Summary

Table of Content

Thrombosis Drugs Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Thrombosis Drugs Market Size

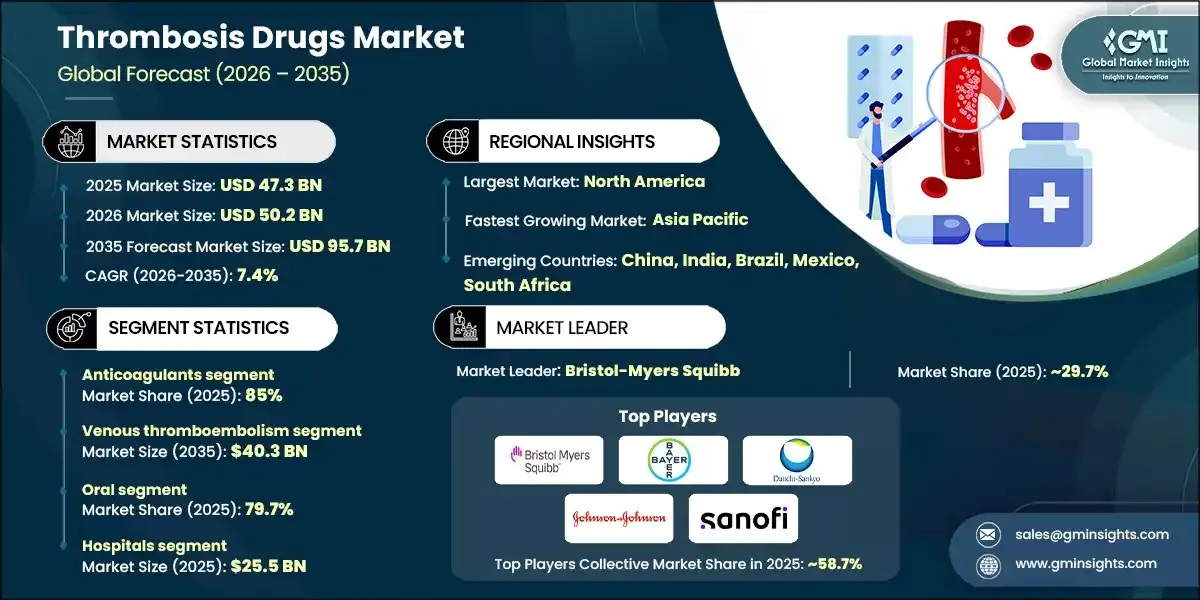

The global thrombosis drugs market size was valued at USD 47.3 billion in 2025. The market is expected to grow from USD 50.2 billion in 2026 to USD 95.7 billion in 2035, growing at a CAGR of 7.4% during the forecast period, according to the latest report published by Global Market Insights Inc.

To get key market trends

The growth of the thrombosis drugs market is supported by the increasing prevalence of cardiovascular diseases such as myocardial infarction, pulmonary embolism, and ischemic stroke. These conditions require rapid restoration of blood flow, thus making thrombosis treatment indispensable in cardiovascular emergencies. For instance, the American Heart Association reports that, as of 2024, thrombosis is responsible for 25% of global deaths, with ischemic heart disease affecting 1,518.7 individuals per 100, 000 annually. This large number of patients is driven by demographic and lifestyle changes, such as the predicted doubling of the global population aged 65 and over by 2050, which is anticipated to increase the need for anticoagulant therapies.

Additionally, sedentary lifestyle patterns and obesity rates exceeding 30% in developing countries, along with the rising prevalence of diabetes and hypertension, are further driving the demand for effective anticoagulant medications.

Thrombosis drugs refer to medications used to prevent and treat clot formations in blood vessels, a condition known as thrombosis. These drugs include anticoagulants, which inhibit clotting factors; antiplatelet agents, which prevent platelet aggregation; and thrombolytics, which dissolve existing clots. Key players driving the growth of the market include Sanofi, Bayer, Boehringer Ingelheim, and Bristol-Myers Squibb, among others. These players facilitate the growth of the market through new drug development and innovation, creating strategic collaborations and licensing agreements, and expanding global manufacturing and distribution networks.

