Summary

Table of Content

Software Testing Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Software Testing Market Size

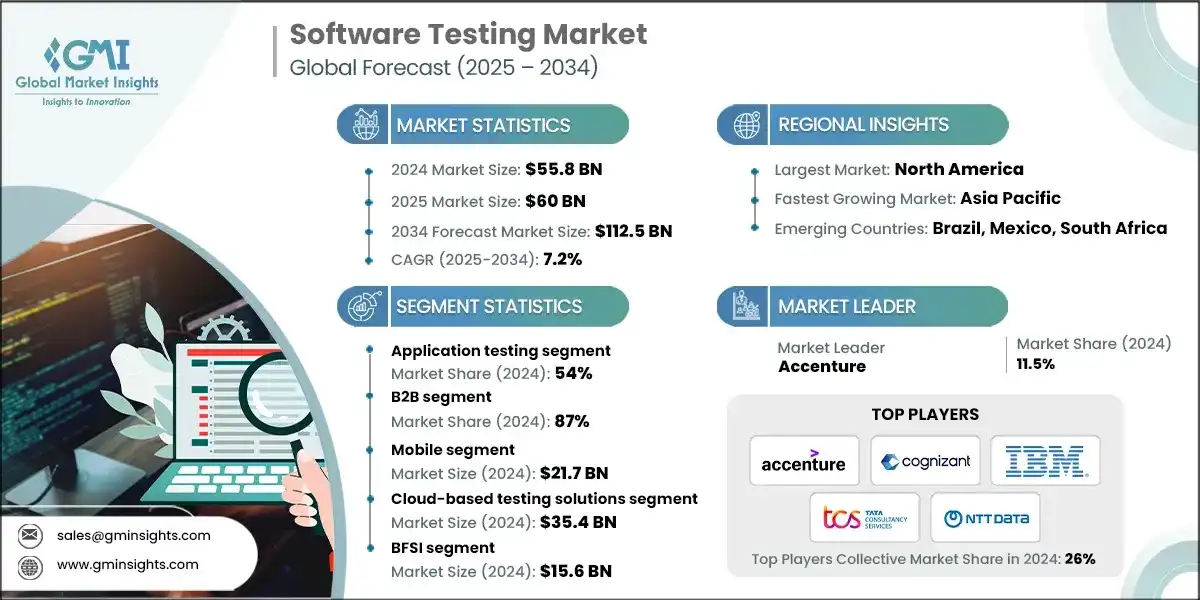

The global software testing market size was valued at USD 55.8 billion in 2024. The market is expected to grow from USD 60 billion in 2025 to USD 112.5 billion in 2034, at a CAGR of 7.2%, according to latest report published by Global Market Insights Inc.

To get key market trends

The software testing market is expected to witness substantial growth, driven by the rising adoption of Agile, DevOps, and continuous integration/continuous delivery (CI/CD) practices, increasing focus on digital transformation initiatives, and the growing demand for high-quality, reliable, and secure software across industries. Continuous innovations in AI-powered test automation, cloud-based testing platforms, and low-code/no-code testing frameworks are enabling enterprises to deploy efficient, scalable, and intelligent testing solutions that enhance software quality, reduce time-to-market, and optimize operational efficiency.

Software testing solutions, comprising automated testing tools, performance and load testing platforms, security testing frameworks, and AI-driven test management systems, play a critical role in ensuring robust software operations. These systems ensure accurate bug detection, real-time monitoring, and end-to-end validation of applications across complex environments, while minimizing manual intervention. Efficient coordination between testing teams, DevOps pipelines, and cloud infrastructure not only improves software quality and deployment efficiency but also supports organizations’ broader digital transformation and customer experience initiatives.

For instance, in 2024, several leading enterprises, including IBM, Microsoft, and Infosys, expanded adoption of cloud-based and AI-driven testing solutions, integrating automated test execution, predictive analytics, and continuous monitoring to enable faster and more reliable software releases. These deployments represent a significant step toward large-scale adoption of intelligent software testing, improving development efficiency, operational reliability, and overall user satisfaction.

The market is witnessing rapid technological advancement driven by AI-enabled automation, cloud adoption, digital infrastructure modernization, and stringent quality and security requirements. Technology providers and enterprises are focusing on developing advanced test automation frameworks, real-time monitoring and reporting systems, predictive defect analysis tools, and secure cloud-based testing platforms to deliver next-generation software testing solutions. These innovations are enabling organizations to provide faster, safer, and more efficient software development and deployment within the evolving ecosystem of digital business operations.

