Summary

Table of Content

U.S. and Europe Endodontics Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

U.S. & Europe Endodontics Market Size

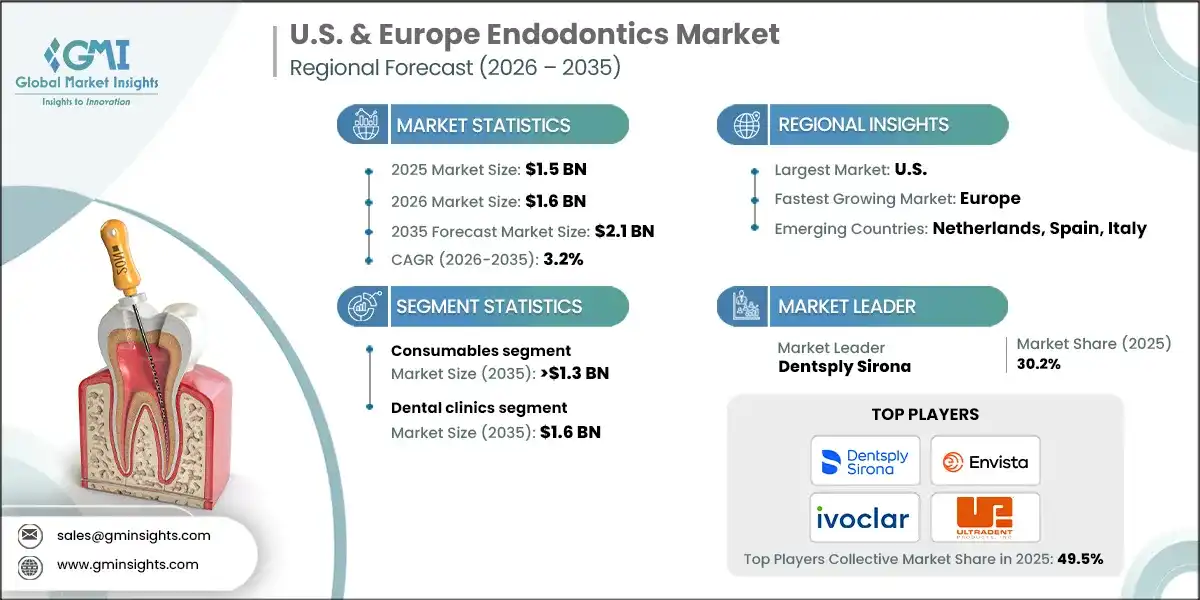

The U.S. & Europe endodontics market was valued at USD 1.5 billion in 2025. The market is expected to reach from USD 1.6 billion in 2026 to USD 2.1 billion in 2035, growing at a CAGR of 3.2% during the forecast period, according to the latest report published by Global Market Insights Inc. The high market growth is attributed to the high prevalence of dental caries and root canal procedures, technological innovations in endodontic devices, growth of dental service organizations (DSOs), among other contributing factors.

To get key market trends

Endodontics is a dental specialty that deals with the detection and treatment of diseases of the dental pulp and tissues around the tooth. It mainly includes the practice of root canal therapy to save a patient's natural teeth. The goal of the specialty is to remove the infection, alleviate the pain, and keep the tooth functional for a long time.

The major players in the U.S. & Europe endodontics market are Dentsply Sirona, Envista, Ivoclar, and Ultradent Products. These firms keep their competitive position through continuous product innovation, worldwide market presence, and hefty investment in research and development.

The market has increased from USD 1.2 billion in 2022 and reached USD 1.3 billion in 2024, with the historic growth rate of 7.4%. The market growth was driven by rising procedure volumes, rapid adoption of advanced endodontic technologies, and increasing investments in modern dental clinics and specialist practices across both regions.

Moreover, high rates of dental decay and pulp-related conditions in both regions continue to drive steady demand for root canal treatments. According to the World Health Organization (WHO), as of 2022, approximately 2.3 billion people globally suffer from dental caries in permanent teeth, with a significant share reported in these markets.

Additionally, the ageing population with higher restorative needs further broadens the patient base. For example, the United Nations reported in 2023 that the U.S. and Europe population aged 65 and older is growing at an annual rate of 3%, increasing the number of patients requiring endodontic care. As a result, demand for files, obturation materials, and endodontic instruments remains consistently strong.

Furthermore, the rise of DSOs in the U.S. and the consolidation of dental practices in Europe enhance standardized adoption of advanced endodontic tools. Larger networks enable bulk procurement, faster technology integration, and uniform treatment protocols. This boosts market penetration of high-value endodontic systems.

