rising demand for natural and clean-label products | U.S. pet owners are seeking natural, non-GMO, and transparent formulations, creating room for innovation in clean-label therapeutic diets. |

| Expansion of microbiome-targeted formulations | Advances in gut health research are fueling interest in diets with probiotics and prebiotics that support digestion, immunity, and overall wellness. |

| Market Leaders (2024) | |

| Market Leaders |

23.5% |

| Top Players |

Collective market share in 2024 is 60% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | South Atlantic |

| Fastest Growing Market | West South Central |

| Emerging Country | |

| Future Outlook |

|

What are the growth opportunities in this market?

U.S. Pet Therapeutic Diet Market Trends

- An upward trend in chronic health issues such as obesity, skin hypersensitivities, and digestive disorders in pets is fueling robust growth in the market.

- For instance, according to the 2022 U.S. Pet Obesity Prevalence Survey, 61% of cats and 59% of dogs now fall into the overweight or obese categories, generating significant demand for veterinarian-guided diets that support weight management and overall metabolic health.

- Such increasing prevalence of lifestyle-related conditions is creating significant demand for nutritional formulations specifically designed to manage these conditions.

- The increasing aging pet population further accelerates the growth of this market. For instance, as per Freedonia Group, in the U.S., the share of households with senior dogs increased from 41.6% in 2012 to 53.5% in 2022. This aging pet population is more susceptible to different chronic diseases, thus creating a substantial demand for pet therapeutic diets.

- In addition, pet therapeutic diets are increasingly incorporated with prebiotics, probiotics, and postbiotics designed for improving digestive health and immune health. Thus, these microbiome-supportive formulations help in balancing gut microbiome and digestive functions are gaining traction in the market.

- Furthermore, the rising trend of pet humanization has increasingly changed the perception of pet owners to treat their pets as family members, resulting in higher spending on premium and specialized therapeutic diets.

- This trend has shifted the consumer mindset from “feeding pets” to “nourishing pets”, translating into greater willingness to invest in therapeutic diets for preventive and holistic health.

U.S. Pet Therapeutic Diet Market Analysis

Learn more about the key segments shaping this market

The U.S. pet therapeutic diet market was valued at USD 1.5 billion in 2021. The market size reached USD 1.8 billion in 2023, from USD 1.7 billion in 2022.

Based on the product type, the U.S. market is segmented into dry food, wet/canned food, and other product types. The dry food segment dominated the market with a market share of 58.3% in 2024. Its popularity stems from easy handling, long shelf life, and convenience during feeding compared to wet alternatives. The segment is expected to reach USD 2.1 billion by 2034, growing at a CAGR of 7% during the forecast period.

- High adoption of dry food can be attributed to its advantages, such as easy storage, portion control, and overall handling convenience to pet owners compared to wet and canned food.

- Dry foods have longer shelf life than the wet therapeutic formulations, which further reduces the wastage and allows owners to order in bulk. This practical approach gains the attention of pet owners, further boosting the adoption of dry food.

- These diets are more affordable, which makes them suitable for a broader range of pet owners, particularly those managing chronic conditions necessitating long-term dietary treatment.

- On the other hand, the wet/canned food segment was valued at USD 533.4 million in 2024. The growth of this segment can be attributed to its superior palatability and ease of consumption for pets suffering from dental disease or chewing issues, a common issue in geriatric populations and animals with particular metabolic disorders.

- The higher moisture content in these diets further encourages fluid intake and supports kidney health, broadening the appeal of this segment.

