Summary

Table of Content

Topological Insulator Materials Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Topological Insulator Materials Market Size

The global topological insulator materials market was valued at USD 64.6 million in 2024. The market is expected to grow from USD 71.6 million in 2025 to USD 180.5 million in 2034, at a CAGR of 10.8%, according to latest report published by Global Market Insights Inc.

To get key market trends

- Topological insulator materials represent a revolutionary class of quantum materials that exhibit unique electronic properties—behaving as electrical insulators in their bulk while conducting electricity on their surfaces or edges through topologically protected surface states. These materials are characterized by strong spin-orbit coupling and band inversion that creates metallic surface states immune to backscattering from non-magnetic impurities, enabling dissipationless charge transport. The primary material families include bismuth-based compounds (BiSe, BiTe), antimony-based compounds (SbTe), quaternary alloys (BiTeSe, BiSbTeSe), magnetically doped variants (Cr-doped, V-doped topological insulators exhibiting quantum anomalous Hall effect), and engineered heterostructures combining topological insulators with superconductors or magnetic materials. These materials enable unprecedented control over electron spin, support Majorana fermion states critical for topological quantum computing, and provide platforms for exploring exotic quantum phenomena with practical device applications.

- The quantum computing revolution serves as the primary catalyst for market expansion. Topological insulators provide the material foundation for topological quantum computers, which promise inherent error correction through topologically protected qubits based on Majorana zero modes. According to quantum technology roadmaps published by government agencies including the U.S. National Quantum Initiative and the European Quantum Flagship program, topological approaches represent one of the most promising pathways to scalable, fault-tolerant quantum computation. Major technology companies and research institutions have invested billions in quantum computing infrastructure, with topological materials playing a critical role in next-generation qubit architectures. The global quantum computing market's rapid expansion—projected to reach tens of billions by 2030 according to industry analyses—directly drives demand for high-purity topological insulator materials with precisely controlled properties.

- Topological insulators bridge fundamental physics and practical technology, representing the commercialization of topological quantum phenomena discovered through theoretical physics and experimental condensed matter research. Since the experimental confirmation of three-dimensional topological insulators in 2008-2009, the field has rapidly progressed from academic curiosity to material commercialization. The unique properties of topological surface states—including spin-momentum locking, protection against disorder, and compatibility with superconductivity—enable applications impossible with conventional materials. Beyond quantum computing, topological insulators are advancing spintronics (spin-based electronics with lower power consumption), thermoelectric energy conversion (exploiting unique phonon-electron decoupling), ultra-low power electronics (leveraging dissipationless edge transport), and quantum metrology (precision measurement devices exploiting quantum Hall effects).

- Technological advances in material synthesis, characterization, and device integration are accelerating commercial viability. Advanced growth techniques including molecular beam epitaxy (MBE), chemical vapor deposition (CVD), and pulsed laser deposition (PLD) enable atomic-layer precision in topological insulator film fabrication with controlled thickness, doping, and interface quality. Characterization methods such as angle-resolved photoemission spectroscopy (ARPES), scanning tunneling microscopy (STM), and quantum transport measurements verify topological surface state properties and material quality. Innovations in substrate engineering, defect control (minimizing bulk conductivity that can mask surface transport), interface optimization (for heterostructure devices), and scalable manufacturing processes are transitioning topological insulators from laboratory samples to commercially viable materials. However, challenges persist including material purity requirements (bulk insulation demands extremely low defect densities), environmental stability (surface oxidation and degradation), scalability of high-quality production, integration with existing semiconductor infrastructure, and cost reduction for widespread adoption beyond specialized quantum applications.

