Summary

Table of Content

Set-Top Box Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Set-Top Box Market Size

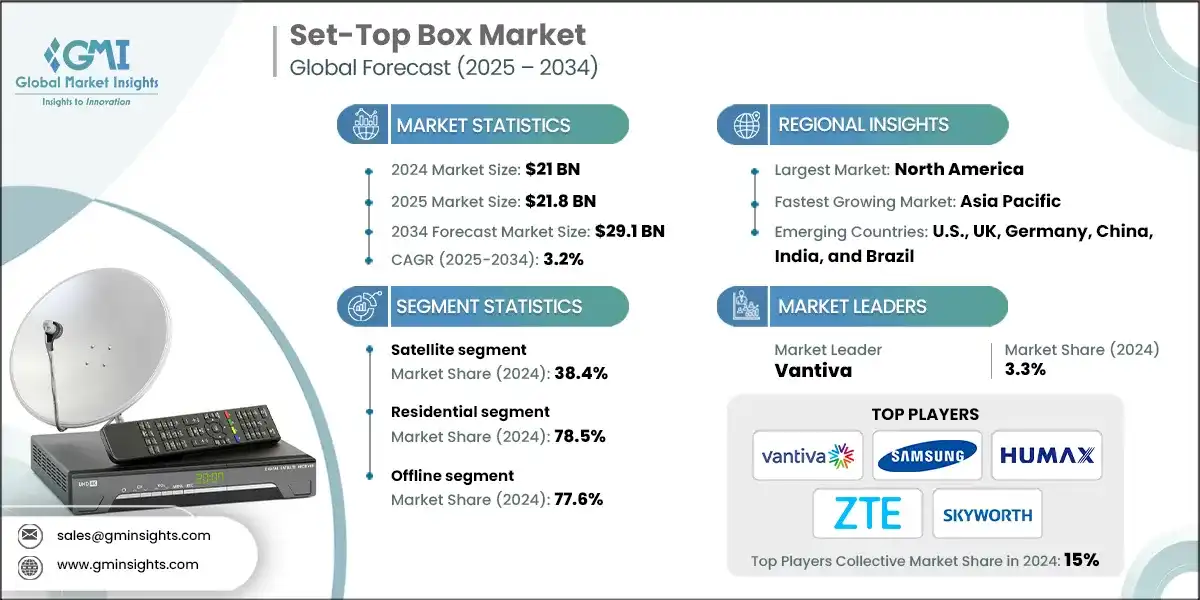

The global set-top box market was estimated at USD 21 billion in 2024. The market is expected to grow from USD 21.8 billion in 2025 to USD 29.1 billion in 2034, at a CAGR of 3.2%, according to Global Market Insights Inc.

To get key market trends

- There are several factors that are driving the growth of set-top box industry which include the growing adoption of OTT services such as Netflix.com, Amazon prime and Disney plus Hotstar, which offer a variety of content and features to the users. OTT services can be accessed through smart set top box that connects to the Internet and stream content directly to the TV. The increasing demand for 4K and HDR content which offer higher resolution and quality of video and audio can be delivered through set-top box that supports UHD and higher resolution and have advanced decoding and processing capabilities.

- The rise of smart homes which integrated various devices and appliances to create a connected and convenient living environment. Smart set top boxes can be integrated with other smart home devices such as home automation systems smart speakers and cameras and offer voice control and remote access features.

- Thus, the increasing availability of high-speed Internet and growing popularity of streaming services which enable user to access and enjoy several types of media content such as movies, shows, music’s from online platforms or local storage devices can enhance their user experience by offering them faster and smoother streaming better sound and picture quality and personalized recommendations.