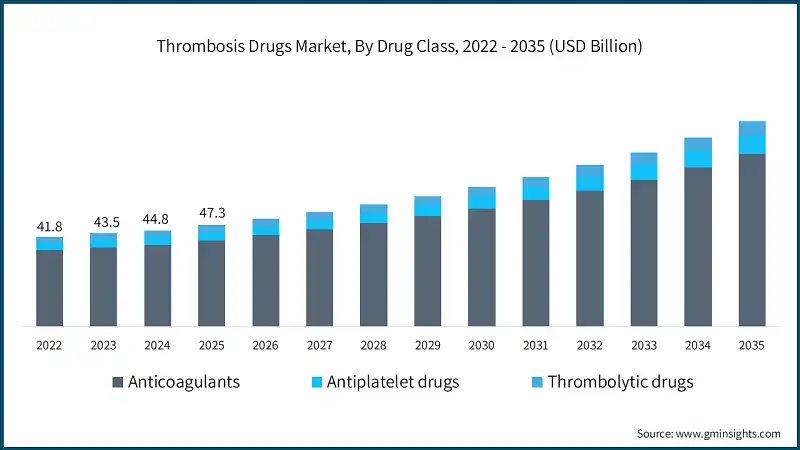

Between 2022 and 2024, the global thrombosis drugs market witnessed considerable growth to reach USD 44.8 billion in 2024 from USD 41.8 billion in 2022, driven primarily by the improved diagnostic capabilities and greater clinical awareness that have led to earlier and more frequent identification of thrombotic conditions. In addition, growing adoption of direct oral anticoagulants, favored for their convenience and improved safety profiles, has further supported market expansion. Moreover, increased rates of surgical procedures, cancer-related thrombosis, and sustained anticoagulation use following heightened focus on thrombotic complications in recent years have collectively contributed to the market’s growth.

Thrombosis Drugs Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 47.3 Billion |

| Market Size in 2026 | USD 50.2 Billion |

| Forecast Period 2026-2035 CAGR | 7.4% |

| Market Size in 2035 | USD 95.7 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising incidence of cardiovascular and cerebrovascular events | Drives continuous demand for anticoagulants and antiplatelet therapies to reduce stroke-related morbidity and mortality. |

| Growing adoption of novel oral anticoagulants (NOACs) | Enhance patient adherence and treatment convenience, accelerating market expansion across chronic and preventive care settings. |

| Rising number of surgical procedures | Increases requirement for perioperative thromboprophylaxis, thus strengthening demand for both oral and injectable thrombosis drugs. |

| Advancements in thrombolytic drug formulations | Improve clot dissolution efficacy and safety, expanding use in acute ischemic and emergency care scenarios. |

| Pitfalls & Challenges | Impact |

| Risk of adverse reactions and side effects | Bleeding complications and drug interactions limit patient eligibility, require monitoring, and may restrain widespread thrombosis drug adoption. |

| Stringent regulatory approval | Lengthy clinical trials, strict safety requirements, and high development costs delay product launches and limit rapid market expansion. |

| Opportunities: | Impact |

| Growing shift towards preventive cardiovascular care | • Encourages early anticoagulant use, long-term therapy adoption, and increased prescriptions to reduce future thrombotic event risks. |

| Developing next-generation upstream coagulation inhibitors | • Enables safer, targeted anticoagulation with reduced bleeding risk, creating new growth avenues and expanding future therapeutic options. |

| Market Leaders (2025) | |

| Market Leaders |

~29.7% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | |

| Emerging Country | China, India, Brazil, Mexico, South Africa |

| Future Outlook |

|

What are the growth opportunities in this market?

Thrombosis Drugs Market Trends

- Rising use of novel oral anticoagulants (NOACs) is one of the major trends driving the market. NOACs are gaining strong clinical preference compared to traditional anticoagulants, driven by their proven efficacy in preventing ischemic stroke in patients with non-valvular atrial fibrillation (NVAF).