Topological Insulator Materials Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 64.6 Million |

| Market Size in 2025 | USD 71.6 Million |

| Forecast Period 2025 – 2034 CAGR | 10.8% |

| Market Size in 2034 | USD 180.5 Million |

| Key Market Trends | |

| Drivers | Impact |

| Quantum computing advancement and investment surge | Global quantum computing initiatives backed by government funding drive demand for topological materials as foundational components for topological qubits and Majorana-based quantum computing architectures. |

| Spintronics and next-generation electronics development | Growing demand for ultra-low power electronics, non-volatile magnetic memory (MRAM), and spin-based logic devices accelerates adoption of topological insulators. Their spin-momentum locked surface states enable efficient spin current generation and detection with minimal energy dissipation, addressing power consumption challenges in advanced computing. |

| Material science breakthroughs and characterization capabilities | Advanced synthesis techniques (MBE, CVD) achieving atomic-layer control, combined with sophisticated characterization tools (ARPES, STM, quantum transport measurements), enable production of high-quality topological insulators with verified properties, accelerating transition from research to commercial applications. |

| Pitfalls & Challenges | Impact |

| Material purity and bulk insulation requirements | Achieving true bulk insulating behavior while maintaining robust surface conduction requires extremely low defect densities and precise stoichiometry control. Unintentional doping and crystallographic defects create bulk conductivity that masks topological surface states, complicating device performance and requiring expensive ultra-high-purity production processes |

| Environmental stability and surface degradation | Topological insulator surfaces are susceptible to oxidation, contamination, and degradation upon air exposure, compromising their unique electronic properties. Maintaining pristine surface states requires protective capping layers, controlled atmospheres, or in-situ device fabrication, adding complexity and cost to manufacturing and limiting practical applications. |

| Opportunities: | Impact |

| Quantum anomalous Hall effect devices for dissipationless electronics | Magnetically doped topological insulators exhibiting quantum anomalous Hall effect enable dissipationless chiral edge transport without external magnetic fields, opening pathways to ultra-low power electronics, precision metrology, and novel quantum devices. Commercial development of room-temperature quantum anomalous Hall materials would revolutionize low-power computing. |

| Topological insulator-superconductor heterostructures for Majorana platforms | Engineered heterostructures combining topological insulators with superconductors provide platforms for realizing Majorana fermions—exotic quasiparticles essential for topological quantum computing. Advances in interface engineering and material compatibility enable practical Majorana-based qubit implementations with inherent error protection. |

| Market Leaders (2024) | |

| Market Leaders |

10% |

| Top Players |

Collective market share in 2024 is 45% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | Brazil, Japan, China |

| Future outlook |

|

What are the growth opportunities in this market?

Topological Insulator Materials Market Trends

- The topological insulator materials industry is experiencing dynamic evolution driven by quantum technology breakthroughs, materials science innovations, and expanding application horizons. Advanced synthesis and fabrication technologies are central to market development. Molecular beam epitaxy (MBE) enables atomic-layer-by-layer growth with precise composition control, creating high-quality thin films with well-defined topological surface states and minimized bulk conductivity. Chemical vapor deposition (CVD) offers scalability advantages for larger-area production while maintaining material quality. Pulsed laser deposition (PLD) provides flexibility for complex compositions and heterostructure fabrication. Emerging techniques including van der Waals epitaxy (reducing lattice mismatch constraints), selective area growth (enabling patterned device structures), and atomic layer deposition (ALD) for protective capping layers are expanding manufacturing capabilities and device integration possibilities.

- Material engineering and optimization represent critical innovation frontiers. Researchers and manufacturers are developing quaternary and higher-order alloys (BiSbTeSe systems) that enable tuning of Fermi level position, band gap magnitude, and surface state properties through compositional variation. Magnetic doping strategies (chromium, vanadium, manganese incorporation) create magnetically ordered topological insulators exhibiting quantum anomalous Hall effect—a key milestone for dissipationless electronics and topological quantum computing. Heterostructure engineering combining topological insulators with superconductors (NbSe, Nb, Al) creates platforms for Majorana fermion realization, while integration with ferromagnets enables spin-orbit torque devices for next-generation magnetic memory. Defect engineering and compensation doping techniques address the persistent challenge of bulk conductivity, pushing materials toward true bulk insulation essential for surface-dominated transport.