Software Testing Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 55.8 Billion |

| Market Size in 2025 | USD 60 Billion |

| Forecast Period 2025 - 2034 CAGR | 7.2% |

| Market Size in 2034 | USD 112.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising Adoption of Agile and DevOps | Continuous integration and delivery require frequent, automated testing to maintain software quality and reduce release cycles. |

| Growing Demand for High-Quality Software | Enterprises prioritize reliability, security, and user experience, driving investment in robust testing solutions. |

| Technological Advancements in Test Automation | AI, machine learning, and cloud-based testing platforms improve efficiency, accuracy, and scalability of testing operations. |

| Regulatory and Compliance Requirements | Industries such as finance, healthcare, and automotive require stringent testing to meet regulatory standards and reduce operational risk. |

| Pitfalls & Challenges | Impact |

| High Initial Investment | Implementing advanced testing solutions (especially AI-driven or cloud-based platforms) can be expensive for SMEs. |

| Complex Integration with Legacy Systems | Legacy applications and diverse technology stacks can make automation and centralized testing challenging. |

| Opportunities: | Impact |

| Rapidly Evolving Technology Landscape | Frequent updates to applications, frameworks, and devices require constant adaptation of testing strategies. |

| Data Security and Privacy Concerns | Testing in cloud environments or with production-like data raises concerns over confidentiality and compliance. |

| Market Leaders (2024) | |

| Market Leaders |

11.5% market share |

| Top Players |

Collective market share in 2024 is 26% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Software Testing Market Trends

The demand for advanced software testing solutions is being driven by increasing collaboration between enterprises, IT service providers, and technology vendors to accelerate the development of efficient, scalable, and modular testing frameworks. Companies are leveraging combined expertise to reduce integration costs, share technological know-how, and shorten the time-to-market for next-generation testing platforms, including AI-driven test automation, predictive defect analytics, cloud-enabled testing environments, and low-code/no-code testing solutions.

For instance, in 2024, IBM and Accenture announced joint initiatives to develop end-to-end software testing platforms optimized for enterprise applications and cloud-native environments. These initiatives utilize their combined expertise in automated test execution, AI-enabled test management, performance monitoring, and security testing to enhance reliability, efficiency, and operational scalability while enabling faster and more accurate software release cycles.

Localization of software testing solutions to meet regional compliance, regulatory, and operational requirements is another emerging trend. Companies such as TCS and Cognizant are establishing regional testing centers in North America, Europe, and Asia-Pacific, ensuring solutions comply with local standards while optimizing integration with enterprise IT environments. These strategies enable providers to deliver robust, high-performance testing services more effectively, reduce dependency on global operations, and improve responsiveness to software vendors, enterprises, and government organizations.

The entry of emerging technology players offering lightweight, modular, and scalable testing platforms is gaining traction among enterprises and IT service users. Startups specializing in AI-enabled test automation, integrated analytics platforms, and cloud-based testing tools are introducing solutions capable of improving test coverage, reducing defects, and supporting innovative application development, such as mobile-first applications, IoT software, and large-scale enterprise systems.

The development of modular testing architectures is enabling providers to deliver frameworks compatible with web applications, mobile platforms, enterprise software, and cloud-native systems. For instance, Cognizant and NTT Data are rolling out modular testing platforms that support multiple application types and deployment environments, reducing integration costs, shortening deployment timelines, and enabling the creation of reliable, efficient, and future-ready software testing solutions.

Software Testing Market Analysis

Learn more about the key segments shaping this market

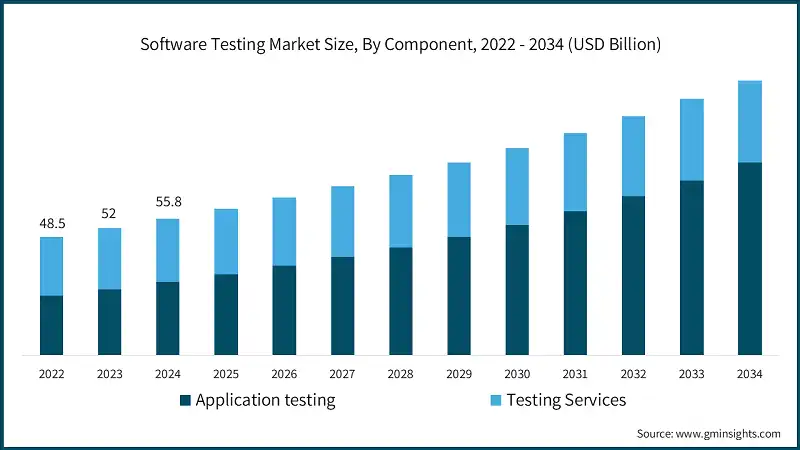

Based on component, the software testing market is divided into application testing and testing services. The application testing segment dominated the market accounting for around 54% share in 2024 and is expected to grow at a CAGR of over 10.1% from 2025 to 2034.

