Summary

Table of Content

U.S. Blood Collection Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

U.S. Blood Collection Market Size

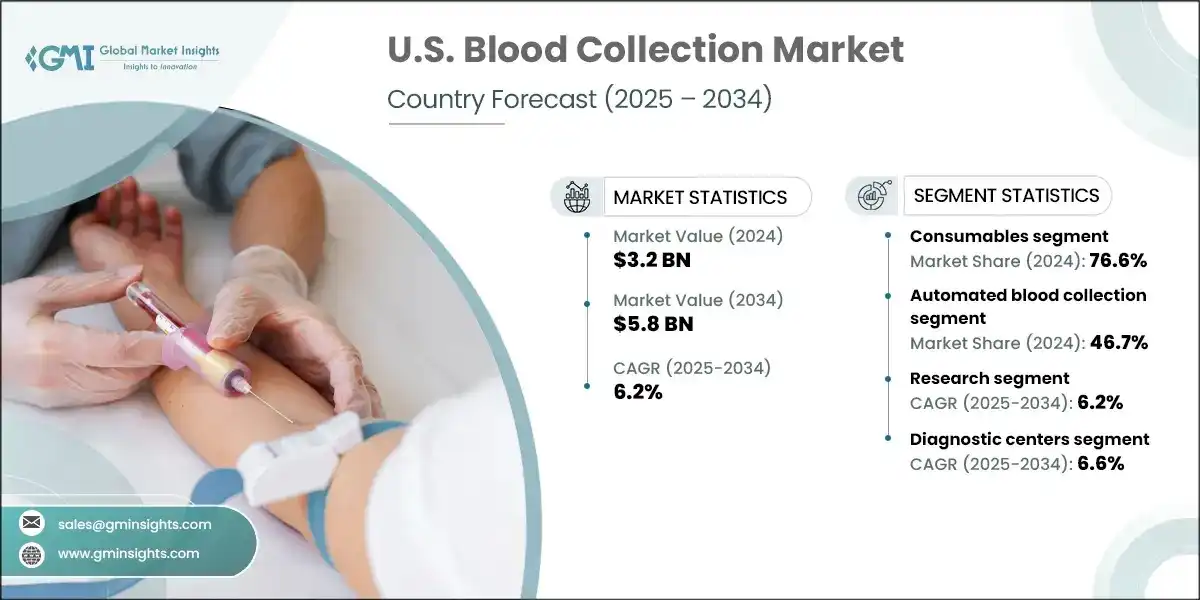

The U.S. blood collection market size was estimated at USD 3.2 billion in 2024. The market is expected to grow from USD 3.4 billion in 2025 to USD 5.8 billion in 2034, growing at a CAGR of 6.2%, according to Global Market Insights Inc. The U.S. blood collection industry is growing steadily, driven by an increase in surgical procedures and advancements in blood collection technologies. Additionally, the rising prevalence of chronic and infectious diseases, such as diabetes, cancer, cardiovascular diseases, tuberculosis, and HIV, is playing a significant role in boosting the market's growth.

To get key market trends

Blood collection devices are essential tools designed to safely and efficiently draw blood samples for diagnostic testing, transfusions, or research. These devices are a critical part of clinical settings and are widely used in hospitals, laboratories, and blood banks across the U.S. Major companies in the U.S. blood collection industry include Becton, Dickinson and Company, Cardinal Health, and McKesson Corporation. The market primarily focuses on devices such as needles, syringes, vacuum blood collection tubes, lancets, and blood collection sets. These devices are designed to prioritize patient comfort, maintain the integrity of samples, and ensure the safety of healthcare professionals.