- Characterization and quality verification standards are evolving to support commercial applications. Angle-resolved photoemission spectroscopy (ARPES) directly visualizes topological surface state band structure, confirming Dirac cone dispersion and spin texture—the definitive signature of topological behavior. Scanning tunneling microscopy (STM) and spectroscopy (STS) provide atomic-resolution surface imaging and local electronic structure mapping. Quantum transport measurements including Shubnikov-de Haas oscillations, weak antilocalization, and quantum Hall effect studies verify topological transport properties. Industry is developing standardized characterization protocols and quality metrics (surface state mobility, bulk resistivity, Fermi level position) to enable material specification and vendor qualification, essential for supply chain development and commercial adoption.

- Application-driven material development is shaping market segmentation and product differentiation. For quantum computing applications, emphasis is on materials supporting Majorana fermions (topological insulator-superconductor heterostructures with optimized interfaces), materials with large bulk band gaps (enabling higher-temperature operation), and substrates compatible with qubit fabrication processes. Spintronics applications prioritize materials with high spin-orbit coupling, efficient spin-charge conversion, and compatibility with magnetic materials for spin-orbit torque devices and spin Hall effect applications. Thermoelectric applications leverage the unique phonon-electron decoupling in topological insulators, with development focused on optimizing figure of merit (ZT) through nanostructuring and composition tuning. Terahertz photonics applications exploit topological surface plasmons and nonlinear optical properties for next-generation photonic devices and sensing applications.

Topological Insulator Materials Market Analysis

Learn more about the key segments shaping this market

Based on material type, the market is segmented into bismuth-based TIs, antimony-based TIs, quaternary & alloy TIs, magnetically doped alloys, and TI heterostructures. Bismuth-based TIs dominated the market with an approximate market share of 35% in 2024 and is expected to grow with a CAGR of 8.2% by 2034.

- Bismuth-based topological insulators dominate the market with well-established material properties and extensive experimental validation. Materials such as BiSe and BiTe demonstrate robust topological surface states with large bulk band gaps (up to 300 meV), enabling elevated temperature operation. This segment benefits from comprehensive ARPES and STM characterization, mature MBE and CVD synthesis protocols, established substrate compatibility, and natural cleavage planes facilitating surface studies—supporting both research advancement and commercial production pathways with favorable safety profiles and regulatory acceptance.

- Antimony-based and quaternary alloy platforms offer complementary properties and expanding applications. Antimony-based materials (SbTe, SbSe) integrate topological transport with thermoelectric functionality for dual-purpose devices. Quaternary alloys (BiTeSe, BiSbTeSe) enable tunable band structure engineering through compositional control—precisely adjusting Fermi level position, band gap magnitude, and spin-orbit coupling strength. This flexibility optimizes materials for quantum computing platforms and spintronics devices, driving the segment's high growth rate (12.9% CAGR) through customized material solutions for specialized applications.

- Magnetically doped alloys and heterostructures represent next-generation platforms with transformative potential. Magnetically doped topological insulators (Cr, V, Mn-doped) realize the quantum anomalous Hall effect, enabling dissipationless edge transport without external magnetic fields for ultra-low power electronics and topological quantum computing. TI-superconductor heterostructures create platforms for Majorana fermion realization—essential for topological qubits with inherent error protection. Additional configurations with ferromagnets or semiconductors enable spin-orbit torque devices and hybrid quantum-classical systems, expanding topological materials applications through advanced interface engineering and atomic-layer-precise fabrication.

