Summary

Table of Content

Synchronous Condenser Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Synchronous Condenser Market Size

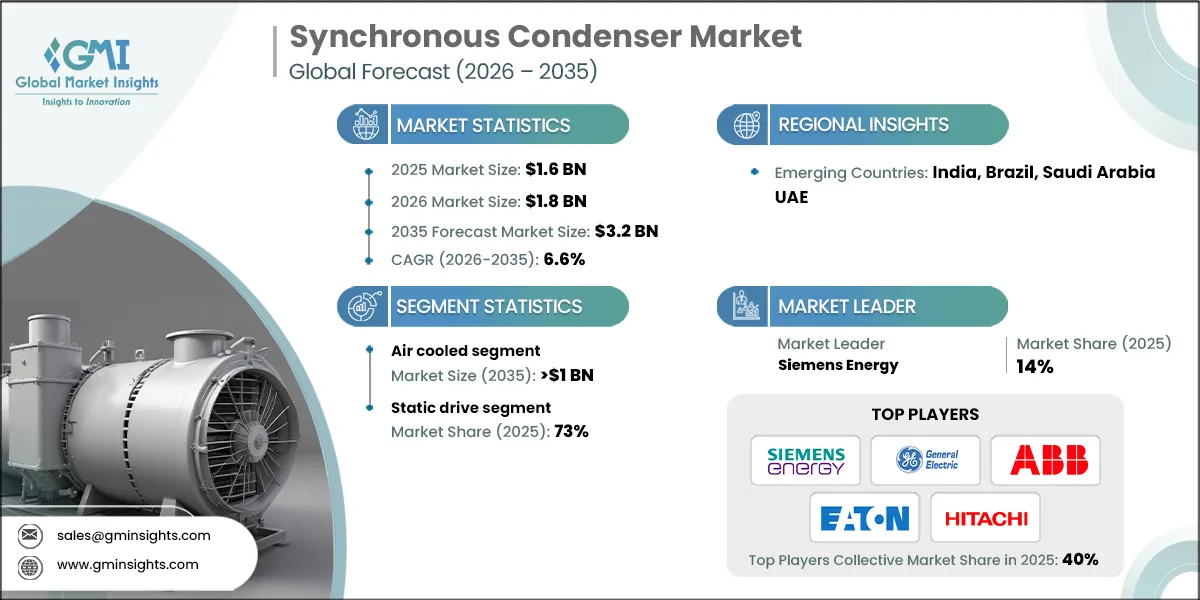

The global synchronous condenser market was estimated at USD 1.6 billion in 2025. The market is expected to grow from USD 1.8 billion in 2026 to USD 3.2 billion in 2035, at a CAGR of 6.6%.

To get key market trends

- The major driver is the behind the growth of synchronous condenser market is decommissioning of fossil-fuel-based power plants, which traditionally supplied inertia and reactive power. Their retirement leaves a gap that synchronous condensers effectively fill.

- Additionally, grid modernization initiatives worldwide, including smart grid development and high-voltage direct current (HVDC) transmission projects, are fueling demand for these devices. Governments and utilities are investing heavily in upgrading aging infrastructure to meet stricter reliability standards and accommodate distributed energy resources.z

- One of the primary factors fueling market growth is also the global shift toward renewable energy. The preference for renewable energy sources is increasing significantly across the world. For instance, global renewable energy capacity grew by a record-breaking 15.1% in 2024 to reach 4,448 gigawatts (GW).

- Wind and solar power plants often produce variable and unpredictable power outputs, leading to voltage fluctuations and grid instability. Synchronous condensers help mitigate these issues by providing fast, reliable reactive power support, ensuring grid stability and enhancing power quality.

- Furthermore, aging power infrastructure in many regions necessitates modernization efforts, including the replacement or upgrade of existing reactive power compensation devices. The investment in the energy sector has increased on a large scale owing to the rising demand for electricity. For instance, global energy investment is set to increase to a record USD 3.3 trillion in 2025, according to reports.

- As governments and private investors pour capital into renewable energy projects such as wind farms, solar parks, and other clean energy sources, the complexity of managing these intermittent power supplies grows. Synchronous condensers offer advantages over static devices like capacitor banks, such as dynamic response capabilities and inertia contribution, which are vital for maintaining grid stability during sudden disturbances.

