Summary

Table of Content

Sodium Cumenesulfonate Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Sodium Cumenesulfonate Market Size

Sodium Cumenesulfonate Market size was valued at around USD 57.5 million in 2019 and will showcase a growth rate of 4.3% from 2020 to 2026. Rising urbanization, growing laundry detergent requirements, and the proliferating demand for personal care products will boost product sales by 2026.

Sodium cumenesulfonate is a hydrotrope organic compound that increases the solubility of a surfactant in a formulation. Sodium cumenesulfonate can be found in products such as liquid soaps, dish washing liquids & shampoos, wax cleaners, commercial/ industrial/ household laundry detergents, etc. Increasing demand for household and industrial detergent products will drive the sodium cumenesulfonate market demand during the forecast period.

To get key market trends

Sodium Cumenesulfonate Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | 57.48 Million (USD) |

| Forecast Period 2020 to 2026 CAGR | 4.3% |

| Market Size in 2026 | 62.42 Million (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Rising uses of chemicals in high-end liquid detergents will propel product penetration

Liquid detergent products are popular in developed economies owing to easy usage and higher performance compared to powder detergents. Sodium cumenesulfonate is one of the key ingredients used in several liquid detergent products such as Tide and Dreft liquid detergent, among others. In 2016, the U.S. laundry detergent market was valued at around USD 7.2 billion and Procter & Gamble Company accounted for around 60% of the sodium cumenesulfonate market share. Tide Plus Ultra Stain Release is one of the high-end brands of Procter & Gamble, which is a popular liquid detergent in the U.S.

Sodium cumenesulfonate, also known as benzenesulfonic acid, (1-methylethyl)-, sodium salt, and sodium 2-isopropylbenzenesulfonate, is used in several applications owing to its viscosity-reducing properties. Furthermore, the chemical is used as a coupling agent, solubilizer, and anti-caking agents in powder detergents. Additionally, it promotes compatibility among several chemicals present in multi-component systems. The use of chemicals in a wide range of shampoos and dishwashing agents is expected to drive the sodium cumenesulfonate market.

During the forecast period, the sodium cumenesulfonate market growth will largely depend on the growing detergent and oil & gas industries. The oil & gas industry will witness a strong growth during the forecast period owing to increasing oil & gas exploration activities in North America and Europe. The metal working industry will also witness strong demand growth due to rising end-user industries, such as automobiles and construction, in Asia Pacific.

Fluctuating crude oil prices are affecting profit margins

The major material used in the production of sodium 2-isopropylbenzenesulfonate includes cumene, sodium hydroxide, and sulfuric acid, among others. The prices of these raw materials will hugely fluctuate in the global market scenarios; hence, directly affecting the cost of production. Cumene is one of the major raw materials used in the production of sodium cumenesulfonate and is produced from propene and benzene (crude oil derivatives). Any fluctuation in the global crude oil prices will hugely impact the overall production cost of sodium cumenesulfonate.

Sodium Cumenesulfonate Market Analysis

Learn more about the key segments shaping this market

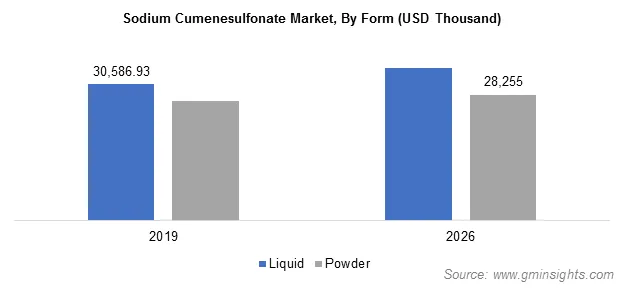

Liquid form dominates market and will hold around 70% volumetric shares in 2026. This form is used in a variety of household detergent and cleaning products including laundry powders & liquids, hand dishwashing liquid, liquid fabric conditioners, liquid & powder laundry bleach additives, machine dishwashing liquid, gel toilet cleaners, liquid and liquid, powder, and gel & spray surface cleaners. Increasing demand for industrial & household cleaners will drive the sodium cumenesulfonate market sales in the coming years.

