Summary

Table of Content

Swine Vaccines Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Swine Vaccines Market Size

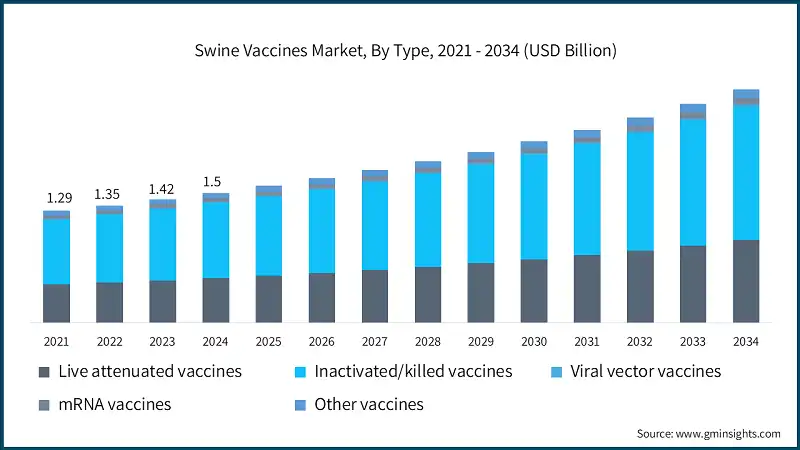

The global swine vaccines market was valued at USD 1.5 billion in 2024. The market is expected to grow from USD 1.6 billion in 2025 to USD 2.7 billion in 2034, at a CAGR of 6.1% during the forecast period, according to the latest report published by Global Market Insights Inc. Strong market growth can be attributed to the rising global consumption and production of pork and pork products. Pork is one of the most consumed meats worldwide, which increases the need to ensure the health and productivity of swine herds.

To get key market trends

For instance, pork accounts for a significant portion (34%) of global meat consumption. Current pork consumption stands at about 131,040 kilotons, with an expected rise to about 131,500 kilotons by 2031. This demand underscores the importance of biosecurity and disease prevention measures, thereby driving the need for swine vaccines. Thus, to ensure animal health and reach production goals, swine producers are placing a growing importance on vaccination protocols and vaccines.

Another key factor influencing the swine vaccines market is the rising incidence of infectious diseases in pigs, such as Porcine Reproductive and Respiratory Syndrome (PRRS), Classical Swine Fever (CSF), and African Swine Fever (ASF). Porcine reproductive and respiratory syndrome (PRRS) caused an estimated USD 1.2 billion per year in lost production in the U.S. pork industry from 2016 to 2020, an 80% increase from a decade earlier, according to a new analysis by an Iowa State University expert. Such disease outbreaks have been responsible for significant loss of life, declines in productivity, and, consequently, substantial economic losses. As a response, governments have increased their surveillance and monitoring, funding research, and using vaccination as a prevention strategy, thereby driving market growth.

Swine vaccines are biological products that stimulate the pig’s immune system to recognize and fight against specific pathogens, including viruses, bacteria, and other microorganisms that infect pigs. Leading players in the global swine vaccine market include companies such as Zoetis, Merck Animal Health, Boehringer Ingelheim, Ceva Santé Animale, and Elanco Animal Health. These companies invest significantly in R&D, innovations, technological enhancements, and strategic partnerships, thereby driving the growth. Their strong global distribution networks enable them to expand market reach and drive the adoption of advanced vaccine solutions worldwide.

The swine vaccines market was valued at USD 1.3 billion in 2021 and reached USD 1.4 billion by 2023. Recurring outbreaks of diseases like African Swine Fever (ASF) and PRRS increased the adoption of preventive health measures, forcing producers to adopt comprehensive vaccination strategies. At the same time, stricter regulations on the overuse of antibiotics in livestock encouraged the broader use of vaccines as safer, long-term disease control tools. Emerging markets, especially in the Asia-Pacific, played a critical role in market expansion due to rising pork demand and the scaling up of commercial pig farming. This period also saw stronger government involvement in disease monitoring and vaccination programs, further reinforcing the role of vaccines in ensuring herd health and food security.

