Summary

Table of Content

Test Strips Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Test Strips Market Size

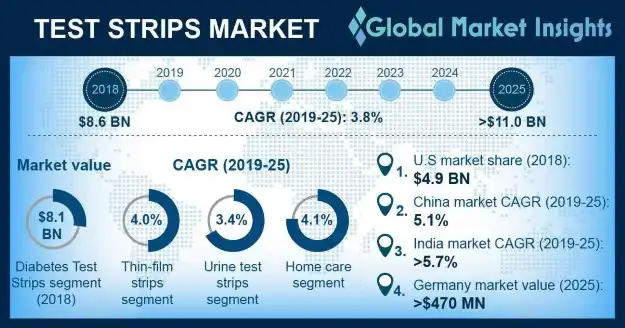

Test Strips Market size was valued at USD 8.6 billion in 2018 and is expected to witness 3.8% CAGR from 2019 to 2025.

To get key market trends

Test strips are a key component of blood glucose testing and urinalysis. These test strips are used to monitor or control glucose level of a diabetic patient. It helps pre-diabetic and diabetic people track their blood glucose level on a regular basis without visiting a clinic or a diagnostic laboratory. The global test strip market is expected to witness substantial growth over the forecast timeframe, owing to increasing prevalence of diabetes across the globe. For instance, as per the National Diabetes Statistics report, 9.4% of the U.S. population had diabetes in 2015. Hence, increasing prevalence of diabetes is a major growth augmenting factor.

Increasing prevalence of other chronic diseases such as kidney disorders and urinary tract infections is another chief growth propelling factor. Increasing incidence of kidney disorders owing to rising intake of alcohol will significantly drive test strips market growth. Moreover, growing habit of binge eating and lack of physical activities leading to rise in prevalence of diabetes will further boost pro duct demand, thus augmenting market demand.

Test Strips Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2018 |

| Market Size in 2018 | 8.6 Billion (USD) |

| Forecast Period 2019 - 2025 CAGR | 3.8% |

| Market Size in 2025 | 11 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

However, in few underdeveloped regions of the world, people tend to ignore regular health check-ups leading to an increasing number of undiagnosed patients. Hence, dearth of awareness among the population about various chronic diseases is a major growth restricting factor. Furthermore, lack of reimbursement policies for test strips is another hindrance, that will limit the market demand.

Test Strips Market Analysis

Learn more about the key segments shaping this market

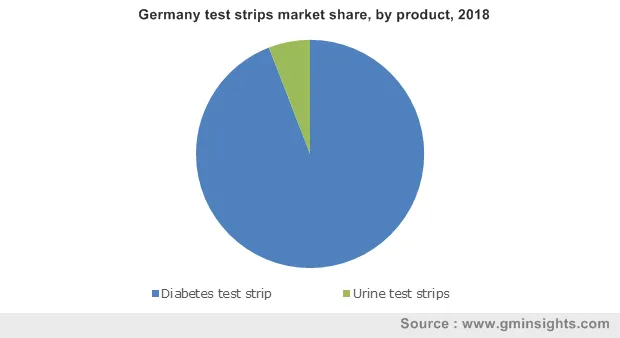

The test strips market is bifurcated into urinary and diabetes test strips. Diabetes test strips segment held major revenue size of USD 8.1 billion in 2018. High growth is attributed to increasing prevalence of diabetes in various developing as well as developed economies of the world. Also, growing preference among the population for point of care testing is another major growth fostering factor.

Glucose test strips are further segmented into thick-film and thin-film, on the basis of technology. Thin-film strips are expected to witness lucrative growth of 4.0% across the forecast years. High growth is attributed to usage of novel nano technology in these test strips. Furthermore, thick-film test strips held the largest revenue share in 2018, owing to presence of major firms manufacturing thick-film test strips.

Urine test strips segment is expected to expand at 3.4% CAGR over the projected period. High growth is attributed to increasing prevalence of urinary tract infections (UTI), mostly in females. Also, rising prevalence of kidney disorders is another major factor boosting product demand, thus fostering business growth. Moreover, increasing number of companies manufacturing urine test strips will further enhance test strips market growth.

Hospitals as an end-use segment held significant revenue of USD 2.5 billion in 2018 with significant growth rate across the forecast timeframe. High growth is attributed to increasing number of diagnostic tests for diabetes as well other chronic diseases. Moreover, availability of required healthcare facilities will further boost segmental growth. Also, increasing number of hospitals in developed as well as developing economies is another major growth augmenting factor.