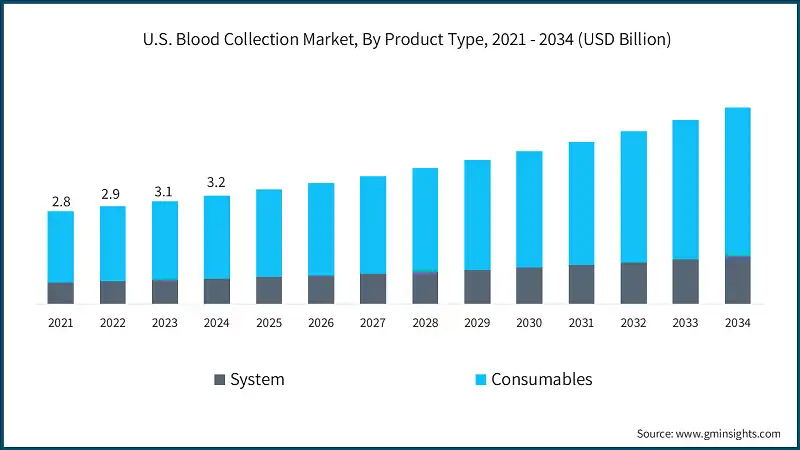

The market increased from USD 2.8 billion in 2021 to USD 3.1 billion in 2023. This growth was fueled by increased government initiatives, awareness campaigns, and a growing elderly population that requires frequent diagnostic tests and medical monitoring. Government programs aimed at strengthening public health infrastructure and encouraging preventive care have significantly increased the demand for blood collection services. At the same time, the aging population in the U.S., which is more prone to chronic conditions such as diabetes, cardiovascular diseases, and cancer has led to a rise in routine blood tests. This has driven the adoption of advanced and safer blood collection devices in healthcare settings.

The increasing demand for blood transfusions is a key driver accelerating the growth of the U.S. blood collection market. Blood transfusions play an important role in managing surgical blood loss, traumatic injuries, and various medical conditions, necessitating the use of sterile needles, blood collection bags, and other specialized devices to ensure safety and efficacy. For instance, according to data from the America's Blood Centers, blood transfusion remains one of the most frequently performed procedures in U.S. hospitals.

Blood transfusion ranks as the second most common procedure among patients over 64 and the fifth among those aged 45–64 in U.S. hospitals, underscoring its critical role in geriatric and middle-aged patient care. Further, in 2021 alone, U.S. hospitals transfused approximately 10.76 million units of red blood cells (RBCs), 2.18 million units of platelets, 2.22 million units of plasma, and 1.25 million units of cryoprecipitate AHF, demonstrating the substantial scale and consistent demand within the blood collection and transfusion ecosystem.

Moreover, the rise in the incidence of chronic and infectious diseases such as HIV, tuberculosis (TB), and others has emerged as a key catalyst driving the growth of the U.S. blood collection market. For instance, according to the data from the Centers for Disease Control and Prevention (CDC), approximately 31,800 people acquired HIV in the U.S. in 2022, and 37,981 individuals aged 13 and older received an HIV diagnosis that same year. These conditions often require frequent blood testing for diagnosis, monitoring, and treatment, thereby increasing the demand for safe and reliable blood collection devices.

Blood collection is the process of collecting blood samples for diagnostic, therapeutic, or research purposes. Depending on the test type and the amount of blood needed, samples are collected using either venous or capillary methods. The process involves various tools and devices, such as needles, syringes, lancets, blood collection tubes, and automated systems, to ensure that samples are collected safely, hygienically, and accurately.

U.S. Blood Collection Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 3.2 Billion |

| Forecast Period 2025 - 2034 CAGR | 6.2% |

| Market Size in 2034 | USD 5.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing incidence of chronic and infectious diseases in U.S. | Drives demand for routine blood testing for conditions such as diabetes, cardiovascular disease, cancer, HIV, and TB, increasing the need for reliable blood collection devices. |

| Rising government initiatives and awareness campaigns | Boosts demand for specialized tubes, micro-containers, and automated collection systems through public health programs and preventive care efforts. |

| Increasing demand for blood transfusions | Sustains high-volume collection needs in hospitals and trauma centers, requiring sterile needles, blood bags, and efficient logistics. |

| Growing geriatric population | Increases demand for minimally invasive, comfort-focused collection tools, especially in home care and long-term care settings. |

| Pitfalls & Challenges | Impact |

| Stringent regulatory challenges | Raises operational complexity for manufacturers. Compliance with sterility, labeling, and traceability standards can delay product development and market entry. |

| Risk of contamination and needlestick injuries | Higher chances of contamination and accidental needle injuries can affect the accuracy of test results, increase the risk of infections for both patients and staff, and drive up healthcare costs especially in busy or understaffed settings where safety protocols may be harder to follow. |

| Opportunities: | Impact |

| Expansion of point-of-care testing | Fuels demand for compact, easy-to-use blood collection devices that support rapid diagnostics in decentralized settings such as clinics, homes, and mobile units. |

| Market Leaders (2024) | |

| Market Leaders |

25% |

| Top Players |

Collective market share in 2024 is 55% |

| Competitive Edge |

|

What are the growth opportunities in this market?