Swine Vaccines Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 1.5 Billion |

| Market Size in 2025 | USD 1.6 Billion |

| Forecast Period 2025 - 2034 CAGR | 6.1% |

| Market Size in 2034 | USD 2.7 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising incidence of zoonotic diseases | The rising incidence of zoonotic diseases emphasizes the critical role of swine vaccines in preventing infections that can spread from pigs to humans, ensuring both animal and public health safety. |

| Expanding livestock industry and food security concerns | The rapid expansion of the livestock industry, combined with growing food security concerns globally, is driving higher demand for effective vaccination programs to maintain healthy and productive pig populations. |

| Advancements in vaccine technology | Advancements in vaccine technology, such as recombinant and DNA-based vaccines, are improving the efficacy, safety, and ease of administration, encouraging broader adoption among swine producers. |

| Increasing outbreaks of animal diseases | Increasing frequency and severity of animal disease outbreaks, including African Swine Fever and PRRS, are forcing governments and farmers to prioritize preventive vaccination measures to minimize economic losses. |

| Pitfalls & Challenges | Impact |

| High R&D costs & long development timelines | The high cost of research and development, along with lengthy vaccine development and testing periods, significantly delays the introduction of new and improved vaccines into the market. |

| Cold chain infrastructure limitations | Inadequate cold chain infrastructure in many regions limits proper vaccine storage and transportation, leading to reduced vaccine potency and decreased immunization coverage. |

| Regulatory complexity & approval delays | Regulatory complexities, varying standards across countries, and prolonged approval processes create significant barriers for manufacturers, delaying timely access to innovative vaccines. |

| Opportunities: | Impact |

| mRNA & next-generation platform adoption | The adoption of mRNA and other next-generation vaccine platforms offers promising potential for quicker, more adaptable vaccines that can respond rapidly to emerging and mutating swine diseases. |

| Thermostable vaccine development | Development of thermostable vaccines that remain effective without refrigeration could revolutionize vaccine distribution, especially in regions lacking cold chain facilities, improving accessibility and reducing costs. |

| Combination vaccine innovation | Innovative combination vaccines that protect against multiple pathogens simultaneously reduce the number of injections required, lowering labor costs and stress on animals while enhancing overall herd immunity. |

| Market Leaders (2024) | |

| Market Leaders |

38.5% market share. |

| Top Players |

Collective market share in 2024 is 95% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Swine Vaccines Market Trends

- The rapid expansion of the global livestock industry to meet the growing demand for animal protein, driven by rising populations, urbanization, and changing dietary preferences, is a key factor driving the global swine vaccines market.

- Pork is one of the most consumed meats worldwide. For example, the OECD-FAO Agricultural Outlook projects global pork demand rising from approximately 110.5 million tons (2019-21 average) to 128.9 million tons by 2031, with Asian demand increasing from 61.4 to 76 million tons, representing a 24% increase.

- With the intensification of swine production for improving efficiency and yields, swine producers are also giving much emphasis to preventive healthcare measures that protect herd health and performance. This intensification is the direct driver for swine vaccine requirements, as the vaccines are key to minimizing the risk for disease occurrence that would have serious effects on the survival of animals as well as financial yields.

- Moreover, food security has emerged as a critical concern for many nations, especially in regions with a high reliance on pork as a protein source. Any disruption in swine production due to infectious diseases can cause severe supply chain imbalances, pushing up meat prices and straining food availability.

- In such cases, vaccines are seen as a key defense mechanism to ensure stable pork production by minimizing losses from diseases such as porcine reproductive and respiratory syndrome (PRRS), swine influenza, and classical swine fever.

- Thus, maintaining herd health through vaccination programs directly supports global food security initiatives.

- Also, technological advances in vaccine development have positively influenced the market demand.

- For instance, Merck Animal Health's Sequivity platform uses a next-generation RNA particle technology to create rapid, custom, and herd-specific prescription vaccines for animals, primarily food-producing livestock. This platform allows for the creation of custom vaccines in as little as 10-16 weeks, enabling quick responses to evolving disease challenges like swine influenza, rotavirus, and porcine circovirus.

- Lastly, immunization campaigns supported by the government and regulatory bodies are also propelling the swine vaccine market.