- Additionally, the advantages such as fixed dosing, fewer drug-food interactions, and less monitoring requirements promote the use of these drugs as well. Thus, as healthcare providers increasingly prioritize safer and more convenient therapies, demand for NOACs continues to grow.

- Further, the growth of the market is supported by the rising availability of generic NOAC formulations, which are improving affordability and access. The increasing number of approved generic rivaroxaban has significantly strengthened this trend.

- For instance, the U. S. FDA has given the green light to generic versions of Xarelto (rivaroxaban) for the reduction of major cardiovascular events in adult patients with coronary artery disease (CAD) and peripheral artery disease (PAD). Additionally, in May 2025, Lupin Limited obtained FDA approval for its Abbreviated New Drug Application for rivaroxaban tablets (10 mg, 15 mg, and 20 mg) manufactured at its Aurangabad facility in India. Such increasing approvals are likely to raise prescription volumes and thus increase the adoption of these drugs in both developed and emerging markets.

- The rising number of surgical operations worldwide is another significant factor that is propelling the expansion of this market. Surgery usually increases the risk of thromboembolic complications considerably. Surgical trauma, anesthesia, endothelial damage, and prolonged immobility collectively create a hypercoagulable state, necessitating prophylactic and therapeutic anticoagulant use.

- For instance, according to the Lancet Commission on Global Surgery, the number of major surgical procedures performed worldwide annually exceeds 300 million. There is a considerable proportion of these that are orthopedics, abdominal, cardiovascular, and cancer-related surgeries, all of which are associated with a high risk of venous thromboembolism (VTE).

- Without thromboprophylaxis, postoperative deep vein thrombosis occurs in 40-60% of patients undergoing major orthopedic surgery, underscoring the critical need for thrombosis drugs. This high incidence demonstrates the high demand for thrombosis drugs to reduce morbidity, mortality, and healthcare burden associated with preventable thromboembolic events.

- Overall, owing to these trends, the global market is set for sustained growth in the coming years.