- Technological advancements also contribute to market expansion. Innovations in machine design, control systems, and materials have improved the efficiency, reliability, and cost-effectiveness of synchronous condensers. These improvements enable utilities to deploy these solutions at a broader scale, including in smaller or more remote locations where traditional solutions might be less feasible.

Synchronous Condenser Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 1.6 Billion |

| Market Size in 2026 | USD 1.8 Billion |

| Forecast Period 2026-2035 CAGR | 6.6% |

| Market Size in 2035 | USD 3.2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing renewable energy integration | Enhances need for reactive power support and grid stability, boosting demand for synchronous condensers. |

| Growing need for grid stabilization | As grids become more complex, synchronous condensers provide inertia and voltage regulation, supporting reliable power supply. |

| Regulatory mandates for grid reliability | Policies promoting grid resilience and stability drive utilities to deploy synchronous condensers for compliance and performance enhancement. |

| Pitfalls & Challenges | Impact |

| High capital and operational costs | Deters smaller utilities and limits widespread adoption, slowing market growth. |

| Opportunities: | Impact |

| Integration with smart grid and IoT solutions | Enables real-time monitoring, predictive maintenance, and optimized operation of synchronous condensers. |

| Market Leaders (2025) | |

| Market Leader |

14% market share |

| Top Players |

Collective market share of 40% |

| Competitive Edge |

|

| Regional Insights | |

| Emerging countries | India, Brazil, Saudi Arabia, UAE |

| Future outlook |

|

What are the growth opportunities in this market?

Synchronous Condenser Market Trends

- As the global shift toward renewable energy accelerates, there is an increasing need for grid stabilization solutions that can handle the variability and intermittency of sources like wind and solar. Synchronous condensers are vital in providing inertia, reactive power, and voltage support, enabling the smooth integration of renewables into existing power systems.

- The rising preference for solar energy is driving the overall demand for synchronous condensers all over the world. For instance, in 2024, the U.S. solar energy sector experienced a record-breaking year, adding more new capacity than any other energy technology in the past two decades. Utility-scale solar generation reached 218.5 terawatt-hours, with total solar generation, including small-scale, estimated at 303.2 TWh.

- Similarly, wind energy is also growing tremendously, driving the market of Synchronous condenser. In 2024, Europe installed 16.4 GW of new wind power capacity, with 13.8 GW coming from onshore and 2.6 GW from offshore wind. The EU-27 accounted for 12.9 GW of this new capacity. Despite this growth, Europe's wind power expansion is not on track to meet its 2030 renewable energy targets.

- The evolution of smart grids incorporates advanced communication, automation, and control systems. Synchronous condensers are becoming integral to these intelligent networks, offering real-time voltage regulation, frequency control, and enhanced grid resilience, which are essential for modern, digitized power infrastructure. Advancements in digital technologies, including IoT, AI, and machine learning, are transforming synchronous condenser operations.

- Governments worldwide are promoting clean energy and grid modernization through policies, subsidies, and incentives. Such supportive frameworks are accelerating investments in synchronous condenser projects, especially in regions committed to decarbonization. Cross-border electricity transmission projects and regional grid interconnections demand advanced stability solutions.