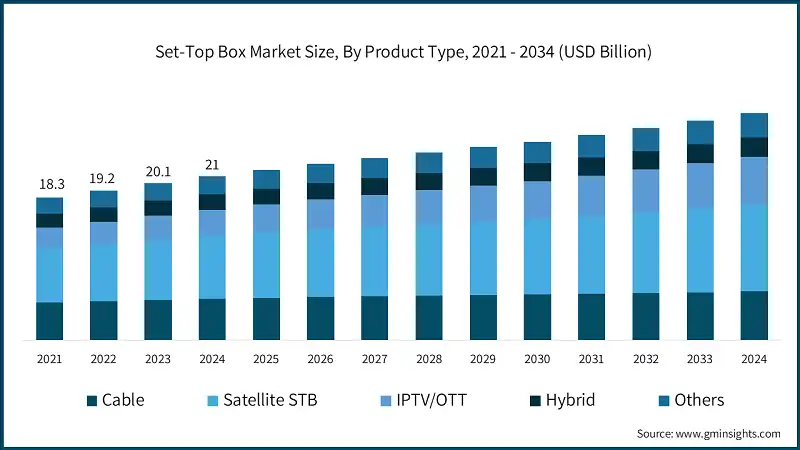

- The set-top box market has grown from USD 18.3 billion in 2021, fueled by increasing use of streaming services, new innovations in video technology and the increasing integration of innovative features such as voice and GPS capabilities, AI-driven custom animation, and personalization. The increased penetration of the internet in emerging markets and the growing trend of hybrid devices that combine traditional television distribution with OTT platforms will spur the pace of market expansion.

- Analysts expect that market growth will continue along a positive trajectory well into the mid-2020s, driven in part by improving technical advances and the changes in how consumers want to engage with media.

- In the market, the satellite STB segment is the dominant segment, which is primarily due to widespread uptake of satellite TV especially in countries and regions with limited cable and telecommunications infrastructure. The satellite STB market continues to grow steadily as more satellite operators upgrade their services with more advanced features such as HD support, 4K, hybrid OTT with different delivery methods, etc. to meet the changes in demand. The market is particularly vibrant in the emerging markets where satellite remains the only streaming service delivery option for consumers.

- The Asia-Pacific region is dominating and as well as fastest growing region in set-top box industry, driven by increasing internet penetration at rapid rates and fast rising disposable income levels along with rising demand for digital entertainment and online content in both rural and urban areas. The strongest adoption of the set-top box happens in countries like India, China, and the rest of Southeast Asia, where consumers want access to cheap content via traditional TV and OTT content.

- Governments are improving digital infrastructure in these markets so the availability of services will continue to expand. The increased adoption rate of smart devices adds to this growth opportunity. This dynamic environment will establish Asia-Pacific as a major technology innovation and growth opportunity for media tech including set-top boxes for the next decade.

Set-Top Box Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 21 Billion |

| Market Size in 2025 | USD 21.8 Billion |

| Forecast Period 2025 – 2034 CAGR | 3.2% |

| Market Size in 2034 | USD 29.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing demand for home entertainment and streaming services | Expands the user base for set-top boxes as consumers seek better content delivery options. |

| Technological advancements | Enhances user experience, driving upgrades and repeat purchases. |

| Increasing internet penetration and smart TV integration | Fuels demand for hybrid set-top boxes with OTT and broadcast support. |

| Pitfalls & Challenges | Impact |

| Price sensitivity and commoditization | Limits profitability as users expects more features at lower prices. |

| Dependency on content providers and regional licensing | Limits product value if access to popular content is restricted or fragmented. |

| Opportunities: | Impact |

| Integration with OTT platforms and app ecosystems | Increase device relevance and appeal to modern consumers |

| Smart home and IoT integration | Transforms set-top boxes into multi-functional hubs, enhancing long-term value. |

| Market Leaders (2024) | |

| Market Leaders |

3.3% market share |

| Top Players |

Collective market share in 2024 is 15% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | U.S., UK, Germany, China, India, and Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Set-Top Box Market Trends

- Now a days, consumers expect their set-top boxes to seamlessly combine traditional cable or satellite TV with popular streaming services, allowing them to switch back and forth without interruption. This hybrid format service will naturally appeal to a diversified user base such as those still watching live broadcasts and those that have warmed up to OTT platforms. Companies should focus on ensuring the integration and accessibility of these services through guiding interfaces that combine content discovery.

- The transition from live viewing to on-demand viewing and convenience has dominated the marketplace since 2018, and it will reign supreme through 2030 and beyond as consumers consistently develop a taste for on-demand viewing while shaped by a combination of OTT services and all forms of video on demand.