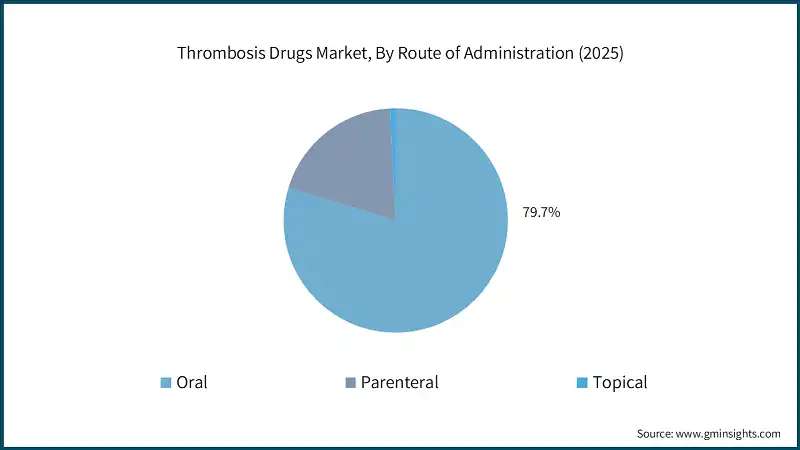

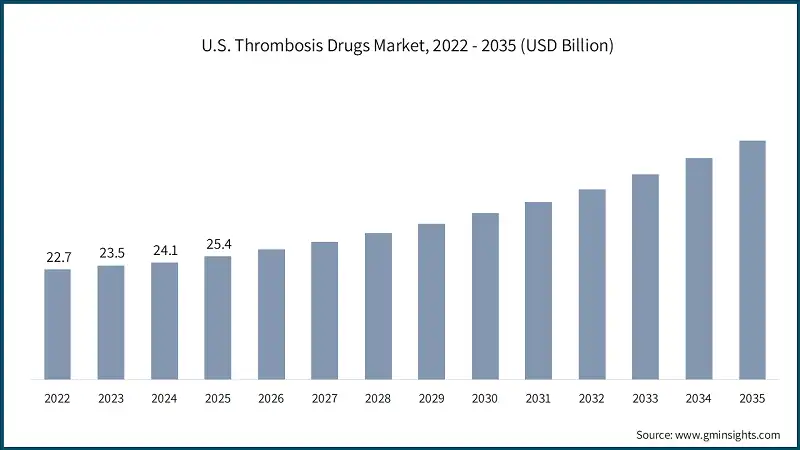

Thrombosis Drugs Market Analysis Based on the drug class, the global market is segmented into anticoagulants, antiplatelet drugs, and thrombolytic drugs. The anticoagulants segment dominated the market with 85% market share and was valued at USD 40.2 billion in 2025. The anticoagulants segment is further classified into direct oral anticoagulants, heparin, vitamin K antagonists, and injectable DTIs. Based on the disease type, the global thrombosis drugs market is classified into venous thromboembolism, arterial thrombosis, atrial fibrillation, cerebrovascular disorders, and other disease types. The venous thromboembolism segment dominated the market in 2025 and is estimated to reach USD 40.3 billion by 2035. The venous thromboembolism segment is further sub-segmented into deep vein thrombosis and pulmonary embolism. Based on the route of administration, the global thrombosis drugs market is segmented into oral, parenteral, and topical. The oral segment dominated the market with a market share of 79.7% in 2025 due to its ease of administration, high patient compliance, and suitability for long-term outpatient therapy, particularly in chronic conditions such as atrial fibrillation and venous thromboembolism. Based on the end use, the global thrombosis drugs market is classified into hospitals, ambulatory surgical centers, and other end users. The hospitals segment held the largest market size with a revenue of USD 25.5 billion in 2025. North America Thrombosis Drugs Market The North America market dominated the global market with a market share of 59.5% in 2025. The U.S. thrombosis drugs market was valued at USD 22.7 billion and USD 23.5 billion in 2022 and 2023, respectively. The market size reached USD 25.4 billion in 2025, growing from USD 24.1 billion in 2024. Europe Thrombosis Drugs Market Europe market accounted for USD 9.4 billion in 2025 and is anticipated to show lucrative growth over the forecast period. Germany dominates the Europe thrombosis drugs market, showcasing strong growth potential. Asia Pacific Thrombosis Drugs Market The Asia Pacific market is anticipated to grow at the highest CAGR of 8.1% during the analysis timeframe, driven by the rising prevalence of cardiovascular diseases and stroke, particularly in countries such as China, India, Japan, and South Korea. China thrombosis drugs market is estimated to grow with a significant CAGR in the Asia Pacific market. Latin American Thrombosis Drugs Market Brazil leads the Latin American market, exhibiting remarkable growth during the analysis period due to its large patient population with a high prevalence of cardiovascular diseases, including atrial fibrillation, venous thromboembolism, and stroke. Middle East and Africa Thrombosis Drugs Market Saudi Arabia market is expected to experience substantial growth in the Middle East and Africa market. Leading companies such as Bristol-Myers Squibb, Bayer, Daiichi Sankyo, Johnson & Johnson, and Sanofi account for approximately 58.7% of the market share. Innovations in oral therapies, subcutaneous formulations, and long acting injectables are driving therapeutic advancement and patient adherence. Additionally, partnerships with academic institutions and licensing agreements for novel pipeline candidates are stimulating progress, particularly in targeting factor-specific clotting mechanisms. Many companies are also increasing investments in research and development to develop safer agents with reduced bleeding risks. Efforts to expand access in developing regions and improve treatment affordability further highlight the market’s shift toward global inclusivity and personalized care. Prominent players operating in the thrombosis drugs industry are as mentioned below: The company accounted for approximately 29.7% and has established a strong presence in the market through its portfolio of anticoagulants, including both oral and injectable therapies. The company has focused on innovation in novel oral anticoagulants (NOACs) and combination therapies, addressing critical needs in atrial fibrillation, venous thromboembolism, and post-surgical thromboprophylaxis. The company made a significant impact with its development and continued evolution of direct thrombin inhibitors, supporting a shift toward safer and more convenient alternatives to traditional therapies. In early 2024, Boehringer Ingelheim expanded the indications for its flagship oral anticoagulant to include broader patient populations, supported by compelling long-term outcome data. This move strengthened its relevance in stroke prevention and management. Bayer has carved out a strong position in the thrombosis drug market through its flagship direct oral anticoagulant. With a focus on Factor Xa inhibition, Bayer has advanced the standard of care in conditions such as venous thromboembolism, atrial fibrillation, and stroke prevention. Learn more about the key segments shaping this market

