Summary

Table of Content

U.S. Apoptosis Assay Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

U.S. Apoptosis Assay Market Size

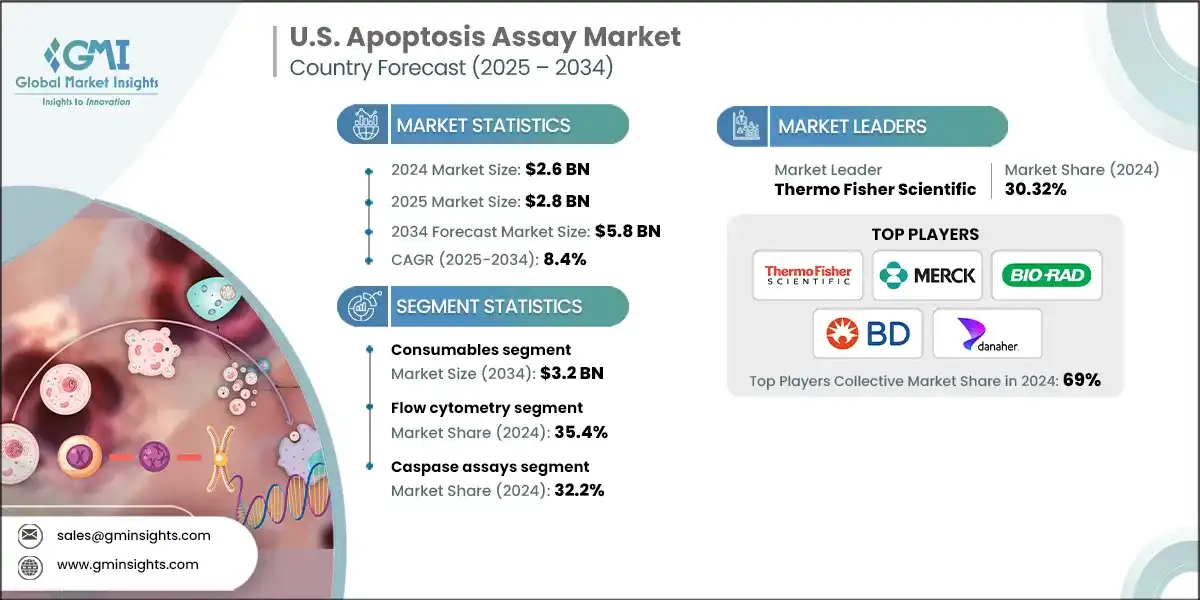

The U.S. apoptosis assay market size was valued at USD 2.6 billion in 2024 and is projected to grow from USD 2.8 billion in 2025 to USD 5.8 billion by 2034, expanding at a CAGR of 8.4% from 2025 to 2034, according to the latest report published by Global Market Insights Inc. The constant rise in the U.S. market for the apoptosis assay is fueled by the growing incidence of chronic diseases and the need for personalized medicine. Advancements in cell analysis equipment, such as high-throughput flow cytometry and image-based assays, are improving accuracy and research efficiency.

To get key market trends

Additionally, growing investment in life science research and increasing use in drug discovery are driving market growth in emerging and developed economies alike. An apoptosis assay is a scientific product utilized for detection and measurement of programmed cell death, for assistance in disease investigation and drug discovery. Some of the larger industry participants include Thermo Fisher Scientific, Danaher, Merck, Bio-Rad Laboratories and Becton, Dickinson and Company.

