Summary

Table of Content

South America Plastic Extrusion Measurement and Control Technology Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

South America Plastic Extrusion Measurement and Control Technology Market Size

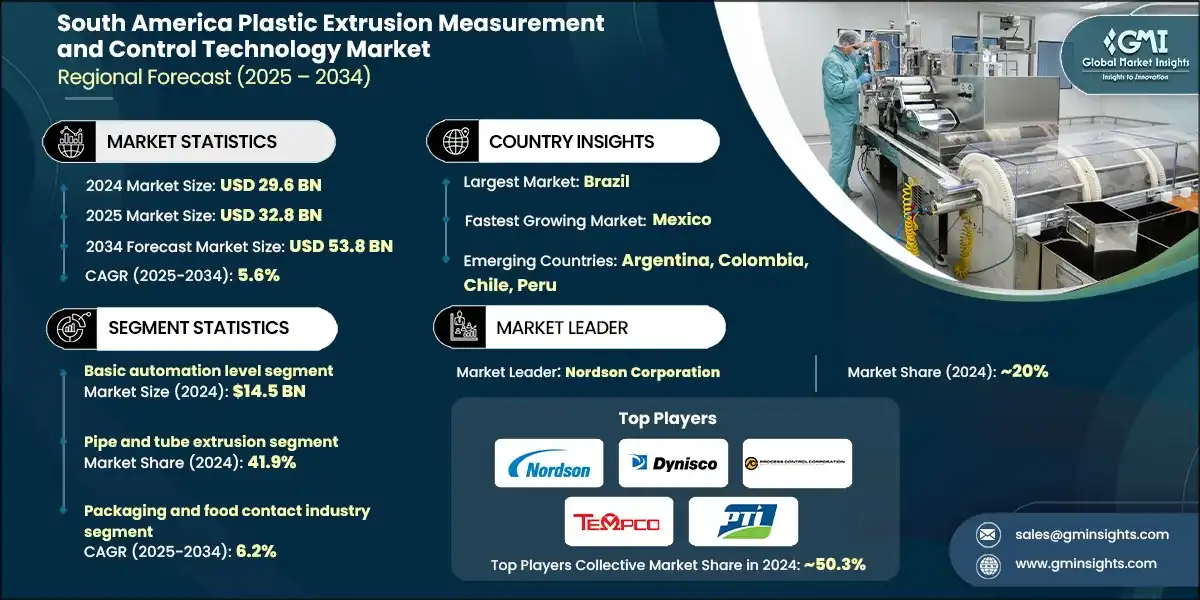

The South America plastic extrusion measurement and control technology market was estimated at USD 29.6 billion in 2024. The market is expected to grow from USD 32.8 billion in 2025 to USD 53.8 billion in 2034, at a CAGR of 5.6% according to latest report published by Global Market Insights Inc.

To get key market trends

- The growth of the South American plastic extrusion measurement and control technology market is being greatly impacted by the emerging economies within Latin America fueled by increased rates of industrialization and large amounts of infrastructure development occurring within these economies. Countries like Brazil, Argentina, and Colombia are all investing considerably in construction, utilities, and transportation projects; “extruded” plastics make up nearly all aspects of each of these types of projects, from pipes to profiles to sheets that can be found throughout many applications. These increasing amounts of Infrastructure Projects have created a need for advanced extrusion systems that include precision measurement and control technologies to provide proper product quality, compliance with stringent specifications, and maximization of operational efficiencies.

- Along with infrastructure development, the packaging and food & beverage (F&B) industries continue to play a major role in the continuing growth of the market. The expanding consumer base in South America along with increasing rates of urbanization continue to create exponentially higher levels of consumption of Packaged Goods. As a result, a tremendous increase in the volume of Films, Sheets and Coatings produced via extrusion processes have been witnessed due to the above-stated trends.

- In the F&B Industry, there are strict guidelines that must be met concerning the parameters of thickness, barrier properties and uniformity for extruded products to be considered compliant. Inline measurement and automated control systems are now a must-have for manufacturers wishing to meet these standards while minimizing material waste, optimizing production rates and maintaining product integrity at high volumes.