- Consumers of set-top box expect to watch visual content in ultra-high-definition and clear 4K HD and HDR support has become a crucial "checking the box" feature of any contemporary streaming set-top box. The color representation, points of clarity, and contrasts will provide a better overall visual experience, especially as each new year brings a substantial number of households with a compatible 4K television.

- Manufacturers and their firmware partners need to prioritize the addition of 4K technologies to meet the increasing demands of consumers and possibly justify the expense of premium hardware. This has been fast-tracked since the start of 2017, with the growth of 4K content and consumers wanting to keep upgrading but will continue to be the only driver of market growth through the 2020s, while a baseline expectation for visual quality will exist across all entertainment devices.

- There has also been a rapid rise in personalization pertaining to their experience utilizing set-top boxes, mainly in the expectation that the devices will learn viewing preferences and suggest appropriate movies or shows based upon those preferences without having to search extensively, often termed personalized contextualization. Companies could enable viewers to find and enjoy content through personalized engagement leveraging AI and machine learning.

- In combining personalization with machine learning, they can impact retention rates for services while reducing consumer churn in the process, since deeper audience engagement leads to more enjoyable experiences discovering content both expeditiously and intuitively. This expectation from consumers has been steadily increasing since 2018 as systems like recommendation engines on sites like Netflix and YouTube became mainstream.

Set-Top Box Market Analysis

Learn more about the key segments shaping this market

Based on product type the set-top box industry is divided into various categories which includes cable, satellites, IPTV/OTT, hybrid, and others. In 2024, the satellite segment dominates the market with 38.4% market share, and the segment is expected to grow at a CAGR of over 3.2% from 2025 to 2034.

- The satellite segment dominates the market in 2024, due to its expansive coverage in real and rural settings, the reliability of signal quality and established infrastructure, and offering greater accessibility in places where cable and IPTV services are few. Therefore, for many of the world's consumers, satellite represents the most logical option and has historically been the choice as a set-top box platform.

- In terms of geographic reach and overall service stability the satellite segment has greater breadth than either cable, IPTV/OTT, or hybrid segments. IPTV and OTT are expanding rapidly in urban markets, but satellite segment will maintain its position in overall volume as countries lag in connectivity to high-speed service.

Learn more about the key segments shaping this market

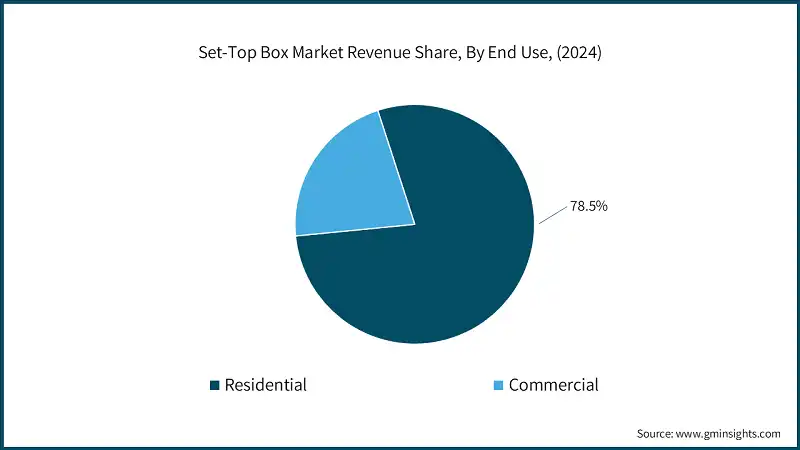

Based on end use, the set-top box market is segmented into residential and commercial. In 2024, the residential segment dominates the market with 78.5% market share, and the segment is expected to grow at a CAGR of over 3.5% from 2025 to 2034.

- The residential segment dominates the market in 2024 due to the increasing demand for entertainment at home, adoption of streaming services, and greater penetration of smart TVs. Consumers want an easy and personalized viewing experience that boosts the mass adoption of set-top boxes in households around the world.