Learn more about the key segments shaping this market

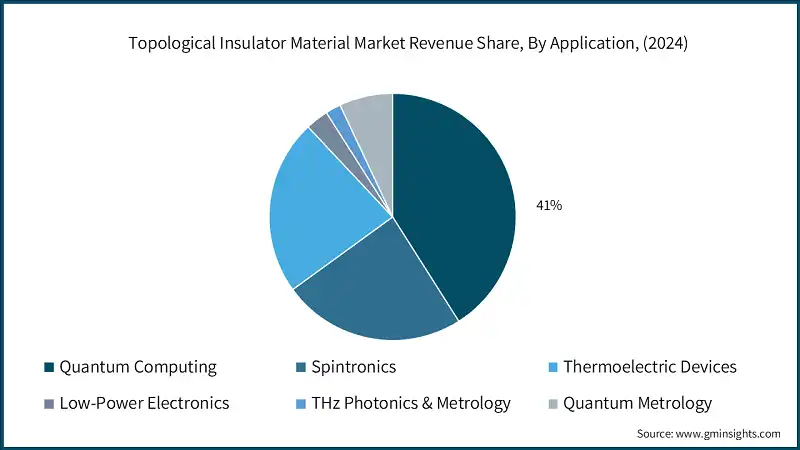

Based on application, the topological insulator materials market is segmented into quantum computing, spintronics, thermoelectric devices, low-power electronics, THz photonics & metrology, and quantum metrology. Quantum computing dominated the market with an approximate market share of 41% in 2024 and is expected to grow with a CAGR of 11.2% by 2034.

- Quantum computing dominates the market with topological insulators serving as foundational materials for next-generation qubit architectures. Topological materials enable Majorana-based qubits through TI-superconductor heterostructures, offering inherent error protection via topologically protected quantum states. This segment benefits from massive government and private sector investment—including the U.S. National Quantum Initiative, EU Quantum Flagship, and corporate commitments from IBM, Microsoft, Google, and emerging quantum startups. The application leverages topological surface states for dissipationless transport, spin-momentum locking for qubit control, and compatibility with cryogenic operating environments, positioning topological insulators as critical enablers for scalable, fault-tolerant quantum computation.

- Spintronics and quantum metrology platforms represent established applications with significant commercial traction. Spintronics applications (24% market share) exploit spin-momentum locked surface states for efficient spin current generation, spin-orbit torque devices, and next-generation magnetic memory (MRAM). Topological insulators enable high spin-charge conversion efficiency, reduced power consumption, and compatibility with existing semiconductor infrastructure. Quantum metrology applications (18% market share) leverage quantum Hall effects and topologically protected edge states for ultra-precise resistance standards, magnetic field sensors, and quantum measurement devices. These segments benefit from near-term commercialization pathways, integration with established industries (semiconductor, data storage, precision instrumentation), and growing demand for low-power, high-performance electronic components.

- Emerging applications in quantum anomalous Hall devices, thermoelectrics, and photonics represent high-growth opportunities with transformative potential. Quantum anomalous Hall devices enable dissipationless chiral edge transport without external magnetic fields, opening pathways to ultra-low power electronics and novel quantum devices with 11.3% CAGR. Thermoelectric applications exploit unique phonon-electron decoupling in topological materials for enhanced energy conversion efficiency in waste heat recovery and solid-state cooling. THz photonics and low-power electronics leverage topological surface plasmons, nonlinear optical properties, and dissipationless transport for next-generation communication systems, sensing platforms, and energy-efficient computing. These emerging segments drive innovation through specialized material engineering, advanced device architectures, and integration with complementary technologies.

Based on end use industry, the topological insulator materials market is segmented into electronics & semiconductors, quantum computing industry, research & academia, aerospace & defense, energy & power, and telecommunications. Electronics & semiconductors dominated the market with an approximate market share of 33% in 2024 and is expected to grow with a CAGR of 13.1% by 2034.

- Electronics & semiconductors dominate the market as primary adopters of topological insulator materials for next-generation device applications. This segment leverages topological materials for spintronics devices (MRAM, spin logic), low-power transistors exploiting dissipationless edge transport, and advanced interconnects with reduced energy loss. The industry benefits from established fabrication infrastructure, compatibility with CMOS integration pathways, and strong commercial drivers for energy-efficient computing solutions. Major semiconductor manufacturers and fabless design companies are incorporating topological materials into roadmaps for sub-3nm nodes, neuromorphic computing architectures, and quantum-classical hybrid processors—driving the segment's high growth rate through volume production scaling and performance advantages.