Learn more about the key segments shaping this market

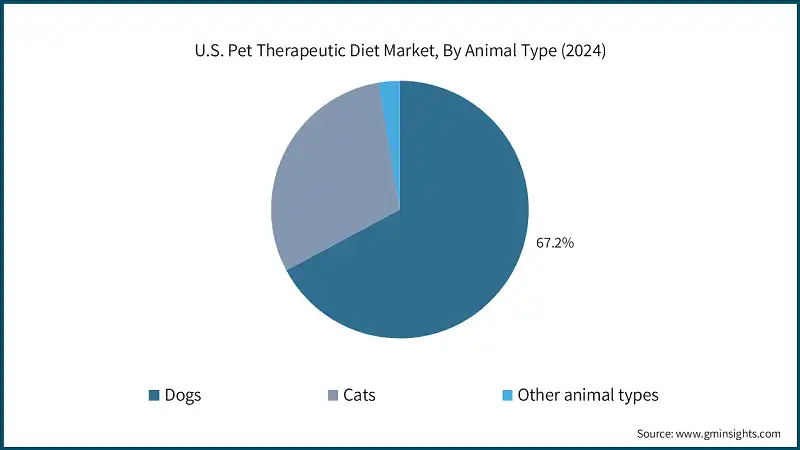

Based on the animal type, the U.S. pet therapeutic diet market is segmented into dogs, cats, and other animal types. The dogs segment accounted for the highest market share of 67.2% in 2024. On the other hand, the cat’s segment is anticipated to grow at a CAGR of 7.6% over the forecast period. Growing adoption of cats as pets is creating a substantial demand for pet foods formulated for cat health.

- The dog population is notably larger than that of cats and other pets, which creates a stronger market for therapeutic nutrition. For example, according to World Population Review, the U.S. is home to about 90 million dogs in 2025, indicating a broad and enduring demand for pet healthcare offerings, including therapeutic diets.

- In addition, dogs face a notably higher incidence of chronic conditions such as obesity, arthritis, kidney disease, digestive disorders, and skin allergies. These health challenges increase the need for specialized diets.

- For example, the Morris Animal Foundation reports that about 14 million adult dogs in the U.S. are living with osteoarthritis, a figure that highlights the immediate need for diets that support joint health and fuels ongoing expansion of the therapeutic food sector.

Based on the health condition, the U.S. pet therapeutic diet market is segmented into renal health, gastrointestinal health, skin and coat health, cardiovascular health, wealth management, joint care, and other health conditions. The weight management segment held the highest market share of 23% in 2024, due to significant increase in the prevalence of obesity in both dogs and cats.

- Pet parents are shifting toward prescription weight-control diets that target calorie moderation and lean tissue preservation over traditional medicines. This increasing trend of adopting weight-management prescription diets drives the growth of this segment.

- These diets achieve weight loss not only by moderating calories but also by providing a carefully calibrated balance of nutrients and high-grade protein to encourage steady and safe reductions in body fat.

- Along with weight and fat loss, these diets provide balanced nutrition enhancing the overall health of the pets, thereby contributing to the significant growth of this segment.

- On the other hand, the gastrointestinal health segment accounted held second largest market share of 20.5% in 2024 and is anticipated to grow at a CAGR of 7% over the forecast period.

- Digestive issues such as vomiting and diarrhea, constipation, food intolerance and allergies, and inflammatory bowel disease are common in pets, especially as they age. Such conditions affect their overall nutrient absorption as well as overall health, leading to discomfort, thus pet owners include such specialized therapeutic diets to effectively manage these conditions.

- The skin and coat segment is anticipated to witness rapid growth at a CAGR of 7.9% during the forecast period.

- Therapeutic diets for skin and coat wellness are fortified with omega-3 and omega-6 fatty acids, zinc, biotin, and premium proteins to promote skin regeneration and shiny coats.

- They are particularly beneficial in treating common dermatological issues such as itching, flaking, dull and dry fur, excessive shedding, and poor coat quality.

- Due to the increasing urbanization, exposure of pets to pollutants and allergens is much higher, thereby driving pet owners to seek such therapeutic diets to address these conditions.