Learn more about the key segments shaping this market

Cloud point depressor is an important property required during the usage of petroleum-based mineral oils at lower temperatures. Sodium 2-isopropylbenzenesulfonate enables detergent manufacturers and other industry users to lower down the cloud point of aqueous formulated products. The cloud point depressor application generated around USD 14.8 million revenue in 2019.

The growing liquid detergent industry in developed economies along with rising concerns for hygiene is driving product demand for cloud point depressor application. Furthermore, the proliferating chemical industry in Asia Pacific is expected to support the sodium cumenesulfonate market segment growth over the forecast timeframe.

The sodium cumenesulfonate market from metal working industry is expected to generate around USD 10.8 million revenue by 2026. Metal worked parts and fabricated products are used in various sectors such as automotive, oil & gas, consumer products, agriculture, aerospace & defense, marine, and medical industries. Growth in the automotive and aerospace sectors will drive the metal processing industry, which, in turn, will propel product demand in the metal working industry.

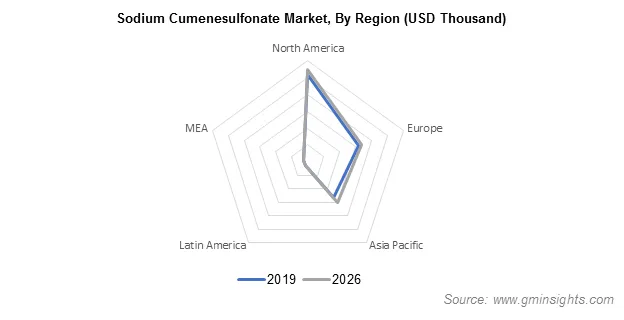

Looking for region specific data?

North America is expected to witness considerable growth over the forecast timeframe and is expected to hold around 44% volumetric shares by 2026. The proliferating detergent and oil & gas industries in the region are expected to drive the sodium cumenesulfonate market demand over the study timeframe. The presence of major end-user industries in the region is further expected to drive industry growth in the coming years. The presence of major detergent manufacturers and high per capita expenditure on personal care products in the region will also support market growth.

Sodium Cumenesulfonate Market Share

Mergers & acquisitions along with production facility expansion are key strategies applied by manufacturers to enhance their sodium cumenesulfonate industry share. For instance, in February 2016, Nease Performance Chemicals expanded its manufacturing site in Ohio, U.S., to meet the needs of its growing specialty chemical business. The expansion enabled the company to enhance its market position and offer customized concentration of chemicals for customers in the U.S. Key sodium cumenesulfonate manufacturers operating in the sodium cumenesulfonate industry include:

- Stepan Company

- Nease Corporation

- Enaspol A.S

- Sasol

- Innospec

Sodium cumenesulfonate market report includes in-depth coverage of the industry with estimates & forecast in terms of volume in tons & revenue in USD thousand from 2016 to 2026 for the following segments:

By Form: (Tons) (USD Thousand)

- Liquid

- Powder

By Application: (Tons) (USD Thousand)

- Cloud Point Depressor

- Solubilizer

- Anti-caking Agent

- Coupling Agent

- Metal Processing

- Others

By End-user Industry: (Tons) (USD Thousand)

- Detergent

- Chemical

- Metal Working

- Oil & Gas

- Others

By Region: (Tons) (USD Thousand)

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Russia

- Asia Pacific

- China

- India

- Japan

- Australia

- Indonesia

- Malaysia

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

Frequently Asked Question(FAQ) :

How is sodium cumenesulfonate demand growing in North America?

North America region is estimated to account for 44% volumetric share of sodium cumenesulfonate by 2026 owing to consistent expansion of oil & gas sector and robust demand for detergents.

What is the impact of cloud point depressor application on sodium cumenesulfonate industry?

The industry revenues from cloud point depressor application was pegged at USD 14.8 million in 2019 due to its requirement in using petroleum-based mineral oils at lower temperatures.

Which form of sodium cumenesulfonate will see the highest consumption?

The liquid form sodium cumenesulfonate will account for close to 70% of the industry share in terms of volume by 2026, as it sees extensive use in household cleaning products and detergents.

How will sodium cumenesulfonate market share expand through 2026?

Global market for sodium cumenesulfonate will expand at nearly 4.3% CAGR through 2026, with high demand for hydrotrope organic compound in laundry detergent and personal care formulations.

Sodium Cumenesulfonate Market Scope

Related Reports