- Quantum computing industry and research institutions represent complementary demand centers with distinct procurement patterns. The quantum computing industry (30% market share, 12.7% CAGR) procures specialized topological materials for qubit fabrication, cryogenic quantum processors, and Majorana-based architectures, emphasizing ultra-high purity and precise material specifications. Research & academia (13% market share) drive fundamental materials discovery, characterization methodology development, and proof-of-concept demonstrations through university laboratories, national research facilities, and government-funded quantum centers. These segments benefit from collaborative ecosystems connecting material suppliers with end use, shared characterization infrastructure, and technology transfer pathways accelerating commercialization of laboratory innovations.

- Aerospace & defense, energy, and telecommunications sectors represent specialized applications with specific performance requirements. Aerospace & defense applications leverage topological materials for quantum sensors, secure communication systems, and radiation-hardened electronics in satellite and defense platforms (9.2% CAGR). Energy & power applications focus on thermoelectric energy harvesting and solid-state cooling, though growth remains modest (1.1% CAGR) pending efficiency breakthroughs. Telecommunications initially showed interest for THz photonics and low-latency switching but faces competition from established technologies, resulting in plateauing demand. These segments drive niche material customization, environmental qualification standards, and long-term reliability validation requirements.

Looking for region specific data?

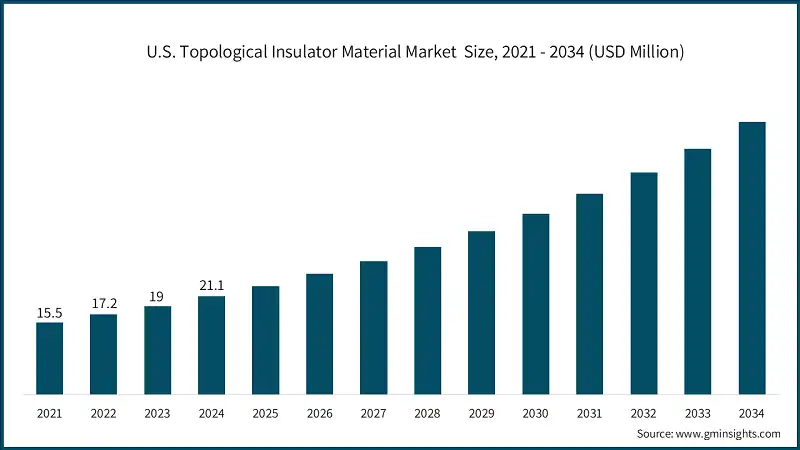

The North America topological insulator materials industry is growing steadily on the global level with a market share of 36% in 2024.

- North America is establishing itself as the leading region for topological insulator materials, supported by advanced quantum computing infrastructure, concentrated research institutions, and substantial government quantum initiatives. Leading universities and national laboratories are taking an active role in topological materials science advancement, while market growth is enabled by the U.S. National Quantum Initiative, corporate quantum computing programs, and established semiconductor manufacturing capabilities.

- U.S. dominates the North America topological insulator materials market, showcasing strong growth potential.

- The U.S. leads regional growth with major quantum computing companies (IBM, Google, Microsoft, IonQ), world-class research institutions (MIT, Stanford, Caltech, University of Maryland), and sophisticated material characterization facilities. The country hosts cutting-edge MBE and CVD synthesis capabilities and houses leading specialized material suppliers. Given the strong momentum, challenges exist in scaling high-purity production, environmental stability of topological surfaces, and transitioning from laboratory-scale to commercial manufacturing volumes.

Europe topological insulator materials market demonstrates solid growth with revenue of USD 11.7 million in 2024 and is anticipated to show steady expansion over the forecast period.

- The region's successful development is enriched by robust quantum research heritage, coordinated EU Quantum Flagship program (€1B investment), and excellence in condensed matter physics. Regulatory frameworks and quality standards create strong foundation for materials innovation and technology transfer from academic research to commercial applications.