- The extrusion industry in South America is being radically changed as technology merges with Industry 4.0. Technology such as the Internet of Things (IoT) with Sensors and machines integrated with cloud computing, Advanced Analytics powered by AI, and Closed Loop Control Systems all are being utilized so production to have greater efficiency and real-time production monitoring. Predictive maintenance through monitoring, reduced unexpected downtime, and increased overall productivity have been major benefits of adopting Technology and the increased utilization of digital uses have addressed the labor shortage issue by providing Automation to perform complex, repetitive manual tasks freeing up Manufacturers to focus on Innovation and Growth Strategies.

- The increasing demand for automation systems in setting up a fully automated plastic factory on a global scale, both by advanced measurement and control solutions in conjunction with increased automation, will allow businesses to utilize resources to build products; thereby, reducing human error and providing time savings across the entire process. It is anticipated that smart technology will continue to play an integral role in the future development of South America and the rest of the world, enabling businesses to build highly automated factories and, thus, create higher quality products at lower costs than traditional methods of production.

South America Plastic Extrusion Measurement and Control Technology Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 29.6 Billion |

| Market Size in 2025 | USD 32.8 Billion |

| Forecast Period 2025 - 2034 CAGR | 5.6% |

| Market Size in 2034 | USD 53.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Accelerated industrialization and expansion of infrastructure projects | Boosts demand for extruded pipes and profiles, increasing the need for precise measurement and control systems to meet quality and safety standards. |

| Increasing demand from the packaging and food & beverage sectors | Drives high-volume extrusion of films and sheets, creating strong adoption of automated thickness and barrier control technologies. |

| Rapid integration of industry 4.0 technologies across industries | Enhances process efficiency and predictive maintenance, accelerating the shift toward smart extrusion lines with real-time monitoring. |

| Pitfalls & Challenges | Impact |

| Significant capital requirements coupled with low return on investment | Restricts adoption among SMEs, slowing penetration of advanced automation and measurement solutions. |

| Persistent skill gaps and limited availability of technical expertise | Limits effective utilization of high-tech systems, creating dependency on external service providers and increasing operational costs. |

| Opportunities: | Impact |

| Growing transition towards sustainable and bio-based materials | Opens demand for advanced control systems capable of handling variable material properties and ensuring compliance with eco-friendly standards. |

| Development of advanced high-tech applications in end-use industries | Creates niche markets for precision extrusion technologies in sectors like medical tubing, EV components, and electronics. |

| Increased adoption of digital tools and simulation software for process optimization | Facilitates predictive modeling and real-time adjustments, improving productivity and reducing waste across extrusion operations. |

| Market Leaders (2024) | |

| Market Leaders |

Market share of ~20% |

| Top Players |

Collective market share in 2024 is ~50.3% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Brazil |

| Fastest growing market | Mexico |

| Emerging countries | Argentina, Colombia, Chile, Peru |

| Future outlook |

|

What are the growth opportunities in this market?

South America Plastic Extrusion Measurement and Control Technology Market Trends

- As South America’s technology marketplace for measuring and controlling plastic extrusion continues to evolve, the way that technology is evolving is through increased focus on automating manufacturing processes. Consequently, manufacturers are now focused on automating the process of plastic extrusion by replacing their manual processes with automated systems that display advanced sensors and complex control mechanisms for precise measurement and dimensional management of wall thickness. By incorporating these technologies, it ensures that manufacturers will consistently produce products with maximum quality and reduced scraps due to high levels of waste material.

- Also, automating the process also provides an opportunity for capital expenditure savings by providing efficiency (energy use) in the manufacturing process and reducing the number of raw materials wasted. The trend of automating plastic extrusion operations has become so popular and necessary for manufacturers to remain competitive within a very cost-sensitive marketplace that they’re going to great lengths to implement this strategy into their business models.

- Alongside the movement toward automating plastic extrusion operations, there has been the implementation of digitization, especially the integration of digital technologies from the fourth industrial revolution (4IR), which has changed the ways in which many manufacturers around the world are running their extrusion operations. The modern-day extrusion plant is beginning to become populated with Internet of Things (IoT)-enabled devices that allow them to connect with each other and communicate information back and forth in real time; this provides manufacturers with the tools to completely integrate and take advantage of data analytics and predictive maintenance systems that have been developed using AI.