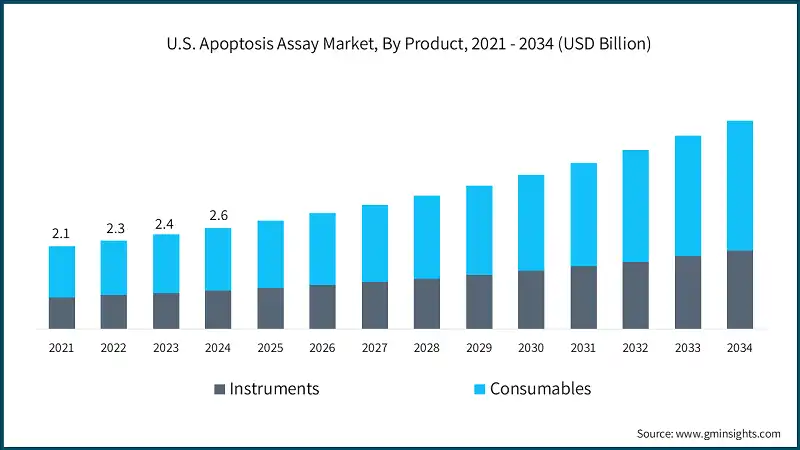

The market increased from USD 2.1 billion in 2021 to USD 2.4 billion in 2023. The growth of apoptosis assay in the U.S. has been spurred mainly by the increasing incidence of chronic diseases, especially cancer, neurodegenerative diseases, and autoimmune diseases. As scientists and pharmaceutical firms focus more on cellular mechanisms involved in disease development and assessing the effectiveness of therapies, apoptosis assays have become crucial tools in both basic and translational research. One of the primary drivers of such demand is the increasing cancer burden nationwide.

In 2022 alone, reports the American Cancer Society, U.S. saw more than 287,000 new invasive breast cancer cases, as well as more than 51,000 ductal carcinoma in situ diagnoses. These numbers highlight the imperative for sophisticated cell-based technology for understanding programmed cell death (apoptosis), a key cancer initiation and response to therapy process. The growing focus on apoptosis-based diagnostics and therapeutic monitoring is part of a larger trend toward precision medicine and targeted cancer treatment within the U.S. healthcare environment.

Growing demand for personalized medicine is providing the apoptosis assay market with a significant boost. Personalized treatment approaches aim to tailor therapies based on a person's genetic makeup, disease classification, and cell behavior, making accurate and early-stage cell analysis more important than ever. Apoptosis assays are also fundamental to this regard since they allow investigators and physicians to discover about how the targeted treatments are processed by specific cells, and especially in cancer, autoimmune, and neurodegenerative disorders.

Some examples include the strategy of customized cancer therapies, whereby much relies on determining if tumor cells are reacting to a candidate drug through apoptosis. This is applied during dosing schedule planning and treatment response predictions. The ability to measure treatment-induced apoptosis at the cellular level enables clinicians to adjust therapies for maximum efficacy and least adverse effects.

Additionally, there has been a notable increase in the geriatric population base across U.S. The U.S. population is older today than ever before. Between 1980 and 2022, the median age rose from 30 to 39 years, and in 2022, 17 states had a median age above 40. According to the U.S. Census Bureau, the number of individuals in the U.S. aged 65 and older is projected to increase from 58 million in 2022 to 82 million by 2050, marking a 47% growth. This age group’s share of the total population is expected to rise from 17% to 23%. This demographic shift is contributing significantly to the growth of the apoptosis assay market.

As individuals age, they become more susceptible to chronic and degenerative diseases such as cancer, Alzheimer’s, Parkinson’s, and cardiovascular conditions—all of which are closely associated with disruptions in programmed cell death. Understanding these cellular mechanisms is critical for developing effective treatments and interventions, and the growing elderly population underscores the need for sophisticated research tools to study cell behavior and therapeutic response.

Apoptosis assays are specialized laboratory tests used to measure programmed cell death a vital biological process that plays a key role in both health and disease. These assays enable researchers to evaluate how cells respond to different treatments and environmental conditions. As a result, they are widely used in medical research and drug development to support the understanding of disease mechanisms and the effectiveness of therapeutic interventions.

U.S. Apoptosis Assay Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 2.6 Billion |

| Forecast Period 2025 – 2034 CAGR | 8.4% |

| Market Size in 2034 | USD 5.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing prevalence of chronic diseases | Fuels demand for apoptosis assays as cancer, neurodegenerative, and autoimmune conditions continue to rise across the U.S., prompting deeper investigation into cellular mechanisms and therapeutic responses |

| Growing need for personalized medicine | Accelerates adoption of apoptosis assays in precision medicine initiatives, particularly within U.S.-based clinical trials, biotech startups, and academic research hubs |

| Technological advancements in flow cytometry | Enhances the speed, sensitivity, and scalability of apoptosis detection, supporting high-throughput screening in leading U.S. pharmaceutical companies and NIH-funded research institutions |

| Rising application in toxicology and drug safety assessment | Strengthens the role of apoptosis assays in preclinical drug development, especially under U.S. FDA regulatory frameworks focused on safety profiling and efficacy validation |