- Germany dominates the European market, showcasing strong growth potential.

- Germany channels investments through its quantum technology initiatives and advanced materials research infrastructure within its broader Industry 4 strategy. The country benefits from world-class research institutes (Max Planck Institutes, Forschungszentrum Jülich), precision manufacturing capabilities, and strong collaboration between academia and industry in quantum technologies.

- UK demonstrates steady market development with leading quantum computing startups, established materials science programs at Cambridge and Oxford, and government support through National Quantum Technologies Programme.

- France shows consistent growth driven by national quantum computing initiatives, CNRS research excellence, and growing quantum technology ecosystem around Paris-Saclay cluster.

The Asia Pacific topological insulator materials market is anticipated to grow at a CAGR of 12% during the analysis timeframe.

- Asia Pacific drives rapid growth in topological insulator materials with aggressive national quantum programs, expanding semiconductor capabilities, and substantial government R&D investment. China's leadership in quantum communications, Japan's materials science excellence, and regional focus on advanced technology development create favorable conditions for market expansion.

- China market is estimated to grow with a significant CAGR of 13.6% in the Asia Pacific region.

- In China, demand for topological materials is driven by national quantum technology strategy, extensive government funding for quantum computing and quantum communications, and rapidly expanding domestic semiconductor industry. Government support through Made in China 2025 and quantum technology roadmaps accelerates growth. The market benefits from large-scale research infrastructure investment, growing number of quantum startups, and strategic focus on quantum technology sovereignty.

- Japan demonstrates mature market characteristics with established materials science expertise, leading research institutions (RIKEN, University of Tokyo), and sophisticated characterization capabilities for quantum materials.

- South Korea Topological Insulator Materials Market exhibits strong growth potential, driven by semiconductor industry integration, government quantum technology initiatives, and advanced materials research capabilities at KAIST and other institutions.

Latin America topological insulator materials accounted for 4% market share in 2024 and is anticipated to show robust growth over the forecast period.

- Latin America is emerging as a developing territory with increasing quantum research activities, expanding academic collaborations with North American and European institutions, and growing government interest in quantum technologies. Investment in research infrastructure and international partnerships provide foundation for market development.

- Brazil leads the Latin American market, exhibiting steady growth during the analysis period.

- Brazil supports regional growth with established physics research programs, government funding for quantum science through CNPq and FAPESP, and academic institutions pursuing topological materials research. The country benefits from growing collaboration with international quantum research centers and emerging quantum technology ecosystem.

- Mexico demonstrates emerging potential with increasing university research programs, cross-border collaboration with U.S. institutions, and growing interest in quantum technologies within academic community.

Middle East & Africa topological insulator materials accounted for 10% market share in 2024 and is anticipated to show modest growth over the forecast period.

- The market is driven by strategic investments in quantum technology research, government-backed science and technology initiatives, and efforts to diversify economies through advanced technology sectors. Emerging quantum research programs and international collaborations are creating early-stage opportunities.

- Saudi Arabia Topological Insulator Materials industry demonstrates steady development in the Middle East and Africa market.

- Saudi Arabia positions itself as a regional hub for quantum technology through Vision 2030 initiatives and investments in research infrastructure. The market benefits from government funding for King Abdullah University of Science and Technology (KAUST), international research partnerships, and strategic focus on emerging technologies as part of economic diversification strategy.

Topological Insulator Materials Market Share

The top 5 companies in the topological insulator materials industry include American Elements, Kurt J. Lesker Company (KJLC, Stanford Advanced Materials (SAM), HQ Graphene B.V. and MSE Supplies LLC. These leading suppliers collectively account for around 45% of the global market share, reflecting their strong presence in advanced quantum materials production. The market remains fragmented, with specialized suppliers serving research institutions and quantum technology developers. These companies maintain competitive positions through deep expertise in high-purity material synthesis, thin-film deposition materials, and advanced characterization solutions. Their broad product portfolios—supported by rigorous quality control, custom synthesis capabilities, and strong technical support—enable them to effectively meet the rising demand across quantum computing, spintronics, and next-generation research applications.