U.S. and Europe Endodontics Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 1.5 Billion |

| Market Size in 2026 | USD 1.6 Billion |

| Forecast Period 2026 - 2035 CAGR | 3.2% |

| Market Size in 2035 | USD 2.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing prevalence of dental diseases | Rising cases of caries and pulp inflammation continue to sustain procedure volumes across both regions. This directly boosts demand for endodontic files, rotary systems, and obturation materials. |

| Technological advancements in endodontic instruments | Innovations such as rotary NiTi systems, cone-beam CT, and enhanced irrigation devices are improving treatment efficiency and driving higher adoption rates. This accelerates replacement cycles and premium product sales in both markets. |

| Rising awareness towards oral hygiene and growing dental tourism | Higher emphasis on preventive care and early diagnosis increases treatment uptake, supporting stable market growth. Europe also benefits from intra-regional dental tourism, funneling additional patients to endodontic practices. |

| Pitfalls & Challenges | Impact |

| High risk associated with root canal treatment | Concerns about treatment failure, post-operative discomfort, or tooth fracture can deter some patients from undergoing procedures. This reduces case acceptance rates and slows potential market expansion. |

| Cost barriers to dental care | Out-of-pocket expenses, limited insurance coverage, and pricing pressure in public dental systems restrict access to endodontic services. These financial constraints particularly affect uptake of advanced or premium endodontic instruments. |

| Opportunities: | Impact |

| Growth in endodontic microsurgery and regenerative endodontics | Rising clinical adoption of minimally invasive microsurgical techniques and biologically driven therapies will create demand for advanced instruments, biomaterials, and imaging systems. These innovations are expected to expand high-value product segments and open new revenue streams for manufacturers. |

| Expansion of DSO-led investments in specialty services | Increasing consolidation and specialty expansion by DSOs will accelerate standardized endodontic service offerings and drive bulk procurement of endodontic devices. This will enhance market penetration for premium tools and consumables across larger, multi-clinic networks. |

| Market Leaders (2025) | |

| Market Leaders |

30.2% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | U.S. |

| Fastest growing market | Europe |

| Emerging countries | Netherlands, Spain, Italy |

| Future outlook |

|

What are the growth opportunities in this market?

U.S. & Europe Endodontics Market Trends

The market is growing considerably with the shift toward minimally invasive and conservative endodontics, rapid integration of digital dentistry and AI-assisted diagnostics, rising adoption of single-visit root canal treatments, and growth of endodontic retreatments and re-RCT procedures, among other factors collectively driving industry growth.

- Clinicians are progressively choosing minimally invasive access designs, advanced rotary files, and precision obturation systems to preserve as much tooth structure as possible. This trend is mainly influenced by better clinical outcomes, less post-operative pain, and longer-term tooth survival. Consequently, it is pushing the demand for premium file systems, irrigants, and sealing materials.

- Improved file designs, better irrigation systems, and efficient obturation devices are allowing clinicians to finish procedures in a single appointment. This trend leads to higher patient satisfaction and less clinic chair-time. It also results in increased usage of advanced consumables and high-speed rotary instrumentation.

- Additionally, the bioceramic sealers, putties, and repair materials are gaining strong acceptance due to superior biocompatibility, sealing ability, and ease of use. Their rising adoption is reshaping obturation protocols and standardizing advanced sealing techniques. Manufacturers are expanding bioceramic-based product portfolios to meet this demand, thereby sustaining market growth.

U.S. & Europe Endodontics Market Analysis

Learn more about the key segments shaping this market

Based on the type, the U.S. & Europe endodontics market is segmented into consumables and instruments. The consumables segment has asserted its dominance in the market by securing a significant market share of 61.5% in 2025 owing to their high procedural usage, frequent replacement cycles, and the continuous demand for files, sealers, obturation materials, and irrigation solutions across routine endodontic treatments. The segment is expected to exceed USD 1.3 billion by 2035, growing at a CAGR of 3% during the forecast period.

On the other hand, the instruments segment is expected to grow with a CAGR of 3.6%. The growth of this segment is driven by rising adoption of advanced rotary systems, enhanced imaging technologies, and increasing clinical preference for precision-focused tools that improve treatment efficiency and outcomes.

- The consumables segment continues to dominate the market. Consumables such as files, irrigants, obturation materials, and sealers are the necessities for each RCT, thus, they are the main sources of recurring and high-volume demand. The U.S. and Europe are performing millions of procedures on a yearly basis, which is the main reason for the continuous consumption. This dependency on the procedure makes consumables the largest revenue contributor.

- Moreover, clinicians are shifting toward rotary NiTi files, heat-treated alloys, and single-use file systems for enhanced safety and efficiency. Single-use adoption reduces cross-contamination risks and simplifies workflow. This trend significantly boosts unit volumes of consumables, unlike reusable instruments.