- The application testing segment holds a dominant position in the software testing market, driven by its critical role in ensuring functional correctness, performance, security, and reliability of software applications. This segment includes functional testing, performance testing, security testing, and user experience validation, which are essential for enterprises, software vendors, and IT service providers to deliver high-quality applications across web, mobile, and enterprise platforms. Advanced testing frameworks and automation tools make this segment the preferred choice for organizations aiming to reduce defects, accelerate release cycles, and improve overall software quality.

- The testing services segment, including managed testing services, consulting, test automation implementation, and cloud-based testing support, is experiencing notable growth as enterprises focus on efficiency, scalability, and cost optimization. Testing services are increasingly integrated with application testing frameworks, reflecting the industry’s shift toward fully automated, continuous, and intelligent software quality assurance. Leading service providers deploy AI-enabled testing platforms and predictive analytics to enhance defect detection, optimize test coverage, and improve overall system reliability.

- Meanwhile, the consulting and support segment, encompassing test strategy development, process optimization, training, and integration support, is expanding steadily, fueled by increasing adoption of cloud-based applications, DevOps practices, and enterprise-scale software systems. Market players are investing in remote monitoring, predictive analytics, and process consulting services that ensure consistent testing quality, reduce operational inefficiencies, and enhance software performance. These services are particularly relevant for large-scale and mission-critical deployments, where reliability, compliance, and continuous quality assurance are key performance considerations.

Learn more about the key segments shaping this market

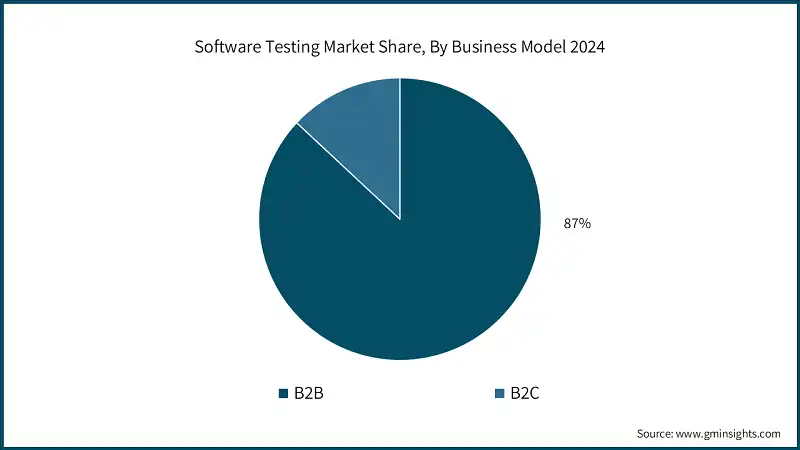

Based on business model, the software testing market is divided into B2B, and B2C. B2B segment dominates the market accounting for around 87% share in 2024, and the segment is expected to grow at a CAGR of over 7.4% from 2025 to 2034.

- The B2B segment accounts for the largest share of the software testing market, primarily driven by increasing demand from enterprises for reliable, secure, and high-performance software across industries such as finance, healthcare, IT services, and manufacturing. Organizations are investing in robust testing solutions to ensure application quality, regulatory compliance, and seamless integration with enterprise IT environments, thereby improving operational efficiency and end-user satisfaction.

- Technology providers and service vendors are actively diversifying their B2B testing offerings to cater to a wide range of enterprise applications, including cloud-native systems, ERP platforms, mobile applications, and mission-critical software. In 2024-2025, leading players such as IBM, Accenture, TCS, and Cognizant introduced next-generation testing platforms featuring AI-driven automation, predictive analytics, and cloud-based test management, emphasizing accuracy, reliability, and efficiency. These advancements highlight the growing importance of intelligent, automated, and scalable testing solutions as key factors driving adoption in the B2B segment.