- By doing so, manufacturers can monitor their equipment from remotely located devices, dynamically adjust manufacturing process parameters, and ensure that their products will always be of high quality. Ultimately, the ability to use AI-generated information to predict and prevent future failures of equipment dramatically reduces downtime, maximizes productivity, and mitigates risks associated with running a company.

South America Plastic Extrusion Measurement and Control Technology Market Analysis

Learn more about the key segments shaping this market

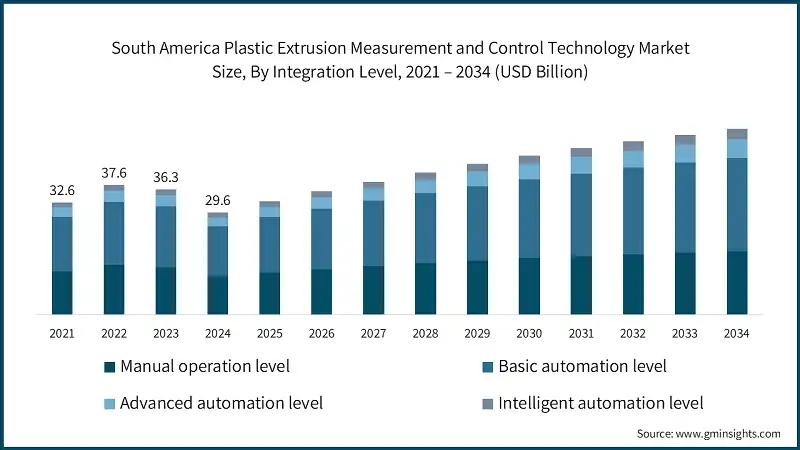

Based on integration level, the market is categorized into manual operation level, basic automation level, advanced automation level, and intelligent automation level. The basic automation level accounted for revenue of around USD 14.5 billion in 2024 and is anticipated to grow at a CAGR of 5.8% from 2025 to 2034.

- Many regional processors face budget constraints and lack the technical expertise required for advanced or intelligent automation systems, making basic automation an attractive entry point. This level typically includes semi-automated controls, simple sensors, and programmable logic controllers (PLCs) that significantly improve process consistency and reduce human error without requiring heavy investment or complex infrastructure upgrades.

- Additionally, rising labor shortages and the need for operational efficiency are pushing companies to adopt affordable automation solutions that deliver measurable productivity gains. Basic automation also aligns well with the growing demand for standardized quality in packaging, construction, and consumer goods sectors, where extrusion processes must meet tighter tolerances.

Based on application of South America plastic extrusion measurement and control technology market consists of pipe and tube extrusion, profile extrusion, cable and wire extrusion, and film and sheet extrusion. The pipe and tube extrusion emerged as leader and held 41.9% of the total market share in 2024 and is anticipated to grow at a CAGR of 6.1% from 2025 to 2034.

- Large-scale investments in water supply networks, sewage systems, irrigation projects, and gas distribution pipelines are driving demand for high-quality plastic pipes and tubes, particularly in countries like Brazil, Argentina, and Colombia. These applications require precise dimensional control and consistent wall thickness to ensure durability, safety, and compliance with stringent regulatory standards, making advanced measurement and control systems essential.

- Additionally, the shift toward lightweight, corrosion-resistant plastic alternatives over traditional metal pipes in construction and industrial sectors further boosts extrusion volumes. The growing emphasis on sustainability and cost efficiency also encourages the use of recycled and composite materials in pipe production, which necessitates accurate process monitoring to handle material variability.