Synchronous Condenser Market Analysis

Learn more about the key segments shaping this market

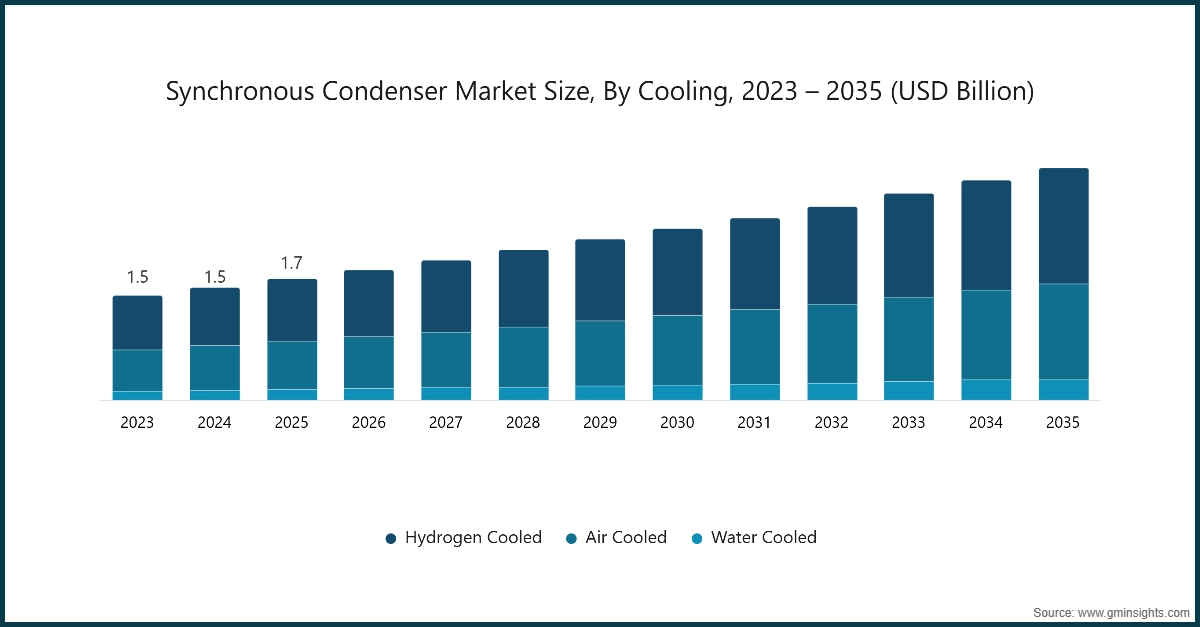

Based on cooling, the industry is segmented into hydrogen cooled, air cooled, water cooled. The air cooled segment is anticipated to exceed USD 1 billion by 2035 since air-cooled synchronous condensers offer a cost-effective and simpler installation process compared to water or hydrogen-cooled systems, making them attractive for a wide range of applications.

- Their design requires less infrastructure, reducing upfront capital expenditure and operational complexities, which is especially advantageous in regions with limited water resources or stringent safety regulations. Additionally, ongoing technological advancements have improved the efficiency and reliability of air-cooled systems, further boosting their adoption.

- Hydrogen cooled segment is also an important segment in the synchronous condenser market, holding around 52% market share. Hydrogen has a much higher thermal conductivity compared to air or water, allowing it to dissipate heat more effectively from the machine’s components. This results in improved cooling performance, enabling the synchronous condenser to operate at higher power ratings and greater efficiency.

- Hydrogen-cooled systems can achieve higher power densities, making them suitable for large-scale grid stabilization, renewable integration, and industrial applications that require robust capacity in a limited footprint. As grids become more complex with increased renewable energy integration, there is a need for highly reliable, efficient, and high-capacity synchronous condensers.

- Electrical consumption across the world is increasing on a large scale owing to multiple factors. For instance, in 2024, the U.S. saw a recovery in electricity demand after a dip in 2023, with a projected increase of 2.5%. This growth is expected to continue, with the Energy Information Administration (EIA) reporting record highs in power demand for 2025 and 2026.

- This rising consumption is creating a huge need for power plants and thereby increasing the demand for synchronous condensers across the world. Additionally, emerging economies are investing heavily in expanding and modernizing their power infrastructure to meet increasing energy demands, which in turn boosts the requirement for such equipment.