- The B2C segment, although smaller in scale, is experiencing steady growth with the adoption of testing solutions for consumer-facing applications such as mobile apps, e-commerce platforms, and digital services. The segment’s growth is supported by the increasing need for seamless user experiences, rapid feature deployment, and high application reliability. Testing solutions in this segment focus on usability, functional correctness, performance, and security to enhance customer satisfaction and retention.

Based on platform, the market is divided into mobile and web-based testing. The mobile segment dominated the market and was valued at USD 21.7 billion in 2024.

- The mobile testing segment holds a dominant position in the software testing market, driven by the widespread adoption of smartphones, tablets, and mobile applications across consumer and enterprise environments. Mobile testing ensures functional correctness, performance, security, and seamless user experience, making it the preferred choice among enterprises, app developers, and IT service providers.

- Technology providers are further enhancing their mobile testing solutions to include AI-driven automation, cloud-based test execution, and predictive analytics. These platforms enable real-time defect detection, cross-device compatibility testing, and efficient test coverage, contributing to improved application reliability, faster release cycles, and higher end-user satisfaction.

- The web-based testing segment is also experiencing steady growth, driven by increasing demand for robust, scalable, and secure web applications across industries such as e-commerce, banking, healthcare, and SaaS platforms. Adoption of web-based testing solutions is supported by automated testing frameworks, performance monitoring tools, and cloud integration, allowing scalable, reliable, and future-ready deployment that aligns with enterprise strategies for digital transformation, operational efficiency, and enhanced user experience.

Based on deployment model, the market is divided into cloud-based testing solutions, on-premises testing solutions and hybrid testing solutions. The cloud-based testing solutions segment dominated the market and was valued at USD 35.4 billion in 2024.

- The cloud-based testing solutions segment holds the dominant market share in the software testing market, driven by widespread adoption of scalable, flexible, and remotely accessible testing platforms across enterprises and IT service providers. Cloud-based solutions enable faster release cycles, seamless integration with DevOps pipelines, and AI-driven test automation, making this segment the primary revenue contributor in the market.

- The on-premises testing solutions segment is also witnessing steady growth, supported by increasing adoption among organizations with stringent data security, regulatory compliance, and legacy system integration requirements. These solutions allow enterprises to maintain full control over their testing environments, ensuring reliability, privacy, and customization, driving gradual expansion in this deployment category.

- Additionally, the hybrid testing solutions segment is emerging, fueled by the need for a balanced approach that combines the flexibility of cloud-based platforms with the control and security of on-premises systems. Hybrid solutions focus on modular, scalable, and reliable testing frameworks that optimize operational efficiency, reduce infrastructure costs, and support continuous testing initiatives, reflecting broader trends toward flexible and intelligent software quality assurance strategies.

Based on applications, the software testing market is divided into IT, telecom, BFSI, manufacturing, retail, healthcare, transportation & logistics, government & public sector, consumer electronics, media and others. The BFSI segment dominated the market and was valued at USD 15.6 billion in 2024.

- The BFSI (Banking, Financial Services, and Insurance) segment holds the dominant market share in the software testing market, driven by the critical need for secure, reliable, and high-performance software across banking, insurance, and financial services platforms. Enterprises in this sector prioritize functional accuracy, regulatory compliance, cybersecurity, and seamless digital customer experiences, making BFSI the primary revenue contributor in the market.

- The IT and telecom segment is also witnessing steady growth, supported by the increasing deployment of enterprise software, cloud-native applications, and communication platforms. Organizations in this segment are leveraging automated and AI-driven testing solutions to enhance operational efficiency, minimize defects, and ensure consistent performance across large-scale, mission-critical systems.

- Additionally, healthcare, retail, transportation & logistics, government & public sector, consumer electronics, media, and other segments are emerging, fueled by rising digital transformation initiatives, adoption of mobile and web-based applications, and regulatory requirements. Testing solutions in these segments focus on scalability, automation, security, and predictive analytics, enabling reliable, high-quality software delivery and improved end-user satisfaction across diverse applications.

Looking for region specific data?