| Pitfalls & Challenges | Impact |

| High cost of advanced technologies | Restricts access to cutting-edge assay platforms for smaller U.S. academic labs and independent research centers, potentially slowing innovation |

| Regulatory and ethical challenges | Delays clinical integration due to stringent U.S. FDA regulations around cell-based assays, patient-derived samples, and data privacy concerns |

| Opportunities: | Impact |

| Rising focus on cancer and neurodegenerative research | Drives increased use of apoptosis assays in the U.S. research institutions focused on biomarker discovery, therapeutic development, and translational medicine, especially in aging-related disease studies |

| Market Leaders (2024) | |

| Market Leaders |

30.32% market share |

| Top Players |

Collective market share in 2024 is 69%. |

| Competitive Edge |

|

| Future outlook |

|

What are the growth opportunities in this market?

U.S. Apoptosis Assay Market Trends

- The U.S. market is changing quickly, driven by national research priorities and industry innovation. Increased funding for cancer and neurodegenerative disease research, along with a strong push towards personalized medicine, is boosting demand for advanced tools to study cell death. Agencies such as the U.S. FDA are also encouraging the use of these assays in drug safety testing, helping expand their role in pharmaceutical and biotech workflows.

- Modern lab technologies such as flow cytometry, valued at USD 4.9 billion in 2022 and is estimated to register over 8.4% CAGR between 2023 and 2032, fluorescence imaging, and luminescence-based assays are now standard in U.S. research labs. These tools help scientists detect early signs of apoptosis with greater precision and consistency. For example, BD Biosciences’ FITC Annexin V Apoptosis Detection Kit is widely used in U.S. labs for flow-based analysis, offering reliable results in high-throughput settings.

- Artificial intelligence is also making a big impact. AI-powered systems now support automated cell analysis, image processing, and predictive modeling, helping labs improve accuracy and save time. Many of these platforms are connected to cloud-based systems, allowing researchers to collaborate remotely and manage long-term data more efficiently. A good example is Bio-Rad’s Image Lab software, which includes AI-assisted tools for analyzing apoptotic markers in Western blot experiments.

- To meet growing demand from universities and commercial labs, leading companies are investing in next-gen reagents, tools compatible with 3D cell cultures, and smart quality control systems. As the U.S. healthcare system continues to focus on early diagnosis and personalized treatment, apoptosis assay platforms are evolving into intelligent lab ecosystems designed for scale, cross-disciplinary use, and data-driven insights.

U.S. Apoptosis Assay Market Analysis

Learn more about the key segments shaping this market

The U.S. market was valued at USD 2.1 billion in 2021. The market size reached USD 2.4 billion in 2023, from USD 2.3 billion in 2022.

Based on the product, the apoptosis assay market is segmented into instruments and consumables. The consumables segment dominated this market in 2024 as a result of the rising incidence of cell-based experiments in academic and pharmaceutical research laboratories. Requirements of reproducible and consistent results have stimulated a massive demand for high-quality reagents, assay kits, and microplates, which are employed regularly across different platforms. This segment was valued at USD 1.4 billion in 2024 and is projected to reach USD 3.2 billion by 2034, growing at a CAGR of 8.5%. The growing need for high-quality reagents, assay kits, and detection consumables for reproducible and scalable, high-throughput apoptosis analysis has fostered expansive growth across pharmaceutical R&D, academic research, and clinical diagnostics. In comparison, the instrument segment, valued at USD 1.18 billion in 2024, is expected to grow to USD 2.6 billion by 2034, with a slightly lower CAGR of 8.3%, supported by rising adoption of automated imaging platforms, integration of AI for real-time data analysis, and expanding applications in drug discovery, toxicology, and personalized medicine across advanced research and clinical laboratories.

- In the U.S., the consumables segment comprising reagents, assay kits, buffers, and microplates remains the backbone of apoptosis assay workflows. These products are indispensable for routine cell death analysis and are extensively utilized in pharmaceutical R&D, academic labs, and clinical diagnostics. Their steady demand is fueled by the need for consistent, reproducible results across both high-throughput and small-scale experiments.

- One of the primary drivers of this segment’s strength is its versatility and compatibility with a wide range of analytical platforms, including flow cytometry, fluorescence microscopy, and spectrophotometry. These consumables are engineered to integrate smoothly with automated systems and multiplexing technologies, helping laboratories boost efficiency while minimizing manual handling errors.