Swine Vaccines Market Analysis

Learn more about the key segments shaping this market

Based on type, the market is segmented into live attenuated vaccines, inactivated/killed vaccines, viral vector vaccines, mRNA vaccines, and other vaccines. The inactivated/killed vaccines segment accounted for a share of 57.6% and was valued at USD 862.4 million in 2024 and is poised to witness growth over the coming years.

- The inactivated or killed vaccines are known for their proven safety and stability and hence are a vaccine of choice among producers.

- Their longer shelf life and ease of storage also make them ideal for large-scale vaccination programs, particularly in regions with established cold chain infrastructure.

- As a result, inactivated vaccines continue to be a preferred choice for controlling common swine diseases globally.

- The live attenuated vaccines segment, on the other hand, secured a significant market share of 34.4% in 2024 and is anticipated to grow at a CAGR of 6.4% over the forecast years.

- These vaccines provide strong, long-lasting, and broad immune responses against multiple swine diseases.

- A key driver of their adoption is their proven efficacy in controlling high-impact swine diseases such as porcine reproductive and respiratory syndrome (PRRS) and swine influenza, which continue to pose significant challenges to herd health and productivity worldwide.

- The rapid onset of immunity provided by live attenuated vaccines is highly valuable in intensive pig farming operations, where disease outbreaks can spread quickly and cause major economic losses.

Learn more about the key segments shaping this market

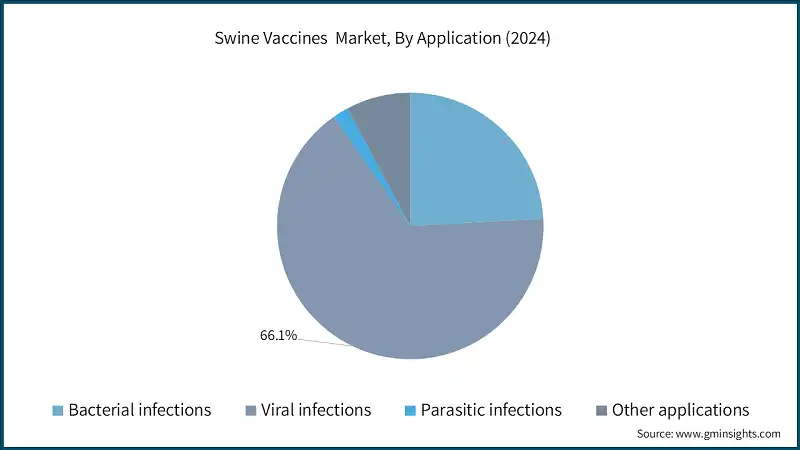

Based on application, the swine vaccines market is classified into bacterial infections, viral infections, parasitic infections, and other applications. The viral infections segment accounted for USD 990.6 million in 2024 and is anticipated to grow at a CAGR of 6.3% during the forecast period.

- The viral infections segment is primarily driven by the widespread prevalence and economic burden of viral diseases such as porcine reproductive and respiratory syndrome (PRRS), classical swine fever (CSF), swine influenza, and porcine epidemic diarrhea (PED).

- These infections are highly contagious and can cause significant mortality, reduced growth performance, reproductive failure, and financial losses for swine producers worldwide.

- The high transmissibility and rapid spread of these viral infections in densely populated farms make vaccination the most effective preventive measure, driving their significant market share.

Based on route of administration, the swine vaccines market is classified into injection vaccines, oral vaccines, and immersion/spray vaccines. The injection vaccines segment accounted for the highest market revenue of USD 1.1 billion in 2024 and is expected to reach USD 2 billion by the end of 2034.

- Injection vaccines are preferred due to their proven effectiveness in delivering a precise dose directly into the animal’s system. They offer strong, long-lasting immunity and are widely used in both preventive and emergency vaccination programs.

- Additionally, the availability of both inactivated and live attenuated vaccines in injectable form offers flexibility for use depending on the disease profile and farm requirements.

- Moreover, advances in needle-free injection technologies are reducing stress and injury to animals while improving biosecurity standards, thereby further encouraging adoption.

- On the other hand, the oral vaccines segment is anticipated to witness rapid growth at a CAGR of 6.5%.