Learn more about the key segments shaping this market

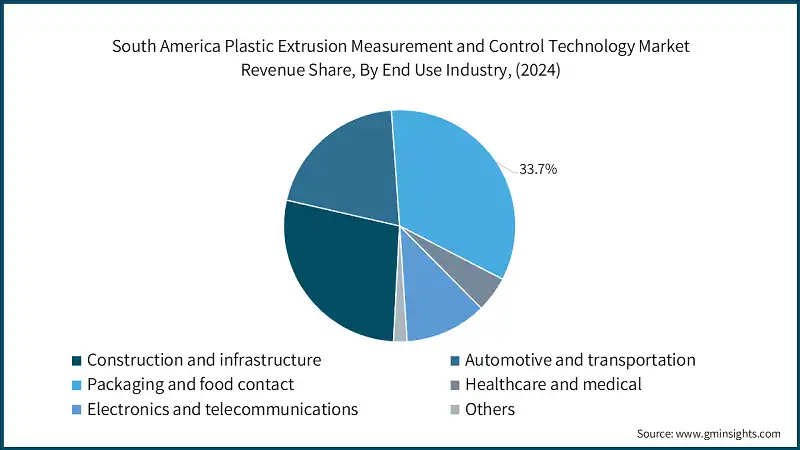

Based on end use industry of South America plastic extrusion measurement and control technology market consists of construction and infrastructure, automotive and transportation, packaging and food contact, healthcare and medical, electronics and telecommunications and others (energy and utilities etc.). The packaging and food contact industry emerged as leader and held 33.7% of the total market share in 2024 and is anticipated to grow at a CAGR of 6.2% from 2025 to 2034.

- Rapid urbanization, changing lifestyles, and the growth of e-commerce have significantly increased the consumption of flexible packaging, films, and sheets, all of which rely heavily on extrusion processes. These applications require precise thickness control, uniformity, and barrier properties to ensure product safety and compliance with food-grade standards, making advanced measurement and control systems indispensable.

- Additionally, the trend toward sustainable packaging such as recyclable mono-material films and bio-based plastics has introduced greater complexity in extrusion operations, further driving the need for accurate monitoring and automated adjustments.

Looking for region specific data?

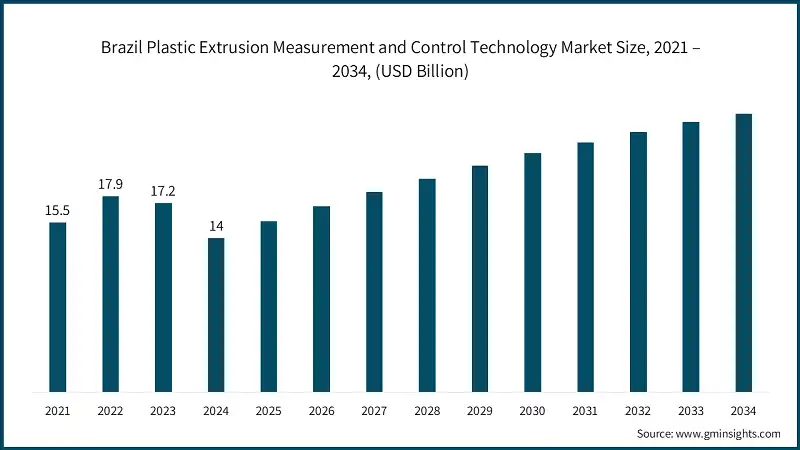

The Brazil dominates an overall South America plastic extrusion measurement and control technology market with USD 14 billion in 2024 and is estimated to grow at a CAGR of 5.6% from 2025 to 2034.

- As the region’s largest economy, Brazil accounts for significant investments in construction projects, water and gas distribution networks, and urban modernization initiatives, all of which require extensive use of extruded plastic pipes, profiles, and sheets.

- Additionally, Brazil hosts a thriving food and beverage industry and a rapidly expanding e-commerce sector, fueling demand for high-quality flexible packaging and film extrusion processes that depend on precise measurement and control systems. The country’s proactive adoption of automation and Industry 4.0 technologies, supported by government incentives for manufacturing modernization and sustainability compliance, further accelerates the integration of advanced extrusion control solutions.

South America Plastic Extrusion Measurement and Control Technology Market Share

- In 2024, the prominent manufacturers in South America plastic extrusion measurement and control technology industry are Nordson Corporation, Dynisco, Process Control Corp, Gefran Tempco Electric Heater, and PTI collectively held the market share of ~50.3%.

- Nordson leverages its Ascend strategy and "NBS Next" framework to boost innovation, enhance customer responsiveness, and trim lead times. A testament to this is Nordson's launch of the Quadra Pro X-ray inspection system, which went from concept to market in under a year, slashing the typical six-month lead time down to just two weeks. Beyond innovation, Nordson strategically acquired Atrion Medical to bolster its foothold in burgeoning sectors like medical devices and electric vehicle battery production. Committed to digital transformation, Nordson is broadening its global footprint and harnessing automation to elevate both efficiency and customer experience.