Based on the distribution channel, the U.S. pet therapeutic diet market is segmented into veterinary hospitals and clinics, e-commerce, retail pharmacies, and other distribution channels. The veterinary hospitals and clinics segment accounted for the highest market share in 2024, with a revenue of USD 885.3 million. On the other hand, the e-commerce segment is anticipated to witness rapid growth at a CAGR of 7.8% between 2025 and 2034, driven by convenience and widespread accessibility and availability on online platforms.

- Veterinary hospitals and clinics serve as a primary point of contact for pet owners seeking medical interventions for their pets, making them a major channel responsible for prescribing and recommending therapeutic diets.

- The ability of veterinarians to accurately diagnose and recommend appropriate therapeutic diets as per the specific health requirements of the animals further supports the growth of this segment.

- Thus, the trust in veterinarian’s recommendations and availability of a broader range of both wet and dry therapeutic diets in these facilities contributes to the growth of this segment.

- Moreover, growing awareness of pet health, along with increased adoption of telemedicine and virtual consultations, has contributed to the growing demand for purchasing products virtually without the need to visit veterinary clinics and hospitals, as well as pet stores.

Looking for region specific data?

South Atlantic Pet Therapeutic Diet Market

The South Atlantic zone dominated the U.S. pet therapeutic diet industry with a market share of 23.2% in 2024.

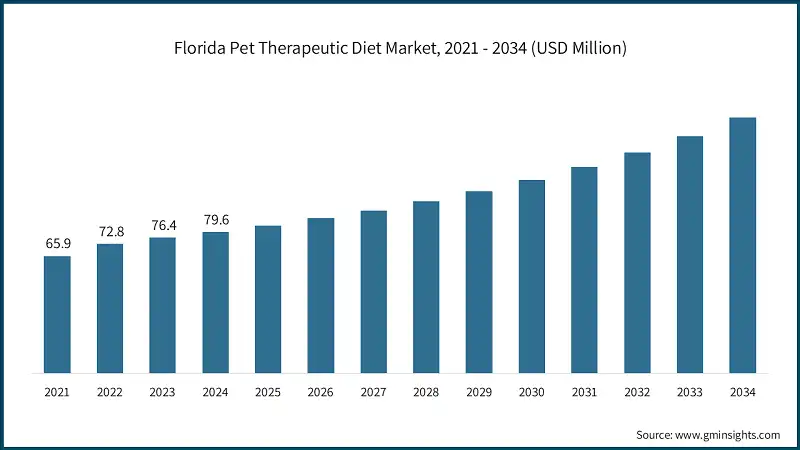

The Florida pet therapeutic diet market was valued at USD 65.9 million and USD 72.8 million in 2021 and 2022, respectively. The market size reached USD 79.6 million in 2024, growing from USD 76.4 million in 2023.

- High pet population in the state, coupled with growing awareness among pet owners, is a key factor contributing to market growth.

- For example, according to Dogster, in Florida, around 5 million households own at least one pet. Similarly, it states that Florida has a household pet ownership rate of 56% of which 39.8% are dog-owning households and 24.2% are cat-owning households.

- This substantial pet population creates a growing demand for pet care products, including pet therapeutic diets to enhance their body functions and manage chronic diseases.

The Georgia pet therapeutic diet market is anticipated to witness considerable growth over the analysis period.

- The Georgia market is growing rapidly due to a well-developed veterinary network, increasing owner awareness of pet well-being, and a heightened incidence of chronic diseases in the animal population.

- Rising disposable income enables owners to invest more in premium nutrition and clinical health solutions, further supporting the growth of this market.

- Public education campaigns and awareness drives led by both government bodies and animal welfare groups have further boosted the adoption of pet therapeutic diets.

The pet therapeutic diet market in the Pacific Central zone of the U.S. was valued at USD 308.2 million in 2024 and is anticipated to witness significant growth over the analysis period.

- The growing adoption of e-commerce platforms in the region supports the growth of this market.

- Additionally, the growing number of aging pet populations prone to chronic diseases drives the demand for age-related health products and nutritional diets to meet the dietary requirements.