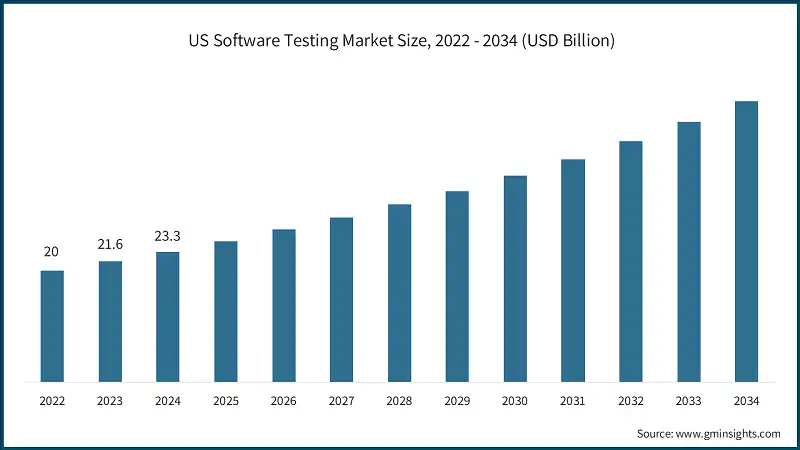

In 2024, US dominated the North America software testing market with around 88% market share and generated approximately USD 23.3 billion in revenue.

- North America accounted for a significant share of the software testing industry in 2024, supported by a mature IT and software development ecosystem, high adoption of Agile and DevOps practices, and strong demand across enterprise, B2B, and consumer applications. The region is witnessing steady growth at a CAGR of 7–8%, as organizations increasingly integrate advanced testing solutions, including AI-driven test automation, cloud-based testing platforms, low-code/no-code frameworks, and predictive defect analytics to enhance software quality, operational efficiency, and regulatory compliance.

- The U.S. represents a key opportunity for software testing providers, driven by a large number of enterprise IT deployments, high adoption of cloud-native and mobile applications, and progressive regulatory requirements for cybersecurity, data privacy, and industry-specific compliance standards. The country’s well-established IT services base allows for rapid deployment of next-generation testing platforms, continuous integration/continuous delivery (CI/CD) pipelines, and AI-enabled test management systems.

- States such as California, New York, and Texas are increasingly adopting advanced software testing solutions across sectors including finance, healthcare, IT services, and manufacturing, demonstrating a clear trend toward automated, scalable, and intelligent quality assurance practices.

- Moreover, leading technology and service providers such as IBM, Accenture, Cognizant, TCS, and NTT Data are pioneering innovations in AI-powered test automation, cloud-based test management, predictive analytics, and real-time performance monitoring. These companies are enhancing the market by delivering scalable, secure, and efficient testing solutions, substantially improving software reliability, reducing operational risks, and ensuring regulatory compliance.

UK holds share of 40% in Europe software testing market and it will grow tremendously between 2025 and 2034.

- Europe holds a major share of the market in 2024, supported by its mature IT and software development ecosystem, advanced technological capabilities, and stringent data security and regulatory compliance standards that are accelerating the adoption of automated, AI-driven, and cloud-based testing solutions. Demand is driven by enterprise applications, financial services, healthcare, and manufacturing, with organizations focusing on scalable, secure, and high-performance testing platforms to align with GDPR, ISO/IEC 25010, and other industry-specific regulations.

- The UK represents Europe’s largest market, buoyed by substantial demand from enterprises, IT service providers, and large-scale software vendors that require reliable, efficient, and high-performing testing solutions. Among current trends is the growing adoption of AI-enabled test automation, cloud-based test management platforms, and predictive defect analytics integrated into DevOps pipelines, CI/CD workflows, and mission-critical enterprise applications. Technology providers are increasingly offering scalable, interoperable, and modular testing platforms to comply with strict UK and EU regulations while maintaining operational efficiency, reliability, and high-quality software delivery.

- The German market is growing steadily, driven by rising adoption of enterprise software, digital transformation initiatives, and stringent regulatory compliance requirements. Leading providers such as IBM, Accenture, TCS, and Cognizant are introducing advanced AI-driven testing platforms, automated performance monitoring, and cloud-enabled solutions for enterprises, highlighting Germany’s focus on secure, high-quality, and efficient software testing practices.

- In contrast, Italy and other Southern European markets benefit from ongoing investments in digital infrastructure, IT modernization, and adoption of cloud-native and mobile applications. Organizations face challenges such as diverse legacy systems, regulatory compliance, and cost-efficiency requirements. This has created demand for robust, scalable, and flexible testing solutions capable of performing reliably across enterprise applications, cloud platforms, and mission-critical software deployments.

China holds share of 33% in Asia Pacific software testing market and it will grow tremendously between 2025 and 2034.

