Summary

Table of Content

Silyl Acrylate Polymer (SAP) Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Silyl Acrylate Polymer Market Size

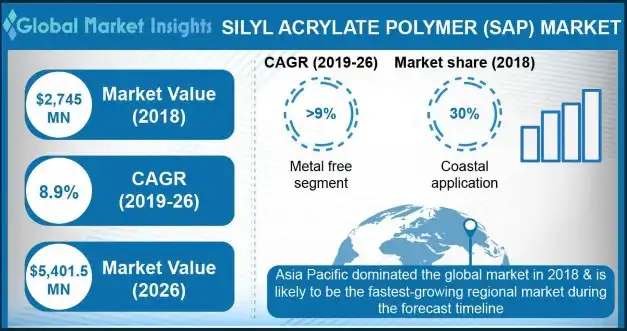

Silyl Acrylate Polymer Market size was valued over USD 2.7 billion in 2018 and is estimated to exhibit CAGR around 9% from 2019 to 2026. Growing need for TBT-free and low emission antifouling coatings will augment the growth of global market.

To get key market trends

Proliferating shipbuilding industry in the Asia Pacific region is the prime factor augmenting the global market growth. Silyl acrylate polymer (SAP) is widely used as an antifouling agent owing to its superior adherence to hulls of the ships and prevention of accumulation of biological species. It is mainly led by China, South Korea, and Japan which accounted for more than 90% of the global shipbuilding industry, in 2018.

In 2018, China dominated the global shipbuilding sector with over 40% market share, followed by South Korea with a robust share of almost 25%, and Japan above 22%. Moreover, China is a prominent country in drydocking activities in addition to its new shipbuilding activities, which will further bolster the silyl acrylate polymer consumption in repair & maintenance and newbuilding sectors.

Silyl Acrylate Polymer Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2018 |

| Market Size in 2018 | 2,746.0 Million (USD) |

| Forecast Period 2019 to 2026 CAGR | 8.9% |

| Market Size in 2026 | 5,401.5 Million (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Additionally, surging maritime trade in Asia Pacific countries such as India and favorable government initiatives will offer ample growth opportunities in ship maintenance & repair services.

Favorable geographic locations for sea trade, presence of numerous shipbuilding companies, and availability of low-cost skilled labor have a positive influence on the shipping industry in Asia Pacific. These factors propel the silyl acrylate polymer market demand in the production of antifouling coatings.

Moreover, Southeast Asian countries such as Philippines, Vietnam, Indonesia, and Singapore offer lucrative opportunities to the silyl acrylate polymer market manufacturers. This is because these countries are equipped with fast-developing ports and docks with low-cost labor and presence of valuable trade routes. Furthermore, Singapore has garnered the leading position in trading of ship parts and ship repair activities and is likely to surpass shipbuilding leaders in the coming years.

There are growing concerns for TBT-free and ecofriendly antifouling paints which provides excellent antifouling performance and substantially reduces fuel consumption. Silyl acrylate polymer has a low erosion rate with stable performance over longer period, thus, it is considered as a viable option among other antifoulants. Moreover, rising government initiatives and growing drydocking activities further drive the shipbuilding business in the Asia Pacific region.

Silyl acrylate polymer is an antifouling coating which comes under self-polishing copolymer (SPC). It is produced by various acrylic monomers, silyl ester, silanes, and acrylates. The product is incorporated with various biocides such as cuprous oxide, copper pyrithione, zinc oxide, and zinc pyrithione to prevent the build-up of algae, barnacles, slime, and other invasive species. It possesses low VOC levels than metal acrylates.

Silyl Acrylate Polymer has a low erosion rate and exhibits controlled release of biocides in sea water, which creates a smooth surface on the hull and reduces the adherence. It exhibits excellent antifouling performance coupled with self-polishing properties. Growing R&D investments and product innovation are enhancing the product characteristics to meet the industry antifouling needs will drive the growth of silyl acrylate polymer market.

Key raw materials such as acrylic monomers are crude oil derivatives. Also, copper is widely used in the production of biocides which are incorporated in silyl acrylate polymer. However, fluctuating prices of crude oil and copper are expected to impact the global silyl acrylate polymer market growth in the following years. Moreover, availability of cost-effective substitutes such as foul release agents and rosin-based coatings is likely to restrain the SAP consumption during the review period.

Silyl Acrylate Polymer Market Analysis

Learn more about the key segments shaping this market

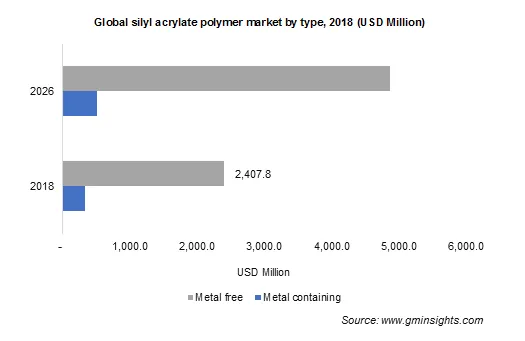

In 2018, the metal free segment witnessed the largest share in the silyl acrylate polymer market and is projected to register the highest CAGR of over 9% during the assessment period. The metal free segment is free from elemental metal but contains metal in the form of biocides. It possesses excellent self-polishing features coupled with controlled release of metal biocides.