U.S. Blood Collection Market Trends

- With an increasing aging population, there is a growing demand for diagnostic tools to identify age-related conditions, many of which rely on blood testing for accurate diagnosis.

- For example, according to the U.S. Census Bureau, the older population increased from 4.9 million (4.7% of the total U.S. population) in 1920 to 55.8 million (16.8%) in 2020. This represents a nearly 1,000% increase, almost five times the growth rate of the overall population. This demographic shift is significantly boosting the need for advanced blood collection technologies to support age-related diagnostics.

- The expanding geriatric population is a key factor driving the growth of the U.S. market. Aging is closely associated with a higher risk of chronic and age-related illnesses, such as cardiovascular diseases, cancer, diabetes, renal disorders, and neurodegenerative conditions.

- These medical conditions often require regular diagnostic assessments, long-term monitoring, and continuous therapeutic interventions, all of which heavily rely on routine blood testing.

- Additionally, older adults make up a significant proportion of surgical patients, further increasing the demand for efficient blood collection methods. From preoperative diagnostics to intraoperative monitoring and postoperative care, accurate blood sampling is essential for ensuring effective treatment outcomes. Thus, the demand for minimally invasive, patient-friendly, and reliable blood collection devices is rising in both inpatient and outpatient care settings.

U.S. Blood Collection Market Analysis

Learn more about the key segments shaping this market

The U.S. market was valued at USD 2.8 billion in 2021. The market size reached USD 3.1 billion in 2023, from USD 2.9 billion in 2022.

Based on the product type, the U.S. market is segmented into system and consumables. The consumables segment accounted for 76.6% of the market in 2024 due to their precise sample collection and ability to support various types of blood tests. The segment is expected to exceed USD 4.4 billion by 2034, growing at a CAGR of 6.1% during the forecast period. On the other hand, the system segment is expected to grow with a CAGR of 6.6% from 2025 to 2034. The growth of this segment can be attributed to the rising demand for systems that improve efficiency, reduce contamination risks, and enhance patient comfort.

- The consumable segment of the U.S. blood collection market includes a variety of single-use products that are crucial for collecting blood samples safely and effectively. These products, such as blood collection tubes, needles, syringes, lancets, and blood bags, play a key role in laboratory diagnostics, transfusion medicine, and routine health check-ups.

- With chronic diseases such as diabetes, heart conditions, and cancer becoming more common, people are undergoing tests more frequently. This has led to a rise in the use of these essential blood collection products.

- Innovation and safety are driving changes in this segment. Manufacturers are working on creating products with built-in safety features to reduce the chances of needlestick injuries and contamination.

- For instance, BD’s Preset Eclipse syringes come with self-venting membranes and needle-shielding mechanisms, which not only protect users but also ensure the integrity of the blood samples.

- Additionally, as healthcare moves closer to home with the growing popularity of home testing kits and point-of-care diagnostics, there’s a rising demand for consumables that are compact, easy to use, and reliable. This shift is making the consumable segment an essential and rapidly evolving part of the U.S. market.

Based on the method, the U.S. blood collection market is segmented into manual blood collection and automated blood collection. The automated blood collection segment accounted for the market share of 46.7% in 2024.

- The increasing focus on digital integration and process optimization in the U.S. healthcare system is driving the adoption of automated blood collection technologies. These systems are reshaping the blood collection process by incorporating advanced features that improve efficiency, safety, and standardization, especially in high-volume clinical and blood bank environments.

- Automated solutions such as apheresis, component separation, and robotic venipuncture are becoming more common, offering streamlined workflows and greater accuracy.

- For instance, in 2023, about 11.6 million units of whole blood and apheresis red blood cells (RBCs) were collected, while 11.3 million units were transfused in 2021. This highlights the growing shift toward automation in blood collection practices.

- Further, modern automated systems include technologies such as continuous-flow centrifugation, real-time monitoring, and programmable collection parameters. These advancements not only enhance operational performance and reduce procedure times but also improve the overall donor experience. Thus, automation is becoming a significant growth driver in the U.S. market.

Based on application, the U.S. blood collection market is segmented into diagnostics, treatment, and research. The research segment is expected to grow at a CAGR of 6.2% in the forecast period.

- The research segment is playing an increasingly important role in the U.S. market, driven by the growing need for high-quality biological samples in areas such as biomedical, pharmaceutical, and clinical research.