- Demand from the residential segment outweighs the demand from the commercial segment as an individual consumer would rather focus on entertainment at home. Demand from the commercial segment, while significant in places like hotels and businesses, is strictly a niche offering and smaller in scale as there are greater specialized requirements in a commercial setting, and it cannot match the mass adoption of residential viewing.

Based on the distribution channel, the set-top box market is segmented as online and offline. In 2024, the offline segment dominates the market with 77.6% market share, and the segment is expected to grow at a CAGR of over 2.9% from 2025 to 2034.

- Offline dominate the market in 2024 as consumers' preference for in-store purchases means they can get their product immediately and receive personal assistance in complicated buying scenarios. Retail outlets or local distributors create trusted buying experiences, particularly in those regions with limited access to the internet or little e-commerce activity.

- Compared to online channels, offline selling can react to the customer and provide instant product availability. Offline channels will always have a place, but online channels are rapidly growing because of their convenience paired with often wider product choice, particularly in urban or millennial tech savvy developed countries.

- The online segment accounts for 22.4% of the market share and is to grow at CAGR 4.2%.

Looking for region specific data?

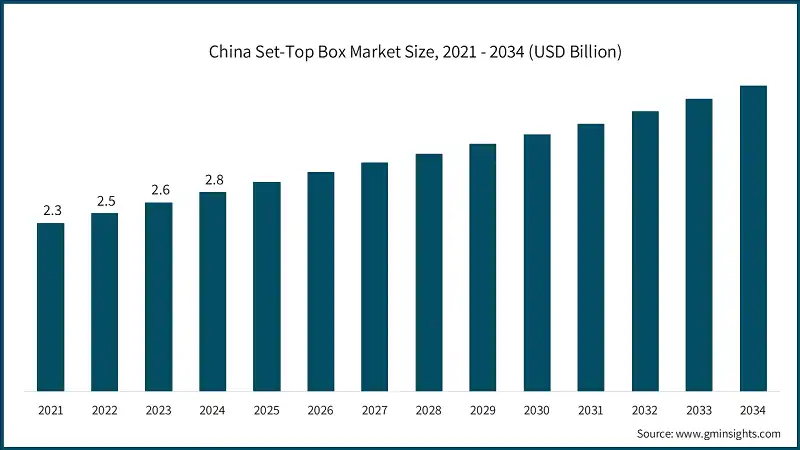

The China dominated the set-top box market with around 32.7% market share and estimated to reach revenue of USD 4.2 billion by 2034.

- China’s share of the worldwide market can be attributed to its population, urbanization rate, and the broadening middle class and disposable income. The Government of China is aggressive about improving digital infrastructure and improving broadband penetration, which will lead to many consumers accessing digital TV services. In addition, the entire manufacturing ecosystem in China has the strong abilities to build advanced set-top boxes in a cost-effective manner and then sell those in the domestic market as well as export them out of the country.

- The market has a lot of competition from local companies as well as international companies in China, the amount of smart and hybrid devices in the market is on the rise, and OTT and streaming services are more combined and integrated, which indicates that China will be a major contributor to set-top box revenue growth in the Asia-Pacific region.

In Europe, the UK set-top box market is expected to experience significant growth and promising growth from 2025 to 2034.

- The UK set-top box sector is experiencing robust consumers demand trends for high-definition entertainment, which has been significantly accelerated by the rapidly increasing popularity of smart televisions and good broadband connectivity and pay-tv ecosystem environment, making the combination of these technologies with a set-top box hybrid model very promising for continued growth.

- Both the tech savvy nature of the UK consumer base, as well as fierce competition within the telecoms sector has and continues to fuel innovation and access to advanced features such as 4K, voice recognition, and content recommendations for the consumer market. Overall, this market is maturing and continuing its evolution by supporting high sectors levels of OTT, increasing consumer demand for seamless multi-platform viewing, and ongoing investment activity in digital media technology.

In North America, U.S. market is expected to experience significant growth and promising growth from 2025 to 2034.

- Strong consumer demand for better home entertainment experiences and rapid adoption of new streaming technologies is driving growth in the U.S. market. The abundance of high-speed internet access, an established pay-tv provider ecosystem, and an increasing number of hybrids set-top boxes that combined traditional TV with OTT platforms all drive demand.