- American Elements product portfolio is diversified, ranging from high-purity topological insulator compounds (bismuth selenide, bismuth telluride, antimony telluride) to sputtering targets, evaporation materials, and custom alloy formulations. The company has undertaken significant investments in quantum materials production with ultra-high purity specifications for MBE and CVD applications, and continues to develop advanced material characterization and quality verification protocols as part of its comprehensive strategy around quantum technology enablement.

- Kurt J. Lesker Company (KJLC) specializes in thin film deposition equipment and high-purity materials for vacuum deposition processes. The offerings at the core of its business include topological insulator sputtering targets, evaporation sources, and substrate materials, which form essential components of quantum device fabrication, spintronics research, and advanced materials characterization across semiconductor fabs and research laboratories.

- Stanford Advanced Materials (SAM) operates in the specialized materials segment with a focused business model centered on custom synthesis and precision manufacturing. The company concentrates on developing and supplying topological insulator crystals, thin films, and powder materials with documented purity specifications, supporting quantum computing research, materials science studies, and device prototyping applications.

- HQ Graphene B.V. specializes in two-dimensional materials production with expanding capabilities in topological insulators and related quantum materials. The company develops high-quality topological insulator crystals and exfoliated materials, supported by European research collaborations and expertise in van der Waals materials for quantum heterostructure applications and fundamental research.

- MSE Supplies LLC operates across research materials and equipment segments, with strong capabilities in topological insulator materials and characterization tools. Activities include production and distribution of topological insulator single crystals, thin films, and powder materials with comprehensive technical specifications, serving academic research institutions, national laboratories, and quantum technology startups requiring reliable material sources with batch-to-batch consistency.

Topological Insulator Materials Market Companies

Major players operating in the topological insulator materials industry include:

- American Elements

- Kurt J. Lesker Company (KJLC)

- Stanford Advanced Materials (SAM)

- HQ Graphene B.V.

- MSE Supplies LLC

- Wuhan Tuocai Technology Co., Ltd.

- SixCarbon Technology (Shenzhen)

- Heeger Materials Inc.

- AEM Deposition

- Stanford Materials Corporation (SMC)

- Edgetech Industries LLC

- Cathay Materials

- ALB Materials Inc.

- QS Advanced Materials Inc. (QSAM)

- Alfa Chemistry (2D Materials Division)

Topological Insulator Materials Industry News

- In February 2025, Microsoft, via its research arm Station Q at UC Santa Barbara, unveiled Majorana 1 — an eight-qubit topological quantum processor built on a novel “topoconductor” material. According to the researchers, Majorana 1 leverages a newly created state of matter (a topological superconductor) hosting exotic Majorana zero modes (MZMs), which promise stronger error resilience and a clear path toward scaling quantum computers to millions of qubits.

This topological insulator materials market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Million) and volume (Kilo Tons) from 2025 to 2034, for the following segments:

Market, By Material Type

- Bismuth-based topological insulators

- Bismuth selenide (BiSe)

- Bismuth telluride (BiTe)

- Bismuth telluride selenide (BiTeSe)

- Antimony-based topological insulators

- Antimony telluride (SbTe)

- Antimony telluride selenide (SbTeSe)

- Quaternary and alloy topological insulators

- Bisbtes e (BSTS)

- Bisbte

- Magnetically doped TI alloys (Cr, V, Mn-doped Bi/Sb-Te systems)

- Magnetic and strongly correlated topological insulators

- Mnb it e (intrinsic magnetic TI)

- Samarium hexaboride (SmB; Kondo TI)

- Topological insulator heterostructures

- TI–superconductor hybrids (e.g., BiSe–Nb)

- TI–antiferromagnet hybrids

Market, By Application

- Quantum computing

- Topological qubits (Majorana-based)