Learn more about the key segments shaping this market Learn more about the key segments shaping this market

Learn more about the key segments shaping this market Looking for region specific data?

Looking for region specific data?Thrombosis Drugs Market Share

Thrombosis Drugs Market Companies

Thrombosis Drugs Industry News

The thrombosis drugs market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2022 - 2035 for the following segments:

Market, By Drug Class

- Anticoagulants

- Direct oral anticoagulants

- Heparin

- Vitamin K antagonists

- Injectable DTIs

- Antiplatelet drugs

- P2Y12 platelet inhibitor

- Aspirin

- Glycoprotein IIb/IIIa inhibitors

- Thrombolytic drugs

Market, By Disease Type

- Venous thromboembolism

- Deep vein thrombosis

- Pulmonary embolism

- Arterial thrombosis

- Atrial fibrillation

- Cerebrovascular disorders

- Other disease types

Market, By Route of Administration

- Oral

- Parenteral

- Topical

Market, By End Use

- Hospitals

- Ambulatory surgical centers

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Which region leads the thrombosis drugs market?

North America led the global market with a 59.5% share in 2025, supported by advanced healthcare infrastructure, and favorable reimbursement policies.

Who are the key players in the thrombosis drugs market?

Major players include Bristol-Myers Squibb, Bayer, Boehringer Ingelheim, Daiichi Sankyo, Johnson & Johnson, Sanofi, Pfizer, Novartis, AstraZeneca, Lupin, and Teva Pharmaceuticals.

Which end-use segment holds the largest share in the thrombosis drugs market?

Hospitals dominated the market with revenue of USD 25.5 billion in 2025, driven by high surgical volumes, acute care needs, and access to advanced diagnostic and monitoring infrastructure.

Which disease type segment leads the market?

The venous thromboembolism (VTE) segment led the market in 2025 and is projected to reach USD 40.3 billion by 2035, driven by rising incidence of deep vein thrombosis and pulmonary embolism across aging and high-risk populations.

Which route of administration dominates the market?

The oral route of administration dominated the market with a 79.7% share in 2025, supported by high patient compliance, suitability for long-term therapy, and strong adoption of novel oral anticoagulants.

Which drug class segment generated the highest revenue in 2025?

The anticoagulants segment dominated the market with an 85% share and generated USD 40.2 billion in revenue in 2025, owing to widespread use in atrial fibrillation.

What will be the market value of the thrombosis drugs industry in 2026?

The market is projected to reach USD 50.2 billion in 2026, reflecting steady early growth driven by higher diagnosis rates, long-term anticoagulation therapy adoption, and improved treatment accessibility.

What is the market size of the thrombosis drugs market in 2025?

The global market for thrombosis drugs was valued at USD 47.3 billion in 2025, driven by the rising incidence of cardiovascular and cerebrovascular diseases.

What is the projected value of the thrombosis drugs market by 2035?

The thrombosis drugs industry is expected to reach USD 95.7 billion by 2035, growing at a CAGR of 7.4% from 2026 to 2035, supported by expanding use of novel oral anticoagulants (NOACs), preventive cardiovascular care, and rising surgical volumes.

Thrombosis Drugs Market Scope

Related Reports