- Asia-Pacific holds a major share of the software testing industry in 2024, supported by a rapidly growing IT and software development ecosystem, increasing adoption of digital transformation initiatives, and expanding investments in cloud infrastructure, AI, and automation. Demand is driven by enterprise applications, mobile and web platforms, BFSI, healthcare, and manufacturing, with organizations and service providers focusing on scalable, secure, and AI-enabled testing solutions to enhance software quality, operational efficiency, and compliance.

- China represents the largest market in Asia-Pacific, buoyed by strong demand from enterprises, IT service providers, and technology vendors that require reliable, high-performance, and automated testing solutions. Among current trends is the increasing adoption of AI-driven test automation, predictive defect analytics, cloud-based testing platforms, and low-code/no-code frameworks integrated into DevOps pipelines, continuous integration/continuous delivery (CI/CD) workflows, and mission-critical enterprise applications.

- Other Asia-Pacific countries, such as India, Japan, and South Korea, are emerging markets, showing growing adoption of advanced software testing solutions across enterprise, consumer, and government applications. These markets are supported by government initiatives promoting digitalization, IT modernization, and quality assurance frameworks, along with increasing interest in cloud-based, automated, and AI-driven testing practices.

The software testing market in Brazil will experience significant growth between 2025 & 2034.

- Latin America holds a 3% share of the market in 2024, with Brazil representing the largest market in the region. Growth is fueled by increasing adoption of enterprise software, cloud-based applications, mobile platforms, and digital transformation initiatives that require reliable, efficient, and scalable testing solutions.

- The software testing market in Brazil is expected to experience significant growth, driven by enterprise IT modernization, expansion of cloud infrastructure, and increasing investments in AI-driven and automated testing platforms. Organizations, service providers, and technology vendors are seeking testing solutions capable of handling high application throughput, ensuring functional accuracy, security, and performance, and optimizing software delivery across diverse business environments.

- A notable trend in Brazil is the gradual adoption of AI-enabled test automation, predictive defect analytics, cloud-based test management, and low-code/no-code testing frameworks. These solutions support enterprise, financial, healthcare, and government applications while aligning with emerging regulatory requirements for data security, privacy, and software quality standards.

- Mexico represents the fastest-growing market in Latin America, driven by rapid digital adoption, expansion of enterprise IT and software services, and early adoption of cloud-based and automated testing platforms across industries such as BFSI, IT services, and retail. The market is witnessing growing interest in scalable, modular, and technology-enabled testing solutions, reflecting enterprises’ efforts to enhance operational efficiency, software reliability, and user experience. Mexico is emerging as a key growth hotspot, complementing Brazil’s established market leadership in the region.

The software testing market in UAE will experience significant growth between 2025 & 2034.

- The software testing industry in the UAE holds a modest share in 2024, supported by steady enterprise IT adoption, expanding digital infrastructure, and the country’s role as a regional hub for technology and software services in the Middle East. The market is driven by growing demand for reliable, secure, and high-performance software solutions across sectors such as BFSI, government, healthcare, telecom, and enterprise applications.

- Enterprises and IT service providers in the UAE prioritize reliability, security, and operational efficiency, given the increasing adoption of cloud-based platforms, mobile and web applications, and digital transformation initiatives. There is growing demand for software testing solutions capable of ensuring functional accuracy, performance, security, and seamless integration across diverse IT environments and business workflows.

- A notable trend in the UAE market is the deployment of AI-driven test automation, predictive defect analytics, cloud-based testing platforms, and low-code/no-code frameworks designed to enhance efficiency, accuracy, and end-user experience. Large enterprises, government agencies, and financial institutions are particularly driving demand for advanced testing solutions that support continuous integration/continuous delivery (CI/CD), scalable automation, and compliance with regional and international standards.

Software Testing Market Share

The top 7 companies in the market are Accenture, Cognizant, IBM, TCS, Capgemini, NTT Data and Wipro. These companies hold around 30% of the market share in 2024.

- Accenture is a leading provider of software testing and quality engineering services, offering end-to-end solutions including AI-driven test automation, cloud-based testing platforms, and predictive defect analytics. The company emphasizes modular, scalable, and interoperable frameworks, supporting enterprise applications, mobile and web platforms, and mission-critical software. Accenture focuses on enabling efficient, reliable, and secure testing across diverse industries such as BFSI, healthcare, IT, and retail.

- Cognizant delivers comprehensive testing services spanning functional, performance, security, and user-experience testing. The company emphasizes automation, predictive analytics, and cloud-enabled platforms to improve software reliability, accelerate release cycles, and optimize operational efficiency. Cognizant’s solutions cater to enterprise applications, SaaS platforms, and mobile and web-based software across multiple industry verticals.