Learn more about the key segments shaping this market

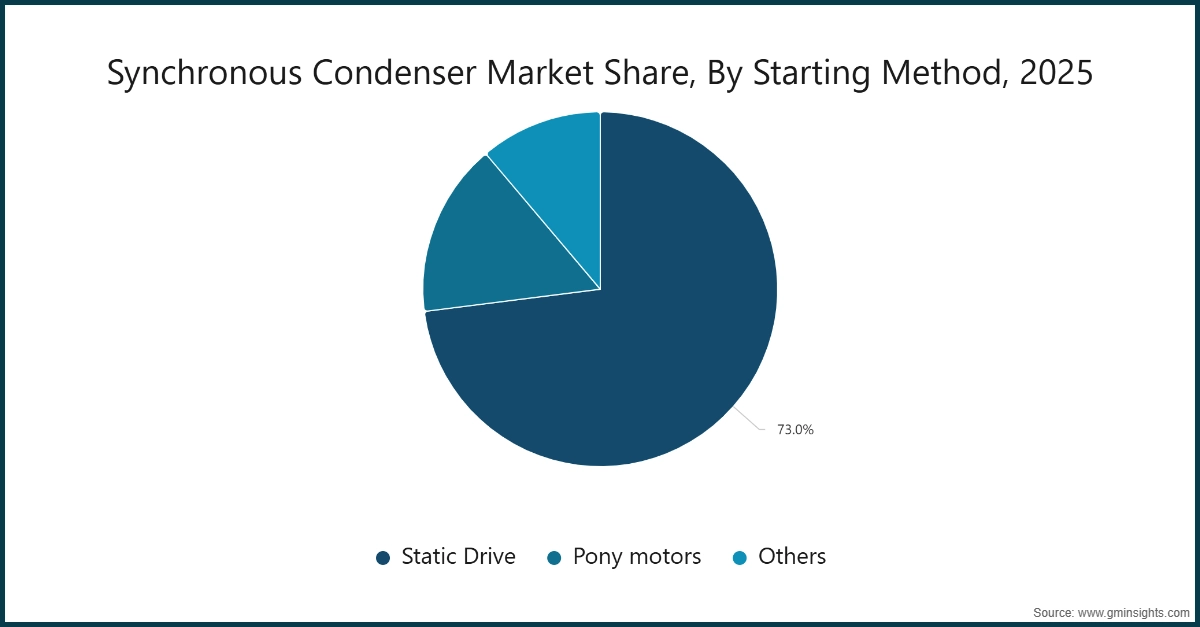

- Based on starting method, the industry is segmented into static drive, pony motors and others. The static drive segment holds a market share of 73% in 2025 and is expected to grow at a CAGR of over 6% from 2026 to 2035.

- Static drives, which use power electronic components such as thyristors or IGBTs, offer superior efficiency compared to pony motors or other starting methods. They enable precise control of starting current and torque, reducing wear and tear on equipment, and ensuring more reliable operation.

- Unlike pony motors, which require additional mechanical components and maintenance, static drives eliminate the need for these parts. This results in lower maintenance costs, longer equipment lifespan, and reduced downtime, making them more attractive for long-term operational efficiency.

- Furthermore, continuous investments in natural gas infrastructure encourage the adoption of cleaner energy sources, are significantly boosting demand for natural gas. Natural gas remains essential for providing reliable backup power, maintaining its vital role within the energy mix. For instance, in 2024, the U.S. clean energy sector announced new investments totaling USD 500 billion, expected to stimulate economic growth across the country.

- As per reports, preliminary data indicate that natural gas demand increased by 2.7%, or 115 billion cubic meters (bcm) (equivalent to around 4 EJ) in year 2024. As natural gas plants are often integrated into power grids powered by renewable sources, they help maintain grid stability. Synchronous condensers are used alongside these plants to provide reactive power support and stabilize the grid during fluctuations.

- Natural gas acts as a transitional fuel, enabling higher penetration of renewables. As their role expands, the grid requires more ancillary equipment like synchronous condensers to handle the increased variability and to maintain system stability. This drives up demand for synchronous condensers to complement natural gas generation.

Looking for region specific data?