- Hybrid qubit systems

- Quantum anomalous Hall devices

- Quantum-coherent logic circuits

- Quantum metrology components

- Spintronics

- SOT-MRAM devices

- Spin-FETs

- Magnetic field sensors (TI nanowire sensors)

- High-efficiency spin injectors/detectors

- Thermoelectric devices

- Thermoelectric generators (TEGs)

- Waste heat recovery modules

- Wearable/flexible thermoelectric sheets

- Industrial and automotive thermoelectric systems

- Low-power electronics

- Topological transistors

- Negative-capacitance TI FETs

- TI interconnects for data centers

- Next-generation logic switches

- Terahertz photonics

- THz frequency converters

- THz detectors

- Spintronic THz emitters

- 6G communication components

- Quantum metrology

- Quantum resistance standards

- Voltage calibration devices

- Magnet-free QAH standards

- Portable metrological instruments

Market, By End Use Industry

- Electronics and semiconductors

- Semiconductor R&D labs

- Memory device manufacturers (SOT-MRAM)

- Logic device manufacturers

- Sensor manufacturers

- Thin-film deposition and metrology equipment buyers

- Quantum computing industry

- Quantum hardware developers

- Cryogenic electronics companies

- Quantum metrology instrument makers

- Cloud quantum service providers

- Research consortia (QED-C, NIST facilities)

- Aerospace and defense

- Defense research agencies (DARPA, AFRL)

- Defense contractors (Lockheed, Northrop)

- Space electronics manufacturers

- Government intelligence and secure communications users

- Energy and power

- Thermoelectric module manufacturers

- Waste heat recovery system integrators

- Renewable energy solution providers

- Power electronics manufacturers

- Research and academic institutions

- National labs (NIST, DOE, ORNL)

- Universities and research centers

- International institutes (IMEC, Max Planck, NIMS)

- Private R&D centers (IBM, Microsoft, Google)

- Telecommunications industry

- 6G system developers

- THz device manufacturers

- Quantum communication infrastructure providers

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Who are the key players in the topological insulator materials market?

Key players include American Elements, Kurt J. Lesker Company (KJLC), Stanford Advanced Materials (SAM), HQ Graphene B.V., and MSE Supplies LLC, alongside other specialized quantum material suppliers.

What are the upcoming trends in the topological insulator materials market?

Key trends include adoption of TI–superconductor heterostructures, development of quantum anomalous Hall devices, and rapid experimentation with magnetic and engineered topological materials for next-gen electronics.

What is the growth outlook for quaternary alloy topological insulators from 2025 to 2034?

Quaternary/alloy materials are projected to grow at a 12.9% CAGR through 2034. This momentum stems from their tunable band structure, enabling optimized performance for quantum and spintronic devices.

Which region leads the topological insulator materials market?

North America leads with a 36% market share in 2024, supported by a strong U.S. ecosystem. Growth is powered by the presence of major quantum computing companies, advanced research centers, and government-backed quantum initiatives.

What was the valuation of the quantum computing application segment in 2024?

The quantum computing segment accounted for 41% market share in 2024, dominating overall industry demand. Growth is powered by global investments in Majorana-based qubits and topological quantum processors.

What is the market size of the topological insulator materials market in 2024?

The market size was USD 64.6 million in 2024, supported by strong demand from quantum computing and advanced electronics.

What is the current topological insulator materials market size in 2025?

The market size is projected to reach USD 71.6 million in 2025 as adoption accelerates across quantum and spintronics applications.

What is the projected value of the topological insulator materials market by 2034?

The topological insulator materials market is expected to reach USD 180.5 million by 2034, driven by rapid advancements in quantum computing, spintronics, and next-generation electronics.

How much revenue did the bismuth-based materials segment generate in 2024?

Bismuth-based materials held 35% market share in 2024, making them the largest segment. This leadership is driven by mature synthesis protocols, large band gaps, and extensive validation across quantum research.

Topological Insulator Materials Market Scope

Related Reports