- The U.S. market features intense competition among incumbent providers, ongoing product innovation in both user interfaces and more recently the addition of 4K and HDR support, and the proliferation of more AI-powered personalized experience recommendations. Furthermore, the rise of the smart home ecosystem supported by voice-controlled devices continues to propel the growth of next-generation set-top boxes across the country.

In MEA, the South Africa set-top box market is expected to experience significant growth and promising growth from 2025 to 2034.

- South Africa is the largest MEA market. It has comparatively advanced digital infrastructure, a growing middle-class consumer population, and increasing demand for better home entertainment propositions. The increasing penetration in South Africa, as well as government support to digital access, has contributed to the uptake of traditional set-top boxes and hybrid set-top box solutions.

- There is a melding of both satellite and IPTV services within the market, catering to different consumer categories. There is growing interest in affordable smart devices that support streaming platforms, and the competitive pay TV market and improvements in networks are driving South Africa's leading position in the MEA set-top box industry and optimism for continued growth through 2034.

Set-Top Box Market Share

Vantiva leads with 3.3% market share due to strong Android TV presence, innovative AI-powered devices, and deep partnerships with global telecom and pay-tv operators. The top 5 companies are Vantiva, Samsung Electronics, Humax, ZTE Corporation, and Shenzhen Skyworth Digital Technology, collectively hold 15% of the market, indicating fragmented market concentration.

- Vantiva is recognized as an organization that makes a broad array of innovative devices powered by Android TV. Vantiva airs its hardware technology with additional AI-enabled capabilities and offers a cloud and analytics ecosystem that allows telecom operators throughout the world to manage and create access to viewers’ experience.

- Samsung Electronics has recognition by integrating its set-top boxes with its proprietary Tizen operating system, achieving interoperability and connectivity between its other electronic consumer goods. Although Samsung is a force to be reckoned with in the global TV marketplace, it uses the platform of the set-top box advantageously, in addition to its premium devices that enhance user experience and content delivery.

- Humax has multiple offerings in set-top boxes, (satellite, cable, IPTV, and OTT), covering the experiences of many multilayered solutions. Humax focuses on delivering reliable, cost-effective and flexible solutions for different regional needs, particularly in Europe and Asia. Humax, in addition to its relationships with major telecom operators, prides itself on being a leading provider of customer support to enhance its position in value delivery.

- ZTE Corporation utilizes its telecommunications expertise to provide customizable IPTV and OTT set-top boxes based on open software platforms such as Android TV and RDK. ZTE is focused on emerging markets by providing integrated broadband and video service platforms that combine low-cost and flexibility and competing in the global STB market.

- Shenzhen Skyworth Digital Technology is one of the biggest manufacturers of set-top boxes, with a range that pays strong attention to integration with the Android TV ecosystem. Their approach to the market is focused on quick time-to-market by partnering and building pre-certified hybrid STB's.

- Vantiva is a USD 2.3 Billion revenue company as of 2024. Vantiva's acquisition of CommScope's Home Networks division has greatly augmented its product offerings, which include multiple line-ups of Android TV-powered set-top boxes, broadband devices, and cloud-based integrated solutions. Vantiva also continues to develop both AI-powered media platforms and analytics services for telecom operators, ultimately positioning the business for operational excellence and diversification opportunities.

- Shenzhen Skyworth Digital Technology is the world's biggest set-top box manufacturer by volume, shipping simply over 40 million devices per year and has shipped over 36 million Android TV and Google TV OS models. Shenzhen Skyworth Digital has a product offering of hybrid STBs, OTT streamers, and broadband CPE. Shenzhen Skyworth has adopted innovation and speed of deployment as part of its competitive advantage.

- Humax is widely diversifying its offerings, most notably Freeview Play recorders, Android TV boxes, and hybrid IPTV systems. Humax is well-known in the industry for sustainable innovation, launching, for example, the first HTML5-based smart STB, and a UHD gateway STB that can stream to multiple devices.