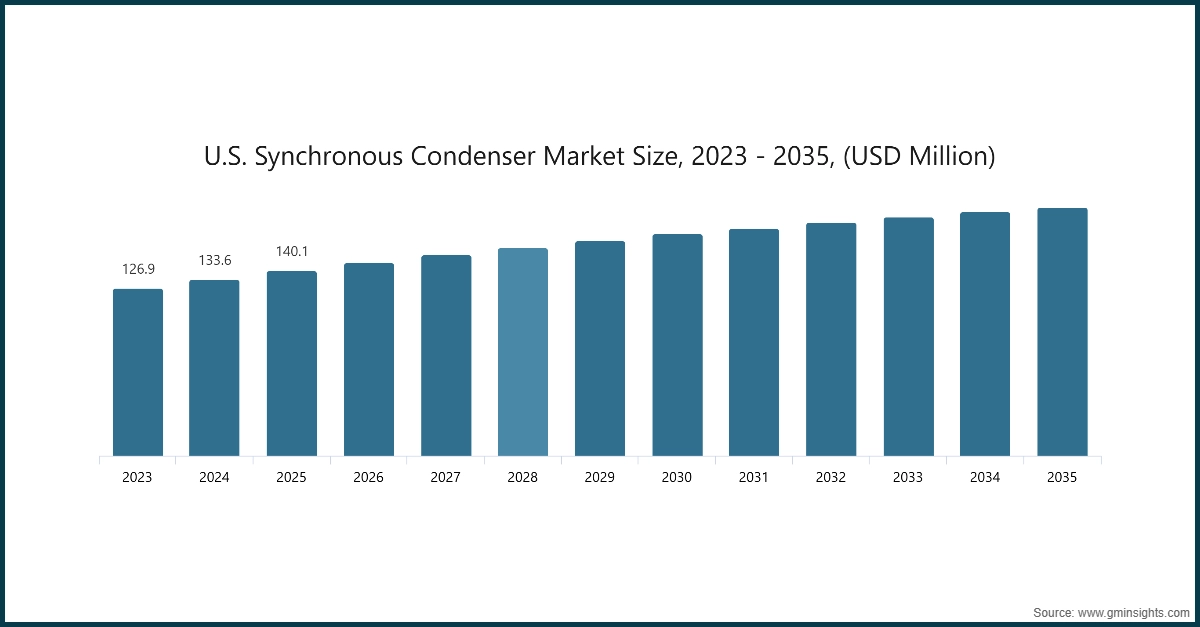

- The U.S. synchronous condenser market is anticipated to exceed USD 188 million by 2035. Regulatory policies aimed at maintaining grid reliability and accommodating the increased share of intermittent renewable sources necessitate advanced reactive power compensation devices like synchronous condensers.

- U.S. is one of the most developed economy in the world, contributing 26.2% to the global aggregate GDP in nominal terms and 14.8% in purchasing power parity terms, according to the World Bank. The U.S. also plays a significant role in international trade, with both exports and imports impacting global trade balances.

- The rising demand for industries such as oil and gas are significantly creating a demand for synchronous condensers. The U.S., the second largest economy in the world, accounts for 15% of global clean energy investment, and remains a major investor in oil and gas. Therefore, U.S. synchronous condenser market is important segment, contributing significantly to the global market size.

- Middle Eastern countries are investing heavily in expanding and modernizing their electrical infrastructure to support economic growth, urbanization, and industrialization. Synchronous condensers are essential for maintaining grid stability, voltage regulation, and reactive power support in these expanding networks.

- In APAC, emerging economies including China, India, Indonesia, and Southeast Asian countries are also experiencing swift urban development and industrial expansion. This growth increases demand for reliable power infrastructure, where synchronous condensers play a vital role in maintaining grid stability and power quality.

Synchronous Condenser Market Share

- The top 5 companies in the synchronous condenser market are Siemens Energy, General Electric, ABB, Eaton, and Hitachi. They are contributing around 40% of the market in 2025.

- These leading companies play a pivotal role in the global synchronous condenser market due to their technological expertise, extensive product portfolios, and innovative solutions. As industry pioneers, they develop high-performance, reliable synchronous condensers that are critical for maintaining grid stability, voltage regulation, and reactive power management in modern power systems.

- These corporations also contribute significantly through their global presence and extensive service networks, enabling them to undertake large-scale projects across diverse regions such as the Middle East, Asia Pacific, and Europe. Their ability to customize solutions to meet specific grid requirements makes them preferred partners for utilities and independent power producers.

- In addition to manufacturing, these companies provide comprehensive after-sales support, maintenance, and training services, which are essential for the long-term performance and sustainability of synchronous condensers. Their leadership and technological advancements have solidified their positions as industry frontrunners, driving growth and innovation in the evolving energy landscape.

Synchronous Condenser Market Companies

- In May 2025, Siemens Energy reported USD 17 billion in orders, marking a 52.3% year-over-year increase on a comparable basis, driven by significant growth in grid technologies and record-high quarterly order in energy services.

- In March 2023, Toshiba Energy Systems received an order from Tohoku Electric Power to install a STATCOM. This STATCOM will play a crucial role in enhancing grid stability during the transmission of high-capacity power and ensuring a reliable power supply in the event of a transmission system fault.

- In January 2023, Ansaldo Energia generated revenue of USD 1.2 billion in 2024. Recently the company, in partnership with Terna, transported a synchronous condenser and transformer to the Codrongianos electrical station in Sassari province, utilizing both sea and land routes. The synchronous condenser, a specialized type of electric generator, will be connected to Terna's transmission grid to facilitate reactive energy exchange and enhance short-circuit power.