- IBM offers advanced AI-powered testing solutions through its IBM Engineering and Watson AI platforms. IBM integrates automated test execution, predictive defect detection, and real-time performance monitoring to ensure high-quality software delivery. The company focuses on scalable, secure, and enterprise-grade testing platforms, supporting digital transformation initiatives, DevOps pipelines, and multi-platform applications.

- Tata Consultancy Services (TCS) provides robust software testing and quality engineering services, combining test automation, cloud-based platforms, and AI-driven analytics. TCS emphasizes scalable and modular testing frameworks, enabling enterprises to achieve faster releases, reduce defects, and maintain high reliability across web, mobile, and enterprise software systems.

- Capgemini delivers end-to-end testing and quality assurance services, leveraging automation, AI, and cloud technologies. Capgemini emphasizes integrated testing solutions for functional, performance, and security validation, enabling enterprises to optimize software quality, ensure regulatory compliance, and accelerate digital transformation initiatives.

- NTT Data specializes in software testing, quality assurance, and managed testing services, offering AI-enabled test automation, cloud-based platforms, and predictive analytics. NTT Data focuses on scalable, flexible, and secure testing solutions for enterprises, supporting mission-critical applications, digital services, and DevOps workflows across multiple industries.

- Wipro provides comprehensive software testing and quality engineering services, combining automation frameworks, AI-driven analytics, and cloud-based testing platforms. Wipro emphasizes high reliability, modular design, and operational efficiency, enabling enterprises to deliver secure, high-quality, and scalable software solutions for web, mobile, and enterprise applications.

Software Testing Market Companies

Major players operating in the software testing industry include:

- Accenture

- Capgemini

- Cognizant

- EPAM Systems

- IBM

- NTT Data

- SmartBear Software

- TCS

- Tricentis

- Wipro

- The software testing market is highly competitive, with established players such as Accenture, Cognizant, IBM, TCS, Capgemini, NTT Data, and Wipro occupying primary market segments. Accenture leads the sector with its extensive portfolio of AI-driven test automation, cloud-based testing platforms, and modular quality engineering solutions, focusing on scalable enterprise applications, multi-platform integration, and high reliability across industries such as BFSI, healthcare, IT, and retail.

- Cognizant competes through its comprehensive testing services, emphasizing automation, predictive defect analytics, cloud-enabled platforms, and end-to-end test coverage for enterprise, mobile, and web applications. IBM has established itself in the market with AI-powered testing solutions, real-time performance monitoring, and predictive quality management, targeting large-scale enterprise and mission-critical software deployments.

- Tata Consultancy Services (TCS) positions itself across multiple segments by offering test automation frameworks, cloud-based platforms, and AI-enabled analytics. TCS emphasizes modularity, scalability, and operational efficiency, supporting enterprises across digital transformation initiatives and DevOps workflows. Capgemini focuses on integrated testing solutions for functional, performance, and security validation, enabling reliable, secure, and high-quality software delivery for enterprise and web applications.

- NTT Data specializes in managed testing services, AI-driven test automation, and cloud-based quality assurance platforms, emphasizing flexibility, security, and scalability for diverse enterprise applications. Wipro delivers comprehensive quality engineering solutions, combining automation, predictive analytics, and cloud-enabled testing frameworks to support mission-critical, mobile, and web-based software systems.

- Overall, the Software Testing market is characterized by intense competition across application testing, testing services, and consulting segments, with companies continually innovating in AI-enabled automation, predictive analytics, cloud-based testing, and modular testing frameworks. Market players are focused on enhancing software reliability, operational efficiency, scalability, and end-user experience, while supporting enterprises’ growing adoption of digital transformation, DevOps, and automated software quality assurance practices worldwide.

Software Testing Industry News

- In May 2025, Accenture announced the launch of its next-generation AI-powered test automation platform for enterprises, mobile, and web applications across North America and Europe. The new system features predictive defect analytics, cloud-based test execution, and real-time performance monitoring, enabling enterprises and IT service providers to improve software quality, release speed, and operational efficiency.

- In March 2025, IBM revealed a $150 million investment in its advanced software testing R&D and cloud testing facilities in the U.S. and Germany. The upgrade will expand development of AI-driven test automation, predictive analytics, and scalable cloud-based testing platforms to meet growing enterprise demand across BFSI, healthcare, IT, and retail, preparing for large-scale deployments in global markets.