- The instruments segment held a revenue of USD 573.3 million in 2025, with projections indicating a steady expansion at 3.6% CAGR from 2026 to 2035. Rising demand for minimally invasive procedures is pushing clinicians toward precision-focused instruments that enhance control and reduce chair time.

- Additionally, growing investments by dental clinics and DSOs in upgrading equipment to improve workflow and patient outcomes is further accelerating instrument adoption.

Learn more about the key segments shaping this market

Based on end use, the U.S. & Europe endodontics market is classified into dental clinics, hospitals, and other end users. The dental clinics segment dominated the market with a revenue share of 75.3% in 2025 and is expected to reach USD 1.6 billion within the forecast period.

- Patients are progressively choosing root canal treatment to keep their natural teeth rather than going for extraction or dental implants. This development is motivating clinics to broaden their endodontic treatment offerings and to implement cutting-edge technologies. The increase in the number of procedures directly leads to the growth of clinic revenue.

- In addition, dental clinics are purchasing rotary NiTi files, apex locators, CBCT imaging, and digital microscopes to elevate the precision of the treatment. Advanced devices make it possible to have shorter procedures, higher success rates, and better patient satisfaction. The use of technology revitalizes the clinic's reputation and enhances its competitive position in the market.

- The hospitals segment accounted for significant revenue in 2025 and is anticipated to grow at a CAGR of 2.9% over the forecast period. Hospitals are increasingly investing in advanced endodontic equipment to provide comprehensive dental care alongside general healthcare services. Additionally, rising patient inflow for complex or emergency endodontic procedures drives demand for specialized instruments and materials within hospital settings.

Looking for region specific data?

U.S. Endodontics Market

The U.S. endodontics market was valued at USD 690.3 million and USD 724.8 million in 2022 and 2023, respectively. The market size reached USD 863.6 million in 2025, growing from USD 785.9 million in 2024, and is anticipated to grow at a CAGR of 2.6% between 2026 to 2035.

- The market for endodontics is largely being propelled by increasing consumption of dental services in the U.S. For example, as per the American Dental Association 2024 study, approximately 45% of the U.S. population were estimated to have visited a dentist in 2022, which is higher compared to 2021. Even though 51% of seniors and 52% of children had dental visits in 2022, only 40% of adults aged 19–64 went to a dentist.

- Growing preference for tooth preservation over extraction is further boosting demand for endodontic procedures such as root canals, retreatments, and dental microsurgery. As more patients seek conservative treatments, the demand for high-quality endodontic instruments and materials rises correspondingly.

- Additionally, dental service organizations (DSOs) are aggressively merging practices, standardizing protocols, and buying equipment in bulk. This network-driven strategy facilitates the rapid uptake of contemporary endodontic instruments and consumables, as well as the dissemination of advanced technologies to numerous clinics, thereby increasing market penetration.

Europe Endodontics Market

Europe endodontics market accounted for USD 626.7 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- Europe’s endodontics market is experiencing robust growth, driven by several interlinked factors that create a favourable environment for increased demand and technological adoption. The high prevalence of oral diseases particularly dental caries, tooth decay, and periapical problems generates significant demand for root canal treatments and related endodontic care.

- According to the World Health Organization (WHO), as many as 50.1% of adults in Europe have experienced major oral diseases in recent years, highlighting the need for systematic endodontic interventions.

- Strong clinician infrastructure and the growing number of dental professionals further support service capacity. Europe hosts a large, skilled dental workforce and an established network of dental clinics and hospitals, particularly in Western Europe, enabling better treatment accessibility and adoption of advanced endodontic technologies, which drives regional market growth.

U.S. & Europe Endodontics Market Share

The markets are highly competitive and moderately consolidated, with several global and regional players vying for market share. Companies focus on innovation, product differentiation, and strategic partnerships to strengthen their position. Continuous advancements in rotary file systems, obturation materials, apex locators, and digital endodontic technologies drive competitive dynamics, while established distribution networks ensure wide product availability across clinics and hospitals. Key players include Dentsply Sirona, Envista, Ivoclar, and Ultradent Products, collectively accounting for 49.5% of the total market share.

Market participants increasingly adopt strategies such as mergers and acquisitions, product launches, and expansion into emerging markets to maintain growth. Investment in R&D is critical, particularly for bioceramic materials, single-use instruments, and AI-assisted diagnostic tools.

Additionally, companies focus on strengthening relationships with dental service organizations (DSOs) and large group practices to secure long-term supply contracts. Regional players also leverage cost-effective solutions and localized services to compete effectively, especially in Europe’s diverse healthcare environment.