Major players operating in the synchronous condenser industry are:

- ABB

- Alstom SA

- ANDRITZ

- Ansaldo Energia

- Baker Huges

- Bharat Heavy Electricals Limited

- BRUSH

- Doosan

- Eaton

- General Electric

- Hitachi Energy Ltd.

- Ingeteam

- Mitsubishi Electric Power Products, Inc.

- NIDEC Corporation

- Power Systems & Controls, Inc.

- Shanghai Electric

- Siemens Energy

- Toshiba Energy Systems & Solutions Corporation

- Voith GmbH & Co.

- WEG

Synchronous Condenser Industry News

- In May 2025, The GE Vernova and ANDRITZ HYDRO Corp. consortium announced award of an engineering, procurement, and construction (EPC) contract for the addition of two synchronous condensers to the LCRA Transmission Services Corporation (LCRA TSC) project at the 345 kV Bakersfield substation in West Texas.

- In May 2025, Siemens Energy has been selected to supply and install synchronous condensers for the Central-West Orana Renewable Energy Zone (REZ) in New South Wales, supporting one of Australia’s most significant renewable energy infrastructure programs. The contract was awarded by ACEREZ, a consortium of ACCIONA, COBRA, and Endeavour Energy, marking a key milestone in enabling up to 4.5 gigawatts (GW) of renewable energy under Stage 1 of the REZ rollout.

- In June 2025, Eaton started working with Tennessee Valley Authority (TVA) to repurpose its retired Bull Run Fossil Plant in Clinton, Tennessee into a critical asset supporting reliable and clean energy. Eaton provides the electrical and mechanical solutions needed to convert one machine comprised of two generators into two 605 mega-volt amperes reactive (MVAR) synchronous condensers.

The synchronous condenser market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) from 2022 to 2035, for the following segments:

Market, By Cooling

- Hydrogen Cooled

- Air Cooled

- Water Cooled

Market, By Starting Method

- Static Drive

- Pony motors

- Others

Market, By End User

- Utility

- Industrial

Market, By Reactive Power Rating

- ≤ 100 MVAr

- > 100 MVAr to ≤ 200 MVAr

- > 200 MVAr

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- Italy

- France

- Russia

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Latin America

- Brazil

- Argentina

Frequently Asked Question(FAQ) :

Who are the key players in the synchronous condenser market?

Key players include Siemens Energy, General Electric, ABB, Eaton, Hitachi Energy Ltd., Alstom SA, ANDRITZ, Ansaldo Energia, Baker Hughes, Bharat Heavy Electricals Limited, BRUSH, and Doosan.

What are the upcoming trends in the synchronous condenser industry?

Key trends include the integration of synchronous condensers with smart grid and IoT solutions, enabling real-time monitoring, predictive maintenance, and optimized operations. The adoption of air-cooled systems and static drive methods is also gaining traction due to their cost-effectiveness and efficiency.

What is the growth outlook for the U.S. synchronous condenser market by 2035?

The U.S. synchronous condenser market is anticipated to exceed USD 188 million by 2035. Regulatory policies aimed at grid reliability and accommodating renewable energy sources are driving this growth.

What is the synchronous condenser market size in 2025?

The market size for synchronous condenser is valued at USD 1.6 billion in 2025. Increasing renewable energy integration and grid stabilization needs are driving market growth.

What was the market share of the static drive segment in 2025?

The static drive segment held a 73% market share in 2025 and is projected to grow at a CAGR of over 6% from 2026 to 2035. Its dominance is attributed to its efficiency and reliability in synchronous condenser operations.

What is the anticipated revenue for the air-cooled segment by 2035?

The air-cooled segment is expected to exceed USD 1 billion by 2035. Its cost-effectiveness and simpler installation process compared to water or hydrogen-cooled systems make it a preferred choice for various applications.

What is the market size of the synchronous condenser industry in 2026?

The market size for synchronous condensers is projected to reach USD 1.8 billion in 2026, reflecting steady growth driven by regulatory mandates and grid reliability requirements.

What is the projected value of the synchronous condenser market by 2035?

The market size for synchronous condensers is expected to reach USD 3.2 billion by 2035, growing at a CAGR of 6.6%. This growth is fueled by the integration of renewable energy sources, grid complexity, and advanced reactive power compensation technologies.

Synchronous Condenser Market Scope

Related Reports