- High growth of the oral vaccines segment is due to their ease of administration, reduced stress on animals, and suitability for mass immunization.

- As innovations improve the stability and effectiveness of oral formulations, their adoption is expected to rise rapidly, particularly in regions with limited veterinary infrastructure.

Based on the distribution channel, the swine vaccines market is categorized into veterinary hospital pharmacies, retail pharmacies, and e-commerce. The veterinary hospital pharmacies segment is expected to reach USD 2.1 billion by 2034. The e-commerce segment, on the other hand, is anticipated to witness rapid growth at a 6.6% CAGR between 2025 – 2034. Increased digital adoption, convenience, and wider product accessibility are major factors driving segmental growth.

- Veterinary hospital pharmacies are a key distribution channel in the swine vaccines market due to their direct access to livestock producers and veterinarians.

- These pharmacies not only supply vaccines but also provide expert guidance on vaccine administration and herd health management, ensuring proper usage.

- Their reliability, professional oversight, and integration with animal healthcare services make them a preferred choice for vaccine procurement.

Looking for region specific data?

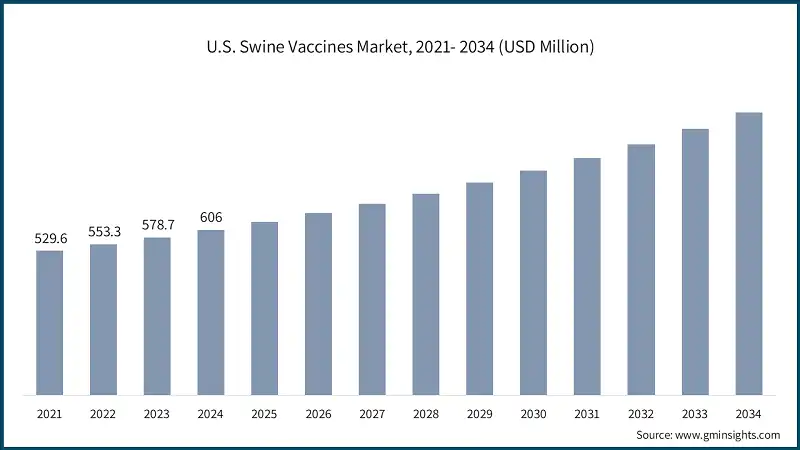

North America Swine Vaccines Market North America dominates the global market with a market size of USD 650.8 million in 2024 and is anticipated to reach USD 1.1 billion by 2034, growing at a CAGR of 5.6% between 2025 - 2034. The U.S. swine vaccines market was valued at USD 529.6 million and USD 553.3 million in 2021 and 2022, respectively. The market size reached USD 606 million in 2024, growing from USD 578.7 million in 2023. Europe market accounted for USD 407.8 million in 2024 and is anticipated to show lucrative growth over the forecast period. Germany dominates the Europe swine vaccines market, showcasing strong growth potential. The Asia Pacific market is projected to grow at a CAGR of 6.8%, reflecting increasing demand for disease prevention and herd health management across the region. This growth is largely influenced by the scale of pig farming operations and the impact of infectious diseases on livestock productivity. China swine vaccines market is estimated to grow with a significant CAGR in the Asia Pacific market. Brazil leads the Latin American market, exhibiting remarkable growth during the analysis period. South Africa market is expected to experience substantial growth in the Middle East and Africa swine vaccines industry in 2024. The competitive landscape of the swine vaccines industry is characterized by the presence of several established global players alongside emerging specialized companies. The market is highly consolidated with top players such as Boehringer Ingelheim, Merck & Co., Inc., Ceva, Elanco Animal Health Incorporated, and Zoetis accounting for 95% of the global swine vaccines market. By investing in cutting-edge immunological research, including mRNA technologies and precision vaccine formulations, these companies aim to enhance disease prevention and support better herd management. Strategic collaborations with veterinary institutions, academic researchers, and agri-tech partners further strengthen their capabilities. Through ongoing R&D, mergers, and acquisitions, these industry leaders are expanding access to high-quality swine vaccines and reinforcing their competitive position in the global swine vaccine market. Prominent players operating in the swine vaccines industry are as mentioned below: Boehringer Ingelheim is a key player in the global swine vaccine market, delivering innovative, science-driven solutions that combine advanced immunology with practical on-farm application. With a strong global presence and a commitment to sustainable livestock production, Boehringer Ingelheim continues to set new benchmarks in swine health, driving improvements in productivity, animal welfare, and biosecurity across diverse production systems. For instance, in September 2025, Boehringer Ingelheim introduced INGELVAC CIRCOFLEX AD in the U.S., the first swine vaccine to combine PCV2a and PCV2d antigens in a single dose. Designed to address the growing prevalence of PCV2d, the vaccine enhances herd health, reduces co-infections, and supports producer profitability in a shifting disease landscape. Merck & Co., Inc. is a prominent player in the global swine vaccine market, offering a robust portfolio of products targeting key swine diseases such as porcine circovirus (PCV2), mycoplasma hyopneumoniae, PRRS, and Lawsonia intracellularis. Its swine vaccine line includes well-established brands that utilize advanced technologies, including inactivated and RNA-based platforms, to deliver effective, tailored protection. Merck’s global manufacturing and distribution network ensures consistent supply and accessibility across major livestock-producing regions. Zoetis is a global provider of swine vaccines, offering a diverse and scientifically backed portfolio that addresses major swine diseases. The company focuses on developing combination vaccines that reduce animal handling stress and improve vaccination efficiency, helping producers streamline herd health management. With a strong emphasis on innovation, Zoetis continues to enhance vaccine delivery technologies and optimize disease prevention strategies.Europe Swine Vaccines Market