- Further, the growing shift towards preventive healthcare and personalized treatment options is fueling the demand for such therapeutic diets.

U.S. Pet Therapeutic Diet Market Share

The U.S. pet therapeutic diet industry is characterized by intense competition with the presence of key players as well as emerging companies. The top 5 players in the market such as Purina PetCare (Nestle SA), Mars, Incorporated, Hill's Pet Nutrition (Colgate Palmolive), Blue Buffalo Company (General Mills), and Virbac accounted for 60% of market share. These players emphasize mergers and acquisitions, partnerships, and collaboration for expanding their business. They leverage strong reputation, extensive R&D capabilities, and a significant distribution network in order to provide science-backed therapeutic diets addressing specific health conditions in pets.

Meanwhile, emerging and specialty brands such as Open Farm, Stella & Chewy’s, Drools Pet Food, JustFoodForDogs, and Diamond Pet Foods are differentiating through transparency in sourcing, customized nutrition plans, and sustainability-driven approaches. This dynamic competitive landscape is shaped by innovation, veterinary partnerships, and growing consumer preference for health-focused diets that enhance pet’s health.

U.S. Pet Therapeutic Diet Market Companies

Few of the prominent players operating in the U.S. pet therapeutic diet industry include:

- Blue Buffalo Company (General Mills)

- Diamond Pet Foods (Schell & Kampeter, Inc.)

- Drools Pet Food

- EmerAid

- Hill's Pet Nutrition (Colgate Palmolive)

- Husse

- JustFoodForDogs

- Mars, Incorporated

- Open Farm

- Purina PetCare (Nestle SA)

- Stella and Chewy’s

- Virbac

- Ziwi Pet

- Purina PetCare (Nestle SA)

Purina leads the U.S. pet therapeutic diet market with a share of 23.5% in 2024, leveraging its strong R&D infrastructure, veterinary partnerships, and consumer trust to deliver diets that combine high therapeutic efficacy with optimal taste and digestibility. Its products are supported by extensive clinical testing, peer-reviewed studies, and continuous innovation in nutrient bioavailability and formulation precision.

- Mars Incorporated

Through its renowned brands, including Royal Canin, the company offers clinically formulated nutritional solutions designed to address a wide range of health conditions such as renal disorders, gastrointestinal sensitivities, dermatological issues, and weight management. Mars integrates cutting-edge R&D, veterinary science, and clinical trials via its Waltham Petcare Science Institute, ensuring evidence-based diet formulations that meet both therapeutic efficacy and palatability standards.

- Hill’s Pet Nutrition (Colgate-Palmolive Company)

Hill’s works closely with veterinarians globally, integrating its solutions into professional practice. The company’s commitment to nutritional precision is supported by collaboration with academic research institutions and pet health networks, enabling the continuous refinement of therapeutic formulations.

U.S. Pet Therapeutic Diet Industry News:

- In June 2025, General Mills announced two new product launches in its North America Pet segment, featuring innovations from Blue Buffalo and Edgard & Cooper. These initiatives are tailored to meet the changing preferences of modern pet parents and are strategically designed to drive growth in the pet nutrition category. By aligning with consumer trends, General Mills strengthened its market position and expanded its revenue potential in the thriving pet food industry.

- In April 2025, Open Farm entered a partnership with Pet Supermarket to broaden the distribution of its pet food products. This collaboration introduced Open Farm’s humanely raised and sustainably sourced offerings to 182 Pet Supermarket locations across the Southeastern U.S. The partnership enhanced the company’s retail footprint in a key regional market, supporting its growth strategy and increasing product accessibility for a wider customer base.

- In January 2025, Pet Food Experts (PFX) announced the addition of Diamond Pet Foods to its brand portfolio, expanding its product offerings in select Pacific Northwest and Mountain Region states. This partnership gives regional pet retailers access to Diamond’s nutritionally balanced pet food lines. The company benefited from this partnership by expanding its distribution reach and gaining stronger access to independent pet retail markets in key U.S. regions.