- A notable example is Merck’s Annexin V-FITC Apoptosis Detection Kit (APOAF), which is widely adopted in U.S. labs for its speed and accuracy. This kit uses Annexin V conjugated with FITC to detect phosphatidylserine on the outer membrane of apoptotic cells, enabling clear differentiation between live, early apoptotic, and necrotic cells. The inclusion of propidium iodide (PI) allows dual staining, enhancing specificity and reducing background noise.

- Overall, consumables remain a cornerstone of apoptosis assay workflows in U.S., supporting innovation in assay design and enabling progress in personalized medicine and translational research.

Based on technology, the U.S. apoptosis assay market is segmented into flow cytometry, cell imaging and analysis system, spectrophotometry and other detection technologies. The flow cytometry segment accounted for the highest market share of 35.4% in 2024.

- Flow cytometry still dominates the technology category in U.S. because it can provide quick, detailed, and multi-parameter analysis at the single-cell level. Scientists in U.S. laboratories use this method more than others because of its precision in identifying several stages of apoptosis and its capacity to assess multiple markers in a single run. Its high sensitivity and trustworthiness make it an ideal instrument for both early and late-stage cell death investigations.

- Today's flow cytometry systems are built to withstand high-throughput conditions and feature advanced capabilities such as laser-based detection, automated cell classification, and real-time data visualization. These features are particularly useful in pharmaceutical and clinical research environments, where time and accuracy are paramount. The capability to process high volumes of samples with limited manual intervention assists labs in enhancing productivity and minimizing turnaround times.

- For instance, BD Biosciences' FACSCanto II is popular in U.S. for multi-color analysis. It proves to be efficient in operating with apoptosis detection kits and accommodates automated sample loading and integrated data management, and therefore, is a good option for intricate cell analysis workflows.

- Conversely, the spectrophotometry segment is gaining traction, especially in academic and clinical labs, due to its affordability and ease of use. With a projected CAGR of 8.9%, this technology is becoming popular for routine apoptosis detection. It offers straightforward, quantitative results with minimal sample preparation and works across various assay formats, making it suitable for labs looking for cost-effective and scalable solutions.

Based on the assay type, the U.S. apoptosis assay market is segmented into caspase assays, DNA fragmentation assays, mitochondrial assays, annexin v, and cell permeability assays. The caspase assays segment accounted for the highest market share of 32.2% in 2024.

- In the U.S., caspase assays continue to be the most widely adopted method for detecting programmed cell death, owing to their central role in tracking cellular responses to stress, therapeutic agents, and disease progression. These assays are particularly valuable in fields such as oncology, immunology, and drug discovery, where understanding apoptosis is key to evaluating treatment efficacy and toxicity.

- Designed for high-throughput environments, caspase assays offer features such as luminescent and fluorescent detection, seamless integration with automated platforms, and support for multiplexed analysis. Their ability to deliver rapid, precise results with minimal sample preparation makes them a go-to solution for both pharmaceutical companies and academic research labs.

- A prominent example is Promega’s Caspase-Glo three-sevenths Assay, which is widely used across the U.S. laboratories. Its mix-and-read format simplifies workflows, while the stable luminescent signal enables accurate measurement of caspase activity, helping researchers distinguish between healthy and apoptotic cells with ease.

- At the same time, mitochondrial assays are gaining traction in the U.S. market, driven by growing interest in the role of mitochondrial dysfunction in diseases such as cancer, neurodegenerative disorders, and metabolic conditions. These assays are increasingly being adopted in research focused on uncovering disease mechanisms and developing targeted therapeutic strategies.