The new shipbuilding sector accounted for the largest share in 2018 due to growing shipbuilding activities in Asia Pacific. Silyl acrylate polymer is used as an antifoulant as it is eco-friendly and offers controlled release of biocides, making it a preferable antifouling coating. Also, growing trend of containerization of marine vessels and rising production of bulk carriers further drive the silyl acrylate polymer market.

Learn more about the key segments shaping this market

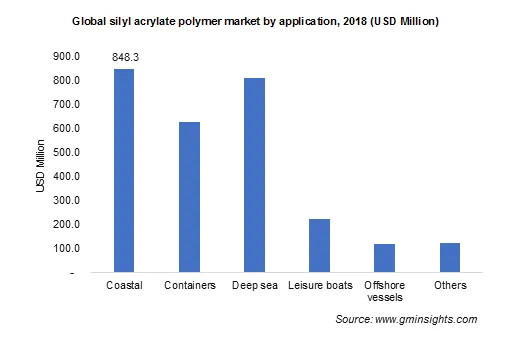

Coastal application garnered the largest market share of almost 30% in 2018 and is likely to grow at a healthy CAGR in the following years. Coastal ships mainly consist of cargo vessels and trading ships and experience severe delays in warm water ports, which results in rapid accumulation of unwanted biological hull fouling. Thus, silyl acrylate polymer substantially reduces fuel consumption with less speed loss.

Looking for region specific data?

Looking for region specific data?

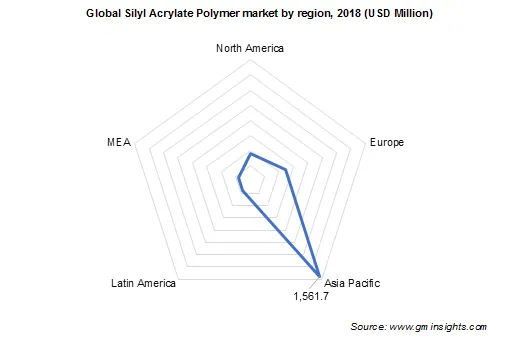

Asia Pacific dominated the global market in 2018 and is likely to be the fastest-growing region during the forecast timeline. This is mainly attributed to the robust shipbuilding and drydocking activities in China, South Korea, Japan, and Philippines. Moreover, low-labor cost, favorable government investments, and growing marine trade activities propel the silyl acrylate polymer market in the region.

Silyl Acrylate Polymer Market Share

Some of the key players in the silyl acrylate polymer industry are

- AkzoNobel

- Chugoku Marine Paints, Ltd. (CMP)

- Hempel A/S

- Jotun A/S

- PPG Industries

- Nippon Paint Holdings Co., Ltd

- KCC Corporation

- Geochem Solutions (Geochem)

- Kansai Paint Marine Co. (Kansai Paint)

- Yuki Gosei Kogyo Co. Ltd

- Arkema SA

- BASF SE

Most of the market players are adopting product launch and capacity expansions strategies to gain competitive strength.

For instance, in November 2018, PPG Industries invested around USD 1.7 million in a new dispense cell for its coatings manufacturing facility in China to increase its production capacity of marine coating products range. Also, in August 2016, CMP launched a new generation of antifouling coatings containing antifouling ingredient Selektope under the brand name, “SEAFLO NEO”, which are based on the zinc and silyl polymer technologies. These strategies have helped the companies to strengthen their respective positions in the silyl acrylate polymer market.

Silyl acrylate polymer market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume in Tons and revenue in USD Million from 2016 to 2026, for the following segments:

Market by Type

- Metal containing

- Metal free

Market by Sector

- New shipbuilding

- Repair & maintenance

Market by Application

- Coastal

- Containers

- Deep sea

- Leisure boats

- Offshore vessels

- Others

The above information is provided on a regional and country basis for the following:

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- Italy

- Romania

- Netherlands

- Nordic Countries

- Spain

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Philippines

- Indonesia

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- UAE

- Saudi Arabia

- Turkey

- South Africa

Frequently Asked Question(FAQ) :

What is the expected growth rate for silyl acrylate polymer industry share through 2026?

The silyl acrylate polymer market is poised to observe a crcr of 9% over 2019-2026.

What will be the worth of global silyl acrylate polymer market by the end of 2026?

According to the report published by Global Market Insights Inc., the silyl acrylate polymer business is supposed to attain $5,401 million (USD) by 2026.

What are the key factors driving the market?

Rising shipbuilding industry, increasing ship repairing and overhaul demand, and growing need for low fuel consumption and low emission coatings are the major factors expected to drive the growth of global market.

Which application segment is expected to emerge as a vital growth avenue for the market during the forecast period?

The coastal application segment registered a decent market share in 2018 and is projected to record a remarkable growth rate throughout the forecast period.

Which are the top companies in the silyl acrylate polymer industry?

AkzoNobel N.V., Chugoku Marine Paints, Ltd., Hempel A/S, Jotun A/S, PPG Industries Inc., Nippon Paint Holdings Co., Ltd, KCC Corporation, Geochem Solutions, Inc. (Geochem), Kansai Paint, Marine Co. Ltd. (Kansai Paint), Yuki Gosei Kogyo Co., Ltd, Arkema SA, and BASF SE, are some of the top contributors in the industry.

How much size did the global silyl acrylate polymer market register in 2018?

The silyl acrylate polymer market in bbbb exhibited a revenue of USD 2.7 billion.

Silyl Acrylate Polymer Market Scope

Related Reports