- In January 2024, Hill's Pet Nutrition announced the launch of new products and enhancements to its leading U.S. vet-recommended therapeutic line, Hill's Prescription Diet, ahead of the NAVC's VMX 2024 conference. This strategic launch reinforced Hill’s position as an innovator in veterinary nutrition, strengthening brand loyalty and expanding its influence within the professional veterinary community.

The U.S. pet therapeutic diet market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 - 2034 for the following segments:

Market, By Product Type

- Dry food

- Wet/canned food

- Other product types

Market, By Animal Type

- Dogs

- Cats

- Other animal types

Market, By Health Conditions

- Renal health

- Gastrointestinal health

- Skin and coat health

- Cardiovascular health

- Weight management

- Joint care

- Other health conditions

Market, By Distribution Channel

- Veterinary hospitals and clinics

- E-commerce

- Retail pharmacies

- Other distribution channels

The above information is provided for the following zones:

- North East

- Connecticut

- Maine

- Massachusetts

- New Hampshire

- Rhode Island

- Vermont

- New Jersey

- New York

- Pennsylvania

- East North Central

- Wisconsin

- Michigan

- Illinois

- Indiana

- Ohio

- West North Central

- North Dakota

- South Dakota

- Nebraska

- Kansas

- Minnesota

- Iowa

- Missouri

- South Atlantic

- Delaware

- Maryland

- District of Columbia

- Virginia

- West Virginia

- North Carolina

- South Carolina

- Georgia

- Florida

- East South Central

- Kentucky

- Tennessee

- Mississippi

- Alabama

- West South Central

- Oklahoma

- Texas

- Arkansas

- Louisiana

- Mountain States

- Idaho

- Montana

- Wyoming

- Nevada

- Utah

- Colorado

- Arizona

- New Mexico

- Pacific Central

- California

- Alaska

- Hawaii

- Oregon

- Washington

Frequently Asked Question(FAQ) :

Who are the key players in the U.S. pet therapeutic diet industry?

Key players include Blue Buffalo Company, Diamond Pet Foods, Drools Pet Food, EmerAid, Hill's Pet Nutrition, Husse, JustFoodForDogs, Mars, Incorporated, Open Farm, Purina PetCare (Nestle SA), Stella and Chewy’s, Virbac, and Ziwi Pet.

What are the upcoming trends in the U.S. pet therapeutic diet market?

Trends include prebiotics, probiotics, postbiotics in pet diets, aging pet population, and a shift toward holistic pet nutrition.

Which region leads the U.S. pet therapeutic diet sector?

Florida leads with a market size of USD 79.6 million in 2024. The growth is led by the state's high pet population and increasing awareness among pet owners.

How much revenue did the dry food segment generate in 2024?

The dry food segment generated approximately 58.3% of the market share in 2024.

What was the valuation of the weight management segment in 2024?

The weight management segment accounted for 23% of the market share in 2024, driven by the rising prevalence of obesity in both dogs and cats.

What is the growth outlook for the cat segment from 2025 to 2034?

The cat segment is anticipated to expand at a CAGR of 7.6% through 2034. This growth is attributed to the increasing adoption of cats as pets and the demand for health-focused cat food.

What is the projected value of the U.S. pet therapeutic diet market by 2034?

The market is poised to reach USD 3.6 billion by 2034, fueled by the growing demand for preventive health solutions and specialized nutritional formulations for pets.

What is the expected size of the U.S. pet therapeutic diet market in 2025?

The market size is projected to reach USD 1.9 billion in 2025.

What is the market size of the U.S. pet therapeutic diet in 2024?

The market size was USD 1.8 billion in 2024, with a CAGR of 7.2% expected through 2034. The market growth is driven by increased pet ownership, rising prevalence of chronic health issues in pets.

U.S. Pet Therapeutic Diet Market Scope

Related Reports