U.S. & Europe Endodontics Market Companies

A few of the prominent players operating in the U.S. & Europe endodontics industry include:

- Brasseler USA

- COLTENE

- Dental Perfect

- Dentsply Sirona

- DiaDent

- EdgeEndo

- Envista

- Essential Dental Systems

- FKG Dentaire SA

- HuFriedyGroup

- Ivoclar

- MANI

- Pac-Dent

- Septodent

- Ultradent Products

- Dentsply Sirona

Dentsply Sirona offers a comprehensive endodontic portfolio, including rotary systems, obturation materials, and digital imaging solutions. Its strong global brand presence and integration with digital dentistry workflows enhance procedural efficiency and clinician trust, driving adoption across both U.S. and European markets.

Envista leverages its Kerr and Ormco brands to provide high-quality endodontic instruments and consumables. Continuous innovation in rotary systems and irrigation solutions, combined with strong clinician loyalty, positions the company as a preferred choice for both routine and complex procedures.

Ivoclar focuses on advanced dental materials and biomaterials for endodontic and restorative procedures. Its emphasis on research-driven, predictable clinical outcomes and material quality differentiates it in Europe and the U.S., particularly for regenerative and minimally invasive treatments.

U.S. & Europe Endodontics Industry News:

- In September 2025, Pac-Dent, the manufacturer of Rodin dental 3D printing resins, announced the acquisition of Taiwan-based 3D printing supplier Ackuretta Technologies. This acquisition strengthens Pac-Dent’s global positioning by expanding its ability to deliver integrated 3D printing solutions to dental clinicians and laboratories worldwide.

- In October 2024, HuFriedyGroup, a global provider of high-quality dental products, acquired SS White Dental, a leading manufacturer of carbide and diamond burs, endodontic instruments, and laboratory tools. The acquisition enhances HuFriedyGroup’s clinically differentiated product portfolio and supports its global manufacturing and distribution capabilities.

- In Jan 2021, Dentsply Sirona completed the acquisition of Datum Dental, Ltd., the developer of the OSSIX biomaterial portfolio. Datum Dental is recognized for its GLYMATRIX technology used in dental regeneration. The acquisition integrates innovative biomaterial solutions into Dentsply Sirona’s portfolio, enhancing clinical outcomes in implant dentistry and oral care.

The U.S. & Europe endodontics market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2022 – 2035 for the following segments:

Market, By Type

- Consumables

- Files and shaper

- Obturation materials

- Solutions and lubricants

- Other consumables

- Instruments

- Motors

- Apex locator

- Endodontic scalers

- Machine assisted obturation system

- Other instruments

Market, By End Use

- Dental clinics

- Hospitals

- Other end use

The above information is provided for the following regions and countries:

- U.S.

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

Frequently Asked Question(FAQ) :

Who are the key players in the U.S. & Europe endodontics market?

Prominent players include Brasseler USA, COLTENE, Dental Perfect, Dentsply Sirona, DiaDent, EdgeEndo, Envista, Essential Dental Systems, FKG Dentaire SA, HuFriedyGroup, Ivoclar, and MANI.

Which factors are driving the growth of the U.S. & Europe endodontics market?

Key factors include the shift toward minimally invasive endodontics, the integration of digital dentistry and AI diagnostics, the rise in single-visit root canal treatments, and the increasing demand for endodontic retreatments and re-RCT procedures.

What was the revenue share of the dental clinics segment in 2025?

The dental clinics segment dominated the market with a revenue share of 75.3% in 2025 and is projected to reach USD 1.6 billion during the forecast period.

What was the market size of the U.S. & Europe endodontics market in 2025?

The market size was valued at USD 1.5 billion in 2025, with a CAGR of 3.2% expected through 2035, driven by the high prevalence of dental caries, technological advancements in endodontic devices, and the growth of dental service organizations (DSOs).

What was the size of the U.S. endodontics market in 2024?

The U.S. endodontics market was valued at USD 785.9 million in 2024 and is projected to grow at a CAGR of 2.6% from 2026 to 2035.

How much revenue did the consumables segment generate in 2025?

The consumables segment accounted for 61.5% of the market share in 2025, generating significant revenue due to high procedural usage and frequent replacement cycles. It is expected to exceed USD 1.3 billion by 2035.

What is the projected value of the U.S. & Europe endodontics market by 2035?

The market is expected to reach USD 2.1 billion by 2035, fueled by the adoption of minimally invasive procedures, digital dentistry, and AI-assisted diagnostics.

U.S. and Europe Endodontics Market Scope

Related Reports