- Blood is one of the most commonly used biospecimens in studies that aim to understand disease mechanisms, discover biomarkers, which is estimated to reach USD 244.8 billion by 2034, develop drugs, and conduct vaccine trials.

- The demand for precise and standardized blood collection methods has grown significantly with the rise of personalized medicine and genomic research. Researchers depend on consistent sample quality to ensure accurate results in advanced molecular analyses, such as DNA/RNA sequencing, proteomics, and metabolomics. This has led to a shift toward advanced blood collection technologies designed to minimize contamination and maintain sample integrity.

- Example of this trend is Project: EveryChild, a pediatric cancer research initiative. By 2022, more than 44,000 children had participated, contributing over 250,000 biospecimens, including blood samples. These samples are driving clinical trials, genomic studies, and long-term research into childhood cancers, emphasizing the critical role blood collection plays in shaping the future of medical research.

Learn more about the key segments shaping this market

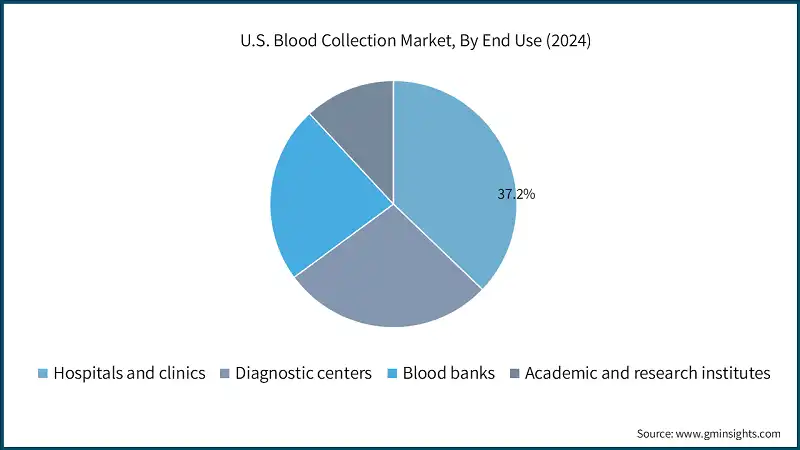

Based on end use, the market is segmented into hospitals and clinics, diagnostic centers, blood banks, and academic and research institutes. The diagnostic centers is expected to grow at a CAGR of 6.6% in the forecast period.

- Diagnostic centers are becoming one of the most essential parts of the U.S. blood collection market. These specialized labs handle a large share of outpatient blood testing, helping doctors make better decisions, monitor diseases, and focus on preventive care.

- The rising number of diagnostic centers across the country is driving up the demand for blood collection products.

- For example, the Centers for Disease Control and Prevention (CDC) reported that as of March 2024, more than 317,000 laboratories were registered under the Clinical Laboratory Improvement Amendments (CLIA) program. These labs range from small physician office labs to large independent testing facilities.

- These numbers highlight the importance of diagnostic centers in managing blood collection and laboratory testing. As the need for faster and more accurate testing grows, these facilities are expected to lead the way in improving blood collection technologies and processes, making them an even more critical part of the U.S. healthcare system.

U.S. Blood Collection Market Share

- The top 5 players, such as Becton, Dickinson, and Company, Fresenius SE & Co, McKesson Corporation, Terumo Corporation, and Cardinal Health collectively held 55% of the market share in the U.S. market. These businesses keep their dominance by combining strong product lines, business alliances, legal clearances, and continuous innovation.

- Cardinal Health plays a vital role in the U.S. market. The company uses its wide distribution network and healthcare logistics expertise to deliver essential consumables and devices efficiently. By providing customized supply chain solutions and personalized blood collection kits, Cardinal Health supports hospitals, diagnostic labs, and public health programs with reliable and timely services.

- In the U.S. blood collection market, companies are focusing on competitive pricing strategies to reach more customers, especially in cost-sensitive areas. At the same time, leading manufacturers are introducing advanced blood collection systems that cater to high-volume sampling while improving patient comfort. New innovations, such as vacuum-based and capillary blood collection devices, now come with enhanced safety features like needle-stick prevention and contamination control, keeping up with modern healthcare standards.

- These advancements are especially important for managing chronic diseases and supporting large-scale diagnostic programs, where frequent and accurate blood sampling is crucial. Additionally, the market is seeing trends such as the rise of high-volume blood collection systems, the use of digital tracking to maintain sample integrity, and the growing popularity of home-based blood collection kits.