- In February 2025, Cognizant introduced its next-generation testing suite for mission-critical enterprise applications in North America, Europe, and Asia-Pacific. The suite combines AI-based test optimization, automated regression testing, and seamless integration with DevOps pipelines, delivering faster, more reliable, and secure software testing across multiple platforms.

- In January 2025, TCS and Capgemini announced a joint research initiative to co-develop AI-enabled testing frameworks and cloud-integrated platforms for enterprise applications, SaaS solutions, and mobile apps. The partnership focuses on modular, scalable, and high-performance testing solutions targeting BFSI, healthcare, IT services, and retail markets worldwide by 2027.

- In December 2024, Wipro and NTT Data completed a strategic expansion of their software testing labs and cloud testing infrastructure in India, Germany, and the U.S., consolidating partnerships with global enterprises. The expansion emphasizes AI-driven automation, predictive analytics, and scalable testing platforms suitable for large-scale enterprise, mobile, and web applications, supporting growing adoption of automated software testing solutions worldwide.

The software testing market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue from 2021 to 2034, for the following segments:

Market, By Component

- Application Testing

- Functional

- System testing

- Unit testing

- Integration testing

- Smoke Testing

- Regression Testing

- Others

- Non-Functional

- Security testing

- Performance testing

- Usability testing

- Others

- Functional

- Testing Services

- Professional services

- Managed services

Market, By Business Model

- B2B

- Enterprise application testing

- B2B platform testing

- Integration testing services

- API testing solutions

- B2C

- Consumer application testing

- User experience testing

- Mobile app testing

- E-commerce testing

Market, By Platform

- Mobile

- Native mobile app testing

- Cross-platform mobile testing

- Mobile device testing

- Mobile performance testing

- Mobile security testing

- Web-based Testing

- Web application testing

- Browser compatibility testing

- Web performance testing

- Web security testing

- Progressive web app testing

Market, By Deployment Model

- Cloud-based Testing Solutions

- Software-as-a-Service (SaaS) testing platforms

- Platform-as-a-Service (PaaS) testing tools

- Infrastructure-as-a-Service (IaaS) testing

- Multi-cloud testing strategies

- On-premises Testing Solutions

- Traditional testing infrastructure

- Enterprise testing platforms

- Dedicated testing centers

- Hybrid Testing Solutions

- Cloud-on-premises integration

- Flexible deployment models

- Hybrid testing orchestration

Market, By Application

- IT

- Telecom

- BFSI

- Manufacturing

- Retail

- Healthcare

- Transportation & logistics

- Government & public sector

- Consumer electronics

- Media

- Others

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Belgium

- Netherlands

- Sweden

- Asia Pacific

- China

- India

- Japan

- Australia

- Singapore

- South Korea

- Vietnam

- Indonesia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What are the upcoming trends in the software testing market?

Trends include AI-driven test automation, predictive analytics, cloud testing, and low-code modular frameworks.

Who are the key players in the software testing industry?

Key players include Accenture, Capgemini, Cognizant, EPAM Systems, IBM, NTT Data, SmartBear Software, TCS, Tricentis, and Wipro.

What is the growth outlook for the B2B segment from 2025 to 2034?

The B2B segment, which held an 87% market share in 2024, is set to expand at a CAGR of over 7.4% through 2034.

Which region leads the software testing sector?

North America leads the market, with the U.S. accounting for 88% of the regional revenue, generating approximately USD 23.3 billion in 2024. Growth is supported by a mature IT ecosystem and high adoption of Agile and DevOps practices.

How much revenue did the application testing segment generate in 2024?

The application testing segment accounted for approximately 54% of the market share in 2024 and is expected to witness over 10.1% CAGR till 2034.

What is the market size of the software testing in 2024?

The market size was valued at USD 55.8 billion in 2024, with a CAGR of 7.2% expected through 2034. Growth is driven by the adoption of Agile, DevOps, and CI/CD practices.

What was the valuation of the mobile testing segment in 2024?

The mobile testing segment was valued at USD 21.7 billion in 2024, led by the widespread adoption of smartphones, tablets, and mobile applications.

What is the expected size of the software testing industry in 2025?

The market size is projected to reach USD 60 billion in 2025.

What is the projected value of the software testing market by 2034?

The market is poised to reach USD 112.5 billion by 2034, fueled by advancements in AI-powered test automation, cloud-based testing platforms, and low-code/no-code frameworks.

Software Testing Market Scope

Related Reports