Learn more about the key segments shaping this market

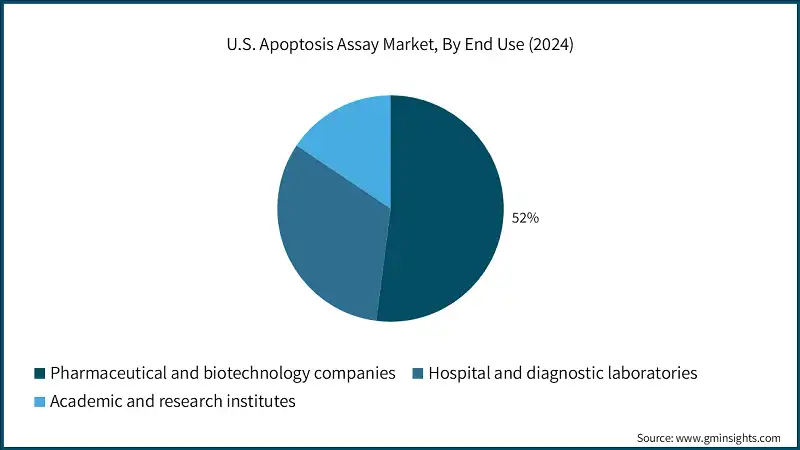

Based on end use, the U.S. apoptosis assay market is segmented into pharmaceutical and biotechnology companies, hospital and diagnostic laboratories, and academic and research institutes. The pharmaceutical and biotechnology companies segment accounted for the highest market share of 52% in 2024.

- In the U.S., pharmaceutical and biotechnology companies represent the largest share of the apoptosis assay market. These organizations depend heavily on apoptosis assays for drug discovery, compound screening, and mechanistic studies, making them key drivers of innovation across therapeutic areas. Their labs typically operate high-throughput workflows, leveraging technologies such as robotic liquid handling systems, Laboratory Information Management Systems (LIMS), and advanced data analytics to streamline operations and accelerate research timelines.

- The rising emphasis on immuno-oncology and neuropharmacology has further expanded the use of apoptosis assays, as understanding cell death is essential for studying immune responses and neurodegenerative conditions. The integration of automation and data-centric platforms has enabled U.S. pharmaceutical labs to enhance productivity, reduce turnaround times, and improve the reliability of experimental outcomes.

- Additionally, growing investments in biopharmaceutical R&D and personalized medicine continue to reinforce the segment’s leadership. Companies are increasingly using apoptosis assays to support targeted therapy development and biomarker validation, solidifying their role as central stakeholders in the evolution of cell-based research technologies.

- Moreover, the hospital and diagnostic laboratories segment, accounting for 32.4% market share in 2024, grew due to the widespread use of apoptosis assays in clinical diagnostics, particularly for cancer and autoimmune conditions. These institutions benefit from high-end laboratory infrastructure, and access to trained clinical personnel, which streamline data interpretation and reporting. The segment also sees high patient volumes and is often involved in state-sponsored screening programs, making it a key setting for routine and specialized apoptosis testing.

U.S. Apoptosis Assay Market Share

- Top companies such as Thermo Fisher Scientific, Danaher, Merck, Bio-Rad Laboratories, and BD (Becton, Dickinson and Company) together account for 69% of the U.S. market. Their strong position is built on continuous product innovation, wide-ranging assay solutions, strategic acquisitions, and well-established distribution networks.

- BD remains a major player in the U.S. apoptosis assay space, offering a variety of tools including Annexin V kits, caspase assays, and advanced flow cytometry systems. Its strength lies in delivering clinical-grade instruments that fit seamlessly into both hospital and research lab environments. BD’s widespread presence in academic and diagnostic labs across the country supports its leadership in cell analysis technologies.

- Smaller companies such as Abcam and Promega are gaining ground by offering affordable, flexible, and AI-ready assay solutions. These firms are meeting growing demand in areas such as personalized medicine, live cell monitoring, and budget-conscious research labs. Their focus on easy-to-use formats and scalable platforms is helping them expand across U.S. laboratories.

- To stay competitive, leading companies are launching next-gen apoptosis assays with better sensitivity, built-in quality checks, and support for 3D cell culture models. The use of AI-based analytics and cloud platforms is changing how labs manage and share data, making research more collaborative and accelerating scientific breakthroughs.

U.S. Apoptosis Assay Market Companies

Few of the prominent players operating in the U.S. apoptosis assay industry include:

- Abcam

- Agilent Technologies

- BD Becton, Dickinson and Company

- Bio-Rad Laboratories

- Biotium

- Danaher

- G Biosciences

- GeneCopoeia

- Merck

- PerkinElmer

- Promega

- Sartorius

- Takara Bio

- Thermo Fisher Scientific

- BD (Becton, Dickinson and Company)

BD offers a strong lineup of apoptosis detection products tailored for both clinical and research use in the U.S. market. Its offerings include Annexin V-FITC kits, caspase assays, and advanced flow cytometry systems. These tools are widely used in hospitals and academic labs due to their clinical-grade reliability and smooth integration with automated lab systems. BD’s focus on multi-parameter analysis and real-time data visualization supports high-throughput screening and detailed cell profiling.