Set-Top Box Market Companies

Major companies operating in the set-top box industry include:

- Apple

- ARRIS

- CommScope

- Dish Network

- EchoStar

- Huawei

- Humax

- Intek Digital

- Kaon Media

- Sagemcom

- Samsung

- Skyworth

- Technicolor (Vantiva)

- Vestel

- ZTE

Set-Top Box Industry News

- In May 2025, Vantiva became a member of the Thread and Matter Alliances, allowing its set-top boxes to be smart home hubs with easy home device control and improved privacy and security protections, while adding customer retention and new revenue potential. Together, these alliances will enhance Vantiva's products in the evolving smart home ecosystem, especially as smart home industry products continue to develop.

- In May 2025, GTPL Hathway also entered an arrangement with OTTplay Premium to launch “GTPL Genie+,” which creates access to 29+ OTT platforms via the GTPL Buzz app and website. This service also enables custom content packs across all devices, reinforcing GTPL’s digital entertainment offerings of millions of Indian consumers.

- In March 2025, Eutelsat and Vestel launched the first Smart TV with Sat.tv Connect that will support DVB-I and HbbTV. Smart TV will allow viewers an even easier way to access free satellite channels without the need for a separate set-top box. This will bring a better user experience across Europe, North America and the middles East, and will be available under the Vestel and Telefunken brands.

- In November 2023, Technicolor (now Vantiva) launched the next-generation Android TV set-top box for TIM that provides Italian household subscribers access premium content from current broadcasters and OTT providers. The launch aims to enhance digital entertainment for TIM subscribers by giving their customers enhanced quality and product offerings. The set-top boxes will use the open platform offered by Android TV to aggregate applications and services to unite the user's experience.

The set-top box market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Product Type

- Cable

- Satellite STB

- IPTV/OTT

- Hybrid

- Others

Market, By Recording

- Standard definition

- High definition

- UHD

- 4K & above

Market, By Technology

- DVB-C

- DVB-S

- DVB-T

- Hybrid

- MPEG-2

- MPEG-4

- Android

- USB storage

- Others

Market, By Service Type

- Pay TV

- Free to air

Market, By Speed

- Below 100 Mbps

- 100 Mbps to 500 Mbps

- Above 500 Mbps

- Gigabit speed (1 Gbps and above)

Market, By Application

- Communication

- Media content

- Audio/video

- Gaming

- Web content

- Cloud services

- Others

Market, By End Use

- Residential

- Commercial

Market, By Distribution Channel

- Online

- Company website

- E-commerce

- Offline

- Specialty stores

- Hypermarket/supermarket

- Retail stores

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the set-top box market?

Key players include Vantiva, Samsung Electronics, Humax, ZTE Corporation, Shenzhen Skyworth Digital Technology, Apple, Huawei, ARRIS, CommScope, and Dish Network.

What is the growth outlook for the online distribution channel from 2025 to 2034?

The online channel accounted for 22.4% share in 2024 and is projected to grow at 4.2% CAGR till 2034.

Which region dominates the set-top box market?

China held 32.7% of the global set-top box market in 2024 and is projected to reach USD 4.2 billion by 2034. Growth is fueled by urbanization, government-backed digital infrastructure, and a strong local manufacturing base.

What are the upcoming trends in the set-top box market?

Key trends include hybrid integration of OTT and broadcast, rising 4K/UHD adoption, and AI-driven personalization for enhanced viewing experiences.

What was the valuation of the residential segment in 2024?

The residential segment dominated with 78.5% share held in 2024.

How much revenue did the satellite STB segment generate in 2024?

The satellite segment held 38.4% market share in 2024. It leads due to expansive coverage in rural areas and reliable infrastructure.

What is the projected value of the set-top box market by 2034?

The global set-top box industry is expected to reach USD 29.1 billion by 2034, fueled by OTT adoption, 4K/HD content demand, and smart home integration.

What is the market size of the set-top box market in 2024?

The set-top box market was valued at USD 21 billion in 2024, with a CAGR of 3.2% expected through 2034 driven by growing demand for home entertainment and streaming services.

What is the current set-top box market size in 2025?

The market size is projected to reach USD 21.8 billion in 2025.

Set-Top Box Market Scope

Related Reports