Home care segment is projected to witness substantial growth of 4.1% across the analysis period. High growth is attributed to increasing number of retail pharmacies across the globe and rising awareness among the population about several point of care testing methods. Also, increasing number of online portals commercialising test strips for personal use is another factor fostering industry growth.

Learn more about the key segments shaping this market

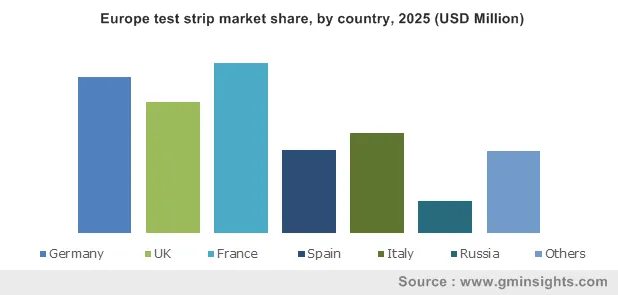

U.S. test strips market is expected to hold considerable market size of 4.9 billion in 2018, owing to increasing number of companies manufacturing diabetes test strips in the U.S. Additionally, growing prevalence of diabetes in North America and rising demand for point of care testing will further augment U.S. market demand.

China is expected to witness favourable growth of 5.1% across the forecast years. China has the maximum number of diabetic patients in the world, followed by India. Hence, rising prevalence of diabetes in the Asian countries will boost product demand, thus propelling business growth. Increasing habit of alcohol intake coupled with lack of physical activities leading to sedentary lifestyle will further fuel diabetes prevalence. Also, increasing incidence of obesity in such countries is another major factor contributing to growth of diabetes, thereby boosting the market revenue.

Test Strips Market Share

Few of the notable test strips industry players operating in global test strip market are

- Roche

- Abbott

- Lifescan

- Bayer

- B Braun

- Siemens

- Arkray

- Henry Schein

- Acon

- Tiadoc

These industry players implemented various strategies such as mergers and acquisitions, collaborations, accreditations, etc. in order to capture high revenue share in test strip industry.

Recent industry developments:

- In August 2016, Roche announced the launch of Accu-Chek Guide blood glucose monitoring system, that comprises spill resistant SmartPack test strip vials. This new product launch will assist the company in expanding its product portfolio.

- In January 2016, Panasonic Healthcare Holdings, Co., Ltd. announced the acquisition of Bayer AG’s diabetes care business. This acquisition strategy enabled the company to expand its diabetes care product portfolio and serve a broadened customer base.

Test Strips Industry Background

During the middle age, doctors used uroscopy, a practice where they studied urine to diagnose medical conditions by consulting intricately designed urine charts. This technique was primarily developed to diagnose diabetes. In 1841, Karl Trommer developed the first clinical test to detect sugar in urine by subjecting a urine sample to acid hydrolysis. In 1950, people witnessed the introduction of test strips by the Ames Company, a division of Miles Laboratory, eventually acquired by Bayer. Later in 1970, the Ames Company introduced the first glucose monitor with test strips for regular monitoring of blood glucose level in diabetic patients. With increasing demand for point of care testing, few other major companies such as Roche, Abbott and Siemens also started manufacturing test strips for diabetes management as well as urinalysis, thus augmenting test strip market growth. Furthermore, increasing prevalence of diabetes and other chronic diseases will also propel industry growth. The tools to diagnose and monitor blood glucose will continue to improve, and better diagnostic techniques will remain the prime focus for major players in the industry.

Frequently Asked Question(FAQ) :

How much growth rate is expected in thin-film strips industry through 2025?

Thin-film strips are expected to witness lucrative growth of 4% across the forecast years due to usage of novel nano technology in these test strips.

What was the estimated global test strips market size in 2018?

The market size of test strips exceeded USD 8.6 billion in 2018.

What is the anticipated growth for the test strips industry share during the forecast period?

The industry share of test strips is expected to expand at 3.8% CAGR from 2019 to 2025.

How much was the market size of test strips in U.S.?

U.S. market is expected to hold considerable market size of 4.9 billion in 2018, owing to increasing number of companies manufacturing diabetes test strips, says a GMI report.

What is the use of test strips?

Test strips are used to monitor or control glucose level of a diabetic patient which helps pre-diabetic and diabetic people track their blood glucose level on a regular basis without visiting a clinic or a diagnostic laboratory.

Test Strips Market Scope

Related Reports