Bio-Rad delivers a broad range of apoptosis assay solutions designed for U.S. research labs. The company emphasizes user-friendly formats, high sensitivity, and compatibility with multiplexed workflows, making its products suitable for both routine and complex cell death studies. Bio-Rad also supports AI-powered image analysis through its Image Lab software, helping researchers accurately quantify apoptotic markers. Its tools are commonly used in academic institutions, pharmaceutical R&D, and clinical testing labs.

Agilent offers a wide range of apoptosis detection solutions designed to meet the needs of U.S. research and clinical labs. Its portfolio includes flow cytometry reagents, TUNEL assay kits, and multiplexed detection systems that support both basic and advanced cell death studies. Agilent’s tools are known for their precision, scalability, and compatibility with automated platforms, making them suitable for high-throughput environments. The company also emphasizes data quality and reproducibility, supporting applications in oncology, immunology, and neurobiology. With strong integration across imaging, cytometry, and molecular analysis workflows, Agilent continues to be a trusted partner for U.S. labs focused on translational and personalized research.

U.S. Apoptosis Assay Industry News:

- In August 2024, Bio-Rad Laboratories launched its Annexin V StarBright conjugates for apoptosis detection via flow cytometry. These reagents were designed to offer brighter fluorescence and improved resolution, enabling researchers to detect apoptotic cells more precisely. The launch enhanced Bio-Rad’s flow cytometry portfolio and supported high-performance, multi-color cell analysis in cancer and immunology research.

The U.S. apoptosis assay market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 - 2034 for the following segments:

Market, By Product

- Instruments

- Consumables

- Kits and reagents

- Microplate

- Other consumables

Market, By Technology

- Flow cytometry

- Cell imaging and analysis system

- Spectrophotometry

- Other detection technologies

Market, By Assay Type

- Caspase assays

- DNA fragmentation assays

- Mitochondrial assays

- Annexin V

- Cell permeability assays

Market, By End Use

- Pharmaceutical and biotechnology companies

- Hospital and diagnostic laboratories

- Academic and research institutes

Frequently Asked Question(FAQ) :

Who are the key players in the U.S. apoptosis assay market?

Key players include Thermo Fisher Scientific, Danaher, Merck, Bio-Rad Laboratories, BD (Becton, Dickinson and Company), Agilent Technologies, Promega, Abcam, Sartorius, PerkinElmer, Takara Bio, G Biosciences, GeneCopoeia, and Biotium.

Which end-use segment led the U.S. apoptosis assay industry in 2024?

Pharmaceutical and biotechnology companies held the largest share at 52% in 2024, using apoptosis assays extensively in drug discovery, biomarker validation, and precision medicine.

Which assay type dominates the U.S. apoptosis assay market?

Caspase assays dominated in 2024 with a 32.2% share, widely adopted for tracking cellular stress, drug response, and disease progression.

What was the valuation of the instruments segment in 2024?

The instruments segment was valued at USD 1.18 billion in 2024, supported by rising adoption of automated imaging systems and AI integration.

What is the growth outlook for spectrophotometry technology from 2025 to 2034?

Spectrophotometry is projected to grow at a CAGR of 8.9% through 2034, gaining traction in U.S. academic and clinical labs due to its affordability and ease of use.

What is the projected value of the U.S. apoptosis assay market by 2034?

The U.S. market is expected to reach USD 5.8 billion by 2034, expanding at a CAGR of 8.4% from 2025 to 2034.

How much revenue did the consumables segment generate in 2024?

The consumables segment, including reagents, assay kits, and microplates, generated USD 1.4 billion in 2024, leading the market with high demand across pharmaceutical R&D and clinical diagnostics.

What is the market size of the U.S. apoptosis assay in 2024?

The market size was USD 2.6 billion in 2024, driven by rising chronic disease prevalence, demand for personalized medicine, and technological advancements in flow cytometry and imaging assays.

What was the U.S. apoptosis assay market size in 2025?

The market size reached USD 2.8 billion in 2025, reflecting sustained demand for advanced cell analysis tools in cancer, neurodegenerative, and autoimmune disease research.

U.S. Apoptosis Assay Market Scope

Related Reports