- Dynisco carves its niche in precision polymer sensing and testing, offering tools like melt-flow indexers and pressure sensors for real-time quality oversight. At its bioplastics Innovation Lab, the company pioneers sustainable materials and eco-conscious resin processing. By embedding IoT and Industry 4.0 technologies, Dynisco facilitates remote diagnostics and process monitoring. With a strong emphasis on intellectual property and patent development, Dynisco solidifies its leadership in advanced sensing technologies, while its lean operations ensure swift market adaptability.

South America Plastic Extrusion Measurement and Control Technology Market Companies

Major players operating in the South America plastic extrusion measurement and control technology industry include:

- Bausano

- Breyer

- Dynisco

- Gefran

- Gemini Group

- Nanmac

- Nordson Corporation

- Pexco

- Process Control Corp.

- PTI

- Pyrometer Instrument

- Sensonetics

- Starrett

- Tempco Electric Heater

- Gneuss Kunststofftechnik GmbH

PCC stands out with its high-precision gravimetric blending systems and the proprietary Gravitrol control software, ensuring top-notch extrusion accuracy and minimized material waste. Embracing Industry 4.0, PCC integrates IoT, smart sensors, and predictive maintenance into its machinery for heightened production efficiency. The company champions sustainability with features like automatic scrap recycling and energy-efficient conveyors. Through advanced automation and real-time feedback, PCC guarantees consistent quality and cost savings for its clients.

Gefran pushes boundaries with its GRC series smart power controllers, boasting Ethernet connectivity and modular designs tailored for industrial heating. These controllers, aligning with Industry 4.0, offer seamless web server configurations. Tempco Electric Heater specializes in bespoke heating solutions, from band and cartridge heaters to advanced TEC controllers. Both companies emphasize tailored designs and ongoing technical education, solidifying their status as trusted leaders in industrial thermal management.

South America Plastic Extrusion Measurement and Control Technology Industry News

- In 2025, Leistritz unveiled its Inline Elongational Rheometer, designed to gauge extensional viscosity during extrusion. This measurement is crucial for film and fiber production, where elongational flow plays a pivotal role. The new tool offers superior data compared to traditional systems, enabling manufacturers to fine-tune processes for enhanced performance.

- In 2024-2025, SIKORA rolled out a suite of advanced measurement and inspection systems. Highlights include the CENTERWAVE 6000 ultrasonic measurement family, the AI-enhanced X-RAY 6000 PRO C-PIPE for pipe wall inspections, the contamination-detecting X-RAY 6000 PURE, the precision-focused LASER PRO for dimensional measurements, and the LM SMART line management system. Leveraging non-contact methods, these technologies bolster quality control and automate processes, driving up production efficiency for manufacturers.

- In 2025, iNOEX launched its WARP radar-based pipe measurement system alongside the promex EXPERT/CYRUS pipe wall inspection systems. Collaborating with optical inspection systems, these tools oversee both the internal and external facets of pipes and profiles, granting manufacturers enhanced oversight of their production processes.

- In May 2025, MAAG Group bolstered its digitalization efforts in extrusion process control by acquiring XanTec Steuerungs- und EDV Technik GmbH. Renowned for its advanced control systems tailored for extruders and pelletizing lines, XanTec's offerings promise heightened efficiency and product quality. This strategic acquisition aligns with MAAG’s vision of integrating smart automation and broadening its digital solution portfolio.

- In January 2025, Dover expanded MAAG’s polymer processing equipment portfolio by acquiring the petrochemical division of Carter Day International. This strategic move not only enhances MAAG’s extrusion and pelletizing solutions but also fortifies Dover’s foothold in the extrusion industry.

The South America plastic extrusion measurement and control technology market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Billion) and volume (Million Units) from 2021 to 2034, for the following segments:

Market, By Measurement Principle

- Optical-based measurement systems

- Camera/vision-based inspection

- Laser-based dimensional measurement

- Advanced spectroscopic analysis

- Radiometric measurement systems

- X-ray systems

- Gamma-ray systems

- Beta-ray systems

- Electromagnetic wave-based measurement

- Radar-based systems

- Terahertz systems

- Acoustic-based measurement

- Ultrasonic systems

- Acoustic emission monitoring

- Electrical field-based measurement

- Capacitive sensors

- Inductive sensors

- Mechanical contact measurement

- Physical probes and gauges

- Tactile measurement systems

- Process parameter monitoring

- Temperature and pressure sensors

- Melt flow and viscosity measurement

- Material property analysis

Market, By Integration Level

- Manual operation level

- Offline measurement with manual adjustment

- Operator-controlled processes

- Basic automation level

- Single-parameter closed-loop control

- Simple measurement-feedback systems

- Advanced automation level

- Multi-parameter process control

- Integrated measurement-control systems

- Intelligent automation level

- AI/ML-driven optimization

- Digital twin implementation

- Predictive maintenance integration

Market, By Control Technology type

- Process control systems

- Temperature control

- Pressure control

- Multi-zone process control integration

- Motion and drive control systems

- Extruder drive control and variable speed systems

- Haul-off and winding control

- Servo-driven positioning and cutting systems

- Material flow control systems

- Gravimetric and volumetric dosing control

- Melt pump control and flow regulation

- Additive and colorant injection control

- Control hardware and platforms

- Programmable logic controllers (PLCS)

- SCADA and HMI systems

- Distributed control systems (DCS)

Market, By Application

- Pipe and tube extrusion

- Single-layer pipes

- Multi-layer pipes

- Specialty/medical tubing

- Profile extrusion

- Simple profiles (single cavity)

- Complex profiles (multi-cavity)

- Co-extruded profiles

- Cable and wire extrusion

- Power cables

- Communication cables

- Specialty cables

- Film and sheet extrusion

- Monolayer films

- Multi-layer films

- Specialty films

Market, By End Use Industry

- Construction and infrastructure

- Automotive and transportation

- Packaging and food contact

- Healthcare and medical

- Electronics and telecommunications

- Others (energy and utilities, etc.)

The above information is provided for the following countries:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Rest of South America

Frequently Asked Question(FAQ) :

Who are the key players in the South America plastic extrusion measurement and control technology market?

Key players include Nordson Corporation, Dynisco, Process Control Corp., Gefran, PTI, Bausano, Breyer, Gemini Group, Nanmac, Pexco, Pyrometer Instrument, Sensonetics, Starrett, Tempco Electric Heater, and Gneuss Kunststofftechnik GmbH.

What are the upcoming trends in the South America plastic extrusion measurement and control technology market?

Key trends include shift from manual to fully automated inline closed-loop measurement systems, integration of IoT-enabled sensors and AI-powered analytics for predictive maintenance, adoption of digital twin technology, focus on sustainability with bio-based and recycled materials, and deployment of advanced thickness and barrier control technologies.

What is the current South America plastic extrusion measurement and control technology market size in 2025?

The market size is projected to reach USD 32.8 billion in 2025.

How much revenue did the basic automation level segment generate in 2024?

The basic automation level generated approximately USD 14.5 billion in 2024 and is anticipated to grow at a CAGR of 5.8% from 2025 to 2034, supported by budget constraints and demand for affordable automation solutions.

What was the valuation of the pipe and tube extrusion segment in 2024?

Pipe and tube extrusion held 41.9% of the total market share in 2024 and is anticipated to grow at a CAGR of 6.1% from 2025 to 2034, driven by large-scale water supply, sewage, and gas distribution infrastructure projects.

What is the growth outlook for the packaging and food contact industry from 2025 to 2034?

The packaging and food contact industry held 33.7% market share in 2024 and is projected to grow at a 6.2% CAGR till 2034, driven by rapid urbanization, e-commerce growth, and demand for sustainable packaging solutions.

Which country leads the South America plastic extrusion measurement and control technology market?

Brazil dominates the market with USD 14 billion in 2024 and is estimated to grow at a CAGR of 5.6% from 2025 to 2034, fueled by significant investments in construction, infrastructure, and a thriving food and beverage industry.

What is the projected value of the South America plastic extrusion measurement and control technology market by 2034?

The South America plastic extrusion measurement and control technology market is expected to reach USD 53.8 billion by 2034, propelled by Industry 4.0 integration, packaging sector growth, and infrastructure expansion in countries like Brazil, Argentina, and Colombia.

What is the market size of the South America plastic extrusion measurement and control technology in 2024?

The market size was USD 29.6 billion in 2024, with a CAGR of 5.6% expected through 2034 driven by rapid industrialization and major infrastructure development across emerging Latin American economies.

South America Plastic Extrusion Measurement and Control Technology Market Scope

Related Reports