Asia Pacific Swine Vaccines Market

Latin American Swine Vaccines Market

Middle East and Africa Swine Vaccines Market

Swine Vaccines Market Share

Swine Vaccines Market Companies

Swine Vaccines Industry News

The swine vaccines market research report includes in-depth coverage of the industry with estimates and forecasts in terms of revenue in USD Million from 2021 – 2034 for the following segments:

Market, By Type

- Live attenuated vaccines

- Inactivated/killed vaccines

- Viral vector vaccines

- mRNA vaccines

- Other vaccines

Market, By Application

- Bacterial infections

- Viral infections

- Parasitic infections

- Other applications

Market, By Route of Administration

- Injection vaccines

- Oral vaccines

- Immersion/spray vaccines

Market, By Distribution Channel

- Veterinary hospital pharmacies

- Retail pharmacies

- E-commerce

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the swine vaccines market?

Key players include Merck, Zoetis, Boehringer Ingelheim International, Ceva Santé Animale, Elanco Animal Health Incorporated, Addison Biological Laboratory, Bioveta, a.s., and Colorado Serum Company.

What was the valuation of the injection vaccines segment in 2024?

The injection vaccines segment held the highest revenue, generating USD 1.1 billion in 2024.

What is the growth outlook for the e-commerce distribution channel from 2025 to 2034?

The e-commerce segment is projected to grow at a 6.6% CAGR through 2034, driven by increased digital adoption, convenience, and broader product accessibility.

Which region leads the swine vaccines market?

North America led the market with USD 650.8 million in 2024. The region's dominance is attributed to strong veterinary infrastructure and high awareness of animal health.

What are the upcoming trends in the swine vaccines industry?

Key trends include the development of thermostable vaccines, adoption of mRNA and next-generation platforms, and innovations in combination vaccines to enhance herd immunity.

What is the market size of the swine vaccines industry in 2024?

The market size was USD 1.5 billion in 2024, with a CAGR of 6.1% expected through 2034, driven by rising zoonotic diseases and advancements in vaccine technology.

What is the current swine vaccines market size in 2025?

The market size is projected to reach USD 1.6 billion in 2025.

What is the projected value of the swine vaccines market by 2034?

The market size for swine vaccines is expected to reach USD 2.7 billion by 2034, fueled by innovations in combination vaccines and the adoption of next-generation vaccine platforms.

How much revenue did the inactivated/killed vaccines segment generate in 2024?

The inactivated/killed vaccines segment generated USD 862.4 million in 2024, accounting for 57.6% of the market share.

Swine Vaccines Market Scope

Related Reports