U.S. Blood Collection Market Companies

Some of the eminent market participants operating in the blood collection industry include:

- Abbott Laboratories

- Becton, Dickinson, and Company

- Cardinal Health

- Fresenius SE & Co

- Greiner

- Haemonetics Corporation

- McKesson Corporation

- Medline Industries

- Nipro Corporation

- QIAGEN

- Sarstedt AG & Co

- Siemens Healthineers

- Streck

- Terumo Corporation

- Thermo Fisher Scientific

- Cardinal Health

Cardinal Health holds a significant share in blood collection market, through its comprehensive product portfolio. It includes Monoject Blue Stopper Blood Collection Tube, Cardinal Health Monoject Grey Stopper Blood Collection Tube, among others.

- McKesson Corporation

McKesson Corporation has a strong global workforce of approximately 45,000 employees, which enables the company to drive innovation, and deliver high-quality solutions.

- QIAGEN

QIAGEN has a robust geographical presence, which enables it to enhance its market reach. Cardinal Health operates over 25 countries, thus comprising of a strong distribution network.

Blood Collection Industry News

- In December 2024, BD and Babson Diagnostics expanded their fingertip blood collection technology across the U.S. healthcare settings. By integrating BD’s MiniDraw system with Babson’s BetterWay platform, they enabled accurate lab-quality results from just six drops of capillary blood, strengthening BD’s leadership in minimally invasive, patient-centric diagnostics.

The U.S. blood collection market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 -2034 for the following segments:

Market, By Product Type

- System

- Automated systems

- Manual systems

- Consumables

- Venous

- Needles and syringes

- Double-ended needles

- Winged blood collection sets

- Standard hypodermic needles

- Other blood collection needles

- Blood collection tubes

- Serum-separating

- EDTA

- Heparin

- Plasma-separating

- Blood bags

- Other venous products

- Needles and syringes

- Venous

- Capillary

- Lancets

- Micro-container tubes

- Micro-hematocrit tubes

- Warming devices

- Other capillary products

Market, By Method

- Manual blood collection

- Automated blood collection

Market, By Application

- Diagnostics

- Treatment

- Research

Market, By End Use

- Hospitals and clinics

- Diagnostic centers

- Blood banks

- Academic and research institutes

Frequently Asked Question(FAQ) :

Who are the key players in the U.S. blood collection industry?

Key players include Becton, Dickinson and Company, Cardinal Health, McKesson Corporation, Fresenius SE & Co, Terumo Corporation, Abbott Laboratories, Siemens Healthineers, Greiner, Haemonetics Corporation, QIAGEN, Sarstedt AG & Co, Medline Industries, Nipro Corporation, Streck, and Thermo Fisher Scientific.

What is the growth outlook for diagnostic centers from 2025 to 2034?

Diagnostic centers are projected to grow at a 6.6% CAGR during 2025–2034, supported by the increasing number of labs (317,000+ CLIA-registered facilities as of 2024).

Which company leads the U.S. blood collection market?

Becton, Dickinson and Company (BD) led the U.S. blood collection industry in 2024 with a 25% share, leveraging advanced automation and safety-focused devices for hospitals and blood banks.

What was the valuation of automated blood collection in 2024?

Automated blood collection systems held 46.7% of the market share in 2024, valued at about USD 1.5 billion, driven by rising adoption of apheresis, robotic venipuncture, and component separation technologies.

What is the projected value of the U.S. blood collection market by 2034?

The U.S. market is expected to reach USD 5.8 billion by 2034, supported by the demand for transfusions, government healthcare initiatives, and the expanding geriatric population.

How much revenue did the consumables segment generate in 2024?

The consumables segment accounted for 76.6% of the market and generated approximately USD 2.45 billion in 2024, driven by high demand for single-use products like tubes, needles, syringes, and blood bags.

What is the U.S. blood collection market size in 2025?

The U.S. market is projected to reach USD 3.4 billion in 2025, continuing its steady expansion fueled by chronic disease burden, rising blood transfusion demand, and government health initiatives.

What is the market size of the U.S. blood collection in 2024?

The market size was USD 3.2 billion in 2024, with a CAGR of 6.2% expected through 2034, driven by rising surgical procedures, growing chronic disease prevalence, and advancements in blood collection technologies.

U.S. Blood Collection Market Scope

Related Reports